-

Why Do Mortgage Lenders Ask Borrowers For a CPA Letter

Harlan replied 1 year, 4 months ago 14 Members · 28 Replies

-

Thank you Ali. How about a little more details on the program you have, videos power point presentation. I will send blast this to all my contacts. Thank you

-

Gus and Ali have been a God send. Never have I worked with two more diligent and caring people. They make you feel like family.

-

Peter, it is a pleasure to be working with you and Doreen @Peter.gun . I spoke with Donna yesterday for quite some time and went over the potential options on your pre-approval. The issue we have in the state of Florida is the homeowners insurance. I did try to get a hold of @Brent yesterday and texted him the property address but he was in meeting all day. I think we got the credit issue fixed thanks to @Ali but now we need to tackle the debt-to-income ratio situation. Here is the mortgage calculator where you can plug in the property info. Since it will be a manual underwrite, the maximum debt-to-income ratio will be reduced to 40% front-end and 50% back-end. If we can get the errors of Doreen off the credit report, we should get an approve eligible and the maximum front-end debt-to-income ratio would be 46.9% and back-end debt-to-income ratio would be 56.9% Per Brent, older homes in Florida, the homeowners insurance can go as high as $4,000 to $8,000. Many states, homeowners insurance is not greater thant $600 to $1,000.

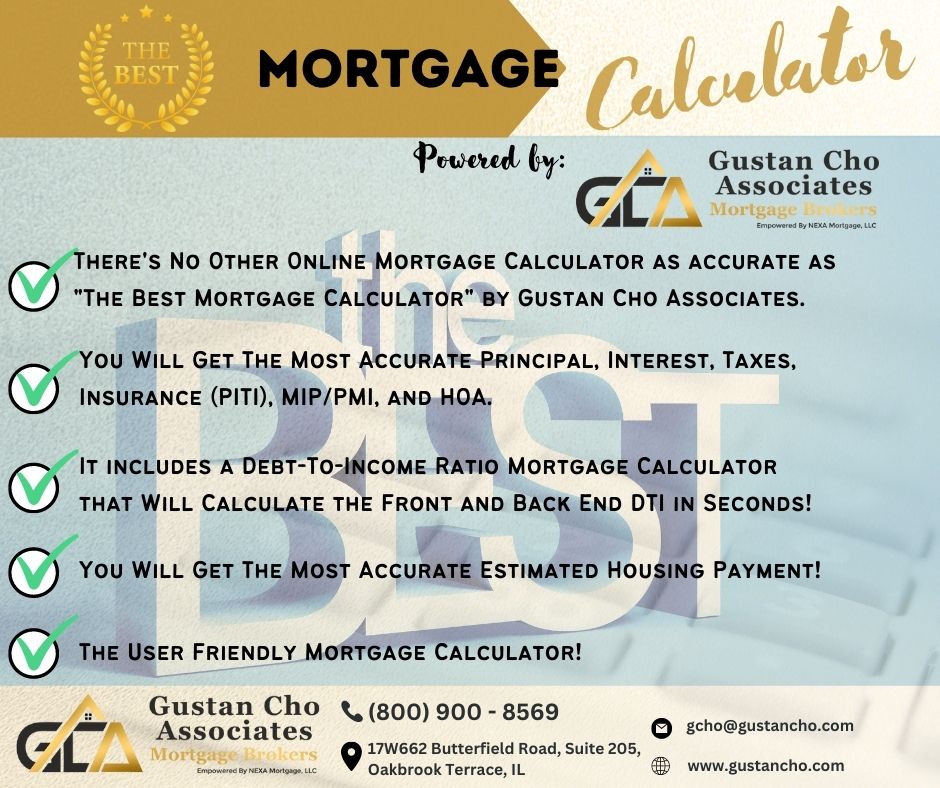

Here is the mortgage calculator

http://www.gustancho.com/best-mortgage-calculator

-

This reply was modified 2 years ago by

Gustan Cho. Reason: wrong url

Gustan Cho. Reason: wrong url

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

We are at Gustan Cho Associates, You easily check your mortgage eligibility with the best mortgage calculator With PITI, PMI, MIP, HOA, and DTI.

-

This reply was modified 2 years ago by

-

Mortgage lenders typically ask for CPA (Certified Public Accountant) letters from self-employed borrowers for several reasons:

Verification of income: Self-employed individuals often have variable income streams, making it more challenging for lenders to assess their financial stability. A CPA letter can provide verification of income, including details such as average income, profitability of the business, and consistency of earnings over time.

Confirmation of business viability: Lenders want to ensure that the self-employed borrower’s business is stable and viable. A CPA letter may include information about the business’s financial health, such as its profitability, assets, liabilities, and overall financial stability.

Compliance with lending requirements: Mortgage lenders have strict underwriting guidelines and regulatory requirements that they must adhere to. Requesting a CPA letter helps lenders ensure that they are compliant with these requirements and have sufficient documentation to support the borrower’s financial situation.

Reduction of risk: Lenders use CPA letters as a risk mitigation strategy to reduce the likelihood of default. By obtaining verification of income and confirmation of the borrower’s business viability, lenders can make more informed lending decisions and mitigate the risk of lending to self-employed individuals with unstable financial situations.

Overall, requesting CPA letters from self-employed borrowers helps lenders accurately assess their financial situation, verify their income, and mitigate the risk associated with lending to individuals whose income may be less predictable than salaried employees.

-

We are waiting for Donna to do some reasearch. I called her earlier today and she did not answer. Need to see what type of properties are in the market, property taxes,etc. I need to talk to Brent as well. By the way, what area in Louisiana were you open to buy a house? Just want to research homeowners insurance, property taxes, and property value just in case Florida is out of the buying market and priced out.

-

Under self-employment verification, mortgage underwriters typically request that CPA letters be issued to borrowers to confirm their incomes and financial positions. And here is why they are asking for such letters and what they are telling in those letters:

Cause to Request for CPA Letter:

Income Evidence:

Earnings Assessment: Among many things that self-employed borrowers’ accountants can provide, these CPA letters assist underwriters in assessing the self-employed borrower’s income, which is better than declaring the amount.

Tax Compliance:

Review of tax returns: Most CPAs tend to look through the borrower’s past tax records, which aids in determining whether the borrower’s declared income is within the IRS guidelines.

Business Stability:

Evaluation of business health: The CPA may also be able to explain and show how stable the borrower’s business is in terms of cash flow and profitability.

Additional Documentation:

Complementing the Other Documents: The CPA letter is sufficient evidence but only complementary to the tax return, profit and loss statement, and any other document.

Likely Manuscript of a CPA Letter

CPA as the first one:

Who’s Who: A letter should include information about the CPA, including his name, the firm’s name, physical address, and other contact details.

Details of the borrower:

Information regarding the borrower: This letter should specify the self-employed borrower’s name and, where possible, their business name.

Income Assessment:

Verification of Income: The CPA must summarize the borrower’s income from previous years through tax returns and any auxiliary documentation.

Business Overview:

Description of the Business: Such letters can also briefly describe the borrower’s business and its time on the market.

Professional Opinion:

CPA’s Conclusion: Since the borrower can pay the debt, the CPA may assess any other associated risks or consider any necessary considerations.

Signature and Credentials:

Certification: The certification indicates that a CPA should sign the letter with their credentials and other relevant licensing.

Mortgage underwriters request letters from self-employed clients who borrow from CPAs to ascertain the borrower’s income without compromising their businesses. These letters form an important part of the underwriting process as they allow underwriters to obtain information about the borrowers from various angles. If self-employed and applying for a house mortgage, preparing the documentation with a CPA is a good idea as it increases the chances of getting approval.

Log in to reply.