-

All Discussions

-

GCA FORUMS NEWS For Tuesday December 30, 2025:

Current SPDR S&P 500 ETF Trust (SPY)

- The SPDR S&P 500 ETF Trust trades on the U.S. stock market and is often regarded as a gauge of the country’s economic performance.

- Currently priced at $687.85, SPY has dropped $2.61 today, indicating that the market is cautious.

- The day began at $687.52, and already, over half a million trades have changed hands.

- Today’s trading range has been tight, with a high of $688.14 and a low of $687.18.

- The most recent trade was at 8:17:35 a.m. CST on December 30, 2025.

GCA FORUMS NEWS — National Breaking NewsBy 8:15 a.m. CT on December 30, 2025, financial markets—metals included—were already in a whirlwind of activity.

LIVE: Current Stock and Bond Market Pre-Market Overview

U.S. stock futures are falling as the end of the year brings more volatility and people sell to lock in profits. Investors are closely monitoring interest rates, metals, tariffs, and inflation.

Bond Market (indicates mortgage rates)

- With fewer trades happening as the year ends, even small news stories can make the markets move a lot.

- Right now, mortgage rates are dancing more closely to the tune of the 10-year Treasury yield than to the ups and downs of the stock market.

LIVE: Changes in Interest and Mortgage Rates

The Federal Reserve’s target rate is now between 3.50% and 3.75% after a cut in December. Experts believe that future cuts will slow down as inflation stabilizes.

Today’s Mortgage Rates

- According to Mortgage News Daily, the average 30-year fixed mortgage rate is now 6.33% ([Freddie Mac’s latest survey puts the 30-year fixed mortgage rate at 6.30%]).

- While rates have decreased slightly, they are still high, and home prices remain close to their highest levels. their peaks.

LIVE: Precious Metals – Silver jumps above $80, then falls backWhat happened

- Silver prices recently shot past $80, only to tumble back down to around $70, according to the Financial Times.

After the big jump, silver now stays between $72 and $73 as selling continues.

- Today, silver is priced at about $72, reflecting continued volatility, according to JM Bullion.

- Why silver prices fell. Silver’s quick drop occurred because people were selling to take profits during slow holiday trading and because margin requirements increased, prompting traders to add more money to back up their bets.

- Debate swirls around silver: Is this a speculative bubble in the making, or the start of a lasting bull run?

- Analysts remain divided.

- According to Market Watch, many analysts believe that robust industrial demand for silver in applications such as solar panels, electric vehicles, and electronics underpins the market.

- The 2025 surge in silver prices has experts detecting signs of a possible bubble, with riskier trades emerging.

- Liquidity, tariffs, and Fed policy are likely to keep silver prices unstable.

- When it comes to banks and JPMorgan, the data is more complicated.

The CFTC Bank Participation Report

- The CFTC Bank Participation Report does not disclose individual bank names, making it impossible to directly associate large short positions in COMEX silver held by non-U.S. banks with those of U.S. banks, which typically maintain balanced long and short positions.

- JPMorgan has a documented enforcement history related to its metals trading practices, including actions from the spoofing era that are widely referenced in financial media.

- Separately, JPMorgan settled with the CFTC regarding trade-reporting and surveillance issues.

- Although this differs from allegations of price suppression, it nonetheless impacts public trust.

- It is essential to note that, although JPMorgan is frequently discussed as a significant silver short, the CFTC Bank Participation Report does not identify JPMorgan by name.

- The best approach is to display total bank short and long positions and avoid making claims that are not supported by public data.

Paper Silver vs. Physical Silver (explained simply for borrowers)

- Paper silver refers to financial products, such as futures contracts, options, and many ETFs.

- It is used by traders, but in the larger market, it can act like a lever, making both gains and losses bigger.

- Physical silver refers to coins, bars, or storage that is fully allocated for you and involves actual delivery.

- This difference is important because when margin requirements for futures increase or traders seek to reduce risk, paper silver can be sold quickly, even if the additional cost of physical silver remains high.

- This has occurred recently, when prices have fluctuated significantly.

Housing and Mortgage Market Forecast: Bubble Concerns vs. the Data: What the data is saying

- Pending home sales have dropped again, illustrating the significant impact of higher rates and affordability issues on housing demand.

- Most experts expect things to improve gradually, rather than rebound quickly, as 2026 approaches. Lower interest rates may be beneficial if inflation remains under control.

“Crash worse than 2008?” – What’s different now?

Some warn that this market could be even worse than the 2008 recession, pointing to problems with affordability, an increase in homes for sale, and a slowing economy. Still, the last crisis was caused by risky lending, which is a big difference today.

Banking/credit system collapse

- Unless there is a big shock to jobs or credit, expect slow growth or some areas to decline.

- Watch unemployment, late payments, and the ongoing effects of tariffs.

- Progress on inflation has been uneven, with tariffs increasing the cost of goods.

- A government shutdown made the data less clear, so experts are using year-over-year and partial numbers.

In Chicago and across Illinois, the spotlight is on policy shifts, budget battles, and evolving business trends.Sanctuary city/state friction

Because of federal enforcement priorities, Illinois leaders have increased protections and oversight, which has limited some cooperation. This is likely to result in further political clashes.

“Big corporations moving out of Chicago” – What’s true and what’s missing

- Chicago has watched some big names leave or shrink, with Citadel’s move sparking debate over taxes, crime, and business climate.

- Yet, the city and state still boast major corporations and continue to draw fresh investment.

- National studies show Chicago has lost more headquarters than it has gained lately, but it’s far from the hardest-hit city in the country.

A closer examination of the mortgage industry reveals why some lenders thrive while others struggle to keep up.The industry is facing:

- Higher rates that have lasted longer than during the refinancing boom years

- Shrinking margins

- Low volume

- An even slower home purchase market because of affordability issues

The result: companies are merging, leaving the industry, or laying off workers. Meanwhile, specialized lenders such as Non-QM, DSCR, bank-statement, and asset-depletion lenders are stepping in where regular lenders fall short.

In today’s market, brokers who offer straightforward rules, specialized products, fast service, and effective online tools

- Mortgage Brokers are performing the best.

- Retail lenders who depend on changing rates are under pressure.

- Top 5 product mix

- Pull through and turn times

All of this will be wrapped into a business report for tonight’s news update.

Up next: a head-to-head look at NEXA Mortgage versus other broker channels in today’s market.

Industry reports describe NEXA as a mega-broker due to its large number of loan officers, which facilitates hiring, nationwide outreach, and access to wholesale deals. Rankings are often used to compare the business activities of different companies, teams, and branches.

Auto Industry: Financing Rates and the 2026 Outlook: Impact of Auto Financing Rates on Consumers

- New cars: ~7.1%

- Used cars: ~11.0%

This means higher monthly payments, even as car prices begin to decrease. Watch for Cox Automotive’s new 2026 forecasts for new and used car markets.

The Discussion: Trump, Powell, Patel, Bondi: Trump with voters / business sentiment

- Recent polls show Trump’s approval ratings feeling the heat.

- CEOs and business leaders are being cautious, especially regarding tariffs and their expectations for growth.

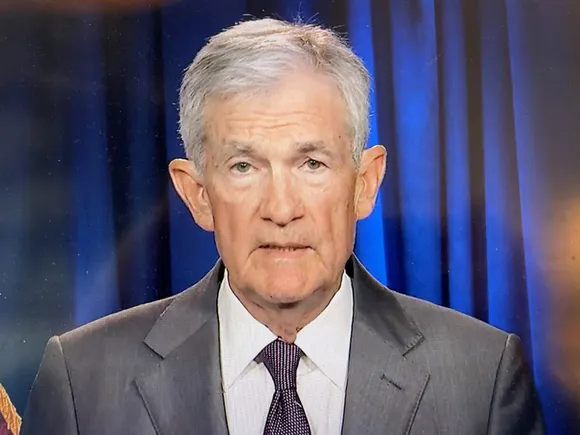

Will Trump remove Jerome Powell?

People and the media have questioned whether Powell will stay, but legal and financial issues make any change hard. Powell’s term will end as planned, and the Federal Reserve’s independence is still very important.

Kash Patel (FBI Director) – ‘On the way out?’

The White House has clearly stated that Patel is being removed.

Pam Bondi has faced significant controversy regarding the Department of Justice’s direction and internal problems, but major news outlets have not confirmed whether anyone will replace her.

https://www.youtube.com/watch?v=EcaBA9nT3P4

-

This discussion was modified 2 months ago by

Sapna Sharma.

Sapna Sharma.

-

Information About SPDR S&P 500 ETF Trust SPY

- The SPDR S&P 500 ETF Trust is a major fund that often influences the direction of U.S. markets.

- In the most recent session, the fund closed at $681.92, a decrease of $4.93 from the previous day.

- This was a small 0.01% drop.

- Trading opened at $687.11, and about 74.144 billion shares changed hands throughout the day.

- Prices fluctuated between a high of $687.75 and a low of $681.81,

- illustrating the significant market movement during the day.

- The most recent trade was at 7:15 p.m. CST on December 31.

GCA Forums News: National News Reports: DATE: 01/01/2026

- Financial markets are closed today because of the NYSE and FINRA holiday, as noted by the Intercontinental Exchange.

- This update covers the latest market close, after-hours activity from December 31, and provides a brief overview of key economic indicators and rates.

FINANCIAL MARKETS LIVE: Year-End Markets Activity (U.S. Markets Closed)

U.S. stock indices ended 2025 on a positive note. The S&P 500 and Nasdaq experienced double-digit gains, and the Dow Jones Industrial Average also finished the year on a strong note.

Marketable proxies as of the last trading session:

- Dow (DIA): last trade visible in the tool

- S&P 500 (SPY): last trade visible in the tool

- Nasdaq-100 (QQQ): last trade visible in the tool

Looking ahead, several key factors are expected to influence the markets in 2026:

- A ‘soft landing’ depends on inflation slowing down and the job market easing, but without causing a recession. More details are below.

- Shifting expectations about interest rates continue to affect the markets, particularly in the technology and housing sectors.

LIVE Bond Market + Interest Rates

10-Year Treasury yield: 4.14% (last updated daily observation).

Every decision by the Federal Reserve impacts financial markets, as changes in yields affect both investors and borrowers.

- The Fed cut rates on December 10, 2025.

- AP reported a 0.25% reduction in the benchmark rate.

- Mortgage rates do not always fall right after the Fed cuts rates.

- They usually follow long-term yields and changes in inflation expectations.

Live Mortgage Rates (Conventional / FHA / VA / Jumbo)Freddie Mac PMMS (weekly):

- 30-year fixed: 6.15% (as of Dec. 31, 2025)

- 15-year fixed: 5.44% (same survey)

Current market pricing for most borrowers is as follows:

- Conventional 30-year: high 5% and low 6% (depending on credit, loan level price adjustments, and property type)

- FHA and VA loans can be more affordable than some conventional loans, but the actual cost depends on factors such as mortgage insurance, closing costs, additional fees, and the lender’s charges.

- Jumbo loan rates depend on how much banks are willing to lend and the amount of money they have available.

- Borrowers can often find better deals by shopping around.

- GCA Forums News stands out because it can handle complex loans, including those with unusual computer checks, high debt-to-income ratios, or past credit problems.

- Fast processing and following standard rules are its main strengths.

LIVE Precious Metals: Silver’s Surge, then a Hard Reset: Silver: “$80+ then back to low $70s”

- Reuters reported that silver briefly exceeded $80 per ounce before dropping sharply due to profit-taking and volatility.

Gold: record highs

- Gold hit record highs in late December, as investors sought safety and anticipated possible rate cuts.

“Paper Silvers” vs “Physical Silvers”

- Paper silver encompasses assets such as futures, options, accounts not backed by physical silver, and various funds.

- These are easy to buy and sell, but investors do not own physical silver.

- Instead, they have a claim whose value depends on the market and the company.

- Physical silver refers to owning actual coins or bars specifically set aside for the investor.

- This offers more security, but owners need to consider premiums, storage, insurance, and the difference between buying and selling prices, especially when demand is high.

From the CFTC Bank Participation Report, we see that all major banks are on a net short position in COMEX silver futures/options for the most recent week.

Banks (U.S. + non-U.S.): Long 25,216 vs Short 67,527 ⇒ Net short 42,311 contracts (≈ 211.6 million ounces, with 1 contract = 5,000oz).

Important: While the public BPR aggregates ’U.S. banks’ vs. ‘non-U.S. banks’, it does not identify JPMorgan or any other individual bank in that summary. Therefore, it is justifiable to make the claim “banks are net short,” but based on the BPR alone, “JPM is X% of the short” cannot be substantiated.

Causes of the Recent Pullback and Potential for Recurrence

- Reuters reported profit-taking after the blow-off move above $80.

- When the CME raises the amount of money traders need to put up, prices can swing more as traders hurry to add funds or risk losing their trades.

- These increases helped drive the recent jump in silver prices.

Silver Price Forecast for 2026: Three Potential Scenarios

- Bull case (higher highs):

- If the Federal Reserve continues to make money easier to borrow and real returns decline, silver could remain popular, aided by its use in industry and its reputation as a safe investment.

- The late 2025 rally showed these expectations.

- Base case (wide swings): Expect large price changes, with quick moves up and down.

- Fast reversals are common, and changes in trading requirements can amplify both gains and losses.

- Bear: If the economy faces high inflation and slow growth, or if a sudden downturn leads many to sell their investments, silver could drop quickly.

- This would indicate that silver can be both a safe and a risky option.

In summary, silver looks strong in the long run, but short-term trading can be very unpredictable, especially for those using borrowed money.

Housing Market and Mortgage Trends Forecast (Bubble vs “Slow Grind”)Current Trends

- Mortgage rates have come down from their peaks, but buyers still face high prices.

- More cities now have a higher number of homes for sale, with some price drops, which represents a significant change from the period when there were very few homes available.

Is a housing bubble “really on its way”?

A crash like 2008 typically requires three elements: a large number of risky loans, forced selling by lenders, and sudden payment increases for many borrowers. Today, conditions are different:

- Most owners have low, fixed-rate mortgages, and underwriting has been much tighter than before the 2008 financial crisis.

- A slow, uneven adjustment is more likely than a big crash.

- Prices are expected to remain mostly stable, although some areas may experience slight drops, and affordability will continue to be a challenge.

Total Single-Family Originations Predicted To Rise In 2026

- Single-family home loans are expected to rise in 2026, as more people refinance and buy homes.

- As The Industry Consolidates: Industry changes point to tougher times ahead.

- The weakest companies are closing, merging, or laying off workers, according to recent news reports.

How GCA Forums Can Keep Winning in 2026 (publishable talking points)

- Focus on loans that do not meet standard rules and employ special evaluation methods for borrowers.

- These options help people who do not meet typical requirements, and GCA Forums’s flexible approach can be beneficial when others cannot.

- Offering fast reviews, detailed checklists, both computer and personal checks, and expert advice can attract borrowers who were turned down by other lenders.

- Keep the business simple and responsive. In an uncertain market, being quick and dependable matters more than always offering the lowest rate.

What does NEXA Mortgage do compared to other lenders or mortgage brokers?

- In 2025, NEXA was reported as one of the largest brokerages by headcount, with over 3,000 sponsored loan officers, according to NMLS Consumer Access.

- This shows that, even in tough times, being large and hiring well are important as brokers and lenders face smaller profits and higher rates.

- GCA Forums, and its parent company Gustan Cho Associates’s business and profit numbers are private, but it is known as a one-stop shop for mortgages.

- If needed, a ‘State of GCA Forums’ report can be created using internal data like applications, approvals, and processing times, while keeping private information secure.

Chicago + Sanctuary City + “Companies Leaving” (LIVE Local Lens)Chicago’s sanctuary-city posture

- Chicago’s City Council stopped attempts to weaken sanctuary protections (notably, a 39-11 vote was reported), maintaining restrictions on the Chicago Police Department’s (CPD) collaboration with federal immigration enforcement.

Big-name corporate exits / downsizing tied to Chicago/Illinois narrative

Several headline instances continue to influence the narrative:

- Boeing consolidated its headquarters to Arlington, VA (relocation announced in 2022).

- Caterpillar consolidated its global headquarters in Texas (relocation announced in 2022).

- Citadel relocated its headquarters to Miami in 2022 and has reportedly been reducing its presence in Chicago.

- The city has seen some projects and large companies leave or relocate to the suburbs, but local supporters argue that new companies are still investing in Chicago.

Auto Industry: Sales, Financing Rates, and 2026 Outlook: Auto financing rates: why buyers are feeling the pinchExperian reported the following average rates:

- New vehicles: mid-6%.

- Used vehicles account for about 11% or more, with significantly higher rates for individuals with poor credit, which exacerbates the car market outlook.

- Edmunds expects about 16 million new vehicles to be sold in 2026.

- Sales appear steady, but high prices remain a concern.

- Other forecasts agree, predicting 15.5 to 16 million cars, with interest rates, discounts, and policy changes all affecting the market.

Cox Automotive Inc.

- Policy risks include tariffs, higher supply costs, and sudden changes in demand (MarketWatch).

Politics: Trump, Powell, and Watching the DOJ/FBI in the Lead

How is the voter favor for Trump?

- Polling averages indicate that Trump’s support remains in the low to mid-40 percent range, although results vary by methodology and timing.

“Are Trump and Jerome Powell meals unrelated?”: Trump and Powell

- Most media outlets say Powell’s term at the Fed will last until May 2026.

- Many reports ask if Trump will replace Powell before then.

- Most experts agree that it is unclear whether the president can replace the Federal Reserve chair, and many see this as an important issue for the institution.

- A clear answer is not expected soon.

There is coverage of people and documents that suggest a civil and political controversy has arisen regarding the actions of the DOJ and the FBI. Financial Times.

- Pam Bondi.

- Bondi has served as the Attorney General, and this has been reported in both informal and formal DOJ documents.

- Bondi’s coverage is in the DOJ, and the A.G. reports. This is a report by Forbes.

What can be said as the truth?

No comment can be provided on this report at this time. While there is evidence of pressure, controversy, and political maneuvering, no documentation indicates that either Patel or Bondi has been dismissed.

https://www.youtube.com/watch?v=ovO7RvAT8Jk

-

This discussion was modified 2 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 2 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 month, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

GCA Forums News For Friday January 2 2025

GCA FORUMS NEWS — News Report: FRIDAY, JANUARY 2, 2026 (Markets & Rates “LIVE” Update)

Published by: GCA Forums News (Great Community Authority Forums), a subordinate company of Gustan Cho Associates

LIVE Wall Street Closing Bell Recap (4:00 PM ET / 3:00 PM CT)

U.S. stocks began 2026 with a slight bounce, aided by strong performances from chip and industrial companies. Even though the usual ‘Santa Claus rally’ did not happen, investors were quick to buy when prices dropped.

Major Index Closes (Jan 2, 2026):

- Dow Jones: 48,382.39 (+319.10 / +0.66%)

- S&P 500: 6,858.47 (+12.97 / +0.19%)

- Nasdaq: 23,235.63 (-6.36 / -0.03%)

- Russell 2000: +1.1% (Small caps broke a 4-day losing streak)

Trading was influenced by rising chip stocks, shifting predictions about interest rates, sluggish performance from major companies, and new developments regarding tariffs. According to Reuters, some planned tariff increases are now paused.

LIVE Bond Market & Interest Rates (Key Benchmarks)

Treasury yields are still high, and the shape of the yield curve suggests that investors expect interest rates to decline soon.

Yields on the U.S. Treasury (most current):

- 10-Year Treasury: 4.18% (result from Dec 31)

- 2-Year Treasury: 3.47%

- 30-Year Treasury: 4.58%

Fed applicable “reality check” $$ rate

- Effective Fed Funds Rate (EFFR): 3.64% (as recorded on Jan 2)

Mortgage rates typically follow the 10-year Treasury, but are also influenced by fluctuations in mortgage-backed securities, inflation, and daily market movements.

Snapshot of LIVE Mortgage Rates (At a National Level)Current “LIVE” averages seen by the consumer

- 30-year fixed: 6.20% (close to 6.25% APR)

- 15-year fixed: 5.44%

- 5/1 ARM: 5.67%

- 30-year jumbo: 6.34%

Weekly benchmarks (Freddie Mac PMMS — week that ends Dec 31, 2025)

- 30-year fixed: 6.15%

- 15-year fixed:5.44%

Today’s rates are still much higher than in 2020 and 2021. Still, mortgages in the low 6% range have led some people to refinance and attracted buyers who want more choices and sellers who are willing to make deals.

LIVE Precious Metals: Gold & Silver (even Silver Shock Move)

Precious metals have not only increased in value but have also demonstrated their ability to maintain their worth, especially after 2025.

New Spot Metals (as of Jan 2, 2026):

- Gold Price: $4,372.35/oz

- Silver Price: $73.79/oz

Silver jumped to a record $83.62 before falling back to the low $70s, illustrating just how volatile its price can be.

Currently, silver is facing two outlooks for 2026. The positive view for silver in 2026 comes from limited supply, increased industrial use, and the possibility that interest rates will decrease. Many sources indicate that demand exceeds supply. Some experts believe that if rates drop further, silver could reach $90 in the first half of 2026.

The

Bubble Risk/Correction’’ OutlookThe negative view warns that silver’s recent price jumps may not last. Analysts at Barron’s and other sources say prices have risen too quickly, which could lead to a drop if past bubbles repeat themselves. High silver prices are likely only if interest rates continue to fall. If not, demand could drop, and prices could decrease.

- If the dollar strengthens, the economy slows, or speculative investors pull back, silver prices could drop rapidly. The same factors that push prices up can also cause sharp declines.

“Paper Silver” versus “Physical Silver”: What is the difference?

This distinction is often debated among investors. Here is a brief explanation:

Paper silver refers to investing through futures contracts or ETFs, where investors typically do not receive the actual metal. Futures contracts let you invest without owning silver, but they come with risks, like price changes that can lower returns. Physical silver, such as coins or bars, requires delivery, storage, and insurance. Extra costs can go up when demand is high. Regulators say that many traders do not fully understand the risks in these markets or the dangers associated with high-risk buying.

“Big Banks Short Silver” — Including JPMorgan: What is Verifiable

What is verifiable today: FTC **Bank Participation Report (BPR)** captures and publishes data on aggregate bank positions, dividing them into U.S. banks and non-U.S. banks. Individual banks remain unnamed, so you cannot “prove” JPM’s net short from the BPR alone.

What’s verifiably recorded in the past:

JPMorgan has faced significant enforcement actions related to precious metals trading, including a well-documented $920 million settlement with U.S. authorities for spoofing metals futures markets.

In summary, while metals markets face challenges, caution is advised regarding unverified claims about specific banks. Regulatory reports do not provide detailed information at the institution level.

Shifting Dynamics in the Housing Market

Although mortgage rates are lower than they were last year, affordability remains the primary challenge for prospective homebuyers, especially first-time buyers. There has been an increase in listings, along with a greater willingness among sellers to negotiate. Market Adaptation.

On December 19, 2025, the Mortgage Bankers Association reported a 5% decline in mortgage applications, indicating that demand remains inconsistent despite modest rate decreases. Purchase activity has risen year-over-year, although refinancing remains highly sensitive to interest rate fluctuations.

For lenders and brokers, this means:

- High interest rates and home prices have led to fewer simple deals, lower profits, and more borrowers shopping around for the best offer.

- Industry leaders are focusing on home purchases, quicker closings, and special loan products, such as Non-QM loans, DSCR loans, bank statement loans, and asset-depletion loans, all of which are offered with fewer additional rules. Gustan Cho Associates and NEXA doing?

Internal performance data is not available, making it difficult to provide a clear answer. The approach of removing unnecessary rules, utilizing hard files, offering alternative methods for showing income, and streamlining processing appears to address today’s approval challenges and the surge in homes for sale.

There are concerns that the economy could weaken due to rising unemployment, reduced consumer spending, and tighter credit. Persistent inflation, stagnant wages, and higher prices for essential goods are widening the wealth gap.

The economy could slow down rapidly if interest rates rise quickly, more people lose their jobs, and loans become harder to obtain. On the other hand, strong spending, low unemployment rates, and higher wages are helping to lower the risk of a recession.

LIVE Sanctuary State News + Chicago

Chicago 2026 Budget Now Impacting Chicagoans

The new budget and added fees include:

- A 15-cent charge applies per plastic or paper bag if you do not bring your own.

- Grocery tax gone (city failed to keep it), saving families money.

- Property: The grocery tax has been eliminated, saving families money. Several executives have also departed from the Chicago area.

Chicago is still known around the world for its high taxes, high costs, and a challenging business climate, with big companies relocating and local business news covering the issue.

Chicago + Sanctuary City + Trump’s Legal Problems

Trump continues to face legal challenges related to Chicago and Illinois policies that limit intergovernmental cooperation with civil immigration detention.

Illinois provides that the TRUST Act generally bars local law enforcement from immigration enforcement and detention.

Another key development: reports indicate that Trump is withdrawing the National Guard from Chicago following legal disputes and court orders.

Auto Industry Update: High loan costs and sales pressure continue. Loan costs, especially for used cars, are making it increasingly difficult for people to afford a car. Experian’s State of the Automotive Finance Market (Q3 2025) reports average interest rates of about:

- Looking ahead to 2026, lower interest rates may make monthly car payments more affordable. High car and insurance costs are still expected to limit demand, so cars with significant discounts will be more popular, while buyers with smaller budgets may face a harder time. ited budgets.

Politics & Power: Who’s On The Way Out? Trump, Powell, Patel, Bondi

Fed Chair Jerome Powell: Will Trump fire him?

Trump has openly criticized Powell and said he would like to fire him. According to Reuters, Trump has even threatened to sue Powell and said he will announce a replacement “next month.”

However, Reuters reports that Trump has said he is not going to fire Powell, though he appears to be keeping that option open.

Most people are aware that Powell’s term ends in May 2026 and that selecting a new chair, which requires a nomination and Senate approval, takes time, according to most experts. Discussing the potential removal of the Federal Reserve Chair can significantly impact stock, bond, and currency markets. The Federal Reserve’s independence remains crucial for maintaining market stability.

FBI Director Kash Patel

Kash Patel is the current FBI Director as of February. He has served as FBI Director since February 20, 2025, according to the FBI’s official leadership page. The FBI wanted to remove him, but there is no confirmation that Patel has been removed.

U.S. Attorney General Pam Bondi

The U.S. Senate confirmed Pam Bondi as Attorney General in February 2025.

As of today, there have been no official announcements regarding the removal of Bondi or Patel from their positions. Current discussions remain speculative and part of ongoing political and media debate.

GCA Forums “What This Means” Summary (Jan 2, 2026)

- Stocks: Gains have been concentrated in the semiconductor and industrial sectors, with ongoing volatility. 2026 has started on a strong note.

- Rates: Elevated Treasury yields continue to limit affordability, though markets anticipate a shift toward more accommodative monetary policy.

- Mortgages: While a 6% rate does not solve everything, it does help a bit. The number of homes for sale and how willing sellers are to make deals remain the primary factors driving the market. These factors depend on interest rates, the number of homes available, and the extent of speculation, especially after prices dropped from the $80s to the $70s. Other changes include new budget rules and ongoing debates about sanctuary city policies.

https://www.youtube.com/watch?v=EHIxB31GJE8

-

This discussion was modified 2 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

GCA Forums News For Saturday, January 3rd, 2026

SPDR S&P 500 ETF Trust (SPY) Current Stock Market Data

- The SPDR S&P 500 ETF Trust is a key U.S. exchange-traded fund that provides investors with a view of how the American stock market is performing.

- SPY is trading at $683.17, about the same as its previous close.

- This shows a brief pause in an otherwise active market.

- SPY opened today at $685.67, with over 89 million shares traded so far, indicating strong investor activity.

- Today, SPY has traded between $686.82 and $679.86, indicating significant market activity.

- The last trade was recorded on Friday, January 2, at 7:15 p.m. CST, ending another busy session.

GCA Forums News: National Breaking News

January 3, 2026 (America/Chicago)

U.S. cash trading is closed on Saturdays. Level indicators show Friday’s market close, with updates reflecting post-close changes.

LIVE Stock Market Snapshot (Last update)

At the start of the year, investors feel both hopeful and cautious. The S&P 500 and Dow Jones rose, but the Nasdaq fell, as investors watch what the Federal Reserve will do next.

- S&P 500 proxy (SPY): 683.17

- Dow proxy (DIA): 483.63

- Nasdaq-100 proxy (QQQ): 613.12

On Friday, the market had both gains and losses. Treasury yields rose slightly as investors awaited further updates after the shutdown, which had made data collection more challenging.

LIVE Bond Market + Interest Rates

Treasuries (benchmark)

- 10-Year Treasury yield: ~4.19% (last reported)

- Bond ETF “tell”: TLT 87.03 (duration 20+ years) and IEF 96.08 (7-10 year)

Federal Reserve (policy rate)

- After cutting rates three times in 2025, the Federal Reserve is now closely monitoring inflation and the slowing job market.

- Analysts are paying close attention to the Fed’s meeting on January 27-28, 2026.

Mortgage-Backed Securities (rate pressure gauge)

- MBB (agency MBS ETF): 95.14

- When mortgage-backed securities decline, regular mortgage rates often remain the same or improve slightly, providing some relief to borrowers.

Current National Mortgage Rates

Rates have remained steady, fluctuating around the mid-6% range with only slight daily changes.

- According to Freddie Mac, 30-year fixed mortgage rates stood at 6.15% as of December 31, 2025.

- 30-year fixed mortgage rates from Mortgage News Daily are 6.20% as of January 2, 2026.

High mortgage rates remain a challenge for buyers, and advertised rates often fail to disclose important details. Fees, credit scores, property type, and other factors can raise real payments, especially for those barely qualifying. precious metals prices and the silver shockwave

Spot Prices Of Metals Today

- Gold: approximately.

- Silver has followed the US dollar, dropping from $80 to $73.

- Several factors are affecting prices, and most spot quote pages now list silver’s average price between $73 and $74.

There Are Usually Two Main Reasons Why Silver Prices Sometimes Reach $80 Or More:

- Retail ‘all-in’ pricing, which means the spot price plus extra costs, sometimes made regular product prices go above $80, even when the spot price was lower, or

- Such prices may also occur due to certain dealer prices, wider gaps between buy and sell prices, or short-term fluctuations when there are few trades.

What has affected silver prices lately?

- China’s new export rules and concerns about low supply have impacted the silver market, particularly at the start of the year.

- Silver’s price is closely tied to China’s exports and strong demand from industries such as solar, electric vehicles, and data centers.

What will silver be priced at in the future again? What may happen? What will probably happen (with bullish and bearish analysis).

- Over the next month or two, silver’s price could fluctuate significantly.

- If interest rates change or the Fed surprises the market, silver might fall to about $70

- If exports grow and borrowing becomes easier, prices could rise.

- But if rates rise, silver could get even cheaper.

Positions in silver (JP Morgan and major banks): how to explain it clearly

- There is an ongoing. People are still talking about short positions in silver.

- Here’s what the Commodity Futures Trading Commission (CFTC) does: it tracks how financial instruments are concentrated, but a short position does not always mean betting against silver.

- Banks often hedge their positions with other assets or manage trades for their clients.

- For most investors, it’s better to focus on liquidity, premiums, and how trades are settled, instead of blaming big players. and Silver Physical Prices Diverge

- Paper silver refers to financial products such as futures,

- ETFs, unallocated silver accounts, and synthetic silver.

- These are often harder to buy or sell quickly than real silver because you only have a claim, not the actual metal.

- Physical silver consists of tangible metal products, such as coins or bars, that can be stored directly by the owner or in secure vaults.

- These factors explain why the prices of paper and real silver can differ significantly.

- When retail supply is low, premiums can increase significantly, so physical silver may sell for more than the spot price.

- In practice, delivery problems, short deadlines, and limited stock can matter more than the quoted price.

- See headlines touting $80 silver, even though the spot price lingers at $73.

Mortgage And Housing Market Forecast

Current status of the market

- Home sales surged in November 2025, reaching a three-year high (National Association of Realtors).

- This increase is attributed to improved affordability and the introduction of new inventory.

- Although more homes are for sale, the U.S. still faces a significant housing shortage, so prices remain high.

- Some people wonder if another bubble, larger than the 2008 one, is coming.

- There are extensive comments.

- Many people have commented on this topic.

Here’s a balanced view: It occurred because banks issued risky loans, and the system ultimately collapsed. Today’s problems are mostly about high prices, with people stuck paying expensive mortgages with rates of 6% or more. This differs from the credit problems of 2008. Most experts believe that things will gradually improve, with more homes for sale and lower rates, rather than a sudden change. With fewer new loans, the mortgage industry is consolidating. Companies like Rocket are now focusing more on servicing and distribution. For 2026, a slow but steady recovery in new loans is expected, but a return to the boom of 2021 is unlikely.

News from the Midwest: Chicago, Illinois, And The Sanctuary City/State

Chicago and Illinois remain central to the national debate about sanctuary cities and federal immigration enforcement.

- Illinois has enacted additional immigration protections (including new avenues for constituents to sue federal agents for alleged rights violations) during a period of increased enforcement.

- In December, both federal enforcement and Chicago immigrant communities reported a new surge in activity in the area.

- Trump announced that National Guard troops are being withdrawn from Chicago and other cities after some legal defeats.

- The U.S. Supreme Court has established limits on deployment authority in Illinois, and the administration is adhering to these rules.

- Illinois has dropped its 1% grocery tax, but starting January 2026, some towns and cities will keep their own local versions in place.

The Road Ahead: Auto Industry Financing, and What 2026 Might Bring

Trends in the auto industry

The Financial Times reports that EV adoption in 2026 is expected to slow, with some predicting U.S. sales will drop even as sales grow in Europe and China.

Auto financing (what buyers are feeling)

- In November, Edmunds reported that the average APR for new car loans had fallen to approximately 6.6%, the lowest level since 2025.

- Gradual improvement is expected, but credit scores still matter a lot.

- Even so, buyers are under a lot of stress as prices and loan terms change.

- Inflation and economic uncertainty continue to make the market uneasy.

- Reuters reports that the November CPI is about 2.7% year-over-year, showing a slowdown from earlier levels.

- But data gaps from the shutdown have made the outlook less clear.

- In December, the Fed showed internal divisions. Inflation remains a concern, but the weaker job market is also becoming increasingly significant.

Politics: Trump, Powell, Kash Patel, Pam Bondi

Trump + the Fed (Powell)

- Powell’s term as Fed Chair ends in May 2026.

- Reports say Trump is pressuring him to choose a replacement, raising concerns about the Fed’s independence.

- Trump begins the year with low approval ratings in some polls, although fewer polls are conducted during the holidays.

- FBI Director Kash Patel: “On the way out?”

- A recent Reuters report stated that Trump openly supported Patel after some reports suggested he might remove him, despite the White House’s denials.

- Leadership changes around Patel; for example, Bongino is stepping down as deputy director.

- Attorney General Pam Bondi: “On the way out?”

- Bondi is still serving as Attorney General, according to the DOJ’s official leader.

- There is political pressure and criticism over DOJ actions, including how the Epstein files were handled, but no one has officially left.

- Since Gustan Cho Associates does not disclose its production, revenue, or staffing numbers, it is difficult to predict what the company will do next.

Still, a few things stand out in the bigger economic picture:

- Currently, successful companies receive numerous referrals, operate in various broker and wholesale areas, possess extensive knowledge of specialized loan types, work efficiently, and excel at identifying new customers.

- GCA Mortgage Group claims it excels in these areas as a broker platform.

NEXA Lending is still regarded as a large brokerage and appears in industry rankings, such as the Scotsman Guide’s broker rankings page.

Across the industry, companies are consolidating rather than expanding. Even the largest firms are cutting costs and carefully planning their next moves.

If top-line metrics from the past 30 to 60 days are available—like lead count, applications, clear-to-close, funded units, pull-through rate, and average compensation—a short “GCA performance versus market” section can be created using these numbers.

https://www.youtube.com/watch?v=xQ74eZIHI10

-

This discussion was modified 2 months ago by

Harlan.

Harlan.

-

This discussion was modified 2 months ago by

Gustan Cho.

Gustan Cho.

-

Current Stock Market Information for SPDR Dow Jones Industrial Average ETF (DIA)

- The SPDR Dow Jones Industrial Average ETF remains a favorite among U.S. investors, consistently capturing attention and fueling enthusiasm nationwide.

- The ETF is currently trading at $481.15, which is $0.65 higher than the previous close.

- The trading day began at $480.56, and with over 6.4 million shares changing hands, the market was abuzz with heightened activity.

- Throughout the session, prices swung between $482.75 and $479.31, reflecting a day marked by noticeable volatility.

- The final trade rang in at 3:55 PM PST on Friday, December 19, capping off a day of gains for U.S. stocks, thanks largely to robust performances in the technology sector.

- The Dow Jones Industrial Average closed at 43,246.65, up 86.31 points.

- The S&P 500 rose 0.7% to 6,140.74, while the Nasdaq gained 1.0% to 20,173.89.

- Shifts in the market were shaped by fresh inflation numbers, ongoing tariff negotiations, and a wave of company earnings, with Nike’s results making a particularly strong impression.

LIVE Rates: Treasuries + Mortgage RatesYields on Treasuries (as of the end of the trading day)

- 10 Treasury = 4.16% (closed)

- 2 Year Treasury = 3.48%

- 30 Year Treasury = 4.82% (closed)

Average Rates on Mortgages (as of today)

- Mortgage News Daily (as of today) 30 Year Fixed = 6.25% (as of 12/19/2025)

- Freddie Mac PMMS week prior to 12/18/25): 30-year.

- With mortgage and real estate rates trending downward, the housing market has sprung to life with renewed activity.

- Buyers are now finding themselves in the driver’s seat, often securing discounts or special incentives from eager sellers and builders.

Live Precious Metals Update: Gold is trading at $4,328.24 per ounce, dipping about 0.1% today.

- Spot silver is currently priced at $65.93 per ounce, up about 0.8% today.

- In the world of precious metals, easing inflation is fueling growth and sparking hopes for more favorable interest rates ahead.

- However, a stronger U.S. dollar is preventing gold prices from rising further.

Economy Watch:

Tariffs and state inflation credits are reshaping the marketplace, changing shopping habits and shifting the price tags on everyday goods.

As store shelves fill up and prices climb, consumers are tightening their wallets, financial leaders report.

Another report states that officials remain cautious about tariffs and anticipate the company will reveal $1.5 billion in new tariffs, a hit that could dent both its profits and its stock price. In the housing sector, rising tariff-related costs have prompted the Federal Reserve to tread carefully, slowing the decline in mortgage and other long-term interest rates. the long-term interest rates.

Circumstances of Policy

The White House disclosed an extension of particular Section 301 tariff exclusions (and associated trade actions) as part of a U.S.–China economic/trade package.

For an overview of 2025 tarifFor a summary of 2025 tariff actions and their status, CRS provides an ongoing update.et: This week, what changed

Existing Home Sales: A Small Improvement, Affordability. November saw existing-home sales tick up by 0.5% to an annualized pace of 4.13 million. The median price climbed to $409,200, outpacing last year’s mark. With 1.43 million homes on the market—a 4.2-month supply—the market is stabilizing. Still, steep interest rates and lofty prices remain hurdles for first-time buyers, who accounted for 30% of the sales in November. According to the National Association of Realtors.

The Mortgage Bankers Association (MBA) reported that mortgage applications declined by 3.8% for the week ending Dec. When rates hover between 6.2% and 6.4%, borrowers tend to act quickly, eager to lock in a deal. Usually move fast.

Lower rates make people more likely to refinance, while higher rates reduce demand.

Soaring prices and mounting costs are squeezing borrowers, making homeownership feel further out of reach.

It’s essential to continually review political and media reports to distinguish facts from speculation.

Erika Kirk and Vice President JD Vance, specifically concerning relationships and paternity, remain unsubstantiated despite mention by some credible sources.

No evidence has been presented to support the alleged affair.

Vance has addressed public discussion of his marriage, and both he and his wife have characterized the rumors as Social media claims about paternity and infidelity have not been verified and are not backed by major news outlets. These claims should be viewed as unconfirmed.

What happened with Erika Kirk and Candace Owens’ meeting (Monday, Dec. 15, 2025)?

Some sources suggest that Erika Kirk and Candace Owens met, possibly to discuss Owens’ criticisms. The meeting was reportedly focused on Owens’ public comments.

- Kirk mentioned Owens during AmericaFest, indicating a clear tension between them.

- Major news outlets have covered the scripts from the closed meeting, so any specific claims should be treated with caution.

Candace Owens’ criticism of Erika Kirk

Owens increased the backlash and controversy surrounding Sabina Kirk, exacerbating the public rivalry. Reuters reported that Bongino plans to resign because of disagreements and issues with FBI Director Christopher Wray, not with Kash Patel. Bongino reportedly wants to avoid a major conflict. Other reports on Facebook and from the Associated Press also stated that Bongino would resign due to disagreements with Patel. However, neither Reuters nor the Associated Press stated that FBI staff mocked Bongino or spoke negatively about him; those claims remain unproven rumors.

Kash Patel: There are rumors about Kash Patel, his girlfriend, and the use of a private jet and security detail. Here’s what has been confirmed: an FBI spokesperson said claims about a SWAT team as security are **false** and that only standard protective measures are used for leadership, not a SWAT team. A local Fox station reported that Patel denied any false claims about using jets or security. No reliable sources have confirmed any details about the ‘Utah tantrum’ or ‘missing FBI jacket’ stories. These should be considered unverified social media speculation until trustworthy reports confirm them. Mortgage rates and 10-year Treasury yields are staying about the same (mid-6% for mortgages, about 4.16% for the 10-year). It remains challenging for many people to afford a home. Home sales have increased slightly, but prices remain high, and the number of homes for sale is limited. Inflation has decreased, but it could remain high, depending on company profits and consumer spending trends. Kirk and JD Vance’s infidelity and paternity rumors have not been confirmed by major news sources. Kash Patel discussed Dan Bongino’s departure from the FBI, stating, “Kash Patel praises Dan Bongino, exiting the FBI.” This headline from Facebook’s Breaking News sums up the story.

-

GCA Forums News For Friday January 9 2026:

At the beginning of 2026, the U.S. economy experienced rising prices, uncertain interest and mortgage rates, and instability in the housing market. Volatility in silver and other precious metals has renewed debates over the value of paper versus tangible investments and highlighted how major banks are positioning themselves. Additionally, high-profile events such as the arrest of Venezuela’s Nicolás Maduro in New York and a significant welfare fraud case in Minnesota have drawn attention to corruption, potential housing market risks, and the effectiveness of President Trump’s economic and legal strategies.

The U.S. stock market entered 2026 with new inflation data but no policy changes. Updates on employment, tariffs, and Federal Reserve rates are shaping investor sentiment. Treasury yields have increased since January and remain elevated, although borrowing has become somewhat easier. These rates, however, are still below their pandemic peak.

Federal Reserve Board

- The Federal Reserve has maintained low short-term rates, with the 2-year Treasury near 3.5%.

- This indicates the market does not anticipate significant rate cuts this year.

- Investors are weighing the risks of high government debt and rising prices, and are adjusting their long-term Treasury forecasts accordingly.

- The 30-year Treasury rate is just under 4.9%. day’s 30-year fixed mortgage rates are between 6.1% and 6.2%.

- That’s lower than last year’s 7%, but still about double the very low rates from 2020 and 2021, making it hard for many people to buy a home.

- Fifteen-year fixed mortgages are currently available at rates ranging from 5.4% to 5.5%.

- These lower rates are appealing, but the monthly payments are higher because the loan is paid off faster.

- Government-backed loans provide some relief: 30-year FHA and USDA mortgages are just under 6%, and VA loans are in the high 5% range, supporting first-time buyers and veterans.

- For auto loans, credit unions offer rates in the low to mid-3% range, but most borrowers receive rates between 7% and 9% for good credit, with higher rates for poor credit.

- Rising car prices and higher rates are making car payments increasingly difficult to manage.

Silver, Precious Metals, and Shorts on Banks

- Silver is trading at $78.74 today, up from $58 a month ago and significantly higher than $30 a year ago.

- Prices remain volatile, with silver briefly surpassing $80 earlier this week before falling back to the mid-$70s.

- These rapid fluctuations are driven by profit-taking and forced sales on risky positions.

- Experts attribute this volatility to several factors: limited mine supply, strong demand from solar panels, electric vehicles, and electronics, ongoing supply chain issues, and more investors seeking tangible assets as inflation stays above the Fed’s 2% target.

- Because the silver market is smaller than gold, large trades by funds or investors have a greater impact.

- The gap between paper silver (contracts and accounts) and physical silver (coins and bars) has widened, with premiums rising sharply during price swings and concerns about counterparties.

- When prices surge, physical silver often becomes scarce and premiums increase, exposing market vulnerabilities.

- CFTC commentary and Bank Participation Reports show that a few large banks, including JPMorgan, have at times held significant net short positions in COMEX silver.

- One analysis found a single bank’s short position equaled 25% of annual global production.

- Some suggest these positions are hedged against industrial flows or OTC derivatives.

- Regulators have documented the concentration but have not found clear evidence of manipulation in recent data.

Silver Price Forecast

- Looking ahead to 2026 and 2027, experts believe silver will remain strong due to limLooking ahead to 2026 and 2027, experts expect silver to remain strong due to limited supply and steady industrial demand, but caution that prices may be highly volatile and could drop sharply.

- If inflation stays near 2.5% and the Fed does not lower rates, most anticipate silver will trade within a wide range, with a risk of decline if returns on safe investments increase.

- Many Americans planning to buy or sell homes in 2026 are preparing for potential market instability, but most buyers, sellers, and agents remain optimistic, viewing the year as challenging yet promising rather than disastrous.elp balance the market.

- However, by year’s end, there will still be 12% fewer homes for sale than before 2020.

- Economists warn that a weak job market and persistent inflation could trigger a crisis similar to 2008.

- However, most forecasts do not predict a recession or major policy changes, instead expecting a gradual return to normal economic conditions.

The Fed, Mortgage Rates, and Treasuries.

The 10-year Treasury rate, currently at 4.17%, has a significant impact on mortgage rates. Despite higher rates, the mortgage market remains active. The Fed expects inflation to stay low and is prepared to cut rates if needed, which helps mortgage lenders even when rates are high.

The mortgage industry is poised for a wave of consolidation as smaller companies struggle to keep pace. High inflation, rising rates, shrinking profits, and more regulations are narrowing The mortgage industry is set for consolidation as smaller firms struggle to compete. High inflation, rising rates, shrinking profits, and increased regulation are narrowing the market. Large, tech-driven platforms with diverse services and adaptable brokerage teams are emerging as leaders. Companies like Nexa Mortgage are thriving due to multiple lender options and competitive pricing. Gustan Cho Associates’ broker-first approach has consistently outperformed peers, driven by efficient operations and a focus on home purchases. Recent inflation data show U.S. prices rising about 2.6% over the past year, the lowest in years but still above the Fed’s target. Early 2026 models suggest prices are increasing 0.2% to 0.3% per month, indicating a gradual slowdown, though tariffs and energy prices continue to create uncertainty.ousing costs, rising credit card rates, and political issues are making things tougher for small businesses and families.

U.S. – Venezuela Relations

US-Venezuela relations have escalated after US forces captured Venezuelan President Nicolas Maduro and his wife, Cilia Flores, and transported them to New York City to face long-standing charges of narcoterrorism and cocaine trafficking. They have been processed in federal court in the Southern District of New York, where a superseding indictment includes a 25-year conspiracy to smuggle cocaine to the U.S. in collusion with Colombian guerrilla fighters and terrorist-designated organizations.

The charges include conspiracy to commit narcoterrorism, cocaine-importation conspiracy, and related weapons offenses, all carrying lengthy minimum sentences and possible life imprisonment. Legal experts note the unprecedented nature of arresting a sitting head of state on drug charges, raising complex issues of sovereignty and international law. The US maintains that this is a law enforcement action to address the drug crisis, while the defense plans to challenge jurisdiction and legality.

Governor Walz and Minnesota Welfare Fraud

The expanding scope of fraud in Minnesota’s welfare system has drawn federal prosecutors and auditors, who now estimate $9 billion in taxpayer funds were stolen through child-nutrition and laundering schemes.

- The Feeding Our Future case is a notable example of such fraud.

- The group allegedly billed for thousands of meals never provided and used the money for luxury real estate, cars, and overseas properties.

- The House Oversight Committee is investigating social services in Minnesota, focusing on state governance and ordering the governor and attorney general to submit records and testify about what they knew and when.

- While this major investigation has led to accusations of “extreme corruption” during the Walz administration, recent public documents focus on the lack of oversight.

- There is still no evidence to substantiate charges against Walz and Ellison in the pending criminal case, nor evidence to support state criminal charges for lack of oversight.

Chicago, Illinois, and Sanctuary Cities:

- Illinois has seen a steady population decline for years, with over 1.6 million residents leaving since 2000, many of them young and highly educated. High taxes, crime, poor schools, and weak public services are the main drivers.

- While new residents, particularly immigrants to sanctuary cities, may slow the decline, the issue remains significant.

- Chicago remains a major sanctuary city, with over 50,000 immigrants arriving since 2022.

- This influx has created financial and management challenges.

- City council debates on Welcoming City rules, shelter budgets, and cooperation with federal immigration officials highlight the balance between supporting newcomers and ensuring public safety.

Auto and Related Industries – Financing

- The U.S. auto industry is facing stagnant sales, high car prices, increased borrowing costs, and continued investment in electric and hybrid vehicles.

- Dealers and lenders say that monthly payment limits now determine what they can offer, especially for loans with rates under 7-9% over seven years, which spreads out interest costs.

- A modest increase in car sales is expected for 2026, driven by pent-up demand from individuals and companies.

- However, this optimism may fade if the economy weakens or interest rates rise, making purchases more difficult and increasing dealer inventories.

- Both public and private conversations show that Trump’s influence is complicated.

- Many people, especially business owners, appreciate his tax cuts and reduced regulations; however, there is still considerable frustration over his views on immigration, trade disputes, and increased regulations, as well as concerns about democracy.

- Bondi has advanced as far as possible in defending the Maduro prosecution, reinforcing the Justice Department’s focus on transnational crime.

- Due to her close ties to Trump, Patel has been rumored in media circles to hold significant roles in Justice and the Intelligence Community.

- However, the public remains unclear about Patel’s involvement, particularly regarding corruption and her recently released subordinate.

- Patel has largely remained out of the spotlight, especially given concerns about the Trump Administration’s approach to the rule of law.

- Media speculation about Patel’s influence within the Administration persists, reflecting ongoing uncertainty about his role.

- Bondi has reached the highest level in defending the Maduro prosecution, reinforcing the Justice Department’s commitment to transnational crime. Due to her close relationship with Trump,

- Patel has been the subject of media speculation regarding significant roles in Justice and the Intelligence Community, though the public remains uncertain about Patel’s involvement, particularly in relation to corruption and his recently released subordinate.

- Patel has largely stayed out of the public eye, especially amid concerns about the Trump Administration’s approach to the rule of law.

- Media speculation about Patel’s influence within the Administration continues, highlighting ongoing ambiguity about his role.

https://www.youtube.com/watch?v=WoS4zt4OZNU

-

This discussion was modified 1 month, 3 weeks ago by

Gunner.

Gunner.

-

GCA Forums News For Sunday, January 4, 2026

As 2026 begins, the U.S. economy faces uncertainty. Inflation is easing but persists, and borrowing costs remain high. Silver prices have reached record highs, increasing market volatility. Observers are monitoring whether housing and credit markets will stabilize or encounter further challenges. Below is a national update from GCA Forums News as of January 4, 2026.

Live Markets, Rates, and Metals

In early 2026, U.S. stock and bond markets are diverging due to ongoing concerns about inflation and new regulations governing borrowing. Despite the Fed’s rate cuts at the end of 2025, mortgage and car loan costs remain elevated.

- Interest Rates (double macro)

- The Federal Reserve’s target interest rate is 3.5% to 3.75%.

- Lenders remain cautious due to concerns about credit risk and regulatory capital requirements, resulting in restrictive borrowing conditions.

- Inflation ended 2025 at 2.7%.

- The Federal Reserve and other experts expect it to stay between 2.4% and 2.6% in 2026.

- Borrowing costs are likely to remain high, even if official rates drop slightly.

- By 2026, 30-year fixed mortgage rates are expected to be approximately 6.1% to 6.2%, and 15-year fixed rates are anticipated to be around 5.4% to 5.6%, according to data from Optimal Blue, Bankrate, and Zillow.

- Government-backed loans, such as those offered by the FHA and USDA, generally provide slightly lower rates than conventional loans.

- However, first-time buyers continue to face challenges due to high monthly payments relative to their income and stricter approval standards, despite lower rates compared to those in 2023 and 2024.

Auto and Auto Financing

- Following the Fed’s rate cuts, new car loans now average in the mid-6% range nationwide, while used car loans typically range from 10% to 11%.

- The most qualified borrowers receive new car loan offers in the mid-5% range.

- Experts are optimistic about summer 2026, predicting that interest rates could decrease by up to one percent.

- Loan performance may improve during the busy season, although reports from Cox Automotive and TransUnion indicate late payments are still rising, but at a slower rate.

Silver and Precious Metals

- In late 2025, silver surpassed $80 an ounce, reaching a new high of $83 to $84 before retreating to the low and mid $70s.

- This followed its strongest year on record.

- As of the latest update, silver spot prices are approximately $72 to $73, with recent trades between $72.6 and $74.5.

- The closing price on January 4, 2026, was $ 72.90.

- Gold continues to set new records, trading at its highest prices ever, with some Asian markets exceeding $4,300 per ounce.

- Investors are increasingly turning to precious metals for protection against regulatory changes and global uncertainty, with silver attracting particular attention due to its sharp price increase.

- These trends are driven by reduced supply, regulatory shifts, and changes in trading strategies.

- The gap between the price of physical silver and silver contracts, as well as between physical silver and paper futures on COMEX, has widened significantly.

- What changed with big banks (JP Morgan and peers)

- For some time, JP Morgan was considered the largest short player in silver derivatives, with an estimated 200 million ounces of paper shorts.

- Critics argued this exposure disproportionately expanded the paper supply.

- Industry reports indicate that between mid-2025 and October 2025, JP Morgan closed its 200 million-ounce short position and established a significant net-long position, reportedly backed by 750 million ounces of physical silver.

- This move made JP Morgan one of the largest private silver holders.

- This significant shift eliminated one of the last barriers to higher silver prices. Former constraints on price increases now contribute to profit-seeking during price squeezes.

- Meanwhile, institutions such as HSBC and UBS are reportedly even more exposed on the short side. on the short side.

- The volume of silver contracts and related positions on COMEX and similar markets remains much higher than the available physical silver.

- Some estimates suggest these contracts could exceed twice the amount of silver in stock by late 2025.

- Physical markets tell a different story:

- There is a limited surplus of silver available, with approximately 1.5 billion ounces above ground.

- Export restrictions from major producers and reduced coin output from the U.S. Mint have made physical silver more expensive than silver contracts.

- Higher borrowing costs and inventory shortages indicate that physical silver now commands a premium over paper futures.

- This widening gap has raised questions about whether paper markets accurately reflect silver’s true value.

- Some forecasts predict increased price volatility, with one computer model projecting significant swings between the low and high $70s in early January.

- Silver’s market fundamentals remain structural in nature:

- Mining supply has declined, while demand is expected to increase, particularly in the United States, where silver is now classified as a ‘critical mineral.’

- Additional silver will be required for solar energy, electric vehicles, and electronics.

- Major market changes include JP Morgan’s reported shift and continued short positions by other banks.

- If these trends persist, more physical silver may exit the market, and regulations may become tighter.

- Larger price fluctuations are possible, even if temporary declines occur.

Mortgages, Housing, Bubble Talk

By 2026, the housing market is preparing for a significant transition. As more homes become available, an increased supply is expected to reduce prices and monthly payments. Experts note a divide in the mortgage market: lenders with excessive debt have exited, while smaller, more flexible companies with lower costs are performing well.

Current Housing Conditions

- Home prices remain at record highs nationwide, making affordability a challenge for many.

- Thirty-year fixed mortgage rates are near 6%, slightly below their peak of % 8%.

- Redfin and other analysts predict the ‘Great Housing Reset’ will begin in 2026.

- In some regions, incomes are expected to outpace home prices as inventory increases.

- Some major cities may experience price declines.

- Debate continues over whether conditions could deteriorate beyond those of the 2008 crash.

- Many experts are more pessimistic.

- One well-known housing expert says home prices would need to fall by 50% nationwide to match incomes.

- Others believe the slowdown will be more gradual and limited to certain regions.

- Major news outlets have identified at least ten cities likely to see significant price drops in the next one to three years.

- These experts view this as a necessary adjustment, due to high interest rates and population shifts, rather than a crisis like the last mortgage crash.

Market and Industry

- The outlook for mortgage rates remains uncertain.

- Experts anticipate gradual changes in 2025 and 2026, as high inflation and trade tariffs limit the potential for significant market declines.

- Many companies are merging or acquiring others in the mortgage industry due to high interest rates, the high cost of homes, and reduced refinancing activity.

- Stricter regulations and higher costs have intensified competition among lenders for top customers.

Positioning for NEXA Lending and Gustan Cho Associates

Gustan Cho Associates:

- Gustan Cho Associates targets fast-growing, often underserved mortgage markets.

- The company promotes itself as a national ‘one-stop shop’ for government and conventional loans.

- It does not impose additional requirements on borrowers and offers a range of loan products tailored to diverse needs.

- The company is expanding rapidly, undergoing a rebranding, hiring loan officers nationwide, and transitioning from a broker-centric model to a broader business strategy.

- Gustan Cho Associates promotes lending through its own programs, while other firms are tightening lending standards.

- The company is also developing educational materials for lenders and buyers concerned about interest rates, helping them navigate market changes.

- Recent executive hires, including a former Loan Depot executive as Chief Strategy Officer, demonstrate NEXA’s commitment to growth through strategic recruitment, mergers, acquisitions, and technological advancements.

- This strategy positions NEXA to expand its market presence as smaller brokers leave the industry.

Sanctuary Cities, Inflation & Macroeconomics

Chicago and other major sanctuary cities are at the center of national discussions on crime, housing, and municipal budgets. Despite these challenges, local job markets remain strong.

- The National Consumer Price Index (CPI) has declined from its peak in 2022-2023 but remains above the Fed’s 2% target.

- The latest annual CPI is approximately 2.7%.

- Although inflation is only slightly above target, many individuals continue to face financial struggles.

- Prices have risen since the 2020 recession, while wage growth remains uneven across sectors.

- Analysts warn that smaller coastal and Rust Belt cities may experience sharper declines in home prices as remote work continues and borrowing costs rise.

- These areas are now considered high-risk markets.

- Commentators note that sanctuary cities face increased government pressure due to higher costs for social services and shelters.

- Combined with a housing slowdown, these factors have reduced demand for city services and property tax revenue, straining municipal budgets.

As President Trump begins his second term, the political and regulatory environment remains largely unchanged. Auto financing conditions remain restrictive, placing financial pressure on consumers. The Federal Reserve and White House are monitoring inflation and approval ratings while managing their relationship.

- Financing and Automobiles

- New car loans now often extend to six years, slightly reducing monthly payments.

- However, the average new car payment exceeds $700, and used car payments average $570, both at record highs due to elevated prices.

- Experts believe sales will remain constrained by affordability, but could increase if the Fed cuts rates and automakers introduce special financing offers by summer.

Voter and Business Relations with President Trump

- Independent polls show President Trump’s net job approval at -13 as 2026 begins, with his trade and inflation policies receiving the lowest support.

- By July 2024, President Trump’s support had declined, particularly among independent voters, and this trend has continued since the midterms.

- Most business leaders continue to support deregulation and tax cuts, but view tariffs and political cycles as significant challenges.

Leadership in Justice and Security (Kash Patel, Pam Bondi, FBI/DOJ)

- Political and media attention remains on policy debates, but there is no confirmation that Bondi or Patel has resigned.

- As of January, neither has announced plans to leave their position.

- Oversight and ongoing investigations continue, but no major leadership changes have been reported at the Department of Justice or the Federal Bureau of Investigation.

- Federal Reserve Chair Jerome Powell faces political criticism as inflation remains high, despite some easing of the rate.

- Elevated borrowing costs continue to pose a challenge to borrowers.

- Supporters of President Trump attribute the situation to the Fed’s earlier rate hikes, calling it a ‘manufactured’ crisis.

- Analysts at global firms expect the Federal Reserve to proceed cautiously in 2026.

- If inflation remains contained, the Fed may implement one or two rate cuts, but will likely prioritize maintaining its credibility and independence despite political pressure.

Uncertainty in credit, political, housing, and metals markets is expected to persist through 2026. Those who remain alert, adaptable, and prepared for unexpected developments will be better positioned to succeed.

-

GCA Forums News For Monday January 19 2026

Federal Reserve Chair Jerome Powell faces heightened scrutiny as a criminal investigation proceeds regarding escalating costs and testimony related to the Federal Reserve’s multi-billion-dollar headquarters renovation in Washington, D.C. While withholding evidence does not constitute proof of criminal activity or indicate institutional failure under the Trump administration, the investigation has introduced significant uncertainty.

Concurrently, precious metal prices are rising, interest rates remain elevated, and ongoing political debates concerning welfare fraud, immigration, and city management are influencing the real estate, mortgage, and automotive markets.

These trends are projected to persist through 2026. This report on GCA Forums News For Monday, January 19, 2026 offers a concise overview in the style of GCA Forums News, highlighting key developments and prompting further analysis.

DOJ vs. Jerome Powell and Fed Renovation Scandal

- For the first time, a sitting Federal Reserve chair is the subject of a criminal investigation.

- The Department of Justice has issued grand jury subpoenas to the Federal Reserve regarding Chair Jerome Powell’s testimony on the headquarters renovation.

- The renovation estimate has risen from $1.9 billion to over $2.5 billion.

- The Federal Reserve attributes these overruns to changes in architectural firms, unforeseen asbestos and soil contamination, necessary design modifications, and increased material costs.

- Jerome Powell has stated that the Department of Justice is using the renovations and his June 2025 Senate testimony as a “pretext” to exert pressure on the central bank.

- He maintains that the Federal Reserve has kept Congress fully informed regarding the project. facilitiesdive

- Some sources indicate that the renovation costs could surpass $4.1 billion, although the highest officially reported budget remains several hundred million dollars above the original estimate.

Trump, Fed Independence, and Political Pressure

- Supporters of former President Trump have seized upon the renovation’s escalating costs, initiating investigations and characterizing the central bank’s leadership as negligent stewards of taxpayer funds.

- Economists and business leaders warn that if the Federal Reserve loses independence under political pressure, it could cause long-term interest rate and financial instability, similar to what has happened with other central banks, and further politicize the Fed.

- https://www.opb.org/article/2026/01/12/federal-reserve-receives-doj-subpoena-in-es

- https://www.cnn.com/2025/09/08/economy/trump-fed-powell-ken-griffin/trump-fed-powell-ken-griffin

- Although Trump and his allies have discussed eliminating or altering the Federal Reserve, no laws have been passed to abolish it.

- Still, recent subpoenas and public arguments have increased tensions between the White House and the Federal Reserve. https://www.gcamortgage.com/

Precious Metals: Silver and Gold

# Bullion delivery delays, silver price shock, and claims of $1,000–$20,000 silver

- Over the past week, silver traded at about $93 per ounce, up from last week’s high in the $80s.

- So far this year, silver prices have climbed more than 30%, including a recent 6% jump.

- https://www.fxstreet.com/news/silver-price-today-silver-rises-according-to-fxstreet-data-202601190931id-January, other real-time trackers indicate silver consolidating just below $90 per ounce, reflecting minor price discrepancies and increased intraday volatility across various data providers.

- https://www.jmbullion.com/charts/silver-prices/