Gustan Cho

Loan OfficerMy Favorite Discussions

-

All Discussions

-

Last week FED CHAIRMAN Jerome Powell announced interest rates will not be cut this year because the economy is in pace on recovering. Inflation has dropped but it’s slightly higher than the 2.0% target. Inflation is at 3% and unemployment rate is at 4 25% which means the economy in the United States 🇺🇸 remains strong. Jerome Powell keeps on lying on national television. The same is true with Joe Biden, Janet Yellen, and hundreds of Democrats on national television. Joe Biden is busy traveling the United States 🇺🇸 campaigning he is the Navy Seal of Fighting Inflation with his Bidenomics. Dementia Lying Cheating Joe Biden aggressively is lying that he took Inflation from 9% when he took office to under 3.0%. All of these clowns are just a joke. Have they not seen prices of goods and services? Ridiculously outrageous. Mortgage loan applications are the lowest in 30 plus years. These numb nuts are destroying America. We need competent politicians and not politicians who never held a job and have been leaching off taxyers for the past 60 years.

-

This discussion was modified 11 months, 1 week ago by

Danny Vesokie | Affiliated Financial Partners.

Danny Vesokie | Affiliated Financial Partners.

-

This discussion was modified 11 months, 1 week ago by

Danny Vesokie | Affiliated Financial Partners.

Danny Vesokie | Affiliated Financial Partners.

-

This discussion was modified 11 months, 1 week ago by

-

There are mortgage lenders that have no overlays on VA loans. Lender overlays are higher lending requirements set by individual mortgage lenders above the minimum agency guidelines from the Veterans Administration on VA loans.

-

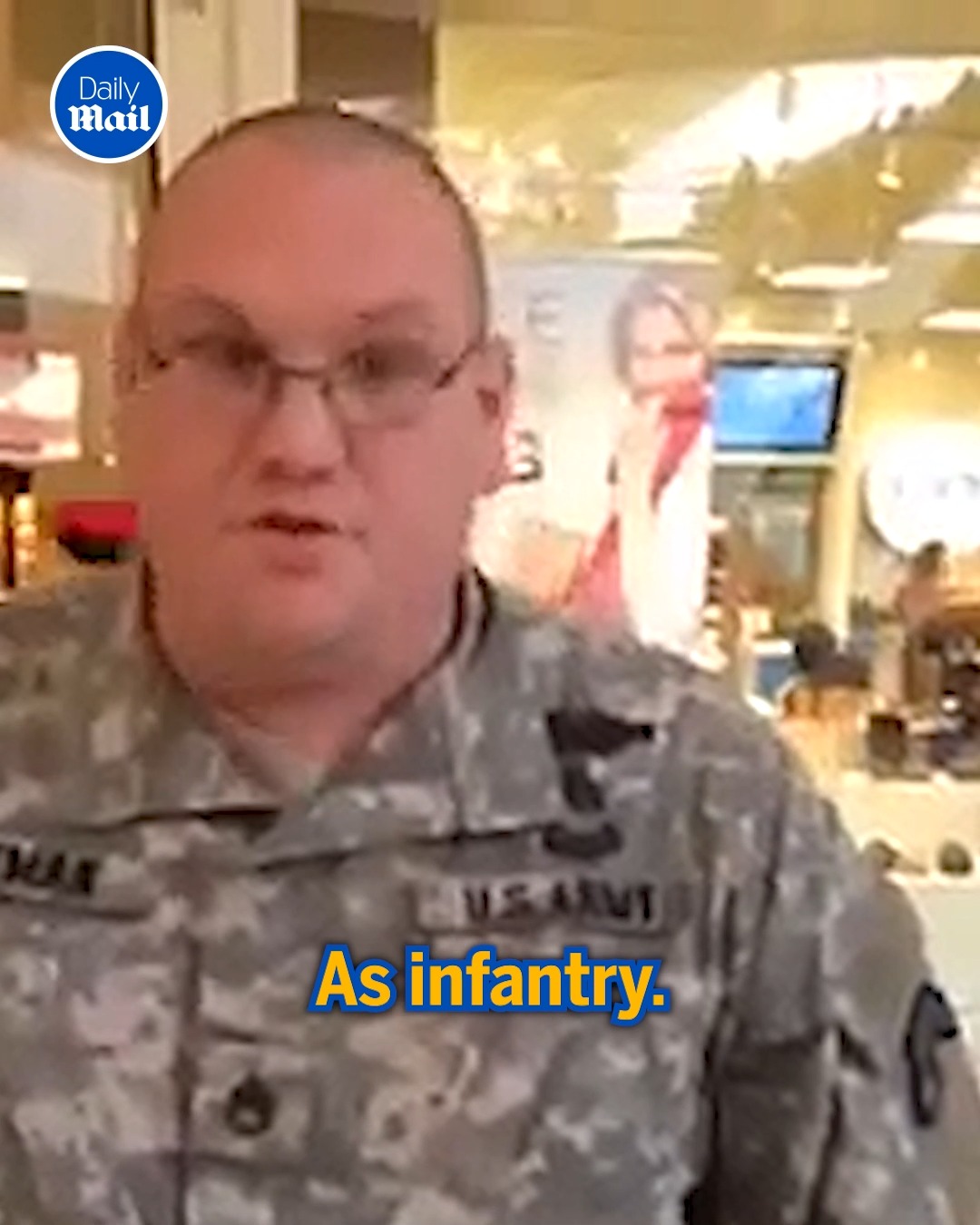

What’s going on in this country. We have serial police inpersonator Jeremy Dewitte and now we have a civilian wearing a full set of Army Uniform shopping on black Friday impersonating a Army Ranger with a purple heart 💜 and other combat patches. What is this guy doing. Chubby fellow who is definitely quite obese to be an active duty Army Ranger. What is he doing? What scam does he want to pull? Is he going to commit a crime? Does he want to pick up little girls or little boys? Does he want free food?

https://www.facebook.com/share/r/C9spumr2GqqegA7M/?mibextid=D5vuiz

facebook.com

Fake' army ranger busted | 'Why don't you just admit you're a phony?' 😠 | By Daily Mail | Facebook

'Why don't you just admit you're a phony?' 😠

-

G-7 is supporting Black Rock buying World’s Infrastructure. The more land and real estate they buy, the more control Blackrock will have. Bill Gates, who is an outspoken supporter of human depopulation has started buying farm land in Arkansas and other states so he can get control of the nation’s food supply thereby controlling population in the United States. This is a disgusting act of malice because I think he’s planning on starving people to death.

rumble.com

Neo-Feudalism: G7 Supports BlackRock Buying up World's Infrastructure, to Make Rich Even Richer

Neo-Feudalism: G7 Supports BlackRock Buying up World's Infrastructure, to Make Rich Even Richer - POLITICIANS HAVE SOLD US OUT - BILLIONAIRES ARE BUYING YOUR FUTURE - 16,254 views • June 15, 2024 Geop

-

I am calling the next Supercar to skyrocket in value to be the 599 GTB Ferrari V12 supercar. The Ferrari 599 GTB Fiorano is a high-performance sports car produced by the Italian automaker Ferrari. It was manufactured from 2006 to 2012. The “599” in its name refers to the engine displacement, with a 6.0-liter V12 engine under the hood. The “GTB” stands for “Gran Turismo Berlinetta,” which is a term often used by Ferrari to denote their two-seater, front-engine, and rear-wheel-drive sports cars.

Key specifications of the Ferrari 599 GTB Fiorano include:

-

Engine: The car is powered by a naturally aspirated 6.0-liter V12 engine, which produces a substantial amount of horsepower and torque. The engine is known for its fantastic sound and delivers exhilarating performance.

-

Performance: The 599 GTB can accelerate from 0 to 60 mph (0 to 100 km/h) in around 3.7 seconds and has a top speed of approximately 205 mph (330 km/h).

-

Transmission: It typically comes with a 6-speed manual gearbox, although an F1 automated manual transmission is also available, providing paddle-shift capability.

-

Handling: The car features advanced suspension technology and active aerodynamics to enhance its handling and stability at high speeds. It has been praised for its balance and precision in corners.

-

Design: The 599 GTB Fiorano features a sleek and aerodynamic design, with distinctive Ferrari styling cues. Its front-engine layout gives it a long hood and a classic GT profile.

-

Interior: Inside, it offers a luxurious and driver-focused cabin with high-quality materials and various customization options.

-

Technology: The 599 GTB includes various technological features, including a modern infotainment system and driver aids to enhance the driving experience.

Please note that my knowledge is based on information available up to January 2022, and there may have been updates or newer models released since then. Ferrari often produces limited-edition and special variants of their vehicles, so it’s a good idea to check the latest information directly from Ferrari or a reliable automotive source for the most current details on their models.

-

-

-

Brian Adams has many songs love and it never gets old.

-

Kamala Harris, is it racism?

Who is Kamala Harris? A vice president who hasn’t achieved much. She is a heartbeat away from being president. If Biden doesn’t run in November, she may be running in his stead. Every time I look up information on her, all I find is the following: The first female African American to hold the office of vice president That’s her claim to fame, and I take issue with that claim. Also, what is she? Her mother, Kamil, is from India, which makes her Asian; her father, Donald, is, get this, Afro-Jamaican with Irish ancestry. I will assume she is a woman. Why isn’t she the first Irish-Jamaican-Asian? You list the adjective first: I’m Italian American. An American by birth, a Native American is what I am. Granted, she was born in Oakland, California, apparently of many different ancestors. Why does Africa come first? She’s barely African; has she been there? I’ve been to Italy many times. I don’t play it up; it’s obvious I’m Italian. My wife’s DNA states she is 2% Polynesian; she can’t relate to that; she’s Ukrainian and Slovak. Would my wife be Polish or Polynesian? My DNA says I’m 20% Greek. Southern Italians and Greeks have been screwing around with each other for a long time. Africa is just 30 miles from Sicily. I have black cousins! Are we Afro-Italianos? Everyone here is from elsewhere. The party plays the female race ticket; just give them a minority, and they will vote them into office.Kamala Harris, is it racism?

Who is Kamala Harris? A vice president who hasn’t achieved much. She is a heartbeat away from being president. If Biden doesn’t run in November, she may be running in his stead. Every time I look up information on her, all I find is the following: The first female African American to hold the office of vice president That’s her claim to fame, and I take issue with that claim. Also, what is she? Her mother, Kamil, is from India, which makes her Asian; her father, Donald, is, get this, Afro-Jamaican with Irish ancestry. I will assume she is a woman. Why isn’t she the first Irish-Jamaican-Asian? You list the adjective first: I’m Italian American. An American by birth, a Native American is what I am. Granted, she was born in Oakland, California, apparently of many different ancestors. Why does Africa come first? She’s barely African; has she been there? I’ve been to Italy many times. I don’t play it up; it’s obvious I’m Italian. My wife’s DNA states she is 2% Polynesian; she can’t relate to that; she’s Ukrainian and Slovak. Would my wife be Polish or Polynesian? My DNA says I’m 20% Greek. Southern Italians and Greeks have been screwing around with each other for a long time. Africa is just 30 miles from Sicily. I have black cousins! Are we Afro-Italianos? Everyone here is from elsewhere. The party plays the female race ticket; just give them a minority, and they will vote them into office.

-

Real estate investors benefit from using fix and flip loans by getting a mortgage for the cost of the acquisition of the property and the cost of construction all in one loan closing. Once the property has been renovated, the investor will sell it for a profit. Many investors, including novices, can get fix and flip loans and start investing in distressed properties.

-

The weather in Florida has been 90 degrees everyday for the past two weeks. The good thing about it being so hot, that there is no one in the back seat of you car waiting to attack you.

-

FED CHAIRMAN LIE ON NATIONAL NEWS. Unbelievable. Inflation, unemployment is all fine according to FAKE NEWS JEROME POWELL. Everything is solid according to this lying POS.

https://www.youtube.com/live/Rhq5Y44OhFo?si=hy7uSUoSZRErhMWL

-

The Mafia and LGBT

I am proud of my Greenwich Village and my heritage. Just before summer kicked in early June 1969, the Stonewall Inn riots occurred. I’m not sure how many LGBTs know of this riot on Sheridan Square in Greenwich Village. The cops had enough of the gays and decided to raid the gay bar. This was the beginning of the gay movement.

This was actually a big mistake by the local police precinct; the “boys” owned the bar. When I refer to the “boys,” I mean the Mafia. They owned all the gay bars in the village. Gays were an everyday, matter of fact, occurrence in the village. The Italians paid them no mind; they didn’t hurt anyone. Tea Roooms, as they were called, sprung up, “Black Rabbit,” “One Potato,” where I actually worked a couple of bar shifts; it’s a long story how I wound up working there. The manager’s name was Bunny. He was gay and connected to the “boys.” My sisters had gay friends in elementary school. Everything was kept quiet, all behind closed doors, until that night in June, when 1,000 protesters came out of the closet and supported the Stonewall Inn. Not all were gay; many straight Villagers joined the protest.

The cops were brutal with their batons. This was long before “The Gay Officers Action League” was born. The cops and the “boys” always got along until that night. I guess there was a “sit down” between the two, and as expected, the “boys” won the battle. When it comes to money, don’t fuck with them. I suppose the Mafia helped the Gay Rights Movement.

-

I have always enjoyed the Italian traditions passed down through the generations. Meatless Fridays is a Catholic tradition the Italians practiced. I still try and adhere to the meatless Fridays whenever I can, except during Lent, when there is no meat at all.

Fish was the usual choice on Fridays, and I’ve eaten a lot of good pizza on Fridays. The Campagna Region of Italy, where this dish originated, has abundant fish and lots of great pizza. I’m sharing my recipe for Bucatini Aioli e Olio, with hot honey-seared scallops.

Aioli means garlic and oil. Olio is also oil.

Cook your pasta al dente.

Add garlic, olive oil, salt, pepper, and red pepper.

Season according to preference

Cast iron pan Heat a little canola or peanut oil, not olive oil.

When the pan is hot, place dried sea scallops in the pan

Salt and pepper lightly.

Sear scallops for three minutes each side.

Serve along with the pasta on a bed of spinach

Two-ounce ramekins of hot honey on the side for dipping

Don’t worry if a little honey mixes with the pasta.

This creates an amazing by-flavor.

New Zealand Sauvignon Blancs are dry and loaded with lemon and grapefruit flavors.

The acidity will call the hot honey a little, if not a beer.I have always enjoyed the Italian traditions passed down through the generations. Meatless Fridays is a Catholic tradition the Italians practiced. I still try and adhere to the meatless Fridays whenever I can, except during Lent, when there is no meat at all.

Fish was the usual choice on Fridays, and I’ve eaten a lot of good pizza on Fridays. The Campagna Region of Italy, where this dish originated, has abundant fish and lots of great pizza. I’m sharing my recipe for Bucatini Aioli e Olio, with hot honey-seared scallops.

Aioli means garlic and oil. Olio is also oil.

Cook your pasta al dente.

Add garlic, olive oil, salt, pepper, and red pepper.

Season according to preference

Cast iron pan Heat a little canola or peanut oil, not olive oil.

When the pan is hot, place dried sea scallops in the pan

Salt and pepper lightly.

Sear scallops for three minutes each side.

Serve along with the pasta on a bed of spinach

Two-ounce ramekins of hot honey on the side for dipping

Don’t worry if a little honey mixes with the pasta.

This creates an amazing by-flavor.

New Zealand Sauvignon Blancs are dry and loaded with lemon and grapefruit flavors.

The acidity will call the hot honey a little, if not a beer.

-

This subforum is directed to my friend Johnny Joe @RPE . Stay positive, stay away from negative energy, if there’s a will there’s a will, believe in yourself and your allies, you are not selling but rather offering, work smart vs hard, believe in yourself and success prevails. Never forget how you got to the top.

https://www.facebook.com/share/uYe3yanAzXHDq7Gq/?mibextid=xfxF2i

facebook.com

Back in the day, Stallone was a struggling actor in every definition. At some point, he got so broke that he stole his wife’s jewelry and sold it. Things got so bad that he even ended up homeless....

-

I am a mirror on a wall in a lobby of a very exclusive, most posh, ritziest hotel in Washington D.C. I have been stared into for a long, long time, 75 years to be exact. I arrived some time before the end World War II. No one really notices me, I mean they gaze at me, but never see me, they look straight through me. The most powerful people in the world have looked into me, never realizing my true worth.

Many times each day I am sprayed and wiped down, this sorta tickles. My gold leaf border is dusted, and no smudges are visible. I weight over 100 pounds, imported from France, created by an artisan glazier for the hotel. I am a portrait mirror, you can check the polish on your shoes and prim your hair all in one look. Every guest must pass by me, either leaving or entering the lobby, you can’t miss me! I stand tall and proud.

Most people look at me to, fix their tie, fluff their hair, smear their lipstick, presently, couples stand in front of me and take selfies, this disturbs me, the glare and the sometimes flash irritate my reflection. So what propose do I serve? I feed the ego, for one. Hundreds of people each day stare at me and wait for my reflection. Am I handsome, pretty, or just fooling them selves? I can recall many presidents checking themselves, they don’t see what I see. I can gaze right back and pierce your heart with MY stare. Politicians can be fake, fake smiles, fake teeth and fake hair. I see who they really are.

I see and stare their sadnesses and their joys, but sometimes their lie directly into me. I can still see truth. If you dyed your hair I can see the roots, if you spin and pirouette I can see all the flaws within you, there is no escaping my truth. The true joys are great to be a part of, the sadness makes me question the person. My heart aches for them, yet I must remain silent.

President Harry S. Truman was my first president. He would stare at me in wonder and awe, I soon realized he was looking for answers. He had to make the most difficult decision of any president, weather or not to drop the Atomic Bomb on Japan. The struggle for this poor man made me believe I was not only a mirror of your image, but a mirror to your soul. Harry would often dine with dignitaries at our restaurant and pass by me, I felt at times he’d wink at me like an old friend. I don’t make decisions, I show you who you really are. His guilt ran deep, but there was no other decision to make to safe our country and our boys.

I felt a part of me shatter when I heard the news of John F. Kennedy, a young man with unlimited potential who really loved America. His death started a decade of destruction. More death of world leaders, a war no one wanted. The Kennedy Family was the backbone of Washington politics. John and Jackie were the most elegant couple ever to grace the White House. When they dined at the hotel all heads turned, I must admit I was taken aback by their appearance. I almost blushed when The First Lady stared at me do adjust her near perfect hair.

Many presidents I have met through my years, my favorite was Jimmy Carter. The kindest and most sincere of all. To this day, and well into his nineties, he still gives his heart and soul to those in need. The Reagan years were a lot of funny, Hollywood moved in. John Wayne, Frank Sinatra, they all came to met and greet me.

Don’t get me wrong my tenure hasn’t been all dreary, I have made friends and there has been many joys I have shared. The countless married couples who have posed with is priceless. The fact that I can see sorrow, doesn’t mean I cant see happiness. Sadness always finds me, but I look for happiness constantly. One couple was married for 50 years. Nearing 80 years old, their reflection was awesome. The love for each other pierced through me like a bright ray from heaven. My fondest memory was when I first arrived at the hotel, it has been my fondest every since. A WW2 sailor and finance met before me just prior to his deployment. They vowed their love in front of me. The sailor swore he’d return and marry her. They set a date to meet again, June 1, after the war in my lobby. No matter where she was she would travel to Washington and patiently wait his return. The war ended and there was no word from the sailor, news travelled slow during the war, she never knew what happened to him. She would wait for a letter, hoping he was still alive. The couple of years passed and still no word. She would to DC every June as she promised. No one ever met her. Finally, in 1947 she received a letter from the US Navy stating he was alive , but a prisoner of war in a German Stalag. He had been seriously wounded and couldn’t get any communication to her. When he was released he was shipped to Oakland, California to a Veteran’s hospital for observation. The Navy’s communication where he was at was late in arriving. She stayed true to her vow.

The sailor was released and had no information where his fiancé was living. He travelled by bus one late day in May to DC. When he arrived on Memorial Day, a few days earlier then the planned date, he though she wouldn’t show up in the lobby. He had lost his leg and was wheel chair bound, barely able to use crutches he waited for days hoping to meet her again. He could not afford our fancy, expensive hotel, he sought lodging in a flea bag hotel several miles away. Over the next few days he would find his way back to our lobby. He’d sit in front of me and I saw his sorrow , same sorrow displayed by his girl when she was waiting. June 1 came, and he made camp in front of me. For some strange reason I didn’t see is sadness today, I saw joy! Just as he was began to wheel himself back to the flea bag, she walks in ! I have never and will never see such happiness in two people. Their love appeared in my eyes and I swear I began to cry. They radiated love! I stored their love in mind and think back over the years of all the sadness and love I had experienced. May their love be a reflection for all to share.

-

Trying to see if buyer that has been renting home for 14 years , with option to purchase. How can he get in home with no down payment. Home is worth 245,000 selling 180,000 seller paying closing cost and prepaids . They are not related but have been good friends like his grandfather prior to renting. I assumed it was no way suggested 3.5 down make 12 payments. And refi as he has an irs lien he wants to pay off. So he can have the money he pays them stop coming out of his check.

-

There are instances when mortgage underwriters will require reserves from borrowers. What does reserves mean? Can equity in the home or 401k be used for reserves? How about if you have a paid off vehicle or precious metals? Or what if you have hard core cash. Can those be used for reserves?

-

South Korean Global tech giant Samsung announced Taylor Texas will be home to Samsung’s U.S. semiconductor factory. The breaking announcement puts Taylor Texas on the global map.

https://youtube.com/playlist?list=PLnxykQ4xCbXu9EHcKzr0XqZioCz2CsDfI&si=mPANQR1Bv3ytMvAR

-

No with former President Donald Trump getting convicted on all 34 charges against him, how is the conviction of President Trump going to affect the state of NEW YORK?

-

If a NMLS licensed loan officer works for a mortgage broker and is licensed in 30 states, can the loan officer be paid their commissions by 1099 on states that he is licensed in that allow 1099 compensation and be paid W2 on states that do not allow 1099 compensation>

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

-

Dogs are better. Better than who? People.

https://www.facebook.com/share/r/wppQvYbvQBzejtv8/?mibextid=oFDknk

facebook.com

📍 Cutest moments with pets. ❤️💕💞 #dogs #dogsofinstagram #dogstagram #dogslife #fyp #fypシ #foryou #foryoupage #viralvideos #viral. thaniaraynemodel · Original audio

-

Growing up in Greenwich Village during the 1950s and 1960s allowed me to be exposed to the melting pot of historical writers. Thomas Paine, William Sydney Porter. [O’Henry] Mark Twain and James Baldwin, just to name a few. They all lived in The Village and embraced the Bohemin life style. For many years aspiring writers have flocked there. However, there are also locally born writers plying their craft. Charles Messina, Alfred Caneccchia, Dom Perruccio and myself. I can say I have know Charles Messina since he was born on Thompson Street. Charles has written many screen plays and plays, his latest musical play soon to be on Broadway, “The Wanderer.” Based on the life of Dion DiMucci, Dion and The Belmonts. Al Caneechia has written many books, “Greenwich Village Vignettes,” the Village seen through his eyes. “When Greenwich Village Was Ours,” which I contributed a short story. My buddy Dom Perruccio, he and Charles wrote, “Stomping Ground, Growing Up On The Streets of Greenwich Village,” His latest work is a beautifully illustrated book, “The Adventures of Miss Canoli The Scamp,” a wonderful tribute to his dog.

We will never be as famous as the afore mentioned writers, their creativity has cemented a place in Greenwich Village for current writers and writers of the future. Growing up in Greenwich Village during the 1950s and 1960s allowed me to be exposed to the melting pot of historical writers. Thomas Paine, William Sydney Porter. [O’Henry] Mark Twain and James Baldwin, just to name a few. They all lived in The Village and embraced the Bohemin life style. For many years aspiring writers have flocked there. However, there are also locally born writers plying their craft. Charles Messina, Alfred Caneccchia, Dom Perruccio and myself. I can say I have know Charles Messina since he was born on Thompson Street. Charles has written many screen plays and plays, his latest musical play soon to be on Broadway, “The Wanderer.” Based on the life of Dion DiMucci, Dion and The Belmonts. Al Caneechia has written many books, “Greenwich Village Vignettes,” the Village seen through his eyes. “When Greenwich Village Was Ours,” which I contributed a short story. My buddy Dom Perruccio, he and Charles wrote, “Stomping Ground, Growing Up On The Streets of Greenwich Village,” His latest work is a beautifully illustrated book, “The Adventures of Miss Canoli The Scamp,” a wonderful tribute to his dog.

We will never be as famous as the afore mentioned writers, their creativity has cemented a place in Greenwich Village for current writers and writers of the future. Growing up in Greenwich Village during the 1950s and 1960s allowed me to be exposed to the melting pot of historical writers. Thomas Paine, William Sydney Porter. [O’Henry] Mark Twain and James Baldwin, just to name a few. They all lived in The Village and embraced the Bohemin life style. For many years aspiring writers have flocked there. However, there are also locally born writers plying their craft. Charles Messina, Alfred Caneccchia, Dom Perruccio and myself. I can say I have know Charles Messina since he was born on Thompson Street. Charles has written many screen plays and plays, his latest musical play soon to be on Broadway, “The Wanderer.” Based on the life of Dion DiMucci, Dion and The Belmonts. Al Caneechia has written many books, “Greenwich Village Vignettes,” the Village seen through his eyes. “When Greenwich Village Was Ours,” which I contributed a short story. My buddy Dom Perruccio, he and Charles wrote, “Stomping Ground, Growing Up On The Streets of Greenwich Village,” His latest work is a beautifully illustrated book, “The Adventures of Miss Canoli The Scamp,” a wonderful tribute to his dog.

We will never be as famous as the afore mentioned writers, their creativity has cemented a place in Greenwich Village for current writers and writers of the future.

-

-

I want to thank my dear friend Peter Arcuri @peter who I highly respect as a client, friend, writer, advisor, and business associate and partner on all he does for the team at GCA, being my advisor, going over ideas and business plans especially with Great Content Authority Forums, and spirituality and life in general. I like to start this forum to share the views of others on their thoughts and opinions of everything that is going on today in the United States and the world. I like to thank Peter for volunteering of taking on the responsibility of being my mentor and professor on studying and mastering the Christian’s view of the Ten Commandments. As I was working i overheard a YouTube video my wife was listening too and asked her what she was listening too. It seemed like whoever was talking, he stole my pricinples, ideology, and foundation i live by every day and base most of my business decisions and make my decisions on who my acquaintances and friends are. So I yelled to my wife who’s the guy talking on YouTube. She yells back, “THE TEN COMMANDMENTS.” That’s when I text Peter Arcuri. I will explain on a separate subforum on why I requested Peter for taking on the task on educating me on a following subforum at a later date on this thread. Basically, I asked Peter Arcuri, “Peter, can you teach me all about the ten commandments.” Peter’s response: ” Easy. Don’t Fuck Anyone.” Okay. Now I know where this academic thesis of the Ten Commandments will lead to. Here’s what started all this

https://youtu.be/RbIZsTVNu5M?si=1AI7U97dTIU_snot

-

This discussion was modified 11 months, 2 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 8 months, 4 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 8 months, 4 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 11 months, 2 weeks ago by

-

Who is this Anthony Fauci? Is he a medical doctor? Does he have a PhD? Does Anthony Fauci a real doctor? Is the information that Dr. Anthony Fauci worked for more than 50 years at the National Institutes of Health worked to manage U.S. public health crises, such as the HIV/AIDS epidemic in the 1980s, the West Nile Virus outbreak in 2009, H1N1, Ebola, Zika and Severe Acute Respiratory Syndrome (SARS), among others true? Did doctor Fauci was leading monster to have created and launched coronavirus and was in charge of developing the coronavirus vaccine to be used as a weapon of mass destruction? Did Dr. Fauci kill thousands of Beagle dogs to use them for lab testing purposes? Is Dr. Fauci a monster or a real doctor who wants to help people?

https://www.youtube.com/watch?v=KxwcdiX9dPI

-

This discussion was modified 11 months, 2 weeks ago by

Danny Vesokie | Affiliated Financial Partners.

Danny Vesokie | Affiliated Financial Partners.

-

This discussion was modified 11 months, 2 weeks ago by

-

Biden Administration is not an inflation fighter

-

Americans no longer trust politicians and the mainstream media. Once trust is broken, you can not get it back. Trust was broken with politicians and the media. Ever listen to lying Jim Cramer of MAD MONEY JIM CRAMER show on CNBC? WHAT INFLATION? What do you mean high unemployment? The economy is great 👍. Joe Biden is great. Bidenomics? President Biden is the Navy Seal of Fighting INFLATION 💪 Whooo. We escaped a second GREAT RECESSION. Listen to Janet Yellen and FED Chair Jerome Power about their soft landing. What are they smoking 🚬 🚭 🤔. Please listen to the attached video carefully. It makes all the sense in the WORLD 🌎

Social Media Links