Tagged: USDA LOANS DIRECT

-

USDA DIRECT MORTGAGE LOANS

Posted by Gustan Cho on July 10, 2023 at 8:52 pmHere is the link to USDA DIRECT LOANS, where packagers make $1,500 per file.

https://www.rd.usda.gov/files/

hb-1-3550.pdf Bailey replied 1 year, 8 months ago 2 Members · 1 Reply -

1 Reply

-

USDA Direct Mortgage Loans

USDA Direct Mortgage Loans, also known as Section 502 Direct Loan Program, help low- and very-low-income applicants obtain decent, safe, and sanitary housing in eligible rural areas. The USDA provides the loan directly, and there are specific income and property eligibility requirements.

Key Features of USDA Direct Loans

Eligibility:

Income: Applicants must meet income eligibility requirements determined by the area median income (AMI). Typically, applicants must have an income of less than 80% of the AMI.

Property Location: The property must be in a rural area defined by the USDA. Rural areas are typically defined as communities with populations of 35,000 or less.

Occupancy: The loan is only for the applicant’s primary residence.

Loan Terms:

Interest Rates: Interest rates can be as low as 1% with subsidies.

Loan Amount: The amount depends on the applicant’s income and the area where they purchase the home.

Repayment: Repayment terms can be up to 33 years (38 years for applicants with incomes below 60% of the AMI).

Benefits: No down payment is required. Subsidized interest rates based on income. Ability to finance some closing costs.

Role of USDA Loan Packagers

USDA loan packagers assist applicants in preparing and submitting their loan applications. They can provide valuable assistance in navigating the application process and ensuring all necessary documentation is provided.

Services Provided by Packagers:

Application Assistance: Help complete and submit the loan application.

Documentation: Assistance in gathering and organizing necessary financial documents.

Guidance: Provide advice on eligibility and loan terms.

Compensation: USDA loan packagers typically earn around $1,500 per file. The applicant often pays this fee, though some programs may incorporate these costs into the loan.

Steps to Apply for a USDA Direct Loan

Determine Eligibility: Check income eligibility using the USDA’s income eligibility calculator. Verify the property’s location using the USDA’s property eligibility tool.

Prepare Documentation: Gather income statements, tax returns, and other necessary financial documents. Ensure the property meets USDA guidelines.

Contact a USDA Loan Packager: Consider working with a USDA-approved loan packager to streamline the application process. Utilize their expertise to ensure a complete and accurate application.

Submit Application: Complete and apply along with all required documentation. Work with the USDA or your loan packager to address additional requirements or questions.

Loan Approval and Closing: Once approved, close the loan and purchase the property. Ensure all terms and conditions are understood before finalizing the loan.

USDA Approved Packagers: Contact local USDA offices for a list of approved loan packages. By understanding the requirements and benefits of USDA Direct Loans and utilizing the services of loan packagers, low- and very-low-income applicants can access affordable home financing options in rural areas.

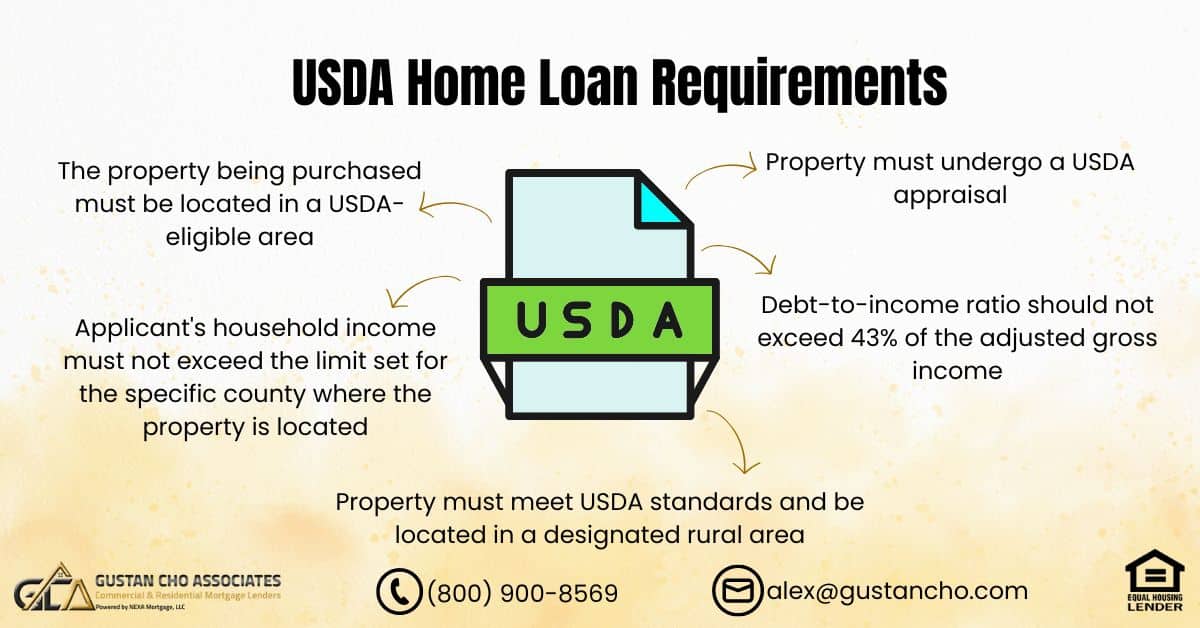

https://gustancho.com/usda-home-loan-requirements/

gustancho.com

USDA Home Loan Requirements allow homebuyers to purchase homes in designated rural areas by the USDA with 100% financing no money down

Log in to reply.