GCA FORUMS and subforums were founded with one concept in mind: To serve consumers, entrepreneurs, homebuyers, home sellers, real estate investors, and the general public. When people buy or sell a certain house, they move and, therefore, have to start life in that new place. All the partnerships that they have developed with local vendors and merchants will cease to exist ………. Read More

-

All Discussions

-

Artificial Intelligence is making headline NEWS lately. Many people are AMAZED about AI. Here’s a very interesting article about Artificial Intelligence. Is Artificial Intelligence built in End Times.

destinyimage.com

Mark of the Beast & AI: Is AI Part of the Devil’s End-Time Strategy? — Destiny Image

Could prophecies in Revelation point toward an advanced form of AI, capable of tracking, analyzing, and manipulating human behavior on an unprecedented scale? Host of Encounter Today and pastor Alan DiDio exposes the truth about AI and whether it could … Continue reading

-

Mortgage Rates a tad lower from yesterday. 30-year fixed-rate mortgage rates 6.78% down -0.10 from yesterday. 15-year fixed-rate mortgages is priced at 5.77% down -0.26 from yesterday. 5/1 ARM is unchanged 6.67% from yesterday. This week has been a steady week for mortgage interest rates at 6.66% . Mortgage rates has been unchanged since December 21st. Lower rates should spark homebuyers but many buyers are sitting on the sidelines. Weekly jobless claims was low for the week mainly due to a four day holiday week. The unemployment rate numbers released last week came in at 3.7 percent in December, and the number of unemployed persons was remain unchanged at 6.3 million. These measures are higher than a year earlier, when the jobless rate was 3.5 percent and the number of unemployed persons was 5.7 million.

Jobless claims, also known as unemployment claims or initial unemployment claims, refer to the number of individuals who have filed for unemployment benefits with the government’s unemployment insurance program. These claims are typically filed by individuals who have lost their jobs and are seeking financial assistance during their period of unemployment.

Jobless claims serve as an important economic indicator and are closely monitored by policymakers, economists, and financial analysts. They provide insights into the current state of the labor market and can indicate trends in unemployment. When jobless claims increase, it often suggests a rising number of people losing their jobs, which may be a sign of economic downturn or labor market challenges. Conversely, a decrease in jobless claims can be a positive sign, indicating improved job market conditions.

Jobless claims are typically reported on a weekly basis in many countries, including the United States, where the U.S. Department of Labor releases a weekly report on initial unemployment claims. These reports help policymakers and analysts gauge the health of the labor market and make informed decisions about economic policies and interventions.

It’s important to note that jobless claims are just one part of the broader picture of employment and unemployment, and they are often used in conjunction with other labor market indicators to assess the overall employment situation.

-

I am looking at buying a RVPark- that is currently cashflowing at a 7.5cap – I am looking at changing the model a bit and infusing capital plan to add capsule airbnbs and boat storage (20) frames are already built. The Property is 10 acres – less than 2 miles from a lake that has over 6 million visitors a year. It is located 30 minutes from 2 of the largest casinos and also 3 state parks. I am wondering if someone could finance on projected dscr. Any help would be great. I will post some designs of the homes and some of the land later today.

-

I appreciate the wealth of information on the Great Content Authority FORUM for the resources available in furthering my career as a branch manager and NMLS licensed loan officer. I could not believe what I have heard today by a fellow mortgage loan originator, a member of this forum, who owns her own mortgage brokerage company. My friend who owns her own mortgage broker company and is licensed in six states always had countless leads from states she was not licensed but could not monetize on those leads and realtor referral because of her mortgage brokerage only being licensed in three states. One of the options my friend had was give up her own mortgage broker shop and close it and join a larger mortgage company with NMLS licenses in most of the 50 states. However, her mortgage broker shop is her baby and she put a lot of sweat and equity in creating and launching her mortgage shop. The great news that was revealed to my friend which can apply to me is that a licensed mortgage loan officer can be licensed with multiple mortgage companies at the same time. Therefore, you can have and own your own mortgage shop licensed with a few states and simultaneously be sponsored with another mortgage company and be licensed in the states your own mortgage broker shop is not licensed. By doing so, you can be licensed in all or most of the 50 states and be in compliance and not worry about crossing the grey area. My friend asked me to reach out to @Bruce , Esq., MBA, LL.M. for more information. From my past experience, if a deal sounds too good to be true, it normally is. I would love to hear a lot more about this. I spoke to Danny Vesokie, President and Founder of Affiliated Business Partners, a commercial loan training school, and Danny did say to reach out to @Bruce . for more detail information because Bruce sponsored by three mortgage companies at the same time

https://www.youtube.com/watch?v=0TKHRlvHNWc

-

This discussion was modified 1 year, 1 month ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 8 months, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 1 month ago by

-

The confusing thing for many consumers is distinguishing the difference between fixed-rate and adjustable-rate mortgages when buying a house or refinancing a mortgage loan.

-

What are the basic requirements for financing a food truck? What are the terms, rates, credit score requirements, and experience.

-

-

If you are buying a new construction home, how are property taxes on new construction homes calculated by mortgage lenders.

-

Pawn Stars was one of the most popular shows on cable. What happened to the cast of Pawn Stars. Here’s a video clip about what happened to the cast of Pawn Stars.

-

The recently announced proposed NAR settlement has generated a lot of discussion about the future of realtor commissions and how the real estate industry will be impacted.

One avenue that seems plausible is the a packaged service plan – designed for the DIY home seller that does not wish to engage a full service brokerage. In addition, some brokerages are offering ala carte services that can be selected from the menu that a home seller or buyer can select to ensure they are only paying for services perceived to have value.

I found an excellent article regarding Houzeo (link below) – a service for the DIY home seller. The Houzeo model offers various packages and costs based on the level of service. While Houzeo has been around for several years, some of the recent attention to realtor commissions have increased their visibility.

https://listwithclever.com/real-estate-blog/houzeo-review/#overall

Please check out this article and post your thoughts.

-

I have never invested in bitcoins and do not know what it is. I have heard a lot of about bitcoins and have heard how bitcoins can go up hundreds of percentage points and drop equally as well. I am a new investors or want to start investing and am very curious on how bitcoins work and like to make a lot of money. I heard bitcoins is a sure thing and it will go up and up and up. Can someone explain what is bitcoin and how do you invest in bitcoins?

-

Hello & Good Morning Everyone!

I wanted to create this new topic based on the recent crypto increases this week –

I am looking forward to hearing all your thoughts on what coins/token you have in your trusted portfolio & what you expect for 2024.

coindesk.com

Bitcoin Could Hit $69K by Mid-2024 as It Enters Acceleration Phase, Analyst Says

BTC prices have doubled this year amid a spot ETF push by prominent traditional finance firms.

-

My client would like to get financing for the following scenario:

- Client that owns property outright and is hoping to

build an apartment building(s) on this property - Client

wishes to finance 100% of the buildout - The

property is in Texas - Value

of Land $250K - Estimated

construction cost $600K - Credit

score estimated at 700 - What other parameters must be considered? Reserves, LTV, etc.? Could this qualify via DSCR?

- Client that owns property outright and is hoping to

-

NMLS licensed loan officers are leaving the Mortgage Industry due to inflation, ridiculous rising rates, and out of control housing priced. Never in history did anyone witnessed such a volatile economy as we are seeing today. The Mortgage Industry has lost 40% of licensed and registered mortgage loan originators and is expected to see more leave the mortgage industry. Many are joining the government agencies such as law enforcement agencies where they are taking individuals without experience in police work and are willing to train. The Illinois State Police is taking applications for state troopers without any experience. Many loan officers are looking for salary or hourly jobs in government because they offer job security.

-

This discussion was modified 1 year, 8 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 3 months ago by

Gustan Cho.

Gustan Cho.

linkedin.com

Illinois State Police on LinkedIn: #diversestrength #joinisp

Empowering diversity, embracing strength. Join ISP and be part of a law enforcement family that values every perspective. Apply now! #DiverseStrength #JoinISP…

-

This discussion was modified 1 year, 8 months ago by

-

What are the main top Google Algorithm Changes Updates for 2024. I heard that many websites got hit by the latest Google Algorithm Updates in September 2023 which devastated many websites counting on organic traffic

-

-

Builders, Realtors, Investors! Lookie Lookie! We have a seller looking to make deal for 2024. Check out the attachment! If you have the brass to tackle this, then let’s connect today! Creative commercial financing available. Call me: 972-707-4963

-

How can you get approved for a commercial loan on commercial properties with creative financing?

-

Many people became oversight YouTube stars harassing cops. They call themselves First Ammendment Auditors

-

I did a side job yesterday and this is fresh on my mind. Busted pipe damaged flooring drywall at a customers house. The cause of the leak is old building materials that don’t hold up to the new standard.

Homeowners often face the headache of dealing with property damage caused by leaks. Well, in this post, we’re going to explore the differences between polybutylene pipe and PEX pipe in the context of preventing leaks like this. It’s all about keeping our homes safe and sound while avoiding costly repairs down the road. Let’s dive in and discover how choosing the right pipe material can make a big difference. Ready? Let’s go!” 😄🏠💦

I’m going to go deeper into the differences between polybutylene pipe and PEX pipe.

Polybutylene pipe, also known as PB pipe, was popular in residential plumbing systems from the 1970s to the mid-1990s. It’s made of a plastic resin called polybutylene, which was chosen for its low cost and easy installation. However, over time, it was discovered that PB pipe had some issues. It had a tendency to become brittle and prone to cracking, especially when exposed to chlorine, which is commonly found in municipal water supplies. This led to leaks and water damage in many homes just like the one I was in yesterday.

On the other hand, PEX pipe, short for cross-linked polyethylene, has gained popularity as a more reliable alternative. PEX pipe is made by cross-linking polyethylene molecules, which gives it enhanced strength and flexibility. It can withstand freezing temperatures without bursting, making it ideal for colder climates. PEX pipe is also resistant to corrosion and scale buildup, which can prolong its lifespan and maintain water flow.

In terms of installation, PEX pipe has an advantage. It can be bent and curved without the need for as many fittings, reducing the risk of leaks. It’s also compatible with various connection methods, such as crimping, compression, and push-fit fittings.

Overall, PEX pipe is considered a more durable and reliable option compared to polybutylene pipe. It has become the go-to choice for many homeowners and plumbers due to its flexibility, resistance to freezing, and longer lifespan. I hope this gives you a better understanding of the leaks and how the type of pipe plays a role!

-

Open Graph tags allow you to control what appears when someone shares a link to your site on social media. They let you specify the title, description, images, etc. that should be used.

– Some important Open Graph meta tags include:

– og:title – The title you want to appear.

– og:description – A description for the page/site. Shows up as the description or caption.

– og:image – An image URL representing the content. The featured image.

– og:type – The type of content being shared (e.g. website, video, article).

– When adding Open Graph tags, you place them in the <head> of your HTML pages. They always start with “og:” and contain properties like title, image, type, etc.

– Using relevant Open Graph tags allows you to control what appears when people share your content on sites like Facebook, Twitter, WhatsApp to make sure the right text, images, and description appear.

– There are many more Open Graph properties you

can add, but og:title, og:description and og:image are the most essential ones

to make your social shares appear properly -

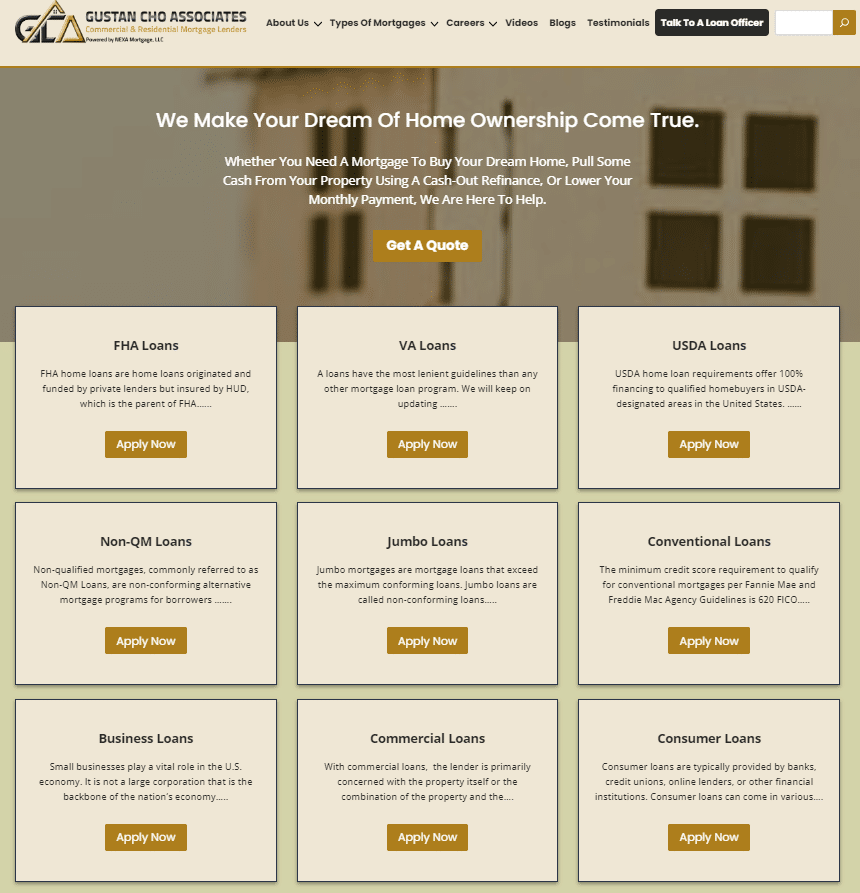

Gustan Cho Associates (NMLS 2315275) and its affiliates is a dba of NEXA Mortgage (1660690), the largest mortgage brokerage in the nation. follow Fannie Mae’s DU AUS and LP AUS. They are renowned for having little to no lender overlays. Mortgage loan customers dealing with judgments, open collections, foreclosures, tax liens, overdrafts, and late payments have all benefited from my assistance. People with credit scores below 600 FICO can receive assistance from the Gustan Cho Team at Gustan Cho Associates, and the lowest credit score borrower I can assist is one with a 500 FICO. 10% of the purchase price is needed from people with credit scores between 500 and 580. A 3.5% down payment is needed for credit scores higher than 580 FICO. I work with consumers whose mortgage loans have been rejected by other lenders because of their overlays for a significant portion of my business. Suppose a borrower signs their 1003 mortgage application and provides me with the necessary documentation.

In that case, I can often give them an official mortgage approval in less than a day. The Gustan Cho Team at Gustan Cho Associates typically closes my loans in three weeks or less. Under the direction and guidance of Sapna Sharma, Gustan Cho Associates’ Chief Technical & Marketing Officer, the company’s marketing division maintains partnerships with real estate experts. Love. Gustan Cho Associates is accessible seven days a week. I get in touch with realtors all the time. To connect with customers, realtors, mortgage brokers/bankers, insurance agents, appraisers, attorneys, and other professionals, please visit me at http://www.gustancho.com and join our forum at http://www.lendingnetwork.org. Our in-house IT department will jointly promote open homes and recommend certain realtors to pre-approved clients looking to buy or sell a property as part of NEXA Mortgage’s collaboration program with realtors. Get in touch with me for further information. Gustan Cho Associates is a reputable mortgage company that offers various services, including mortgage loans for various scenarios, debt consolidation and credit restoration, and personalized support throughout the loan application process. One of the main reasons to choose Gustan Cho Associates is their reasonable prices, quick and efficient loan approval process, and commitment to customer satisfaction and support. Regarding your mortgage requirements, it is recommended that you consider Gustan Cho Associates. They offer debt reduction and credit repair assistance, personalized loan application assistance, and reasonable loan rates. Their commitment to customer satisfaction and support makes them a reliable mortgage lender, and they provide contact information for further assistance.

I. Overview of Gustan Cho Associates in Brief: Their Services Explained Selecting a trustworthy mortgage provider is crucial.

II.Gustan Cho Associates’s past customer testimonies and reviews; the company’s history and establishment; the team’s expertise and experience

III. Gustan Cho Associates’ Services are available for FHA, VA, conventional, and other types of mortgage loans. They also provide assistance with credit repair and debt consolidation. They also provide personalized assistance with the loan application procedure

IV. Motives for Selecting Gustan Cho Associates: Reasonably priced loans and interest rates A prompt and effective loan approval procedure A dedication to ensuring client assistance and happiness

V. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Information on whom to contact in the event that you need further support or details Assistance with credit repair and debt consolidation Personalized assistance with the loan application procedure Reasons to Select Gustan Cho Associates IV: Reasonably priced interest rates and loans Ensuring client pleasure and assistance via a fast and efficient loan approval procedure.

VI. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Gustan Cho Associates provides support with loan applications, debt reduction, and credit restoration, in addition to affordable interest rates. As a trustworthy mortgage lender, they provide contact details for further help and demonstrate a strong dedication to client satisfaction and support. Gustan Cho Associates is a reputable mortgage provider offering services such as FHA, VA, conventional, and other types of mortgage loans, credit repair and debt consolidation assistance, and personalized loan application assistance. The company’s history, expertise, and experience are highlighted. Reasons for choosing Gustan Cho Associates include reasonably priced loans and interest rates, a prompt and effective loan approval procedure, and a commitment to customer satisfaction and happiness. They provide support with loan applications, debt reduction, and credit restoration, along with affordable interest rates. Customers can use their contact details to contact Gustan Cho Associates for further support, and they can demonstrate a strong dedication to customer satisfaction and support. The company’s commitment to customer satisfaction and support is evident in its commitment to providing the best possible service to its clients.

The Gustan Cho Team at Gustan Cho Associates has licenses in most 50 states. Contact Gustan Cho seven days a week, nights, weekends, and holidays, at 800-900-8569 or mobile at 262-716-8151.

-

This discussion was modified 1 year, 2 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 2 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

This discussion was modified 1 year, 2 months ago by

-

Will the 2024 housing market crash forecast be worse than the 2008 Financial Crisis and Housing Market Crash Forecast? What goes up comes down right? Why are housing market experts and economists saying the 2024 housing market crash forecast will be worse than the 2008 housing crash? Interest rates have skyrocketed from 2.0% to 7% in twenty four months. The sudden increase in mortgage rates and skyrocketing home prices as well as surging inflation have put a halt in home affordablility among millions of potential home buyers. Unemployment rates have surged and many people are becoming homeless or are in the verge of being homeless. Please take a look at this video.

https://www.youtube.com/watch?v=zY0d-RKtYaQ&ab_channel=Econofin

-

Have you ever thought moving to Florida is a fantasy come true? Many of you remember when someone mentions FLORIDA, the Sunshine State comes to mind. Disney World, Epcot Center, beautiful beaches, sun tans, beautiful women, great weather 12 months of the year, boating, jet skiing, outdoor kitchens, great restaurants, great job opportunities, and opportunities. So have you still eyeing and dreaming moving to Florida and buying your dream home? Are you planning on selling your home and buying your forever home in Florida? Are you planning on quitting your job in your current state and finding a new career in Florida?

Whether buying a house in Florida is a great investment depends on various factors such as the local real estate market conditions, your financial situation, your investment goals, and your risk tolerance. Here are some considerations to keep in mind:

-

Market Trends: Research the current trends in the Florida real estate market. Look at factors such as home prices, inventory levels, and demand. Historically, Florida has been known for its strong real estate market due to factors like warm weather, tourism, and population growth.

-

Location: Location is crucial in real estate. Certain areas in Florida may have higher demand and potential for appreciation compared to others. Consider factors such as proximity to amenities, schools, transportation, and job opportunities.

-

Rental Market: If you’re considering buying a property for investment purposes, evaluate the rental market in the area. Florida has a significant tourist industry, so vacation rentals might be an option in certain areas. Additionally, long-term rental demand can vary depending on the local economy and job market.

-

Financial Considerations: Evaluate your financial situation and whether buying a house aligns with your long-term financial goals. Consider factors such as your down payment, mortgage rates, property taxes, insurance costs, and potential rental income if you plan to rent out the property.

-

Maintenance and Management: Owning a property entails ongoing maintenance and management responsibilities. Factor in the costs associated with property upkeep, repairs, and potential property management fees if you don’t plan to manage the property yourself.

-

Risk Factors: Real estate investments carry risks, including market fluctuations, economic downturns, natural disasters, and regulatory changes. Consider your risk tolerance and diversify your investment portfolio accordingly.

-

Consult Professionals: It’s advisable to consult with real estate agents, financial advisors, and legal experts who are familiar with the Florida market and can provide personalized advice based on your specific situation.

While Florida real estate can be a great investment under the right circumstances, it’s essential to conduct thorough research and consider various factors before making a decision. The cost of living in Florida can vary depending on the city or region you’re considering. Generally, Florida is known for having a relatively affordable cost of living compared to some other states in the U.S. However, specific factors such as housing, healthcare, transportation, and groceries can significantly impact the overall cost.

Here are some general considerations:

-

Housing: Housing costs can vary greatly depending on whether you’re in a major city like Miami or Orlando versus a smaller town. In cities like Miami or Tampa, housing costs tend to be higher compared to smaller towns or rural areas.

-

Utilities: The cost of utilities such as electricity, water, and heating/cooling can also vary depending on the location and the size of the property.

-

Transportation: Florida is a state where having a car is often necessary due to limited public transportation options in many areas. The cost of owning a car, including gas, insurance, and maintenance, should be factored into your budget.

-

Groceries and Dining: The cost of groceries and dining out can vary depending on your location and lifestyle preferences.

-

Healthcare: Healthcare costs can vary depending on factors such as insurance coverage, healthcare providers, and specific medical needs.

-

Taxes: Florida is known for not having a state income tax, which can be advantageous for residents. However, there are other taxes to consider such as sales tax and property tax.

It’s important to research and consider these factors based on your specific situation and the location within Florida where you plan to live. Additionally, using cost of living calculators available online can help you estimate your expenses more accurately based on your lifestyle and preferences.

Florida offers a diverse range of career opportunities across various industries due to its thriving economy, tourism, technology sectors, and favorable business climate. Some prominent industries and career opportunities in Florida include:

-

Tourism and Hospitality: With famous attractions like Walt Disney World, Universal Studios, and beautiful beaches, Florida has a vibrant tourism industry offering jobs in hospitality, hotel management, entertainment, and event planning.

-

Healthcare: Florida has a large population of retirees and tourists, driving demand for healthcare services. Opportunities exist for healthcare professionals such as nurses, physicians, medical assistants, and healthcare administrators.

-

Technology and Aerospace: Florida is home to several technology companies, particularly in aerospace and aviation. With NASA’s Kennedy Space Center, Cape Canaveral Space Force Station, and a growing tech hub in cities like Miami and Orlando, there are opportunities in aerospace engineering, software development, cybersecurity, and data analytics.

-

Finance and Banking: Major financial institutions have a presence in Florida, particularly in cities like Miami and Tampa. Career opportunities exist in banking, investment management, financial analysis, and accounting.

-

Real Estate: Florida’s growing population and attractive climate make it a hot spot for real estate development. Careers in real estate include real estate agents, property management, appraisers, and construction management.

-

Education: With numerous universities, colleges, and public school districts, there are opportunities in teaching, administration, curriculum development, and educational technology.

-

Agribusiness: Florida is a leading producer of citrus fruits, vegetables, and other agricultural products. Career opportunities include farming, agricultural management, food processing, and agricultural research.

-

Maritime and Logistics: With extensive coastline and ports, Florida is a hub for maritime trade and logistics. Career opportunities include port management, logistics coordination, shipping, and freight forwarding.

-

Creative Industries: Florida has a burgeoning arts and entertainment scene, particularly in cities like Miami, Orlando, and Tampa. Opportunities exist in film production, advertising, graphic design, and performing arts.

-

Environmental and Renewable Energy: Given its unique ecosystem and concerns about climate change, there are opportunities in environmental science, conservation, renewable energy, and sustainability initiatives.

These are just a few examples, and the job market in Florida is continually evolving. The specific career opportunities available will depend on factors such as location, qualifications, experience, and industry trends. Networking, researching companies, and staying updated on job listings are essential for finding suitable career opportunities in Florida.

The Florida housing market has capped at its peak in 2022. If you are thinking about moving to Florida, please think again.

-

-

When it comes to insurance policies, insurers need to make sure they’re covering their bases. One of the ways they do this is by conducting insurance inspections and ensuring that the policyholder meets their underwriting criteria.

An insurance inspection, whether conducted by the insurance company or a trusted third-party inspector, is a comprehensive review of a property or asset. It meticulously determines its value, condition, and potential for risk. The results of this diligent inspection provide the insurer with a clear understanding of the risk associated with the property or asset, enabling them to offer the most appropriate coverage and premiums.

Meeting underwriting criteria is a crucial factor in getting approved for an insurance policy. Underwriting criteria are the set of guidelines insurers use to determine a policyholder’s eligibility. This includes factors like the individual’s credit score, age, occupation, and health status.

For example, if you’re applying for a life insurance policy, the insurer will want to know your age, whether you smoke, and whether you have any pre-existing medical conditions. Based on this information, they will determine your risk level and offer you an appropriate coverage plan.

Insurance inspections and meeting underwriting criteria go hand in hand. Insurers use the information gathered from a property inspection to determine the risk level of the asset, which in turn helps them determine the premiums they will charge. Similarly, underwriting criteria help the insurers understand the risk level of the policyholder, which plays a significant role in determining the policy’s cost.

In conclusion, insurance inspections and meeting underwriting criteria are not just processes; they are opportunities to be an active participant in your insurance coverage. They help insurers understand the risks associated with the property or asset they are insuring and the individual they are covering. As a policyholder, your transparency and provision of accurate information are key to ensuring you’re getting the coverage you need.

-

Sammy Gravano explains how President John Kennedy got assainated in detail.

-

Tucker Carlson details who Barack Obama is and how he rose to fame. Tucker Carlson interviews Larry Sinclair on his encounter with Barack Obama

-

Maybe this season is the right time to make your own garden.

rumble.com

IN FOCUS: Injecting Lethal Bioweapon Into Food Supply with Dr. Judy Mikovits, Virologist - OAN

Wolves In Politicians Clothing | Ep. 559 Tonight IN FOCUS... It's April Fool's Day and the Commie-fornia joke is on us with fast food minimum wage increasing to $20 dollars per hour. Also eat your spi

-

-

When is a good time to refinance if you have a 7.5% rate on FHA loan? I heard mortgage rates are dropping lower.