Gustan Cho

Loan OfficerMy Favorite Discussions

-

All Discussions

-

I’ve warned my audience countless times about the dangers of buying things we don’t need, but what about buying cars? Do cars appreciate enough over time where it becomes a good investment, and if so what are some things that a buyer should know when purchasing a unique model car?

We head back to Walt Grace Vintage to get these answers sorted!.

-

GCA Forums Headline News Weekend Edition Report: May 26 – June 3, 2025 Introduction

This is the GCA Forums Headline News Weekend Edition Report. In this report, I will discuss the most important global happenings with timelines between May 26 and June 3, 2025. The report includes acute changes in the sports sector, business events, technology news, entertainment hubs, and more, along with the story behind them. Follow this summary to ensure you do not miss the most critical news of the week.

Sports Updates

- The 2025 NBA Finals are set for an intriguing face-off between Oklahoma City Thunder and Indiana Pacers.

- Game 1 is on 5/06/2025 and will air at 8:30 PM with Pacers facing Thunder at their home turf.

- The series proceeds with Game 2 on 8/06, with Games 3 and 4 played in Indiana on June 11 and 13, respectively.

- Anticipation is fired up for legendary highlights and crowning feats unfolding in this championship series.

- Burnes’s injury concern has evoked mixed reactions from fans.

- Leading Arizona Diamondbacks’ thought to sit on the bench due to right elbow inflammation put him on a 15-day injured disability, leaving Burnes’s injury concern.

- The injury is thought to be problematic for the franchise, especially for the exacerbating condition of careful tests the franchise initialed and is headed for a second opinion. Initially, the franchise has exalted Tommy Henry from Triple-A Reno while placing Ryne Nelson back in the starting rotation alongside slated expectations of Burnes’s forthcoming. Seasonwise, this has consequences on the performance of the Diamondbacks in this ongoing cycle of American Baseball.

- Paris Saint-Germain (PSG) celebrated a historic 5-0 victory over Inter Milan in the Champions League final match on May 31, 2025, at Munich’s Allianz Arena.

- Marquinhos lifting the trophy symbolized the PSG triumphing as the champions during the European Cup final, which fundamentally established their status as a world footballing superpower.

Economic and Financial Development

Inflation Eases to 2.1% in April

- Compared to other months within this range, the American economy is getting some relief due to the Personal Consumption Expenditures (PCE) price index previously set at $2.2, which has now dropped to a $2.1 annual rate.

- With other economists forecasting a rate of $2.25, this informative data could slow down the acceleration of the price of consumer goods.

Mortgage Refinance Rates Climb

- According to their June 3rd publication, the Mortgage Refinance Rates had increased, whereas the 30-year fixed refinance had surged to 6.92%.

- Their 15 and 20-year fixed averages at 5.84% and 6.79%, respectively, also align.

- For homeowners, there remain better options for refinancing their mortgages.

- However, strategic restructuring could enhance their finances by lowering payments or increasing home equity for projects such as remodeling.

Nvidia Faces China Export Challenges

- Despite the US restrictions on chip exports to China, Nvidia still exceeded its quarterly sales forecasts.

- However, this will not last long since Nvidia expects to lose $8 billion in sales this upcoming quarter.

- The changes, set to take effect in 2025, have led customers to begin stockpiling products, changing Nvidia’s outlook and raising concerns regarding global tech supply chains.

Global Events And Geopolitics

- India And Pakistan Increase Tensions escalate Focusing on April 22, 2025, the strike in Pahalgam of Kashmir, which is Indian administered, has killed 26 people, mostly tourists, marking an escalation in tension for India and Pakistan.

- Alleged Pakistani culpability had led to missile and drone warfare until a ceasefire was negotiated. Indian Parliamentarians were discussing the matter in Doha, Qatar, on May 26, 2025, marking further diplomatic strain.

Russia-Ukraine Conflict Further Escalation

- On May 25, 2025, Russia launched a record 355 drones into Ukraine, which marked one of the largest airborne assaults in history.

- This came after US President Donald Trump’s criticism, which added to the geopolitics boiling pot.

- The world has its eyes on the current situation while experts anticipate a further depth into chaos.

Technology And Innovation

FORTUNE ASEAN-GCC-China Economic Forum

- The FORTUNE ASEAN-GCC-China and ASEAN-GCC Economic Forums held in Far Malaysia on May 29, 2025, focused on sovereign AI, regional connectivity, and inclusive growth.

- The forums emphasized the region’s participation in the impact of collaboration on technology and the economy.

ASCO 2025 Showcases Cancer Research Breakthroughs

- At the 2025 ASCO Annual Meeting in Chicago held from June 1 to June 2, 2025, notable advancements in lung cancer were discussed.

- Innovative therapies for NSCLC and SCLC were introduced in paradigm-shifting studies such as CheckMate816 and NeoADAURA.

- Another major theme of the meeting, fostering international cooperation between researchers and advocates from many countries and global patient communities, was the role of AI in cancer diagnostics.

Entertainment and Culture

Dept. Q Series Gains Traction

- The Dept. Q crime series set in Edinburgh has snagged a Netflix deal, and while some viewers were thrilled with the addition to the genre, others seemed put off by the direction the story took.

- For better or worse, the show’s humor and engaging plot won praise.

- It follows a detective who is outlandish and happens to be a part of a quirky band of detectives.

- Many fans are eager for a second season, but more than a handful would argue that the long, tired, slow dialogue and pacing drag make this a confusing place to pile the so-called genre crime-thriller.

Chicago Summer Festivals Announced

- Among the headline events scheduled for the summer of 2025 are Riot Fest on September 26-28 and Lollapalooza, with headliners Blink-182, Green Day, Tyler, The Creator, and Sabrina Carpenter.

- The Chicago Blues Festival, the largest and one of the most famous free blues festivals in the world, is held every year with Mavis Staples anchoring.

- These events will enhance local tourism.

Global Weather Snapshots

- Noteworthy weather occurrences between May 26 and June 1, 2025, include a damaging tornado in Puerto Varas, Chile, and lightning storms over the Seyhan River in Adana, Turkey.

- Also, in Varanasi, India, people tried alleviating the oppressive summer heat by swimming in the Ganges River.

- Such phenomena emphasize the variety of weather experienced by different parts of the world.

- Reflecting on the economics of the decade (2020-2030), one glazes over the immense technological border advancements, sociocultural occurrences, and geopolitical tension.

- Those were turning decades for humanity.

- Looking out onto or from the GCA Forums Headline News will ensure the utmost.

These days, it’s inevitable to overlook that PSG Sico is bypassing, and the economy of service and help continue raging.

What could one tighten as leverage? Most demonstrated descents in articles were sensitive.

-

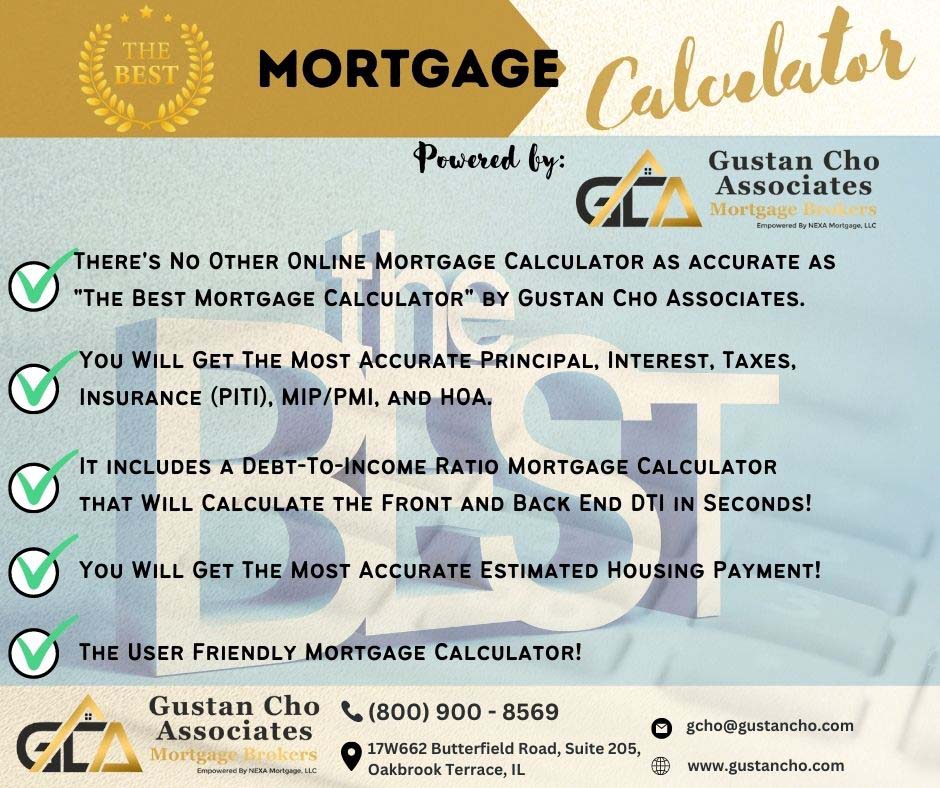

I like to go over a case scenario on a house that has been or is in the final stages of getting foreclosed in Sacramento, California. The homeowner has not made a mortgage loan payment in quite some time. Therefore, the house is under the receivership-temporary ownership of the lender, which is often referred to as REO. It is a bank owned property and the bank is responsible to get the most and highest priced offer for the property. The home is located in 2663 LA VIA WAY, Sacramento, CA 95825. The bank has hired a real estate broker and/or California DRE expert to prepare a comprehensive report of the subject property. The Repart was prepare on May 26, 2025. The house needs to be sold to the highest bidder. The exterior and interior condition of the subject property is not fully known nor can it be warranteed by the seller, or in this particular case, the note holder which is the bank. The current homeowner who defaulted on the mortgage is currently living on the subject property and the potential buyer of the property should not expect cooperation as of the condition and answers to questions they may have. I have attached GCA Forums Best Mortgage Calculator to figure and calculate the monthly housing payment versus the rental income and what the minimum monthly lease needs to be charged with a potential tenant in order to be profitable as a real estate investor unless the homebuyer is planning on living on the house as a primary owner-occupant home. Any feedback from real estate experts in the Sacramento, California area who are members of Grat Content Authority Forums would be greatly appreciarted. Here is the link to Gustan Cho Associates Best Mortgage Calculator:

https://gustancho.com/best-mortgage-calculator/

gustancho.com

Best Mortgage Calculator | PITI, PMI, MIP, and DTI

The best mortgage calculator powered by GCA Mortgage Group is different than the competition due to PITI, PMI, MIP, HOA, and DTI features.

-

I have been hearing and also know a few friends and coworkers who are Jeep lovers and swear that Jeeps are great investments especially the older Jeeps where you can restore and make the jeep look like Neguyw. Many Jeeps from the 1980s especially the Jeep Wrangler Rubicon are great investments if you buy them at the right price and is mechanically sound and in excellent shape and has been well taken care of, preferably garaged. If any viewers and members of Great Content Authority Forums and Sub-Forums are Jeep experts and Jeep lovers, if you can guide us through the various types of Jeeps and suggest and recommenond what type of Jeeps to look out for and what type of Jeeps to stay away from, it would be largely appreciated. I have five large dogs and my dogs always travel together with me when running errands and when I need to go to my office. How is the space of 4 door Jeeps? From the picture, it looks cramped and not too spacious. What Jeep would you recommend for folks with multiple large dogs.

Attached is a video clip by Dennis Collins talk about 1981 to 1986 Jeep CJ. Some of these Jeeps have appreciated crazy in value.

Welcome to Coffee Walk Ep. 147!

This week we’re talking Jeep CJ’s and how to tell the difference(s) between a Base, Renegade, Laredo and a Limited Edition Model. Let me know which Jeep is your favorite in the comments section below AND let me know if this killer CJ collection that we’ve been stacking up over at our secret warehouse is something that you guys would like for us to feature on an episode here soon… although, I think I may already know the answer to Question #2!As always… GO FAST, HAVE FUN & HAVE A GREAT WEEKEND!! and thanks for watching!

-

Welcome To The Great State of Wisconsin . In this thread and post we will cover and discuss everything Wisconsin. You can also start your own GROUP Wisconsin.

-

My big guy Chase, my German Shepherd Dog, has a baby sister. SKYLAR. Skylar is an eight month old female long coat black and red German Shepherd Dog from the same breeder Chase came from. Chase is neutered and i am going to get Skylar spayed in about six months. Skylar is underweight and skinny. You can feel the ribs when you pet her on the sides of her body. Skylar was the runt of the litter and was bullied on by her furry brothers and sisters. She was bit in many places and her siblings stole her portion of Dog food so that is why she is underweight and malnourished. Had a visit to the veterinarian and got her tested for worms 🪱 and parasites. Results came back negative. Skylar is takung a 14 day antibiotics program due to her scabs, a lump on her left side rib area due to blunt trauma and urinary infection and scratches on her vulva. She got her rabbits and puppy shots and weighs 52.5 pounds. Unfortunately Skylar is not fully potty trained nor obedience trained. I will work on a training regiment after a few weeks. Extremely skittish therefore I want her to get used to her new home and her new family and environment. Here are a few photos of Skylar and Chase. One of Skylar ears is floppy. I adopted Skylar on Sunday October 6th. Dan Ivenovic dropped her off the house. Dan has two other German Shepherd pups that are nine months. Please let me know if anyone is interested . Price is discounted. 9 months old.

-

Here is our third German Shepherd Dog Bailey. We call Bailey “Floppy” because both of her ears are floppy. Skylar has just one year that is floppy but Skylar floppy ear 👂 is getting stronger 💪 and stands up when it is cold. Bailey turned one year old in January 25th, 2025 so she is now 14 months old. Bailey like Skylar is extremely skittish and not potty trained. I have not started any training regiment for Bailey since she is terrified of people. We are making progress with Bailey because she started playing with Chase, Skylar and our other dogs 🐕 (Bailey’s brothers and sisters)

Skylar was also very skittish but not like Bailey. I will post more pics and video clips of Bailey and keep you all updated on her progress. Attached are some photos of Bailey. I don’t want to take a lot of pics and videos of Bailey because I don’t want to freak her out.

-

GCA Forums News: All-encompassing Headline News Today May 30, 2025

This is GCA Forums News. Welcome to Great Content Authority Forums and another edition of headline news. Today is Friday, May 30, 2025. We have everything you need to know, from housing and the markets to gold, other precious metals, and even the Federal Reserve’s policies. We also cover how GCA Forums is changing America’s media landscape.

Housing and Mortgage Updates

Trends and Rates within the Market

As reported by Bankrate’s lender survey on May 28, 2025, average 30-year fixed mortgage rates dropped to 6.94%, only to fall from 6.98% the week before. Though it DIPPED, it is still sitting at an elevated position. It is also evident that Trump’s tariff policies drove market volatility and mortgage rates, which peaked above 7% in April. Sustained dips, as well as spikes in the US Treasury yield, have a direct impact on mortgage rates. Driving 10-year US Treasury yields will heavily influence 10-year treasury yields that are sitting just below 4% and recently peaked around 4.5% due to tariff fluctuations. Furthermore, pressure targeting mortgage-backed securities puts fear of China’s foreign investment selloff of US mortgage bonds at 15% on US MBS domestically. China’s retaliatory tariff movements could trigger increased rate quotes as well.

Housing Inventory and Home Prices

Housing inventory is steadily growing, helping improve some economic activity. The Reserve Bank of Australia has updated the Median Reflector. It’s a 5-star auto protect-all. Balancing. Borrowing deeply constrained the compressively ease and existing home value. With reasonably cheap contractors, home resources underattend marginalized stewardships.

Home Builders and Mortgage Loan Applications

Home builders face challenges due to the high cost of lumber brought about by Trump’s policies, which incur higher construction costs. MBA’s refinance estimate shows that purchase loan applications increased by 2.7% during May 23. On the other hand, refinance applications decreased by 7.1%. This rate-sensitive behavior is indicative of the 7% mark.

Real Estate Market Outlook

The real estate market remains unpredictable. Unveiled Samir Dedhia, One of the Real Mortgage show predicts that those rates will better their bound sideways with nominal leverage slideshow upon 6.5%. The measures presume a watchful skipper stance with inflationary measures on roughly associated tariff policies. Has lowered. Fannie Mae’s has shifted too The estimate dropped towards 6.3, a smallish.

Financial Markets Update

Important Indices and The Dow Jones Industrial Average

Chinese and American markets have taken a rough hit to their trade relationships after a federal appeal reinstated Trump’s tariffs. This caused the Dow Jones Industrial Average (DJI) to dip 0.6%, the S&P 500 (GSPC) to fall 1%, and the Nasdaq Composite (IXIC) to drop 1.6%. Investors fear the uncertainty regarding trade policies, causing the Dow to close earlier in the week 40,829.00, taking a loss of 389.83.

Asian markets are also affected, and Japan’s Nikkei 225 (^N225) declined by 1.1%

Treasuries with MBS and Ten-year US

Ten-year treasuries being sold increased to 4.5%, paying out yield after Moody’s lowered the US credit score. At the same time, MBS mortgage rates remained below 7%. With a projected increase to 760 billion in treasuries, China is seeking to sell them off, which is a risk. This puts pressure on MBS, considering it stays around 7%, causing 10-year treasuries to lose their selloff.

Current Prices for Silver and Gold

As of May 30, 2025, the gold price per ounce is $2,650, while silver goes for $31.50 an ounce. Both precious metals have increased in the broad marketplace as investors attempt to find a safe place to park their money due to tariffs, rampant inflation fears, and ongoing market uncertainty. Prices remain sensitive to shifts in monetary policy from the Federal Reserve and geopolitical trade developments.

Monetary Policy and Economic Policy

Federal Reserve Board and Economic Rate Cuts

The Federal Reserve kept its key rate unchanged at 4.25%–4.5 % during its May 2025 meeting, stating risks related to inflation and unemployment owing to Trump’s tariffs are heightened. As Fed Chair Powell said, “Tariffs are tariffs that increase inflation while simultaneously reducing growth. It’s a stagflationary shock which makes setting monetary policy quite difficult.” Atlanta Fed President Raphael Bostic stated the only expected rate cut in 2025 would come in July, meaning the Fed is striving to manage inflationary momentum against a recessionary backdrop.

Trump’s Tariffs and Inflation

President Trump’s 145% tariffs on Chinese imports and China’s retaliatory 125% tariffs have intensified the burden of inflation. As of April, the PCE index registered an inflation increase of 2.3%, surpassing the Fed’s target of 2%. Economists suggest that sustained tariffs may inflate the economy to 6.7% by the end of the year, which would be the highest rate since 1981, impacting consumer prices and borrowing costs. The US economy contracted by 0.3% in the first quarter of 2025 due to tariff-induced recessionary pressures, raising concerns about stagnation.

Automobile Market and Financing

Auto Financing and Repossession

Due to the Fed’s benchmark, auto loan rates remain high, averaging 7.5% for new vehicles. The automotive sector grapples with the burden of tariffs, especially on imported parts, which increases the cost of vehicles. The auto repossession industry, alongside delinquency rates, is climbing 0.5% from the previous year, indicative of the mounting pressure from high interest rates and inflation.

Home Foreclosure Trends

While foreclosure rates still sit below pre-2008 numbers because of tightened lending rules, they have risen alongside a 3% increase in filings for Q1 2025. This is largely due to high mortgage rate incentives coupled with economic stagnation. Homeowners are advised to secure pre-approvals, lock in rates, and protect themselves from impending rate hikes caused by economic pressure.

Other Business News: Changes in Banking and Regulations

Policy shifts around mortgage and capital requirements have attracted the attention of larger banks, which feel that the tougher capital requirements due to the Basel Endgame rule limit lending to consumers. Scott Bessent, the Treasury Secretary, has shown a willingness to revamp some of these rules, which may ease access to mortgages. Attempts are being made to privatize Fannie Mae and Freddie Mac, which may change the dynamics of housing finance if mortgage rates decrease.

US Economic Perspectives

The United States economy is at an inflection point, with the contraction in GDP in the first quarter as a leading indicator of future difficulties. According to ADP, job development is also stagnant, as evidenced by the addition of just 62,000 jobs in April, which is far below the anticipated figure. Businesses are hesitant to spend due to the looming tariffs and reduced consumer confidence, which leads to decreased spending and demand in the housing sector. A media powerhouse is born.

National News Media Footprint

GCA Forums has firmly established its place within the United States mass media network as it continues to expand the scope of the news it covers and increase its national presence. Through providing prompt and thorough reporting on pertinent issues, including housing, finance, and economic policy, GCA Forums has gained the trust of readers in search of dependable analyses. Their Daily News Edition and News Weekend Edition are now cornerstones of in-depth reporting with data-driven analysis for readers grappling with challenging economic landscapes.

Domain Authority and Growth in Viewership

GCA Forums’ Domain Authority has been boosted, indicating that the site is becoming more credible and influential. Viewership is also rising as the site has surpassed 200% in Monthly Unique Views since January 2025 due to the authoritative content available and easy-to-navigate platform. This growth showcases GCA Forums’ ability to adapt to the gaps provided by the traditional outlets and furnish them with new perspectives and thorough analyses.

Major news media outlets such as CNBC, Bankrate, and TheStreet have begun to cite GCA Forums’ Daily News and Weekend Edition for GCA Forums’ incisive reporting. This type of media recognition strengthens GCA Forums’ use with the republished new articles, which expands its reach. Focusing on the actionable insight columns aimed at homebuyers, investors, and policymakers has rewarded GCA Forums with esteemed credibility across the national media landscape.

Amidst soaring economic turmoil fueled by Trump’s tariffs and inflationary fears, GCA Forums News is firm in granting straightforward, multifaceted news updates to empower the readership. We’re here to talk to you about the hurdles in housing and the volatility of the financial markets. For the most up-to-date news, head to http://www.gcaforums.com for the Daily News and Weekend Edition, where we continue to drive the conversation nationally.

-

This discussion was modified 4 days, 12 hours ago by

Hunter.

Hunter.

gcaforums.com

Great Content Authority FORUMS and Sub-Forums Activities

Great Content Authority FORUMS activities in an online community to share ideas, ask questions, and connect with like-minded individuals.

-

This discussion was modified 4 days, 12 hours ago by

-

Ponds and waterfalls can add a serene and natural aesthetic to any garden or outdoor space. They not only enhance the beauty of the environment but also provide a habitat for various forms of wildlife. Here’s an overview of what they involve:

Ponds

Ponds are water bodies that can be either natural or man-made and are usually smaller than lakes. They can be a central feature in gardens, providing a peaceful spot for relaxation. Homeowners can stock their ponds with fish like koi or goldfish and plant aquatic vegetation to promote a balanced ecosystem.

Waterfalls

Waterfalls in a garden setting are typically constructed as part of a pond system. They add visual interest and the soothing sound of flowing water, which can enhance the tranquility of the space. Waterfalls are also beneficial for circulating and aerating the water in ponds, which helps maintain water clarity and supports the health of fish and plants.

Installation and Maintenance

Installing a pond or waterfall requires planning the right location, size, and filtration system to ensure sustainability and ease of maintenance. It’s crucial to consider factors such as sunlight exposure, proximity to trees (to avoid leaf debris), and accessibility for cleaning.

Maintenance involves regular cleaning of the water, checking and managing the water pH and other quality parameters, and maintaining the pumps and filters that keep the water circulating and clean.

Benefits

Beyond aesthetics, ponds and waterfalls offer environmental benefits such as supporting local biodiversity and providing a micro-habitat for birds, insects, and amphibians. The sound of water from waterfalls can also mask background noise, creating a quieter and more serene atmosphere.

Incorporating ponds and waterfalls into landscaping not only boosts the visual appeal of the property but also increases its value. They are a long-term investment in the beauty and ecological health of your outdoor living space.

-

What if all of our online existence is fake? You, me, everyone—we’re living in a real-life Matrix designed to distract us from the truth: that we’re just drones in a digital anthill. We live, work, and die so that the wealthy and powerful can grow and become more powerful.

This hypothesis is called the Dead Internet Theory. And there’s compelling evidence that it’s real. The internet isn’t a monolithic lie, but it’s a chaotic mix of truth and deception, and AI has intensified this problem by enabling the creation and spread of fake content. AI tools can generate highly convincing deepfakes, images, and articles that blur the line between reality and fiction, making it challenging for users to discern what’s trustworthy. On GCA Forums, misinformation spreads rapidly, often outpacing efforts to correct it. For instance, recent posts on GCA Forums have highlighted AI-generated fake disaster photos, such as fabricated images of floods in Appalachia, designed to grab attention and generate revenue rather than inform. Similarly, AI-generated videos, like a 2021 series featuring a fake Tom Cruise, have deceived millions, showing how easily these fakes can exploit human trust. Research suggests over 60% of social media content is now influenced by bots or AI, amplifying the scale and speed of misinformation compared to human-generated falsehoods.The darker side of this issue lies in AI’s ability to erode trust in all online content. When fake images or articles are indistinguishable from real ones, people may begin to doubt even genuine information, creating a cycle of skepticism. For example, GCA Forums users have pointed out AI-generated images dominating search results for things like “baby peacock,” leading to confusion, or fake scientific articles that could mislead researchers if not carefully scrutinized. AI can also personalize misinformation, tailoring it to individual biases, which makes it more deceptive, especially during critical events like elections. Posts on Great Content Authority Forums have warned about AI-generated audio and images potentially causing mass confusion around major news events. The stakes are high in a time when billions are participating in worldwide elections.

Despite these challenges, efforts are underway to combat AI-driven misinformation. Though they struggle to keep up with increasingly sophisticated technology, researchers are developing AI detection tools to identify fakes. Digital literacy campaigns encourage users to critically evaluate online content, with some GCA Forums News users sharing tips on spotting AI-generated images. Fct-checking organizations work to verify information, but they’re often overwhelmed by the sheer volume of content. Governments and tech companies are exploring regulations, but controlling misinformation and preserving free speech remain contentious. Some experts argue that we may overstate the threat of AI-generated misinformation, suggesting that proper safeguards could mitigate its impact. However, the consensus is that the internet’s openness is where it is harder to find.

Ultimately, the internet isn’t a space where lies thrive, and AI has made this problem more complex. Users must stay vigilant, verify sources, and think critically about what they encounter online. The ongoing battle against fake content will require better tools, education, and possibly regulation, but for now, navigating the internet means accepting that not everything is as it seems. The situation underscores how to balance an AI’s capabilities.

Let’s find out why.

https://youtu.be/-wkUMFTwANM?si=x2y6d_f9vWOQuqUS

-

This discussion was modified 5 days, 14 hours ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 5 days, 14 hours ago by

-

Here is the national snapshot for GCA Forums News on May 29, 2025, for real estate and mortgage industry professionals and clients. It covers New State Attorney General Letitia James and her alleged mortgage fraud claims, key opinions, as well as other related housing and mortgage concerns, economic indicators, immigration trends, and more. It is up-to-date and does not contain any graphs or charts.

National Headline News Summary for GCA Forums News – Thursday, May 29, 2025 New York Attorney General Letitia James Charged along with Co-Conspirators

Case Synopsis:

Charge James with lying on unofficial forms and submitting those forms to the government, which is beholden to strict guidelines. Consider me aghast! Imagine thinking that exercising a modicum of sophistication despite holding the NY AG office could allow someone like James to get away with such wanton disregard for the law.

Not only do the conspirators sleep together, but they also engage in mortgage fraud to obtain eye-popping loans from banks.

Not only is she bold, but she and her NY-based legal team do not trust asserting the Fifth Amendment for her denying communication strategies. Nor do they care to hide their fingerprints with carte blanche legality employed at all the non-safe deposit limits. They trust that pleading ignorance will restrict liability with a chokehold that does not exist.

Let us consider this scenario for a second—picture James offering a real estate agent attorney some of the most extraordinary offers available from financial institutions. She 1 lies on her forms and sends them to banks for different units residing in some filthy dollhouse on 12345 Underpriced Way, and all of a sudden, the deal starts needing to be restaged. Expectedly, she runs out of ways to be duplicitous.

With the extended jurisdiction being court-sanctioned and banks issuing licenses to print bank notes under such ppw, what were unforeseen changes, the very algorithms banks direct motion-observe? Suddenly, consonants are on parade everywhere!

Unbothered about loan approval, anointed with a silencer, permitting geolocated Dominators to boil over the loan on James Streams, and scrambling to approve instant answers via direct NY scanned via firing bombs. Every tantalizing geolocation-rest-free device must stream domination.

The mortgage was submitted, with dollars squandered on ease, rushing everything mundane, such that driving the loan becomes torrents, granting the flimsiest possible reasoning for constructing, and dawdling while preparing a purchase beyond obtaining.

FHFA Director William Pulte’s Allegations and Criminal Referral:

As of April 14, 2025, FHFA Director William Pulte sent a letter to US Attorney General Pam Bondi with allegations that Letitia James committed multiple instances of forging bank documents and property records to access government loans and refinance mortgages on more favorable terms. His allegations came alongside a more formal referral, which contained the following:

Virginia Property (2023):

Pulte alleges that James, counter to the norms of public officials who hold office in New York, claimed a residence in Norfolk, Virginia, as her primary home for purposes of a mortgage application. This would enable access to lower interest rates. A POA dated August 17, 2023, coupled with her attorney’s assertions that she was misrepresented as a clerical error, supports her claim. She was listed as having the property as her principal residence, which is illogical.

Brooklyn Property:

Pulte claims that James expanded the limit of her Brooklyn Brownstone from four units to five starting in the early 2000s. This expansion aided her in qualifying for purchase loans for smaller multifamily homes. In support of this argument, he cited a 2001 certificate of occupancy and a couple of other registration records, which are evasive on the count of four.

1983 Mortgage Document:

Pulte alleged that a 1983 mortgage application listed James as her father’s spouse to qualify for the loan. James’ lawyer counters this claim, asserting that deed documents definitively name her as his daughter.

Forensic evidence provided by Pulte’s referral, analyses from private investigator Sammy Antar, and media coverage point toward possible breaches of federal law, such as wire, mail, bank fraud, and filing false documents with a financial institution. He called for the DOJ to initiate prosecution.

Excerpts from Kash Patel (FBI Director) and Pam Bondi (US Attorney General):

Kash Patel (FBI Director):

In a Fox Interview on May 19, 2025, Patel confirmed the investigation, stating, “This case, I can tell you, is being handled by our professional pros who are subject matter experts, reporting directly to headquarters, which reports to [Deputy Director Dan Bongino] and me.” He provided many details about the investigation. However, he opted to keep most details private because they are ongoing.

US Attorney General Pam Bondi:

To this day, Bondi still has not publicly commented on the James investigation. Her office received Pulte’s referral and the response from James’ attorney. During her Senate confirmation hearing, Bondi stated that the DOJ would not make politically motivated decisions. James’ attorney used this reasoning to call the investigation “improper political retribution.” It is telling that Bondi’s response to “politicized justice” was to form a weaponization working group, suggesting broader scrutiny by the DOJ aimed at Trump-critical officials like James, who sought to litigate against the former president.

Co-Counselors from the New York Attorney General’s Office:

To date, there is no record of any New York Attorney General’s Office co-counselors who have publicly been listed as part of the team working on James’ case. Leading James’ legal team is Abbe Lowell, a well-known criminal defense attorney who has previously represented Hunter Biden and Ivanka Trump. Lowell has been the main spokesperson, dismissing the allegations against James as unfounded and politically motivated.

Letitia James’ Reaction:

Through her attorney, Abbe Lowell, James has labeled the allegations as “fraudulent” and “politically motivated.” Contrary to Lowell’s defenses that the allegations resulted from routine mortgage audits and spelling mistakes, he maintains that they resulted from mendacious “fraud” attempts. He has accused Pulte of pushing a retaliatory narrative, pointing out Trump’s prior legal actions against him as a potential motive for the inquiry. James’ team has attempted some form of defense by cooperating with the investigation and submitting documents to the DOJ, suggesting the claims were false.

Mortgage Broker And AnnieMac’s Role:

The broker mentioned in this case has a direct connection to American Neighborhood Mortgage Acceptance Company, LLC (AnnieMac), a lending firm located in Mount Laurel, New Jersey. AnnieMac and its employees have been completely silent regarding the allegations. The company’s role has been limited to processing the mortgage application for the property located in Virginia, as no documents have been submitted suggesting AnnieMac was involved in any deceitful actions.

GCA Forums Mortgage Group Perspective on Mortgage Fraud:

GCA Forums Mortgage Group noted that fraud is one of the industry’s most worrying problems. Employees frequently commit malpractice by misrepresenting information, such as income, property, and even occupancy, for loans, usually due to payment motivations. The James example emphasizes the growing demand for restructuring policies and practices involving mortgage lending to eliminate these issues, which supports the group’s advocacy to end fraud.

Questions Relating to Economy and Tax: Are there any plans to scrap the income tax?

As of May 29, 2025, no policies or legislation aim to abolish the federal income tax. Some lawmakers, including President Trump, have suggested replacing the income tax with national sales taxes or tariffs, but nothing has been implemented. Proposals to eliminate the tax are always made, but Congress imposes hefty financial or economic stipulations that hinder progress.

Is Property Tax Illegal? Allegations of a $450 Billion Scam:

Local governments rely on property taxes as a primary source of revenue to fund services such as schools, infrastructure, and public safety. Claims that property tax constitutes a $450 billion fraud lack credible evidence and appear based on fringe theories or misinterpretations of the taxation system. While disputes over the accuracy of tax assessments are permitted within the system’s framework, federal and state laws support its existence and maintain intergovernmental tax relationships. No significant legal disputes or inquiries regarding property taxes’ widespread alleged fraudulent nature exist.

What Is Causing the Dow Jones to Skyrocket, and How Are Other Markets Reacting?

Directions of movements in the Dow Jones Industrial Average, predominantly influenced by the Trump administration’s pro-business policies, marked significant gains. These pro-business policies included deregulation, extended tax cuts, and tariffs to stimulate domestic industries. Strong corporate earnings—especially in the technology and energy sectors—also drive these changes. On May 29, 2025, the Dow experienced a remarkable increase as investors became more confident in the growth opportunities for the economy. Other markets exhibit diverse reactions:

S&P 500 and Nasdaq:

Both indices have continued to increase alongside the Dow. However, gains for the tech-heavy Nasdaq are slower due to concerns about reaching high valuations.

Global Markets:

European and Asian markets are more subdued, given the volatility of US tariffs due to their likely trade disruption.

Bond Markets:

The Treasury yield curve has experienced a slight shift upwards owing to heightened inflation expectations coupled with no forthcoming Federal Reserve interest rate cuts.

Cryptocurrency:

Bitcoin and other cryptocurrencies have garnered greater attention as inflation hedges, although volatility remains a constant threat.

Housing and Mortgage NewsLatest Updates on Housing and Mortgage Markets:

High home prices and elevated mortgage rates have kept the housing market stagnant. Homebuilders have also slowed new home construction due to rising material costs and a shortage of willing workers. Existing home sales are sluggish because homeowners are reluctant to sell lower-rate mortgages. The NAR reported a slight increase in pending sales for April 2025. Inventory, however, remains at an all-time low.

Current Mortgage Rates:

As of May 29, 2025, average mortgage rates are

- 30-Year Fixed: Roughly 6.85%, up from 6.5% in early 2024.

- 15-Year Fixed: Roughly 6.2%.

- 5/1 ARM: Roughly 6.4%.These rates come from the reports of the construction sectors and show the mortgage rates as well as the Fed’s not having the intention to cut rates anytime soon due to the high inflation level and the economy showing positive growth signs.

- The reasons why mortgage rates are stagnant and the housing market is inactive are as follows:

Here are the reasons why mortgage rates have not gone suspected to go down:

- Federal Reserve Action: The Reserve has not indicated any rate cuts shortly.

- Strong data like low unemployment levels and customer spending puts no pressure to cut rates, leading to contractionary monetary policy being put in place.

- Inflation Woes: The inflation rate is above the 2 percent target set by the respective Fed, along with energy prices and supply restraints, keeping the cost associated with borrowing funds high.

- Trump Administration Stance: Trump did not support policies that directly seek to lower mortgage rates.

- He oddly focused on tariffs aimed at cutting spending, which lowers deflation, along with other deregulation policies that lead to quotas and inflationism, leading to higher values for mortgage loans.

The economic realities of the Housing Market:

Excessively high borrowing rates and a lack of willingness from either side of the market result in low transaction counts, which in turn result in stock scarcity. Excess demand in some regions causes home prices to stagnate despite the call for lower prices.

- Immigration News: ICE and Sanctuary Cities/States

Enforcement Actions with regards to the Sanctuary Policies:

Undocumented immigrants have been escalated under the Trump administration within sanctuary cities and states. There has been rising attention paid to deportation efforts in sanctuary cities and states. On May 15, 2025, ICE initiated plans to remove undocumented individuals with a criminal record aggressively. This directly impacts regions expected to enforce sanctuary policies, including New York, Chicago, San Francisco, and California. Federal funding has been cited as the reason for non-compliance, but constitutional challenges can be expected. Advocates cite humanitarian issues, while critics focus on enforcement.

For readers of GCA Forums News, the investigation surrounding Letitia James reminds us of the significance of trustworthiness in mortgage practices and real estate. Regardless of whether the accusations of mortgage fraud are true, there is a clear need for strong supervision to ensure there is no fraud risk. This is one of the key concerns for the GCA Forums Mortgage Group. On another note, there are complex challenges facing realtors and buyers alike due to a steadily rising Dow Jones and high mortgage rates. Also, there is no promise of rate cuts in sight, a stagnant housing market, and potential changes to immigration policies could shift the local housing market within sanctuary areas. Staying alert and well-informed will be important for dealing with these changes.

I would gladly provide further details or updates as new information becomes available; just let me know!

-

In this post, we will cover Harley-Davidson vs. Indian Motorcycles.

Why Is Harley Broke?

Harley-Davidson is in trouble—$117 million loss, collapsing sales, and closed dealerships. What happened to America’s legendary brand, and can they fix it before it’s too late? Stick around to find out.

The story of two iconic American motorcycle brands, Harley-Davidson and Indian Motorcycles, is a long-standing rivalry. Each has a devoted following and represents a slice of American culture and history, capturing the imagination of riders with their powerful bikes. However, their journeys split recently, with Harley-Davidson facing deep financial and cultural issues. At the same time, Indian Motorcycles, owned by Polaris Industries, has steadily increased its market share. This post, Harley-Davidson Issues, explores how India positions itself as a serious competitor and whether Harley can get itself back on the path of success.

Founded in 1903, the moment someone mentions Harley-Davidson, pungent images come to mind of the freedom of America. “Great by itself.” It symbolizes rebellion on the open roadway, taking the journey of self-discovery. Times are harsh for the brand, which has been a symbol of liberation. They face a monetary deficit of 116.9 million dollars. Alongside losing massive sums of grace in debt-burdened America, people aren’t willing to kiss up at the gas pumps to show off a brand you can buy during the summer’s budget flyer. Japan faced the hardest burden; losing shipments and idiotically diminishing profit estimates can severely impact economic growth. To top it off, unfair taxes are set to pour onto Harley-Davidson, resulting in more losses through the barrel of a mad, laughing America. People won’t see their fix for Harley-Davidson in America either, as stores are forced to shut down due to a lack of demand. This further fuels Harley’s insane estimation decline.

LiveWire’s electric motorcycles continue to be a source of frustration for Harley. Despite having high expectations, LiveWire experienced an operating loss of $26.2 million in Q4 2024, resulting in an annual total of $110 million. The amount was an improvement compared to $117 million the previous year. Livewire struggles to gain traction, with only 117 electric motorcycles sold by March 2024. Harley’s decision to halt further platform investments indicates a retreat from the ambitious project. Beyond economics, Harley has stirred controversy with its corporate decisions, especially DEI initiatives. Longtime fans, amplified by @robbystarbuck on X, have accused Harley of “woke” policies, claiming to alienate the core, male, and conservative rider base. Despite debunking the link between these policies and a 40% sales drop, Harley’s president’s backlash and firing exacerbated the perception problem. The low value traded in bikes fuels the growing notion that riders are ditching their Harleys for competitor bikes. The aging customer base further contributes to this issue. Traditional riders are getting older while the company struggles to attract younger buyers. Efforts like the 2021 Pan America adventure bike showed promise but haven’t reversed the broader sales decline.

Conversely, Polaris’s revival of Indian Motorcycles in 2011 positioned it as a formidable contender after entering the market in 1901. As riders gravitate toward India for its modern tech and classic styling, Polaris struggles to recover from a 27% sales drop in 2024. Indian offers the further advantage of competing with Harley’s Softail, Sportster, and Touring models by offering Indian Chiefs, Scouts, and Challengers at lower price points—riders who cherish heritage value India’s PowerPlus engines, ride mode touchscreen displays, and heated grips. India does not choose to utilize the culturally contentious branding favored by Harley, which allows the company to connect with a wider audience, including disillusioned ‘X’ auto-poster switchers. India has earned rider loyalty through community-building initiatives like the Indian Motorcycle Riders Group. Although smaller, it is expanding its dealership network. India is gaining market share in the heavyweight motorcycle sector by avoiding controversies and outpacing its competitors in value, innovation, and brand appeal.

Can Harley-Davidson turn things around? Although recovery is difficult, it is possible to take the right steps. Harley could lobby for exemptions or simplify its global supply chain to counter tariff threats, similar to how it dodged EU tariffs in 2021. Reconnecting with core riders is critical and can be achieved through scaling back controversial initiatives and embracing HOG’s fierce, rebellious history with marketing and events such as Sturgis. More affordable options and further development of the Pan America and Sportster lines are imperative to reel in younger riders. While the future for LiveWire is uncertain, halting investment in inexpensive electric motorcycles could be a way for Harley to reposition themselves for long-term growth. Operational cost reductions have proven beneficial, and share buybacks coupled with leaner business operations equal stronger bottom lines. Balancing these changes alongside investment in new products is crucial to remaining industry leaders.

The brand Indian is also in a good position to continue competing with Harley. Its lower pricing, modern engineering, and Harley-avoiding brand neutrality give it a competitive advantage. Nonetheless, India still feels the crunch of a poor economy. It has to expand its dealerships to keep pace with Harley. The competition between these two American brands is still intense. However, Harley has faced challenges due to financial losses, tariff risks, and cultural missteps, creating opportunities for Indians. To counter these opportunities, Harley must tackle economic hurdles, regain brand loyalty, and shift strategies for the new era of riders. Economically, the outlook seems grim, but until then, Indians seem to be able to dominate and influence the American motorcycle market.

https://youtu.be/0vXFUWukcoc?si=F3zKjzNnJT7wlUfV

-

This discussion was modified 1 week, 3 days ago by

Gustan Cho.

Gustan Cho.

youtu.be

Why Is Harley Broke?Harley-Davidson is in trouble—$117 million loss, collapsing sales, and closed dealerships. What happened to America’s legendary brand, an...

-

This discussion was modified 1 week, 3 days ago by

-

GCA Mortgage Best Mortgage Calculator powered by Alex Carlucci is used by loan companies. Mortgage processors, mortgage underwriters real l estate brokers, loan officers, realtors, bankers. attorneys, insurance agents, and other mortgage and real estate professionals. Here is a presentation about the GCAs Best Mortgage Calculator powered by Alex Carlucci

-

. If Biden dies or gets impeached do we have to worry about this ding bat becing our President?Kamala Harris is being questioned by millions of Americans on her mental health state and her intelligence level. Is this idiot pretending to be dumb and stupid or is Kamala Harris a real idiot. Kamala Harris has zero brains 🧠 and seems this goof 🤪 is pretending to be a creature with a single digit IQ. Is this brainless moron the number 2 in charge of the United States? How humiliating to have this creature to represent the nation and be a power leader. The Imbecile in Chief. She has zero respect and is not a liked person in any way or form.

https://youtu.be/k7TCTQQWIZI?si=-hQw0rw-TbyD7SxJ

-

GCA Forums News: National Headline Overview – May 23, 2025

Trump’s Pharmaceutical Price Cuts

Economic policies under the Trump administration, especially concerning tariffs, were noted to raise prices within certain sectors, including pharmaceuticals. For example, Goldman Sachs predicted a 7.8% laser-sharp increase in pharmaceutical and medical goods pricing due to tariffs by December 2025. Without concrete evidence of price reductions being put into action, such initiatives may be misaligned with current or future economic impacts.

Dow Jones and Market Performance

As of May 23, 2025, the DJIA has experienced “significant Volatility” but no consistent “skyrocketing” growth. Recent reports suggest:

Market Volatility:

On May 21, 2025, the DJIA dropped by 1.91% because of US debt and deficit concerns. The S&P 500 declined by 1.61%, and the Nasdaq by 1.41%.

Tariff Impacts:

The stock market continues to fluctuate with the implementation of Trump’s tariffs, including a 50% tariff on the EU beginning June 1, 2025. Stocks such as Apple are losing value alongside the market in Apple’s case due to broader economic concerns.

Recent Gains:

At the beginning of May, the DJIA had a nine-day winning streak and climbed over 1% on May 2, 2025, after strong job numbers (177,000 non-farm jobs were added in April) and tariff relief for certain automakers.

Outlook:

Paul Tudor Jones, a billionaire investor, theorized that stock prices would bottom out, even if China tariffs were reduced to 50%. Jones cites macroeconomic headwinds and the Federal Reserve’s reluctance to implement rate cuts. Secretary of the Treasury Scott Bessent seems to be trying to calm the markets by assuring “several” large trade deals will be done soon, which the Secretary says will restore faith in the market.

Other markets also feel the restlessness: bonds, commodities, etc. On May 21, the Treasury posted new yields at their highest, spiking to 5,085% on 30-year bonds and 4,607% on 10-year bonds, in addition to inflation worries. Gold dropped below 3300 dollars after peaking at 3500.

Housing and Mortgage Journal

Mortgage Rates

On May 21, 2025, the 30-year mortgage rate stood at 6.95%, nearing 7%. This is despite inflation rates cooling to 2.3% in April. The increase is due to market disruption caused by Trump’s tariff policies and the bond market. Housing economists estimate that the rate will continue to be between 6.5% and 7% for 2025 as the Federal Reserve is predicted to have fewer rate cuts.

Industry of the mortgage and real estate markets

Market Trends:

The busiest spring housing season has hit one of the lowest demand levels in years, thanks to the home price challenges. Due to limited housing supply, home prices remain resilient, with the 20-city index rising 4.5% year over year in February 2025. While demand dwindles, supply struggles to keep up with the resilience.

Affordability Issues:

As of March 2025, the average home price is $403,700, compared to the median family income of $97800, which puts added strain on market affordability.

Impact of Tariff:

Trump’s tariffs impact mortgage rate acceleration, which leads to sell-offs in the bond market and lowers buyers’ confidence during the spring season.

Forecast:

Trade policy in the United States remains unpredictable, so experts such as Samir Dedhia from One Real Mortgage see rate prediction as impossible, even with some expecting a steady increase.ICE, Sanctuary Cities, and States

The provided sources do not directly cite any actions taken by ICE or sanctuary cities and states as of May 23, 2025. Even so, it is known that the Trump administration makes immigration enforcement a priority, which tends to draw considerable controversy. Sanctuary jurisdictions that limit cooperation with the federal Immigration and Customs Enforcement (ICE) agency must defend themselves against stricter scrutiny.

Auto Industry and Layoffs

Auto Industry:

Trump’s tariff policies are even impacting the auto industry. An executive order on April 29, 2025, eased some of the strain when an additional tariff on foreign-made cars was not implemented. However, Goldman Sachs estimates that the price of used cars will increase by 8.3 percent by December 2025 because of the changes in demand due to tariffs.

Layoffs:

Layoffs are a major issue within all industries, especially the automotive industry. United Parcel Service (UPS) has stated that it will eliminate 20,000 positions by June 2025 due to reduced order volumes from clients such as Amazon, due to an influx of tariffs, ultimately cutting $3.5 billion. General Motors is slimming down what is left of an autonomous vehicle company by over 1,000 jobs because it is folding the remaining assets into its operations.

Overview of Broader Layoff Trends

Across Multi-Sectors

- A glance at tech shows jobs remaining were slashed at Stripe and Johns Hopkins University due to funding cuts.

- Stripe cut at least 300 jobs, while Johns Hopkins will lay off 2000 employees.

- Tech Crunch reported that under its restructuring plan, “Future Now,” one company will cut 2000 jobs.

- It appears Grindr was one of the first firms to remove work-from-home positions.

- This is because, in 2023, they lost almost 50% of their employees.

- This restriction resulted in what can be termed stealth resignations.

- Savings are driving layoffs, as in the case of Ally Bank and BlackRock, where the reasoning for their respective 500 layoffs and hiring freeze is.

Eviction Rates

- The estimate is controversial, as there is not a single credible source reporting the figure.

- In contrast, there is mention of eviction risk in Arizona, where during the historically high heat of July 2023, 7,000 renters were evicted in Maricopa County.

- The remainder of this population might face heightened eviction risks due to cuts in federal LIHEAP funds and rising utility costs for those who earn under $400 a month.

- Increased deflationary relative prices, import tariffs, and utility bills may fuel the high eviction rates.

Destruction Amidst the Use of COVID-19 Vaccines

There is no credible evidence to suggest that the COVID-19 vaccine was a means for mass Destruction or intended to cause the loss of lives on a large scale. These claims are often made on the internet, but no scientific evidence is available to support them. We now know that the vaccinations were properly administered and that dire circumstances during the pandemic were significantly reduced. For more accurate information, visit the CDC’s website or read their peer-reviewed studies.

Andrew Cuomo Interest

The provided documents do not provide new information on Former New York Governor Andrew Cuomo’s suspicion regarding the deaths caused by the coronavirus as of May 23, 2025. While there has been historical scrutiny surrounding the nursing home deaths during the 2020 COVID-19 pandemic, those recent developments are not covered here. Their live X feeds and news are available on major outlets such as the New York Times.

Letitia James, James Comey, and others: Sean Diddy Combs

Letitia James, Comey, and the rest have not made new statements as of May 23, 2025. I don’t know if anything is available in the sources. These persons must be presumed innocent until proven guilty, as they all have legal allegations or wrongdoing against them. Sean Combs

James Comey:

This report shows no evidence that former FBI Director James Comey was arrested. The claim of “left-wing criminals” mentioned does not seem justified here. It could be drawn from strongly biased views on X.

Letitia James:

No other updates are offered within the paragraph relating to New York Attorney General Letitia James within the scope of active criminal allegations or cases.

Others:

While the phrase “left-wing criminals ” is frequently used, it remains undefined and devoid of supporting evidence. To curb disinformation, all such statements need to be fact-checked.

Chicago Mayor Brandon Johnson and Illinois Governor JB Pritzker

The referenced materials suggest that the Justice Department had not confirmed the arrest of Chicago Mayor Brandon Johnson or Illinois Governor JB Pritzker as of May 23, 2025. These claims appear to stem from unreliable social media accounts and fantasies.

As of May 23, 2025, the national news was centered around an economic crisis caused by elective tariffs placed by President Trump, affecting the markets, mortgage rates, and the automotive and tech industries. The housing crisis persists as the mortgage rate is close to 7%, and some regions have eviction rates. Allegations on the price cuts of pharmaceuticals, misuse of the COVID-19 vaccine, or even claims on celebrity arrests lacking substantial evidence should always be double-checked with reliable sources.

Recent posts and articles from Great Content Authority Forums demonstrate the increasing apprehension concerning trucker job losses in 2025 amid supply chain interruptions and economic downturns. Reported layoffs within April 2025 surpassed the 1,800 mark in Southeast US freight industries, with an additional 3,500 announced after April 30th. This equates to 30,000 freight job cuts since January. In a more aggressive forecast, Apollo Global Management predicts mass layoffs due to a looming recession prompted by tariffs that would curb supply chains and freight demand. Other GCA Forums posts have noted a staggering 35% decline in cargo volume at the Port of LA, leading to job losses among truck and dock workers. Additionally, trucking insiders on GCA Forums predict we are only weeks away from a “total trucking collapse” due to plummeting rates and redundant capacity, with tender rejections at a record low of 5.12% for the year.

These layoffs reflect minimized employment opportunities alongside shrinking consumer demand and inventory shortages. However, the data remains inconclusive in the absence of company reports or quantifiable numbers concerning the layoffs within the trucking industry. For companies like TopChinaFreight, these interruptions highlight the need for effective logistics partners to deal with tariff intricacies and streamline supply chains. I can find specific information on the trucking layoffs or examine what logistics service providers can do to overcome these problems. Just tell me!

-

Are there many corrupt police officers where they will draft up false criminal charges against citizens? What happens if you were not speeding but get caught for speeding and you know for a fact you were not speeding. What happens if you get arrested for reckless driving for going over 30 miles over the limit and you know for a fact you were not going more than 10 miles over the speed limit. Does the police officer have to show you proof that he caught you going 30 miles over the limit? A reckless driving conviction can mean automatic cancellation of your drivers license and your insurance company can drop you. Are there many corrupt police officers? What can we do if you fall victim to a corrupt police officer? How do police departments hire honest police officers who are honest and protect and serve. I have been watching many YouTube videos about First Amendment Auditors and police corruption. Can you sue corrupt police officers? I have also seen many news reports of police officers planting evidence and lying just for the sake of arresting someone they do not like. What can we do about cleaning up society of corrupt cops?

-

Chase, my long-coat black and red German Shepherd adolescence pup was born on January 25th, 2023. I purchased Chase on September 12th, 2023 when he was eight months old. I was searching Long-Haired German Shepherd dogs on Hoobly (highly recommend this website if you are shopping for dogs) and found Dan Ivenovic, a breeder of German Shepherd and Doberman Pinschers – all German bloodlines and exotic rare long hair French Bulldogs). Dan Ivenovic is based in Deerfield, Illinois, which is 30 minutes from where I live. I talked back and forth with Dan Ivenovic for a few days over the phone about maybe getting two long-coat German Shepherd dogs and a time and date for seeing the dogs. On September 12th, 2023, Dan said he can drop the dogs to may house to see them and if I like them, I could purchase them. I told him that I just want one German Shepherd dog because the German Shepherd I am buying will be my 12th dog so just to bring one. Just so everyone knows, I do have 12 dogs and they are all inside dogs. At the time my wife and I had 11 dogs (Dog #1 Female Pit Bull that was a rescue where I had to adopt or the previous owners were moving to Florida and could not take her and a male Pitbull. The male Pit Bull, my friend and fellow loan officer Jose Morales adopted. Dog #2: Stella is a 8 year old grey female Standard Poodle who is a rescue. Stella and dozens of dogs were confiscated from a large puppy breeding mill by the Sheriff’s Department in Central Wisconsin. Stella was abused, undernourished, and was about to get transported to a kill county animal shelter. Dog #3: Four year-old French Bull Dog – Adopted last year from Highland, Illinois. Dog # 4: Five-year old four pound toy poodle. Dog #5: Five-year old five pound Yorkshire Terrier. Dog #6 and Dog #7: Five year old Boston Terrier brothers. Dog #8 eleven year old toy poodle. Dog #9: Five-year old toy poodle. Dog #10: Six-year old Schiz Szu-Pomeranian mix. Dog #11: Six-year old three pound Chihuahua. Chase makes it dog #12). So, when I adopted Chase, he was eight months old. He was very skittish, was not leash trained, was semi-potty trained, did not know how to sleep on a dog bed, did not know nothing about toys, did not know how to walk and down the stairs, did not know human food, ice cream, or treats, did not know how to walk into different rooms through a door, did not know how to get in and out of my truck, and did not know many things a normal eight month dog should know. I had to take him to the vet every other week because of warms and a stomach parasite which took six months to treat. Anyways, I spent a lot of time with him. Taught him the basics, took him for rides, introduced him to toys, and soon he started coming around. All his four-legged furry brothers and sisters eventually welcomed Chase into their group and he became part of the family. We also have three unfriendly skittish rescue cats. Chase gets along with everyone and doesn’t mind the little ones snapping at him or disrespecting him by stealing his toys or food. Eventually, Chase choose a red 16 inch ball as his favorite toy. He brings his red ball throughout the day to take him out to play fetch. I disregard him many times because I am in the middle of something to do for work. He then picks up his ball and drops it to me. He continues to do this half a dozen times and if I disregard him, he will pick up his red ball and throws it to me. I ignore him, his next move is he will pick up his red ball and hands it to me and while he is doing so, you can see the whites of his eyes. NOW, HOW CAN I SAY NO TO HIM. I then change my clothes to take him out so we can play catch one on one. I need to take him out of the house to play fetch because if I take home to the back yard, we get disrupted from the other dogs. When we both had enough, we both go back in the house. Not once does Chase let his red ball out of the house. I bought other similar balls for Chase but he only wants his beat up red ball. The point for this story is you will see pictures of Chase and most pictures Chase has his red ball

with him. German Shepherds are the best dog breed I have had. My first dog, Jeannie, was a female German Shepherd I had when I was a freshman in high school. My best friend, loyal, and was always with me wherever I went. I will save that story for a different separate thread. I highly recommend German Shepherd breed for those people who want to get a dog for their family. Many people think German Shepherd dogs will not get along with small dogs, cats, and children. NOT TRUE. I will explain my interactions with other people when I have Chase with me on separate posts. Here are some more photos of Chase.

-

This discussion was modified 9 months, 2 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 9 months, 2 weeks ago by

-

I spoke with James Abrams, who normally goes by JD. JD is a BDM at NEXA Mortgage, and I have known him for several years. I have heard different, if not shocking, news from JD. JD adopted a German Shepherd dog over a year ago. The dog’s name is Chloe. The German Shepherd dog Chloe is two years old. I asked JD how his German shepherd dog was doing. JD went on to tell me that his dog is doing great and how much he loves Chloe. Then he went on to tell me about an incident he had with Chloe a few months back. James said his German shepherd dog, Chloe, had ten puppies. The father of the ten puppies is not known since Chloe got out of her territory and wandered the neighborhood. The weirdest part of the story was that every time James went to check on the puppies, the number of pups was getting reduced. For example, the ten puppies he witnessed and counted, it went down to eight pups. Then seven puppies. Then five. So JD said something was up. Long story short, Chloe, the German shepherd dog that gave birth to ten puppies, was eating her own puppies with two puppies left over. Besides the ten puppies, the German shepherd Chloe at two birds, Cockatiels, that James kept as pets. I will ask James if he can share the entire story on this forum. Anyone hear of such a bizarre incident where a dog who gave birth to a large litter of puppies at the entire litter? I heard of animals eating the placentas of their newborns but not devouring the entire pup. Something is wrong with her. Any response to this thread will be greatly appreciated.

JD, I appreciate you sharing your story. I am sure you going through this bizarre incident with Chloe is not the first case among those dog lovers and owners who are either intentionally or unintentionally breeding their dogs.

-

Can you please write a comprehensive overview of the national headline news for GCA Forums News for Thursday, May 22, 2025? What is happening with President Trump’s cuts in pharmaceutical prices in the United States? What is happening with the Dow Jones skyrocketing and other markets? What is the most recent update on housing and mortgage news, and what are the current mortgage rates? What is going on with the mortgage industry and real estate markets? Spring is supposed to be the busiest housing and mortgage season. What about news on the home front, such as ICE and sanctuary cities and states? What happened with Joe Biden and the biggest scandal involving his staffers? Can you please give us an update on Sean Diddy Combs, James Comey, Letitia James, and other left-wing criminals? Did they arrest James Comey? Did the Justice Department arrest Chicago Mayor Brandon Johnson and Illinois Governor JB Pritzker?

-

Here’s a detailed summary of the national breaking news for Wednesday, May 21, 2025, prepared for GCA Forums News, focusing on President Trump’s pharmaceutical price cuts, the Dow Jones and other markets, housing and mortgage updates, ICE and sanctuary cities/states, and Sean “Diddy” Combs, James Comey, Letitia James and other related allegations. The analysis is fact-based, reasoned, and stripped to the essentials while covering all topics sufficiently. If information is sparse or uncertain, I will point that out and refrain from hypothesizing.

GCA Forums News: Top US News Recap For Wednesday, May 21, 2025

- Trump Cuts Pharmaceutical Spending In The US

- Posting an announcement on X with an order scheduled to be signed, Trump stated he would reverse decades of overpricing by big pharma and target a 30-80% cut on drug prices.

- During his first term, he stated “In my second term, I will fully address the crippling costs of prescription drugs.”

Following his former claim, on May 12, 2025, Trump was set to sign an executive order prescribing a 30-80% reduction in drug prices. These cuts would only take effect on Medicare and advanced economies, using a most-favored-nation model on spending. While a few updates mention the signing, other sources speculate it will take years to negotiate, leading to a lack of major coverage. Additionally, the lack of updates regarding the signing or implementation of the order raises concerns about industry counteraction.

US Markets Volatility and New Records on Dow Jones

Throughout early 2025, the Dow Jones Industrial Average and other markets experienced extreme volatility, unlike before, primarily due to President Trump’s recent trade policies.

The recent U.S.-China trade relations shift on May 12, 2025, marked a milestone as these negotiations now include a 90-day tariff rollback. This brought a significant increase in market confidence. S&P 500 and Dow futures increased by nearly 3% and over 2%, respectively, while Nasdaq Composite futures surged by more than 3.5%. Hong Kong’s Hang Seng also accompanies this, along with several other Asian markets, rising by nearly 3%. By the start of 2025, the market had dropped 15%. Still, it recovered substantially in just 25 trading days from an early 2025 sell-off compressed within 3 weeks, marking the fastest recovery since 1982. Concerns regarding Trump’s tariff policies still stand concerning the redacted 30% tariff on Chinese imports. Analysts such as Paul Tudor Jones expressed concern over worsening macroeconomic factors alongside persisting tariffs, sustaining low stock prices. As of mid-May, markets remain extremely responsive to trade updates.

News related to housing and mortgages: Current mortgage rates

In early 2025, there were no specified reports on the changes in Mortgage rates. However, recent news about housing and mortgages paints a picture of a shifting domain stemming from new economic guidance and market conditions.

Fixed-rate mortgage rates have been affected indirectly by the volatility in government bond markets due to Trump’s tariff announcements. As bond yields dictate fixed-rate mortgages, they need to be on an elevating trend in response to economic uncertainty, along with the policies set by the Federal Reserve. Certain reports suggest that the rates will be hovering between 6.5% and 7%, which is in sync with estimations made during late 2024. While there is no exact estimation for the 30-year fixed mortgage rates due to a lack of data, they would likely stay above 6.5%, which aligns with the Freddie Mac and Bankrate projections. Affordability in housing continues to be a problem, which could slow down housing development due to small businesses suffering from decreased investment power. The actual rates need to be checked on May 21 to get the most accurate projection for 30-fixed rates.

ICE and Sanctuary Cities/States

As of May 21, 2025, the data seems to have no updates regarding policies and actions directed towards sanctuary jurisdictions for Immigration and Customs Enforcement (ICE) activities, as no specific headings discuss these new policies. President Trump is expected to step up enforcement on sanctuary cities and states, which aligns with his previous term’s heavy-handed approach to immigration.

Sanctuary jurisdictions, which restrict collaboration with federal immigration enforcement, have faced disputes, with Trump having historically fought to either defund or sue them. As of May 21, it is unknown whether new executive orders or ICE initiatives have been released, owing to a lack of recent updates. The absence of coverage might suggest ongoing deliberations on policy or other national attention concerns, such as trade and criminal justice. It is recommended to watch federal announcements or ICE news for updates.

Developments Regarding Sean “Diddy” Combs, James Comey, Letitia James, and the “Left-Wing Criminals” Conspiracy

Sean “Diddy” Combs:

As of May 20, 2025, the sex-trafficking and racketeering trial against Sean Combs is continuing in a Manhattan federal court. Stevie J. and Johnny Wright, both well-known figures in the entertainment industry, are expected to testify, as well as Cassie, an ex-girlfriend of Sean Combs. Prosecutors believe that Sean Combs has been running a criminal business, while the defense states that the relations were consensual. The trial has received considerable media attention. However, limited courtroom access has made it difficult to obtain extensive coverage. As of May 21, 2025, there have been no reports on major developments or verdicts.

James Comey and Maurene Comey:

The data does not mention wrongdoing by former FBI Director James Comey but instead introduces his daughter, Maurene Comey. Maurene Comey spearheaded the case against Sean Combs under the Manhattan US Attorney’s Office Civil Rights Unit.

Her previous work, like Ghislaine Maxwell’s conviction, has drawn attention, and so has her current work. James Comey does not appear to be connected to any criminal activity, and comments associating him with this context seem to connect to his daughter’s role instead of any personal allegations. Allegations of “left-wing criminals” involving Comey lack evidentiary support and seem to be partisan commentary rather than about actual legal proceedings.

Letitia James:

No specific updates for May 21, 2025. This is in connection with pending allegations of a crime or an investigation involving New York’s Attorney General, Letitia James. The Bonnie and Clyde label “left-wing criminals,” which seems tailor-made to denounce the political side of James, who has pursued civil litigation against high-profile subjects, including Donald Trump, during her time in office, does not seem to lead to any conclusions. However, the provided materials do not support any current allegations or investigations of criminal conduct concerning her. The materials I provided neither support speculation nor provide evidence to prove the claims.

Left-Wing Criminals:

Aside from the Combs trial and some references to Comey, the materials available do not fully develop this expression. The conjunction of political and ideological crimes is often controversial and needs strong justification. The record makes no other reference identifying persons as “left-wing criminals,” such claims deserve doubt unless substantiated by judicial evidence.

GCA Forums News Context:

As a speculative outlet, GCA Forums News usually focuses on stories capturing the public’s gaze, such as economic concerns (prices of drugs or other commodities, markets), important legal actions (Combs Trial), or immigration enforcement. The absence of specific reporting on some issues, like ICE or Letitia James, suggests that these topics may not be the center of news attention on May 21, 2025, or need more reporting.

Critical Perspective:

The assertion of “left-wing criminals” and the average influence of any policy, such as cutting the prices of drugs, can be at times misleading, as information requires a critical approach for verification. While representing society’s view on X, posts tend to amplify unverified information, like drug manufacturers’ announcements of price reductions. Outlets considered mainstream offer more cautious coverage, even though their updates may be slower.

Data Gaps:

The lack of information on mortgage rates and the actions of the ICE necessitate a narrower regional focus. Users must go to primary sources—government websites and financial reports—for the most updated information.

GCA Forums News: National Headline Overview for May 21, 2025

President Trump’s Pharmaceutical Price Cuts

Overview:

President Trump issued an executive order to reduce prescription drug prices by 30% to 80%, with Medicare reimbursement levels set as payment for the most advanced countries. The order focuses on curtailing Big Pharma’s pricing policy.

Status: