Brandon

Dually LicensedMy Favorite Discussions

-

All Discussions

-

Here’s a funny comedy short from the Johnny Carson show

https://www.facebook.com/share/r/xCqEdP6dVFda6MzV/?mibextid=D5vuiz

facebook.com

Part 2 - Tommy Smothers Walks Out As Johnny | Carson Tonight Show

-

-

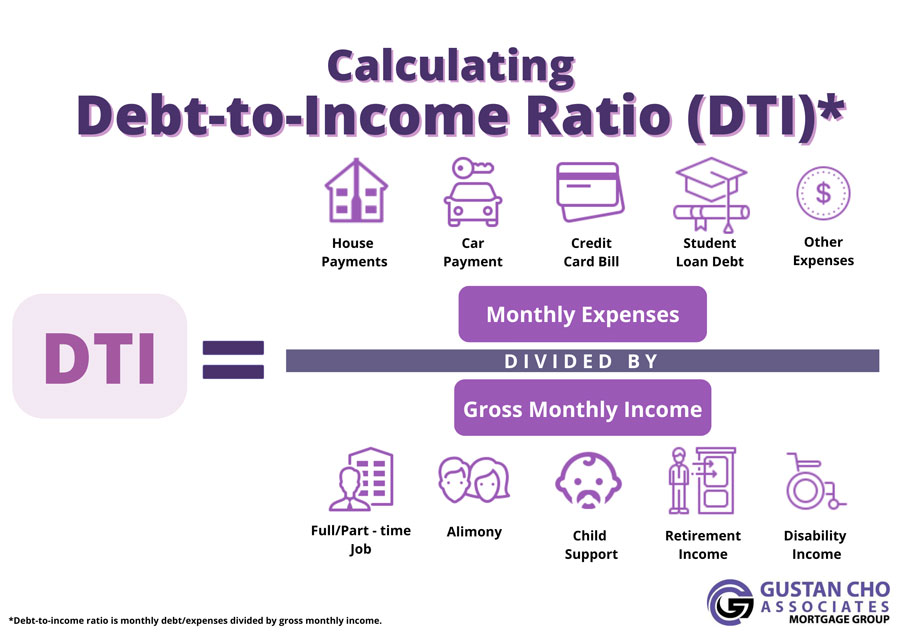

You do not need perfect credit or high credit scores to qualify for a mortgage loan. Every loan program require a minimum credit score. Besides HUD, VA, USDA, FANNIE MAE, FREDDIE MAC, or non-QM portfolio lenders requiring a minimum credit score, each lender can impose lender overlays on credit scores. Lender overlays are additional credit score requirements above and beyond the minimum agency mortgage guidelines imposed by each individual mortgage lender. Regardless of the minimum credit scores required, all lenders will normally want to see timely payment history in the past 12 months. Regardless of the prior bad credit you have, having timely payment on all of your monthly debt payments that report on the three credit reports is crucial. Do not worry about prior collections, charge-off accounts, late payments, or other derogatory credit tradelines unless you are going though a manual underwrite on FHA loans. HUD manual underwriting guidelines require timely payments in the past 24 months. VA manual underwriting guidelines require timely payments in the past 12 months. In many instances when you get an approve/eligible per automated underwriting system but late payments in the past 24 months, the lender may down grade your file to a manual underwrite. The best solution for you to increase your credit scores and strenghen your credit profile with recent late payments is adding positive credit with new credit. Please read this guide on how to boost your credit to get approved for a mortgage: Capital One Secured Credit Card will get you a $250 secured credit card with a $50 deposit. Self.Inc is a bank that has a phenomenal credit rebuilder program where you can make a monthly deposit as small as $25.00 per month. That monthly deposit goes towards a savings account but it reports as an installment loan to all three credit bureaus. Get a Discover secured card. Secured credit cards are the same as unsecured traditional credit card. The only difference is you need to put a deposit. The amount of deposit is the amount of credit you get by the credit card company. You need to make timely minimum monthly payments on your secured credit cards. Just start with these three creditors and you will see wonders in the weeks and months ahead. I will cover some quick fixes for you to increase your credit scores fast and at the end of this topic thread, I will list helpful resources on boosting your credit to qualify for a mortgage, how to reach a human at the credit bureaus, and how to rebuild your credit:

1. Capital One Secured Credit Card

2. Self.Inc

3. Discover Secured Credit Card

As time pass and you make timely payments, your secured credit card company will increase your credit limit without asking your to put additional deposit. If you can get more secured credit cards, it will expedite your credit rebuilding process. However, you should at least start with the above three creditors.

Improving your credit scores and rebuilding credit can be crucial when seeking mortgage approval. Here are some effective strategies to consider:

Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion. Identify and dispute any errors or inaccuracies that may be negatively impacting your credit scores.

Pay bills on time: Payment history is the most significant factor affecting your credit scores. Make sure to pay all your bills (credit cards, loans, utilities, etc.) on time, every time. Set up automatic payments or payment reminders if necessary.

Reduce credit card balances: High credit card balances can hurt your credit utilization ratio, which accounts for a significant portion of your credit scores.

Aim to keep your credit card balances below 30% of your total available credit limit. Consider paying off credit cards with the highest balances first.

Don’t close unused credit cards: Closing credit cards can inadvertently increase your credit utilization ratio and decrease your overall available credit. Keep unused credit cards open, but avoid using them to maintain a low credit utilization ratio.

Increase credit limit: Request a credit limit increase from your credit card issuers, which can improve your credit utilization ratio. Be sure to handle the increased credit limit responsibly and avoid overspending.

Limit new credit applications: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit scores. Limit credit applications only to when absolutely necessary.

Use different types of credit: Having a mix of different types of credit (e.g., credit cards, auto loans, personal loans) can positively impact your credit scores. Consider taking out a small loan or opening a new credit card account if you have limited credit types.

Monitor your credit regularly: Check your credit reports and scores periodically to ensure accuracy and track your progress. Consider signing up for a credit monitoring service to receive alerts for any changes to your credit profile.

Be patient and consistent: Rebuilding credit takes time and consistent effort. Stick to responsible credit habits, and your credit scores should gradually improve, increasing your chances of mortgage approval.

Remember, lenders evaluate various factors beyond just credit scores when considering mortgage applications. However, improving your credit scores and maintaining a healthy credit profile can significantly increase your chances of getting approved for a mortgage with favorable terms.

https://gustancho.com/boost-your-credit-with-new-credit/

gustancho.com

Boost Your Credit With New Credit To Qualify For A Mortgage

Boost your credit with new credit to qualify for a mortgage . New secured credit cards and credit builder loans increases credit scores for mortgage

-

Many of our viewers are asking about ITIN loans. FAQs are can I get a mortgage loan with my ITIN number? What are ITIN loans? How much down payment is required to buy a house with my ITIN number? What documents are required to buy a house with an ITIN number? Can I use my ITIN number to get a credit score and establish credit? ITIN loans are designed for borrowers who have an Individual Taxpayer Identification Number (ITIN) but lack a Social Security Number (SSN). They offer a pathway for individuals who are not eligible for an SSN, often non-citizens, to purchase a home.

Frequently Asked Questions (FAQs)

-

Can I Get a Mortgage Loan with My ITIN Number?

- Yes, many lenders offer mortgage loans specifically for ITIN holders. However, not all lenders provide them, so it’s essential to find those that specialize in these loans.

-

What Are ITIN Loans?

- ITIN loans cater to individuals without SSNs. These loans help borrowers with an ITIN prove their creditworthiness and qualify for a mortgage. Lenders typically review their credit history, income, and financial stability.

-

How Much Down Payment Is Required to Buy a House with My ITIN Number?

- The down payment requirement typically ranges from 10% to 20%, often higher than conventional loans. The exact amount depends on the lender’s criteria, credit history, and the borrower’s financial profile.

-

What Documents Are Required to Buy a House with an ITIN Number?

- Proof of Identity: ITIN card or letter, passport, or other government-issued IDs.

- Bank Statements: Usually 12 months of statements to verify financial stability.

- Tax Returns: Two years’ worth of tax returns filed with the ITIN.

- Proof of Income: Pay stubs, invoices, or other documentation showing consistent income.

- Employment Verification: Documents showing stable employment or self-employment.

-

Can I Use My ITIN Number to Get a Credit Score and Establish Credit?

- Yes, ITIN holders can build credit by opening credit accounts like credit cards or loans. Make sure to work with lenders who report to the credit bureaus. A good credit history can improve your chances of obtaining an ITIN loan.

The team at Gustan Cho Associates can help you qualify and get pre-approved for a mortgage loan with an ITIN number.

- Research Lenders: Look for lenders specializing in ITIN loans, as they are more familiar with specific requirements.

- Improve Financial Stability: Demonstrate consistent income and a stable credit history.

- Seek Financial Counseling: Consider speaking to a financial counselor or mortgage broker who understands ITIN loans to guide you through the process.

-

-

Home staging is the process of preparing a home for sale by making it look as attractive and appealing as possible to potential buyers. The goal of home staging is to help buyers envision themselves living in the space and to highlight the home’s best features. Here are some key aspects of home staging:

- Decluttering and depersonalizing: Removing excess furniture, personal items like family photos, and clutter to create a sense of openness and allow buyers to imagine their own belongings in the space.

- Furniture arrangement: Rearranging and sometimes renting furniture to showcase the flow and function of each room optimally.

- Deep cleaning: Ensuring the entire home is thoroughly cleaned, from windows to carpets, to create a fresh, move-in ready feeling.

- Curb appeal: Enhancing the home’s exterior by power washing, landscaping, and making the entrance inviting.

- Repairing and updating: Attending to minor repairs like patching holes and updating elements like light fixtures to give the home a well-maintained look.

- Style and accents: Using stylish yet neutral decor pieces, fresh linens, pillows, and accents to give rooms an updated, model home appearance.

- Staging vacant homes: For empty properties, staging companies bring in rental furniture and decor to make the space feel warm and livable.

Home staging aims to appeal to the highest number of potential buyers by making the home look its absolute best while remaining neutral enough for buyers to envision their own style. Studies show well-staged homes tend to sell faster and for higher prices.

Chic interiors and home staging are key elements in creating a stylish, inviting, and market-ready home. Whether you’re decorating for personal enjoyment or preparing to sell, understanding these concepts can make a significant difference.

Chic Interiors

Chic interiors are defined by their elegant, fashionable, and timeless qualities. Key elements include:

- Neutral Color Palette: Soft tones like white, beige, gray, and black provide a sophisticated base. Accents in metallics, pastels, or bold colors can add personality.

- Quality Over Quantity: Invest in high-quality furniture and decor pieces. Fewer, well-chosen items can make a bigger impact than cluttering the space with too many things.

- Mix of Textures: Combine different materials like velvet, leather, wood, and metal to create depth and interest.

- Minimalist Aesthetic: Keep spaces uncluttered and streamlined. Use sleek, modern furniture with clean lines.

- Statement Pieces: Incorporate standout items like a designer chair, a piece of art, or a unique lighting fixture to add a focal point to the room.

- Functional Design: Ensure that the design is not only beautiful but also practical. Furniture should be comfortable and arranged for ease of movement and conversation.

Home Staging

Home staging involves preparing a property for sale by making it appealing to the highest number of potential buyers. Key aspects include:

- Decluttering and Depersonalizing: Remove personal items and excess furniture to make the space look larger and allow buyers to envision themselves living there.

- Neutral Decor: Use neutral colors to appeal to a broad audience. This helps buyers focus on the home itself rather than the decor.

- Furniture Arrangement: Arrange furniture to highlight the flow and function of each room. Create cozy conversation areas and ensure there’s enough space to move around.

- Lighting: Use a mix of ambient, task, and accent lighting to create a warm and inviting atmosphere. Ensure all lights are functioning and rooms are well-lit.

- Curb Appeal: Enhance the exterior of the home with fresh landscaping, clean walkways, and a welcoming front entrance.

- Clean and Fresh: A clean home is more appealing. Pay attention to details like fresh paint, clean windows, and pleasant scents.

Tips for Combining Chic Interiors and Home Staging:

- Focus on Key Rooms: Prioritize staging the living room, kitchen, master bedroom, and bathrooms. These are the areas buyers focus on the most.

- Highlight Features: Use decor to draw attention to the home’s best features, like a fireplace, large windows, or architectural details.

- Use Chic Decor: Incorporate chic elements like stylish throw pillows, modern artwork, and elegant lighting fixtures to elevate the overall look.

- Update Strategically: Small updates like new cabinet hardware, fresh paint, and updated light fixtures can make a big impact without a significant investment.

Resources and Inspiration:

- Interior Design Magazines and Websites: Publications like Architectural Digest, Elle Decor, and Houzz offer inspiration and tips.

- Professional Stagers: Consider hiring a professional home stager for expert advice and hands-on help.

- DIY Resources: Books, online courses, and DIY blogs can provide step-by-step guides to achieving chic interiors and effective staging.

By combining the principles of chic interior design with strategic home staging, you can create a beautiful, inviting space that appeals to both you and potential buyers.

-

I heard conflicting stories about DACA recipients being able to get access to government assistance programs to overcome financial barriers, particularly for down payments to buy a house in the United States. Is there such a thing as DACA FHA Loans. I know FHA loans offer lower down payment requirements at 3.5% at certain credit rating levels, compared to 5% for conventional mortgages.Are there non-QM loans available for DACA recipients?

-

As a diabetic, I can provide you with some general information that may be helpful. However, it’s crucial to consult with a healthcare professional for personalized advice tailored to your specific situation.

Managing diabetes involves making lifestyle changes that can help control blood sugar levels and reduce the risk of complications. Here are some general tips:

Healthy Eating: Focus on a well-balanced diet that includes a variety of fruits, vegetables, whole grains, lean proteins, and healthy fats. Limit the intake of refined carbohydrates and sugars. Pay attention to portion sizes to help control blood sugar levels.

Regular Exercise: Engage in regular physical activity, as it can help improve insulin sensitivity and control blood sugar levels. Aim for at least 150 minutes of moderate-intensity aerobic exercise per week, along with strength training exercises.

Weight Management: Losing excess weight, if overweight, can have a significant impact on blood sugar control. Work with a healthcare professional to establish realistic weight loss goals and strategies.

Monitoring Blood Sugar Levels: Regularly monitor your blood sugar levels as advised by your healthcare team. Keep a record of your readings to identify patterns and trends.

Medication Adherence: Take prescribed medications as directed by your healthcare provider. If you have concerns about your medications or experience side effects, discuss them with your healthcare team.

Stress Management: Practice stress-reducing techniques such as deep breathing, meditation, yoga, or any activity that helps you relax. Chronic stress can affect blood sugar levels, so finding healthy ways to manage stress is important.

Regular Medical Check-ups: Schedule regular check-ups with your healthcare team to monitor your overall health and make adjustments to your diabetes management plan as needed.

Quit Smoking: If you smoke, consider quitting. Smoking can contribute to complications associated with diabetes.

Remember, diabetes management is highly individual, and what works for one person may not work for another. It’s essential to work closely with your healthcare team to develop a personalized plan that meets your specific needs and circumstances.

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

-

Adam Kizinger, a congressman from Illinois accused for

Er President Donald Trump as being the worst President and most corrupt President in the history of the United States. Adam Kizinger and a dozen members of Congress has been branded Rhinos and the blacksheep of the Republican party for distancing themselves from Trump after the so-called January 6th insurrection and are considered heroes by the Democrats and globalist in the nation.

-

So you’re in a restaurant, you order a nice bottle of wine, the server comes over, he/she presents you with the cork, and you’re a little bit embarrassed because you don’t know what to do. Don’t be embarrassed, in this video, I’ll tell you what to do!

-

I like old songs of bollywood and Hollywood. One of my fev song . Really like music of this song

-

Here are some key facts about Nevada: Nevada is a state located in the western United States. Its capital and largest city is Carson City. Major cities include Las Vegas, Reno, Henderson, and North Las Vegas. Nevada is the 7th largest state by area but one of the most sparsely populated. Most of the state’s terrain consists of desert and semi-arid landscapes. It is part of the Mountain West region of the U.S. The Mojave Desert covers much of southern Nevada. Nevada is best known for its gambling, entertainment and tourism industries centered around Las Vegas. Other major industries include mining, logistics, and renewable energy. Notable geographic features include Lake Mead, the Hoover Dam, Red Rock Canyon, Valley of Fire State Park, and Great Basin National Park. Native American tribes have inhabited the area for thousands of years. Nevada became the 36th state admitted to the Union in 1864. Top institutions of higher education include the University of Nevada, Las Vegas and the University of Nevada, Reno. Let me know if you need any other details about the history, culture, economy or attractions in the state of Nevada. Gambling in Nevada: Nevada is famous for its legalized gambling and is considered the gambling capital of the United States. Here are some key points about gambling in Nevada.

Gambling was legalized in Nevada in 1931, when the state passed a law allowing gambling establishments. This move helped bolster Nevada’s economy during the Great Depression.

Las Vegas is the gambling mecca, home to lavish casino-resorts like the Bellagio, MGM Grand, Caesars Palace, and the Venetian. The Las Vegas Strip is an iconic destination for gambling. Reno is another major hub for casinos and gambling, known as “The Biggest Little City in the World.” In addition to slot machines and table games like blackjack, roulette and craps, Nevada casinos offer sports betting, poker rooms, and racebooks for betting on horse races. Nevada’s lenient regulations on gambling have allowed the state’s casinos to experiment with new games and gambling formats over the years. Gambling tax revenues are a critical part of Nevada’s economy and state budget. In fiscal year 2022, gambling taxes provided over $1 billion to state coffers. While Nevada is famous for its mega casino-resorts, there are also many smaller local casinos and gambling halls across the state. Native American tribes have also opened casinos on tribal lands in Nevada in recent decades. So in summary, legalized gambling, pioneered in Nevada, has become a pillar of the state’s identity, economy and tourism draw.

-

This discussion was modified 1 year ago by

Lisa Jones.

Lisa Jones.

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year ago by

-

NEXA Mortgage has revenue share which is residual income for loan officers and employees for NEXA Mortgage. Residual income is an override of every loan officer they recruit who does production. The residual income is through revenue share of loan officers monthly revenue and it goes down three levels. CEO Mike Kortas does a Zoom webinar live every Thursdays at 11 am Arizona time. It is a live Q and A for all loan officers who are interested in joining NEXA Mortgage. I have been with NEXA Mortgage going on two years come February 24th, 2024 and I can attest that CEO Mike Kortas is the real deal. We have a rock solid Chief Executive Officer and with that, we have a rock solid foundation. It is hands down better to take a few steps backwards to go forwards and make sure whatever you do, make sure you have a solid foundation. Anything with a weak foundation will not last. You can build a multi-million dollar home in a cracked foundation and it is not if it will crack but when it will collapse. I have been in the mortgage industry since 2012 and was a real estate investor and developer since 1998 and I have never met so many scumbags in any industry like the mortgage industry. Most CEOs of mortgage companies will tell you one thing and not honor their word in a matter of months. CEO Kortas has honored every single word he has said or promised. Never in my career have I ever met such a man of integrity, honor, and fairness like CEO Michael Kortas. With a strong foundation, you can rest assured you have the keys to your destiny in the mortgage industry.

https://gustancho.com/mlo-revenue-share-residual-income/

gustancho.com

MLO Revenue Share Residual Income For Loan Officers

Loan officers at Gustan Cho Associates will have the opportunity to participate in the MLO Revenue Share Residual Income, up to $3 million down.

-

Any loan officers or real estate agents know about the new federal law on non-competes for NMLS licensed loan officers?

https://www.facebook.com/share/cgEJD2Etq9fHit7p/?mibextid=oEMz7o

facebook.com

I am super excited about the new rules for non-competes. These have been abused by so many mortgage companies hurting Loan Officers. It’s about time Loan Officers have the right to feed their...

-

-

-

Builders, Realtors, Investors! Lookie Lookie! We have a seller looking to make deal for 2024. Check out the attachment! If you have the brass to tackle this, then let’s connect today! Creative commercial financing available. Call me: 972-707-4963

-

How can you get approved for a commercial loan on commercial properties with creative financing?

-

The Francis Scott Key Bridge, often referred to simply as the Key Bridge, is a prominent bridge located in Baltimore, Maryland, USA. It spans the Patapsco River, connecting the neighborhoods of Baltimore City with Anne Arundel County. The bridge was named after Francis Scott Key, who wrote the lyrics to “The Star-Spangled Banner,” the national anthem of the United States. Construction of the Key Bridge began in 1972, and it opened to traffic in 1977. It is a vital transportation link, carrying Interstate 695 (the Baltimore Beltway) across the river.

As of my last update in March 27th, 2024, there were reported incidents of the Francis Scott Key Bridge collapsing and being done intentionally by a ship navigated by a Ukrainian Ship Captain. There have been many developments since then and Maryland Governor Westmoreland’s asshole is puckering because first thing out of his month is it seems that is was an accident with no foul play. Why would he even say that in such an early stage of the investigation. I would recommend consulting recent news sources from reputable media neworks for the latest information.

The Maryland Francis Scott Key Bridge Collapse was a black swan event per former Army General Michael Flynn says Clayton Morris, previous host of WEEKENDS ON FOX NEWS and now the host and owner of REDACTED NEWS. What is a Black Swan Event asks Clayton Morris? A black swan event is a term used to describe an unpredictable event that has significant and widespread consequences. Coined by Nassim Nicholas Taleb in his book “The Black Swan: The Impact of the Highly Improbable,” these events are characterized by their extreme rarity, their severe impact, and the tendency for people to rationalize them in hindsight as if they were predictable.

The term “black swan” originates from the belief in Europe that all swans were white, as all historical records confirmed this, until the discovery of black swans in Australia challenged that assumption. Thus, a black swan event represents a surprise that has a major impact and is often explained or rationalized after the fact, despite the fact that it was not anticipated beforehand.

Examples of black swan events include the 9/11 terrorist attacks, the 2008 financial crisis, and the COVID-19 pandemic. These events were highly unexpected, had profound effects on society and the economy, and were difficult to predict using conventional forecasting methods. Michael Flynn is a retired United States Army Lieutenant General who served as the 25th National Security Advisor to President Donald Trump from January 20 to February 13, 2017. Born on December 24, 1958, in Middletown, Rhode Island, Flynn graduated from the University of Rhode Island in 1981 with a Bachelor of Science degree in management science.

Flynn’s military career spanned over three decades. He served in various positions, specializing in intelligence and counterterrorism. Notably, he served as the Director of the Defense Intelligence Agency (DIA) from July 2012 to August 2014. Flynn’s tenure at the DIA was marked by controversy, including clashes with the Obama administration over his management style and views on radical Islam.

After retiring from the military in 2014, Flynn became involved in politics. He emerged as an outspoken critic of the Obama administration’s foreign policy, particularly regarding its approach to combating terrorism. Flynn became a close advisor to Donald Trump during his 2016 presidential campaign, advocating for a more aggressive stance on national security issues.

Following Trump’s victory in the 2016 presidential election, Flynn was appointed as National Security Advisor. However, his tenure was brief and marred by controversy. He resigned from his position after less than a month amidst allegations that he misled Vice President Mike Pence and other administration officials about his communications with Russian officials before Trump took office.

Flynn’s legal troubles continued after leaving the White House. In December 2017, he pleaded guilty to lying to the FBI about his contacts with the Russian ambassador to the United States during the presidential transition period. However, in May 2020, the Department of Justice moved to dismiss the charges against Flynn, citing misconduct by the FBI.

Throughout his career, Michael Flynn has been a polarizing figure, admired by some for his military service and strong stance on national security issues, while criticized by others for his controversial statements and actions. His biography reflects a complex mix of military service, political involvement, and legal controversies. Expect more man made natural disasters happening in the coming weeks and months because the Democrats are definitely panicking.

What do you think @Cpensacola

https://rumble.com/v4ltaif–mike-crispi-unafraid-3.27.24-10am-est.html

rumble.com

KEY BRIDGE COLLAPSE: INTENTIONAL OR ACCIDENT? WE INVESTIGATE | MIKE CRISPI UNAFRAID 3.27.24 10am EST

www.collect45.com Use Code ‘Crispi’ for 20% Off! www.itargetpro.com Use Code ‘Crispi’ for 10% Off www.TWC.Health/Crispi Code ‘Crispi’ for 15% Off! www.GreatPatriotShopper.com LFA SPONSORS & PARTNERS C

-

How does adjustable rate mortgages work? What are the three numbers X/X/X on ARMs? Can someone help me with this question about adjustable rate mortgages?

Matt has obtained a 30-year 3/1 ARM mortgage loan for $150,000 on a beautiful four-bedroom two bath home in the suburbs. The start rate was 3%. The rate caps are 4/2/8. The margin is 3%. The index was 4% at the start of the loan, 4.25% at the end of year three, and 6.5% at the end of year four. Which of the following rates would reflect the interest rate that will begin in year number five?

-

I love this little French Bulldog. So cute. Anyone know about Frenchies

-

Like to welcome my Tim Cho of Cho Time Fitness to GCA FORUMS. Tim is my son and has been a champion wrestler in high school, and is a former professional mixed martial arts fighter. Time is also a drill sergeant in the United States Army reserves and does personal training, and coaches groups like local police departments and other agencies in defensive tactics. Tim is going to launch and run the eGym and Nutrion subforum under the HEALTH, WELLNESS, AND FITNESS FORUM here and will answer any questions viewers have about setting up a work out regiment, defensive tactics, and nutrition. His company, Cho Time Fitness is a one on one personal training curriculum. He is taking a working business model and plans on expanding his successful work out coaching program to those who want to be in the best health through regular exercise, and proper eating.

-

Jeffrey Epstein, the pedophile sexual predator has bribed famous people including politicians to his pedophile palace in the United States Virgin Islands often referred to Epstein Island. The names of the important people who were his guests was released. Here is a video news about who the guests of Jeffrey Epstein were.