GCA FORUMS and subforums were founded with one concept in mind: To serve consumers, entrepreneurs, homebuyers, home sellers, real estate investors, and the general public. When people buy or sell a certain house, they move and, therefore, have to start life in that new place. All the partnerships that they have developed with local vendors and merchants will cease to exist ………. Read More

-

All Discussions

-

What are the benefits of investing in coins? Investing in coins, particularly rare and collectible coins, can offer several benefits. Here are some of the key advantages:

-

Historical Value: Many collectible coins have historical significance, making them valuable to collectors who appreciate their historical and cultural context.

-

Tangible Asset: Unlike stocks or bonds, coins are physical items that you can hold. This tangibility can be reassuring for investors who prefer physical assets.

-

Portfolio Diversification: Investing in coins can diversify your investment portfolio. Tangible assets like coins can help balance a portfolio that includes stocks, bonds, and real estate.

-

Potential for Appreciation: Rare and collectible coins can increase in value over time, especially if they are well-preserved and have a limited supply.

-

Inflation Hedge: Precious metal coins, such as gold and silver, can act as a hedge against inflation. The value of these metals tends to rise when the purchasing power of paper money declines.

-

Tax Advantages: In some jurisdictions, profits from selling collectible coins might be taxed differently from other investments, potentially offering tax benefits.

-

Ease of Storage and Transport: Coins are relatively easy to store and transport compared to other physical assets like real estate or large collectibles.

-

High Liquidity: Rare coins often have a strong market, making them relatively easy to buy and sell. There are numerous coin dealers, auctions, and online platforms dedicated to coin trading.

-

Privacy: Coin investments can be made and held privately, offering a level of confidentiality that is not possible with some other types of investments.

-

Enjoyment and Hobby: For many investors, coin collecting is also a hobby. The enjoyment and educational value of collecting coins can be a significant benefit beyond financial gains.

-

Limited Supply: The rarity of certain coins can make them highly desirable. Limited mintage and historical scarcity can drive up their value over time.

-

Global Market: Coins have a global market, meaning they can be bought and sold internationally. This broad market can provide more opportunities for liquidity and appreciation.

Considerations

While there are many benefits to investing in coins, it’s also important to be aware of potential challenges:

-

Expertise Required: Successfully investing in coins often requires specialized knowledge. Understanding the market, grading standards, and authenticity verification is crucial.

-

Risk of Fraud: The coin market can be susceptible to counterfeits and fraud. Working with reputable dealers and getting coins authenticated can mitigate this risk.

-

Market Volatility: Like any investment, the value of coins can fluctuate. Market demand, economic conditions, and trends in collecting can all impact coin prices.

-

Storage and Insurance: Proper storage is essential to preserve the condition of coins. Additionally, insurance may be necessary to protect against theft or damage.

By considering both the benefits and the potential challenges, investors can make informed decisions about whether investing in coins aligns with their financial goals and interests.

-

-

-

Here’s a funny clip

https://www.facebook.com/share/r/eoRe8Qxi96oS7UGf/?mibextid=D5vuiz

facebook.com

It’s just a joke! 🤣🤣🤣 #comedy #skit #justjokes #funny. Jerrold Benford · Original audio

-

5 Pillars of a Home Loan

Become the qualified Buyer that Lenders are looking for!

Understanding what components make up a home loan will give you the advantage of being able to take the right steps towards homeownership.

I’ve been in the home lending industry since Fall of 2011. In that time, I’ve had to go through the highs and lows of understanding the home lending process. In my experience, I’ve had numerous conversations with clients that simply did not understand the home lending process. As I gained more experience, I coined the “5 Pillars of a Home Loan”. When I started explaining the lending process in this fashion during my initial consultation calls, my clients were able to quickly grasp the concept of the risk assessment of lending. This led to a boost in confidence in my clients which gave them the courage to take action. In writing this post, I’m hoping that I can go from a limited one-on-one conversation and expand my reach to communicate this concept to a larger audience to help more people find their confidence to realize that the process of homeownership doesn’t need to be this mysterious or unattainable process. It’s open to whomever is willing to obtain it.

The 5 Pillars are:

- Credit

- Repayment Ability

- Funds Needed for Closing

- Subject Property

- Loan Program

As a Borrower, before you even get started the first three pillars are the most important actionable categories you will be preparing for BEFORE you try and get pre-approved or go under contract for purchase.

Credit:

Of course this is an obvious point. But the key to understand here is this concept: “Before the lender extends you more credit, they must first determine your creditworthiness by evaluating your current credit profile”. Think about it this way: If you have a friend, and they ask you to borrow $200.00, but that has a history of never paying people back on-time/ever. If you had it to lend, would you do it? If we’re honest with ourselves, we would say no; of course a strong emotional attachment would say otherwise, but even in that statement we must deal with the reality that lenders don’t have a strong emotional attachment to their customers, outside of paying their bills on-time. This isn’t a charity, as they would say. If you want to know how to go about working on your credit, I would suggest going to https://www.myfico.com/credit-education. There you will get a TON of free information on how credit REALLY works. If you are in a position where you need credit repair, then my good friends at Kredit Kleanse have a very good track record of helping people Kleanse their credit.

Repayment Ability:

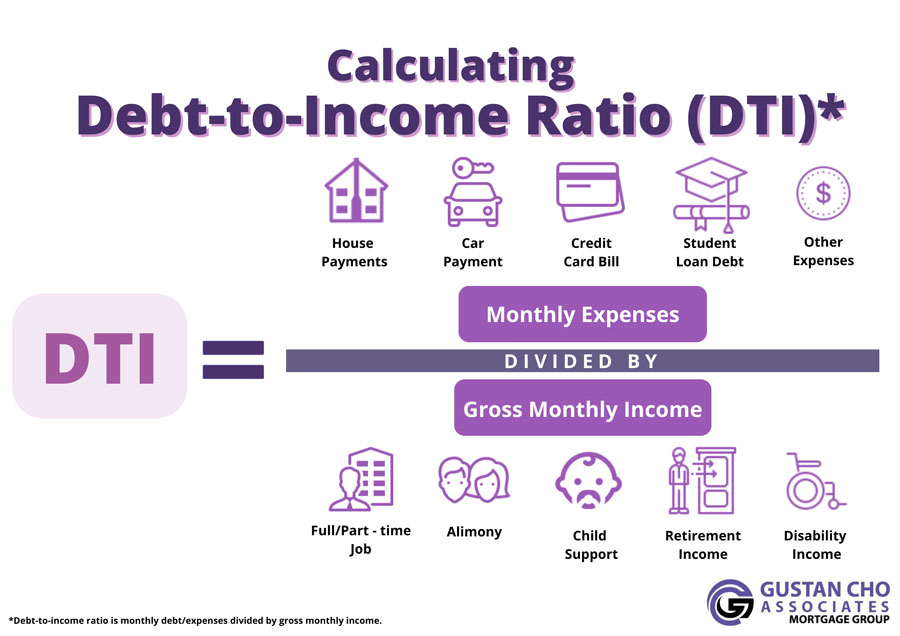

Think “personal cash-flow”. The technical lending term is debt-to-income ratio “DTI”. This is what mortgage licenses were originally created to address: to ensure lending professionals are taking the appropriate action of making sure the borrower can actually afford the home loan so that we don’t have the 2008 housing crisis all over again. The equation I use is (credit debts + court debts + proposed subject property housing expense) / (Total calculated gross income). The numbers used will vary program to program, but overall this is the basis in which all DTI is calculated. There are two distinct DTIs:

- “Housing DTI” which is ONLY: (proposed subject property housing expense) / (Total calculated gross income). A ratio of 30% is considered “healthy”

- “Total DTI” This is the complete equation: (credit debts + court debts + proposed subject property housing expense) / (Total calculated gross income). A healthy ratio is 45%.

- Key takeaway. Knowing EXACTLY what your DTI is will vary based on (1) the market in terms of what the fed-rates are, (2) which lender you are getting approved through since lenders decide their own margins and loan-pricing-levels which will dictate the final interest rate used for your housing payment, (3) the selected loan program, due to the requirements for things like debt-calculations and housing expenses like PMI, and (4) The subject property housing expenses like property taxes, homeowners insurance premiums, and community dues like HOAs.

Funds:

There’s 4 REALISTIC categories that you must consider when trying to purchase a home with a loan:

- Down-payment: People like to lump this into closing costs, but by true definition that’s simply not the case. Down-payment is a “MIR” minimum investment requirement, meaning that it’s not truly a cost (a cost is something you “spend” to acquire something). In the sense of a down-payment you are converting your liquid-cash into a hard-asset which is home equity. With this clarity, you can expect to get your money back at a later date whether that’s through selling or cash-out refinancing your home. You can put down as little as 3% of the purchase price, and there are loan programs available that don’t require a down-payment like with VA loans, USDA loans, and down-payment assistance loan programs.

- Transactional Costs: This includes appraisal costs, title costs, government fees, inspections, lender costs, etc. Typically this amount ranges from 3-6% of the purchase price and greatly depends on what market your home is in along with the final loan structuring. There are ways to get most of these costs covered. It’s best to consult with a mortgage professional to know what your options are.

- Reserves: This is not always required for a home loan, but if it does come up during your approval process, it’s good to know just what the heck lenders are talking about. In short what this means is: “after all the necessary transactional funds”, how many monthly total housing expense payments do you have remaining in your account(s). Example: If your proposed total housing payment is $3,865/mth, and you have $52,862 left in your account(s), then you have 13-months of reserves remaining in your account.

- After transaction expenses: This last point has no bearing on whether you will get approved for a home loan or not, but it is something that needs to be addressed, as some people are so excited about becoming homeowners that they forget non-transactional costs like: moving expense, deposits for utilities, time away from work for relocating, housewarming parties etc. These costs are completely unknown and not factored into your home buying process, and falls in the category of “living expenses”.

Subject Property:

Of course buying the right home for you and your family is most important to you, but when it comes to finalizing your loan approval to get to the closing table, these are the factors that the lenders care about:

- Loan-to-Value “LTV”. Without losing you with all the LTVs that there really is, in this context is do you have the minimum required equity requirement in the home according to the loan program. In ALL cases even if you have 50% equity in the home, if the loan program requires a MIR down-payment then you would have to bring those eligible funds to the closing table.

- Property Condition: Is the property habitable? Is the property safe in terms of potential obstacles that could cause injury to you or another person. In the appraisal report, there’s a property condition report that outlines these conditions. Different programs have different program requirements, so you may hear Sellers say I only want to sell to a person that has a conventional home loan knowing that conventional loan programs are the most lenient when it comes to property conditions required for final loan approval.

Loan Program:

This last pillar is more along the lines of the first 4 pillars being weighed against. In other words does your credit, DTI, Funds needed for closing, and subject property fit within the guidelines of the loan program. As you change loan programs the whole lending process changes, and even “meaningless” changes can affect your ability to close on the home. Working with the right company and professional will make all the difference in getting that home you want. Some lenders ONLY work VA loans, or don’t do USDA loans, or have “lender overlays”. A “lender overlay” is an additional guideline the lender places on-up of the actual loan program guideline. Having a consultation call with a lending professional to determine what they are capable of can save you a lot of time and stress.

A couple of my deals:

There’s one deal that comes to mind, and for the sake of privacy I will refer to the client as Gina. Gina was looking to purchase a home, but everything she went to a lender, she always got denied, but never received a clear explanation as to why. Eventually she got connected with me and we began to address each loan pillar. In doing so, it was uncovered that the funds that she was using were considered unsecured loan funds which is a no go for ANY loan program. Upon further inspection, I noticed that the funds were deposited into her account in about 45-days, with this knowledge I was able to leverage the proper interpretation of the lending guidelines. In short, we held closing another 2 weeks that way the deposited unsecured funds would be seasoned for 60-days and now would be considered eligible funds for closing. If the previous lending professional knew this they would have gotten the deal done.

Another deal I did, and again for the sake of privacy I will refer to the client as Ben. Ben had found a home that he wanted to buy, however when the appraisal report came back, there were some property conditions that neither the Seller or Buying was willing to fix, because it totaled over $40,000.00. Instead of denying the loan, we changed the loan from FHA to FHA 203k which is a renovation purchase loan, and was able to finance the cost of the repairs into the loan. A lot of lenders don’t even offer this special loan program let alone know how to actually do it late in the lending process.

What I always tell people:

Most people are just too afraid to buy a home, because it seems like such a lot of steps to get into a home. And to those people I would say you’re ABSOLUTELY correct (not what you wanted to hear huh?). The truth of the matter is that the home buying process is difficult, but the great thing about it is that you don’t need to know everything, you just have to know the right person that does know.

Another misconception is that you have to have perfect credit to buy a home, and that’s not true! I’ve gotten a lot of people with sub-600 credit scores into a home.

Lastly, getting with an experienced and knowledgeable professional early could make a huge difference. For instance there was a wonderful lady I helped become a homeowner, but it was a whole 2 years before she was ready! The key was that she had her free consultation call early, when she didn’t know which way was up. I was able to give her an action = plan that actually works, and she took my advice and implemented everything I told her. During those two years, she had challenges and unexpected financial situations that came up that ended up delaying her progress. However, she preserved and never gave into the setbacks, and now she’s a proud homeowner. You could be next!

My take on it:

Through my 12+ years of experience, I’ve seen a lot of different financial situations, and the overarching commonality is that there’s always a creative way to get anyone into a home. It could be on your part in the form of financial changes, discipline, knowledge, etc.; or the experience, knowledge, creativity, etc. of the loading professional. Is this a difficult process, yes! But it doesn’t have to be hard! ANYONE can own a home, and if you have made it this far, then that means you have the ability to become a homeowner.

When looking to use ANY financial loan instrument, the first 3 pillars are what you should be constantly working on. Focus on becoming a well qualified borrower and lenders will love lending you money because your behaviors display financial & credit worthiness. Ask yourself: “What if I am considered financial & credit worthy to lenders?” & “How do I go about becoming this person?”. Swallowing the red pill and putting in the work, will open doors that you could never have had imagined.

There was a client of mine a couple years ago that implemented the strategies I gave her. I’ll refer to her as Susie, and this is her story: Susie reached out to me about buying her first home. She had good intentions: more space for her kids, tired of paying her landlord, building towards generational wealth, and a lot of other great points. She imagined “what if” I could make this work. When she reached out to me in the Fall of 2021 and had her free home loan consultation we were able to come to the conclusion that she was not financially ready to purchase a home. Instead of allowing the reality of her situation to destroy her dreams, she asked “how do I get ready”. At this point I had to get her to willingly swallow the red pill, so I asked if she was ready for me to be brutally honest? She said, “Yes, please! I really want to do this!”. Then I said to her, “This is REALLY what the banks are saying behind closed doors, you simply don’t make enough money for the home you want. You got to make more money!”. She replied, “OK, then that’s what I’m going to do”. Now, in my experience, normally people don’t actually do what it takes to live the dreams they have. A few months went by, and she reached out to me the following Spring. When we reconnected over the phone, she said in a very confident tone, “OK , I’m ready now!”. We restarted her pre-approval process and she provided her bank statements. When I reviewed them I thought she was going to jail for criminal activities! Susie had saved over $200k, mind you her previous qualifying income was $50,000.00/year. So, how on earth did you get that much money in roughly 6-months? Come to find out, she became a tax preparer and made more money in 6-months than she’s made in the last 4+ years! I still had to do some creative loan structuring due to the loan guidelines on employment history, but she’s a homeowner now!

Final Thoughts:

By understanding the 5 Pillars of the home loan, you can come up with a good plan to work towards homeownership. If you are trying to get prepared to buy a home, then focus on the first three pillars to become a well qualified borrower. They are:

- Credit

- Repayment Ability

- Funds needed for closing

- Subject Property

- Loan Program

The time between when you have a good idea and the moment you act on that idea is the #1. #2 is executing a plan consistently over time in spite of the hardships that may arise. The first step is getting the right information from an experienced & knowledgeable professional. If you made it this far then you can become a homeowner.

-

This discussion was modified 9 months, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 9 months, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 3 months, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 3 months, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

FHA 203k Loans are great acquistion and renovation mortgage loan programs all in one loan closings. An FHA 203(k) loan is a type of mortgage loan offered by the Federal Housing Administration (FHA) for properties that need renovations. It allows the borrower to include both the cost of the home and the cost of necessary repairs or improvements in a single loan. Here are the key features and benefits of FHA 203(k) loans:

Key Features:

-

Loan Types:

- Standard 203(k) Loan: Suitable for extensive repairs and improvements, including structural changes. Minimum repair cost is $5,000.

- Limited 203(k) Loan: Also known as a Streamline 203(k), it is for minor repairs and improvements, with a maximum repair cost of $35,000.

-

Eligibility:

- The property must be at least one year old.

- Eligible properties include single-family homes, multi-family properties (up to 4 units), condos, and mixed-use properties.

- The borrower must meet FHA credit requirements, which generally means a credit score of at least 580, though some lenders may require higher scores.

-

Loan Amount:

- The total loan amount is based on the lesser of the property’s value after repairs or 110% of the appraised value before repairs, plus repair costs.

- The loan covers the purchase price of the property plus the cost of repairs.

-

Interest Rates:

- FHA 203(k) loans typically have slightly higher interest rates compared to standard FHA loans due to the additional risk associated with the renovation process.

Benefits:

-

Single Loan for Purchase and Renovation:

- Simplifies the financing process by combining the purchase and renovation costs into one loan, avoiding the need for separate home improvement loans.

-

Low Down Payment:

- Like other FHA loans, FHA 203(k) loans require a low down payment, usually 3.5% of the total loan amount.

-

Flexible Credit Requirements:

- More lenient credit requirements compared to conventional loans, making it accessible to more borrowers.

-

Potential for Increased Property Value:

- Renovations and improvements can significantly increase the property’s value, potentially offering a good return on investment.

Steps to Obtain an FHA 203(k) Loan:

-

Find an FHA-Approved Lender:

- Work with a lender experienced in FHA 203(k) loans to understand the specific requirements and process.

-

Get Pre-Approved:

- Obtain pre-approval to determine your borrowing capacity and budget for purchasing and renovating the property.

-

Find a Property:

- Identify a property that qualifies for an FHA 203(k) loan and requires repairs or improvements.

-

Work with a Consultant:

- For Standard 203(k) loans, you may need to work with a HUD-approved 203(k) consultant to evaluate the property and estimate repair costs.

-

Submit Your Loan Application:

- Include detailed renovation plans and cost estimates. The lender will appraise the property based on its after-repair value.

-

Close the Loan:

- Once approved, close the loan, and the funds for repairs will be held in escrow and disbursed as work is completed.

Considerations:

- Contractor Selection:

- Borrowers must choose licensed and insured contractors for the renovation work. The lender may need to approve the contractors.

- Timeline and Budget Management:

- Ensure realistic timelines and budgets for the renovation work to avoid complications during the project.

If you have specific questions or need more details about FHA 203(k) loans, feel free to ask!

Here is a blog written by Peter Arcuri

https://gustancho.com/fha-203k-contractor/

gustancho.com

FHA 203k Contractor Role For Homebuyers of Fixer-Uppers

Hiring the right FHA 203k Contractor is so important. Good communication skills and a FHA 203k Contractor you can get along with is a must.

-

-

I may have been destined to become a concert pianist. After all, I began my piano lessons at age 7, like my two older sisters. Piano playing was a prerequisite for the Catholic school we attended. A nun, Sister Stella had a sister who was also a nun at St. Anthony of Padua in lower Manhattan; her name was Sister Catherine Marie. Sister Stella, who was in her 80’s, small and ornery, had the difficult task of teaching us. My love of music was put on the back burner after I realized the pain and agony involved in learning. A wooden ruler would grace your knuckles for every sour note, not like the piano was ever properly tuned. The fear of striking the wrong key would resonate through my body. I would begin to sweat, and I already stuttered, which didn’t help. By the time I was eight, my knuckles were raised with callouses. I was the envy of the martial arts world.

My earliest memory of nuns was when I was in the first grade, standing in line after lunch, waiting to go back inside the classroom. The kid behind me didn’t appreciate his lunch, or maybe he was scheduled for a piano lesson and threw up on my pants. He vomited all over the back of me. The nuns felt this was not part of their job description to clean me and began to yell at me. What did I do? They called for my older sister, who was in the 8th grade, to come down and clean me up. I was crying, stuttering, and everyone was yelling at me. That day I learned every curse word in the book; my sister was muttering them under her breath.

As I have mentioned, I stuttered, and I was a big kid, so I sat in the back of the classroom. Because I stuttered, I was made fun of, and the nuns who were teaching me thought I was either an idiot or I couldn’t see well. But they didn’t move me to the front of the class. Instead, they told my parents I needed glasses. Duh? Glasses to cure stuttering! I started wearing reading glasses when I was 55; to this very day, my distance vision is great. Funny, back then, whatever a nun would suggest, my parents, and all parents, would blindly follow.

I wasn’t particularly bright. Since I stuttered, I never raised my hand to give the answer. One day I knew the answer; I raised my hand. I am beaming with information this time, “Sister, Sister, Sister.” She ignored me and said, “John, what’s the answer.” As John searched his heart and soul for the answer, my insides were bursting, and I yelled out the answer. No one knew I even had a voice; I did, and I wanted to answer. When I bellowed out the answer, the nun turned to me and said, “Is your name John?” I was sent to Mother Superior’s office. Mother Bettina was not a force to be reckoned with. She was 90 if she was a day. You knew you were in deep trouble when she rolled her sleeves up. I always wondered what was up their sleeves? She kept a metal ruler handy, not wood, metal, probably because the wooden rulers cracked after so much use. If you failed a test by 10 points, that meant ten cracks on your open palms to make up the difference in your grade. If you still failed, they didn’t give you back the points, just the pain. My knuckles were sore, and my palms were beet red; I could hardly hold a pencil. That yelling out in class got me ten cracks, and I knew the answer! What a way to teach.

My sister Joanne was left-handed. The nuns constantly tried to correct this; they thought being left-handed was a problem. Ironically, my sister became a Sister herself. I never thought nuns were human; I thought they had wheels for their feet like robots. Then one day, their habits were adjusted for more comfort. Imagine my surprise!! Oh, my, they have hair and feet! I then realized they were human.

-

-

-

Cheeseburger in paradise by the late Jimmy Buffet, no relationship to Mr. Bill Burger-King @Bill Burg is one of all time favorites.

-

Lenders Mortgage Insurance (LMI) sounds complicated, but it’s a safety net for lenders when your deposit is less than 20% of the property’s value. Unfortunately, you have to pay for it.

Understanding LMI means knowing how property value, deposit size, and loan type work together. You can avoid paying LMI by having a 20% deposit or getting help from family or government schemes.

Key Facts about LMI

- LMI is a one-time payment added to your home loan’s total amount.

- It protects the lender, not you if you default on your home loan.

- To avoid LMI:

- Put down a larger deposit (over 20%).

- Use government programs like Keystart home loans.

- Remember, if you refinance later, LMI doesn’t go away.

What is Lenders Mortgage Insurance (LMI)?

If your deposit is less than 20% of the property’s value, you might have to pay LMI. This happens because loans with a higher Loan-to-Value Ratio (LVR) are seen as riskier by lenders.

LMI is a non-refundable fee charged to you as an upfront cost, added to your loan if your deposit doesn’t meet the lender’s requirements. It’s a way for lenders to protect themselves in case you can’t repay the loan and they can’t recover the full amount through the sale of the property.

How is LMI Calculated?

Lenders use a tiered system to calculate LMI based on:

- The value of your property.

- Your deposit size.

- The amount you borrow.

- The type of loan.

- The type of property.

Generally, the higher your LVR, the higher your LMI. Investment loans usually have higher LMI than owner-occupied loans. It’s best to get a quote from your lender since calculations can vary.

How Much Does LMI Cost?

LMI can range from 1% to 5% of your total loan amount, depending on your LVR. For example, here’s a rough estimate:

Note: These are indicative only. Actual costs can vary with different lenders.

Should You Pay LMI Upfront or Add It to Your Loan?

Paying LMI upfront is the least expensive option, but many borrowers choose to add it to their loan to spread out the cost. The downside is you’ll pay interest on both your home loan and the LMI amount. Consider using an offset account to reduce your interest.

Are There Benefits to Paying for LMI?

We usually recommend avoiding LMI, but if you can’t, here’s why it’s not all bad:

- No need for a guarantor: You won’t need someone else to secure your loan.

- Enter the market sooner: You can buy a home earlier and avoid paying rent.

How to Get LMI Waived

- Guarantor: A family member can use their home equity to help you avoid LMI.

- Home Guarantee Scheme: Government programs like the Home Guarantee Scheme can help you buy with a smaller deposit and no LMI.

- Save a 20% Deposit: Aim to save 20% of the property value to avoid LMI.

- Lender Discounts: Some lenders offer LMI discounts for certain loan products or professionals.

- Professional Waivers: Certain high-paying professions may be eligible for LMI waivers.

- Parental Help: Parents can gift money or act as guarantors to help you avoid LMI.

Who is Eligible for an LMI Waiver?

Professionals such as doctors, surgeons, lawyers, accountants, and engineers may qualify for LMI waivers, depending on the lender. Requirements often include a high credit score, a minimum annual income, and membership in a professional organization.

Pay LMI or Keep Saving?

Paying LMI:

- Lets you buy a home sooner.

- Can be a good choice if property prices are rising.

Saving a Larger Deposit:

- Reduces your mortgage repayments.

- Eliminates or lowers LMI costs.

How to Avoid LMI When Refinancing

To avoid LMI when refinancing, ensure you have at least 20% equity in your home. You can increase your equity by improving your home’s value or paying off your mortgage early. Remember, LMI isn’t transferable between lenders or loan programs.

Got More Questions?

If you have more questions or need help with LMI, check out Nfinity Financials. They assist first-time homebuyers in purchasing their own homes and avoiding LMI.

-

Here’s Willie Nelson funny clip with Steve Colbert

https://www.facebook.com/share/r/dgQjuYqKgE3WqMRJ/?mibextid=D5vuiz

facebook.com

We love WILLIE!! 🤠 ♥️ | Broken Spoke | brokenspokeaustintx · Original audio

We love WILLIE!! 🤠 ♥️. brokenspokeaustintx · Original audio

-

Back in the day, a long time ago, we had a band called The Hinges, we used to open for the Doors.

-

People always ask, “how do I come up with topics to write about?” I’m a creative writer,, so I’m a dreamer. My four children write better than I, there are technical writers, couldn’t come up with a creative thought. One daughter is a veterinarian, the other daughter is a teacher, one son is a Michelin chef, and one son is a savant. To creative you have to be a little odd and think of things others don’t. I can suffer from writer’s block for weeks and turn around and write 3000 words in a morning. They way to cure this is to sit in front of a blank piece of paper, dream and write, just start writing, everything else will fall into place.

-

-

I love steak on the grill, New York Strips, Rib-Eye, all of them and cooked medium rare. Or favorite steak house is Bern’s in Tampa, not only are the steaks cooked to perfection they have a desert room with old Madeiras, Cognacs and Ports that’s where I get into trouble.

-

This discussion was modified 1 year ago by

Peter.

Peter.

-

This discussion was modified 1 year ago by

-

I went to the toy store the other day to get me granddaughters a doll. They had a Muslim woman talking doll! She didn’t say much so I stared at her for awhile and I was scared shit to pull the string!

-

I am a 1970 Cherry Red Chevy Camaro Convertible that has been stored in the back of a garage from the day I was purchased new. I cost $3,000 back in the day, the dream car of most red-blooded American boys. The young man who purchased me died in Vietnam later that year. The sadness I felt when I heard the news was overwhelming. He took me out only once, with his girlfriend, for a drive with my top down and four on the floor. We were the envy of everyone. It was a wonderful ride with James and Cathy; I can still hear their laughter. James had a hardy laugh. He thought about returning to his girlfriend and me with hopes of starting a new future. Unfortunately, life doesn’t always turn out the way we plan. I wonder what happened to Cathy?

His parents never got over their loss, and I was a painful reminder of their loving son. So, here I sat for 50 years. The parents thought many times of selling me. However, I was the last thing their son bought before being deployed. Both parents have passed, and my future is questionable. There are no grandchildren to pass the car on to, so I am being sold at an auction. I hear I’m worth a pretty penny.

James, my original owner, has a brother, Tom, who will handle the auction and the proceeds. He has mixed feelings about selling me. He’d rather keep me, but the old house and garage are being sold, and I have nowhere to go. The burlap tarp that covers me in the garage has kept me rust-free. I long to be started and hear the roar of my 350 cubic inches V8 engine with 375 horsepower. I need to blow out my carburetor and breathe life into me once again. I can go from zero to sixty in seven seconds and hit a quarter-mile in fifteen seconds at ninety-four miles per hour; not too shabby!

It will be a closed auction with bids submitted quietly. The highest bid will not necessarily win me. Tom is requesting a letter to accompany the silent bid. Tom wants me to go to a nice, caring family that will keep his brother’s memory alive. He doesn’t want me to be sold to a spoiled kid who will race me and never maintain me. I do not want to be pimped out with spoilers or painted racing stripes. I am a classic and should remain so!

Tom has received dozens of letters with bids; it will take some time to read and figure out who is who. One bid was $80,000! Can you believe that? However, the letter didn’t sit well with Tom; they wanted me for Hollywood. I’m from South Carolina; why would I want to go to Hollywood? They want to paint and repaint me according to the needs of the movie and race me in car chases. Tom declined the offer. Another bid was almost as high as $75,000, but the letter was from a rich guy who wanted to give me to his son for graduating high school. I don’t want any privileged kid owning me. High school kid, racing me with his pals, I don’t think so.

After reading a dozen or more letters, Tom was getting frustrated with the responses. One letter was totally absurd. They offered $3000, my purchase price. Are you serious! I’m worth 20 times that. Tom didn’t even read the letter; he just discarded it with the rest of the letters he felt didn’t meet the bill. Foolish man; he was 50 years old, not too well off with money, and wanted me, really? What use would he have for me, just showing off as he went through his mid-life crisis?

Another letter was a sob story of how a guy had the same car back in the day and felt he needed this car because it was owed to him. Tom had it with all these phony letters. He placed them all in a box and put them on my front seat. Where was I going? What was my future?

One letter fell from the box, it was the offer for $3000, which Tom never read. I noticed an old black and white photo of a young girl and baby boy. The boy’s name was James. Tom didn’t make the connection, well, not yet, anyway.

The silent auction went according to schedule, all the letters were read, and Tom was just about to make his decision when he noticed an older woman in the back of the room. She was accompanied by a man. I’d say the man was about 50 years old. Tom peered into the eyes of both of them and began to cry. The auction was momentarily stopped so Tom could compose himself. Tom raced back to me and opened the box of rejected letters. He rifled through the letters, and the black and white photo fell out. He stared hard and deep at the picture, the boy resembled his brother James, and the young girl was Cathy! His mind raced with thoughts of 50 years ago. Could this possibly be Cathy and his nephew!

The auction resumed, and Tom made his decision on who would take me home. He read the letter that he once quickly discarded:

Tom,

You may not remember me, I was James’ girlfriend Cathy back in 1970, and this is his son, James. My love for your brother never ceased. I kept my secret long enough. I didn’t want to burden your family. They were grieving too much. We were in love. The only time James and I road in the car was that one time. We vowed our love that day. I was three months pregnant when I heard he was killed in Vietnam. I was so lost that I even thought about an abortion. I needed a memory of my true love and kept his son. There is nothing left for my son to remember his dad. I’m an old lady now and raised James Jr. by myself. I’m not looking for money, just a memory.

Thank you,

Cathy

Tom began to cry. He was in total shock. He ended the auction by stating: We found the buyer! Everyone left after hearing who won. A frail woman was led by a middle-aged man to the podium from the back of the auditorium. Tom hugged and kissed Cathy as well as his nephew.

He gladly handed the keys over to her and refused the money for me. “This is the home for James’ Camaro.” As they opened my doors to enter and started to drive away, I felt I was born again; I could feel this spirit of James. I could almost hear his hardy laugh. He was alive within all of us.

-

John Steinbeck was perhaps the finest American writer, he wrote about the struggles during the Great Depression. He was able to write humor, “Travels with Charlie.” Who do you enjoy reading?

-

Want to congratulate Stephen LaFlamme on his new addition to his family, Pepper. Beautiful pup and well deserved. No doubt Pepper will have a lifelong safe and great home. Here’s a note from Steve LaFlamme:

I just got Pepper, standard size merl colored labradoodle. I couldn’t pass on this one.

-

-

The Grapevine…

I have always liked reading weekly or daily columns by Earl Wilson, Herb Caen, Jimmy Breslin, etc. This will be the first of a weekly column, mostly about real estate-type businesses. Here are my two cents.

I heard that buying or selling a house right now is as difficult as putting a square peg in a round hole. All y’all know better than me. My wife and I have been working with a realtor in Tampa, Donna Davidson. Bless her Irish soul! She is great to work with. My wife and I found a house in Ocala, Florida, and called Donna with two other listings, all within ten minutes of each other. Donna was, at the time, visiting her sister on the opposite coast and said maybe if she called ahead to the listing realtor, that’s exactly what she did, and she spoke to Ortiz, who was handling one of the listings. Donna asked if he could possibly show the two others; his response was yes. ”We realtors have to stick together.” He was more than happy to do so and contacted my wife. They spoke briefly on the phone as I chimed in that I would give him $50 cash for his trouble. He agreed at 10 a.m. Friday morning, just before 10:30, the time we were leaving, to make the hour and a half drive to Ocala for a noon appointment. At ten minutes to twelve, he calls my wife—mind you, we are ten minutes away—and changes his mind. He now says he wants Donna’s 3% commission on the two other listings, and, get this, he wanted 6% on the house he was showing! He wanted me to screw my realtor broker and collect fifty bucks. Being the New York City boy as I am, I said, Well, you really don’t want to know, and I cursed at him like I was a drunken sailor who hasn’t been on shore leave for two years. We immediately made a u-turn and headed back to Tampa. I turned to my wife and said in my best mafia voice, “Now he’s got nothing.” I’m supposed to be buying from this guy and trusting him, and he’s screwing me even before we meet. I will only give you one chance to be trusted; if you fail, there is no second chance. He had a one-in-three chance of us buying his listing, plus he would have a crisp Grant in his pocket. Now he’s got nothing. Is this common? Also, while I’m at it, who determines the percentage rate for the realtor? Some realtors state 1.75% or 2%. What’s that all about?

Let’s get back to realtors: who do they work for? I am always confused about the buyer or the seller; they can’t sell a house without the owner, right? That’s where the cash is being generated. So they work for you, the owner. However, they play footies with the buyer, saying, “Don’t worry, we can get them down in price.” When my wife and I sold her previous house, we used. Nice people, so I thought they just wanted the listing. When we had a prospected buyer, I knew right away by the sidebar conversations that something was brewing and it was rotten. They asked me if they could have someone inspect the roof, and I agreed. The buyer brings one of his drinking buddies, wearing sneakers and a roofer. They ascended the ladder; they had no tools, had a little pow wow, and left without saying a word. People must think I’m a complete idiot; I am street smart! I have an IQ of 185 on the street! I look and sound like I came out of central casting for a mob movie. You are not pulling any wool over my eyes. Within minutes, our realtor, remembering the person working for me, calls and says in an excited voice, ”You need a new roof; the next strong wind will rip it right off!” I’m smiling and saying to myself, Are they for real? I responded to her, sort of like the drunken sailor, and told her to pick up her sign,For Sale,” which would be in the street. I pulled that sucker out of the ground as if it were a strong man’s cement or wood post and tossed them far in the street. They never came back for the sign, so I kept the 4×4 post and trashed the sign. So I ask again: who does your realtor really work for?

You heard it through the grapevine.

-

The Power of the Holy Spirit🙏

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

livingproof.co

What Is the Holy Spirit’s Role in a Believer’s Life?

The Holy Spirit convicts believers of sin, fills us with God’s strength and wisdom, and produces fruit that draws people to Jesus. When we place our faith in Jesus, the Holy Spirit dwells inside us. This permanent indwelling means we … Continue reading

-

This discussion was modified 1 year ago by

-

Kevin Hart is one of the funniest comedians today

https://www.facebook.com/share/r/ZdLBaPY5JiYuChFS/?mibextid=D5vuiz

facebook.com

Poor Kevin... #kevinhart #dwaynejohnson #jimmyfallon #viral #fyp | | live_n_moments · Original audio

Poor Kevin... #kevinhart #dwaynejohnson #jimmyfallon #viral #fyp. live_n_moments · Original audio

-

Keep all your pennies folks. Copper prices is skyrocketing as is prices for Gold and Silver. Copper is going to be the next winner. I will be covering more on investing in precious metals in the coming days, weeks, and months. Silver price is at $31.77 per ounce and is forecasted to skyrocket in the coming weeks. A pound of Copper is $23.00 per pound. Here is a calculator for Copper. 16 ounces of Copper is one pound.

http://coinapps.com/copper/gram/calculator/

coinapps.com

Calculate the price of copper measured in grams or kilograms; denominated in U.S. Dollars, Canadian Dollars, Euros, Pounds or in one of several other currencies.

-

I am thinking about starting a career in commercial lending? How do I go about starting my foot in the door as a commercial loan officer.

-

I heard the great news from Gustan that Viral Website Developers will be launching a CRM for real estate agents and loan officers in one platform.. That is great news for realtors who are loan officers because we do not have to go back and forth between two CRM systems. Gloria and I are looking forward to seeing the newly designed one stop shop online loan officer and real estate CRM designed from Viral Website Developers.

-

You do not need perfect credit or high credit scores to qualify for a mortgage loan. Every loan program require a minimum credit score. Besides HUD, VA, USDA, FANNIE MAE, FREDDIE MAC, or non-QM portfolio lenders requiring a minimum credit score, each lender can impose lender overlays on credit scores. Lender overlays are additional credit score requirements above and beyond the minimum agency mortgage guidelines imposed by each individual mortgage lender. Regardless of the minimum credit scores required, all lenders will normally want to see timely payment history in the past 12 months. Regardless of the prior bad credit you have, having timely payment on all of your monthly debt payments that report on the three credit reports is crucial. Do not worry about prior collections, charge-off accounts, late payments, or other derogatory credit tradelines unless you are going though a manual underwrite on FHA loans. HUD manual underwriting guidelines require timely payments in the past 24 months. VA manual underwriting guidelines require timely payments in the past 12 months. In many instances when you get an approve/eligible per automated underwriting system but late payments in the past 24 months, the lender may down grade your file to a manual underwrite. The best solution for you to increase your credit scores and strenghen your credit profile with recent late payments is adding positive credit with new credit. Please read this guide on how to boost your credit to get approved for a mortgage: Capital One Secured Credit Card will get you a $250 secured credit card with a $50 deposit. Self.Inc is a bank that has a phenomenal credit rebuilder program where you can make a monthly deposit as small as $25.00 per month. That monthly deposit goes towards a savings account but it reports as an installment loan to all three credit bureaus. Get a Discover secured card. Secured credit cards are the same as unsecured traditional credit card. The only difference is you need to put a deposit. The amount of deposit is the amount of credit you get by the credit card company. You need to make timely minimum monthly payments on your secured credit cards. Just start with these three creditors and you will see wonders in the weeks and months ahead. I will cover some quick fixes for you to increase your credit scores fast and at the end of this topic thread, I will list helpful resources on boosting your credit to qualify for a mortgage, how to reach a human at the credit bureaus, and how to rebuild your credit:

1. Capital One Secured Credit Card

2. Self.Inc

3. Discover Secured Credit Card

As time pass and you make timely payments, your secured credit card company will increase your credit limit without asking your to put additional deposit. If you can get more secured credit cards, it will expedite your credit rebuilding process. However, you should at least start with the above three creditors.

Improving your credit scores and rebuilding credit can be crucial when seeking mortgage approval. Here are some effective strategies to consider:

Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion. Identify and dispute any errors or inaccuracies that may be negatively impacting your credit scores.

Pay bills on time: Payment history is the most significant factor affecting your credit scores. Make sure to pay all your bills (credit cards, loans, utilities, etc.) on time, every time. Set up automatic payments or payment reminders if necessary.

Reduce credit card balances: High credit card balances can hurt your credit utilization ratio, which accounts for a significant portion of your credit scores.

Aim to keep your credit card balances below 30% of your total available credit limit. Consider paying off credit cards with the highest balances first.

Don’t close unused credit cards: Closing credit cards can inadvertently increase your credit utilization ratio and decrease your overall available credit. Keep unused credit cards open, but avoid using them to maintain a low credit utilization ratio.

Increase credit limit: Request a credit limit increase from your credit card issuers, which can improve your credit utilization ratio. Be sure to handle the increased credit limit responsibly and avoid overspending.

Limit new credit applications: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit scores. Limit credit applications only to when absolutely necessary.

Use different types of credit: Having a mix of different types of credit (e.g., credit cards, auto loans, personal loans) can positively impact your credit scores. Consider taking out a small loan or opening a new credit card account if you have limited credit types.

Monitor your credit regularly: Check your credit reports and scores periodically to ensure accuracy and track your progress. Consider signing up for a credit monitoring service to receive alerts for any changes to your credit profile.

Be patient and consistent: Rebuilding credit takes time and consistent effort. Stick to responsible credit habits, and your credit scores should gradually improve, increasing your chances of mortgage approval.

Remember, lenders evaluate various factors beyond just credit scores when considering mortgage applications. However, improving your credit scores and maintaining a healthy credit profile can significantly increase your chances of getting approved for a mortgage with favorable terms.

https://gustancho.com/boost-your-credit-with-new-credit/

gustancho.com

Boost Your Credit With New Credit To Qualify For A Mortgage

Boost your credit with new credit to qualify for a mortgage . New secured credit cards and credit builder loans increases credit scores for mortgage

-

I am a first-time precious metal investor. How do you go about investing in Gold and Silver? Do I need to watch out for scammers? Where do I buy gold or silver? What is the minimum I can invest in Gold and Silver?