Gustan Cho

Loan OfficerMy Favorite Discussions

-

All Discussions

-

GCA Forums Headline News Weekend Edition Report

July 7-13, 2025

Executive Summary

This comprehensive report outlines the strategic content framework for the GCA Forums News Weekend Edition, a compilation of breaking news summaries from July 7 through July 13, 2025. Based on extensive polling and focus group studies conducted among our viewers and forum members, we have identified key content categories that will significantly enhance viewer engagement, retention, and website traffic while serving our core audience of homebuyers, real estate investors, mortgage professionals, and business entrepreneurs.

Audience Research Findings

Recent polling data from our GCA Forums community indicates that viewers seek a strategic combination of timely, relevant, and engaging content that addresses their immediate concerns while providing actionable insights for their real estate and mortgage-related decisions. The research emphasizes the importance of balancing breaking news coverage with educational content that helps our audience make informed financial decisions.

Core Content Categories and Strategy

Breaking News and Current Events Coverage

This week’s primary focus includes comprehensive coverage of significant developing stories that impact our audience’s interests. The editorial team will thoroughly analyze major news developments while maintaining our commitment to factual reporting and professional journalism standards.

Key coverage areas include updates on significant political appointments and policy changes that may affect the mortgage and real estate industries. Additionally, we will monitor and report on any developments related to high-profile legal cases that have captured public attention.

Mortgage Market Updates and Interest Rate Analysis

As the cornerstone of GCA’s business model, mortgage and housing news remains our primary content focus. This section provides essential daily updates that mortgage professionals rely on for client consultations and market analysis.

Our coverage includes comprehensive daily updates on mortgage rates across all major loan types, including conventional, FHA, VA, DSCR, and non-QM products. We will analyze Federal Reserve policy changes and their direct impact on mortgage rates, providing expert forecasts on future rate movements. Additionally, we will cover evolving lender requirements from major entities like Fannie Mae and Freddie Mac and trends in credit scoring and debt-to-income ratio standards that affect mortgage approval processes.

This content serves real estate investors, homeowners, and refinancers who constantly monitor mortgage rates for optimal timing decisions. Mortgage professionals value this information as it eliminates the need to track multiple sources independently.

Housing Market Indicators and Real Estate News

Our housing market coverage provides crucial insights for investors and homebuyers by analyzing current market conditions, sales data, and pricing trends. This section addresses the dynamic nature of real estate markets and their impact on buying and selling decisions.

We will focus on first-time homebuyers’ affordability rates and their challenges in today’s market. Our analysis will include continuously changing housing inventory levels, updating home price indices across national and regional markets, and identifying the best and worst housing markets for buyers and sellers. Special attention will be given to rental market insights, particularly multifamily housing opportunities that appeal to investors.

This comprehensive coverage addresses the universal impact of real estate news on homeowners and investors alike, providing data-driven insights that support informed decision-making for those considering buying or selling properties.

Federal Reserve Reports and Inflation Analysis

Federal Reserve policy decisions and inflation trends directly correlate with mortgage rates, economic stability, and home affordability. Given its broad impact on our audience’s financial decisions, this critical coverage area cannot be overlooked.

Our analysis will include coverage of Consumer Price Index reports, Personal Consumption Expenditure indices, and Federal Reserve interest rate decisions. We will provide expert speculation on real estate market changes and rate adjustment predictions, including a comprehensive analysis of how inflation impacts home affordability.

This content addresses mortgage borrowers’ concerns about future interest rate movements and provides investors with essential inflation indicators relevant to the real estate and financial sectors.

Economic Reports and Job Market Trends

Economic conditions influence housing affordability, mortgage approval rates, and investment potential. This section attracts entrepreneurs, professionals, and homebuyers who need to understand broader economic trends.

Coverage will include monthly employment and unemployment reports, comparative analysis of wage increases versus housing price appreciation, GDP growth data, recession risk assessments, and the effects of economic changes on mortgage lending practices. We will also analyze stock market behavior and business confidence indicators.

This content appeals to economic cycle followers who want to understand how these trends impact their housing market buying power, attracting attention from professionals, investors, and business owners.

Government Policy and Housing Regulations

Housing policy and mortgage regulation changes significantly affect the lending process and market dynamics. This coverage is essential for borrowers, realtors, and industry professionals.

We will provide updates on FHA, VA, USDA, and conventional loan limits, cover proposed tax credits for new home buyers, and analyze rent control legislation and tenant protection law changes. Additionally, we will monitor fair housing laws, anti-discrimination policies, and government-backed foreclosure prevention programs.

This content helps investors and homebuyers understand how new policies may support or hinder their goals while informing real estate professionals about regulatory changes.

Real Estate Investment and Wealth Building Strategies

Real estate remains the premier asset class for wealth building, making this content highly valuable for entrepreneurs and investors seeking expert guidance and maximum return on investment.

Our coverage will identify the most profitable cities for rental property investments, analyze investor-friendly mortgage programs and DSCR loans trends, and provide updates on short-term rental markets, including Airbnb opportunities. We will also cover multifamily and commercial real estate investment trends and real estate tax planning strategies for investors.

This high-value content attracts sophisticated readers interested in real estate investment topics and positions GCA Forums News as a trusted source for expert-backed investment advice.

Business and Financial News Focus

Covering key business stories that impact housing and lending markets strengthens our credibility. It provides comprehensive market analysis for our professional audience.

Our business coverage will include stock market activity and major earnings releases, news from banking and financial institutions, including mortgage lender developments, analysis of cryptocurrency and digital asset impacts on real estate, and updates on credit and small business loan markets.

This comprehensive business coverage provides investors, entrepreneurs, and finance professionals with actionable insights while building GCA Forums News’ reputation for credible business journalism.

Foreclosures, Distressed Properties, and Housing Crisis Coverage

Economic uncertainty increases interest in foreclosure opportunities and distressed property markets, making this content particularly relevant for investors and buyers seeking value opportunities.

Coverage will include national and local foreclosure rates and trends, REO (Real Estate Owned) and short sale market analysis, and the impact of job market changes on foreclosure rates. We will also identify available distressed properties in the market and provide educational content for investors seeking bargain properties and distressed homeowners looking to prevent foreclosure.

This content serves investors searching for auction property opportunities while providing valuable information to homeowners facing financial difficulties.

Viral Content and Market Engagement

Daily coverage of trending real estate stories and viral news helps expand our audience beyond traditional real estate enthusiasts while increasing social media engagement and content sharing.

Topics will include real estate scandals and controversies, viral homebuying success stories and cautionary tales, coverage of significant mortgage fraud cases, and unusual or noteworthy property listings that capture public attention.

This engaging and relatable content increases participation and attracts casual readers who might not typically engage with mortgage-focused content, expanding our overall audience reach.

Expert Analysis and Forum Discussion Highlights

Summarizing leading discussion threads from GCA Forums and presenting them with expert commentary enhances forum engagement while providing valuable insights to our broader audience.

This section will feature expert responses to community questions, highlight trending forum discussions, and provide professional analysis of member-submitted scenarios and challenges.

Content Distribution Strategy

The Weekend Edition Report will synthesize the most important developments across all categories, providing comprehensive analysis and expert commentary that serves our diverse audience of mortgage professionals, real estate investors, homebuyers, and business entrepreneurs. Each section will be crafted to provide actionable insights while maintaining the high editorial standards that GCA Forums News is known for.

Summary

This strategic content framework ensures that the GCA Forums Headline News Weekend Edition delivers comprehensive, timely, and relevant information that serves our audience’s immediate needs while positioning our platform as the premier destination for real estate and mortgage industry news and analysis. By focusing on these key content categories, we will continue to build audience engagement, increase website traffic, and strengthen our reputation as a trusted source for real estate and mortgage market insights.

-

GCA Forums Headline News Weekend Edition: June 23–29, 2025

Welcome back to this weekend’s GCA Headlines, your go-to spot for the freshest numbers and stories if you’re buying a home, flipping a property, or working in the mortgage game. From tricky loan updates to headline-worthy policy moves, we mix plain talk with expert takes so you can keep one step ahead.

Let’s jump into the news currently steering the housing and finance markets.

Mortgage Rates at a Glance

- Mortgage rates kept everyone talking this week, and the slight nudges up or down do matter for anyone planning a deal.

- The Mortgage Bankers Association reports that the average rate on a standard 30-year fixed loan was 6.85% for the week ending June 27.

- FHA and VA products stayed close behind, landing at 6.45% and 6.30% respectively.

- On the non-QM and debt-service coverage ratio (DSCR) side, lenders pushed rates up slightly, now falling between 7.10% and 7.50% as they tighten their underwriting belts.

- The Federal Reserve hinted that it will keep interest rates where they are for a while.

- With new rules from Fannie Mae and Freddie Mac, lenders are now capping debt-to-income (DTI) ratios for most conventional loans at 43 percent.

- They are also looking at credit scores more closely.

- FHA loans now require at least a 620 score.

- These updates show how quickly the lending landscape can change, so anyone considering buying or refinancing a home should keep up.

Why does that matter?

- Buyers and people looking to refinance check mortgage rates almost daily to decide when to act.

- Loan officers do the same thing to give clients solid advice.

- By following the numbers, you can spot trends early and tweak your financing plan before a big move hits the market.

The Housing Market

- Turning to the housing market, news this week is a mixed bag.

- The National Association of Realtors reports that existing home sales climbed 2.3 percent in May 2025.

- Part of that boost comes from a tiny increase in available listings, giving buyers more options.

- Still, the median sale price jumped 4.1 percent over the past year, landing at $425,000 and making life harder for first-time shoppers.

- Regionally, Austin, Texas, and Raleigh, North Carolina, remain hot seller markets.

- At the same time, places like San Francisco and Chicago offer better chances for buyers thanks to growing inventories.

- Rental markets, especially for apartment buildings, have picked up steam this year.

- Cap rates in cities now average around 5.8 percent, giving buyers a solid return on investment.

- At the same time, the Case-Shiller Home Price Index showed home prices rising 5.6 percent over the past twelve months.

- However, that pace slows in pricey coastal areas like San Francisco and New York.

- Why this matters: These numbers give homebuyers and sellers something to work with—guiding listing prices and starting offers—while investors use the data to spot deals and decide when to pull the trigger in tight markets.

Inflation and the Fed’s Next Move

- Inflation is still the headline story for mortgages and housing.

- The Consumer Price Index (CPI) for May 2025 ticked up 3.1 percent year-over-year, slightly above the Fed’s 2 percent goal.

- The Personal Consumption Expenditure (PCE) index, which the central bank favors, climbed by 2.7 percent, reinforcing the sense that price pressures aren’t backing off anytime soon.

- Because of this, talk of a possible rate cut in September is heating up, even though the Fed keeps saying it will act based on hard data, not speculation.

- Steady inflation squeezes affordability by pushing up the cost of lumber, steel, and everything else that goes into building a house.

- That, in turn, nudges new-home prices higher, pinches budgets.

- Investors are watching these inflation numbers closely since they directly affect loan costs and rental returns.

Why this matters:

- By understanding how inflation feeds into interest rates, borrowers and investors can get ahead of the curve instead of chasing it.

Economic Snapshot and Job Market Trends

- The latest Bureau of Labor Statistics report shows that the U.S. economy added 200,000 jobs in May 2025.

- At the same time, the unemployment rate held steady at 3.9 percent.

- While those numbers are encouraging, GDP growth cooled to an annualized 2.1 percent, and wage gains, although healthy at 4.2 percent over the year, are being watched closely to see if they keep up with everyday bills.

- Not surprisingly, cooler growth and steady wages led to a jumpy stock market.

- The S&P 500 slipped by 1.8 percent as firms reported mixed quarterly results.

- Business owners expressed caution, which trickled down to commercial real estate lenders tightening their standards because of that, mortgage approvals now hinge even more on a reliable work history and steady income.

Why You Should Care

- Shifts in jobs, pay, and production numbers flow straight to the desk of every mortgage broker and would-be buyer.

- When lenders loosen or tighten their rules, search timelines and budget limits change overnight, so staying current on the economy is vital for anyone battling high home prices.

Policy Moves and Housing Rules

- In housing news, the Federal Housing Administration raised its loan limits for 2026.

- The new cap is $510,400 for standard single-family properties and a noteworthy $1,149,825 for areas where the cost of living is especially high.

- On Capitol Hill, lawmakers are reviving talks of bigger tax credits for first-time buyers to help offset the climb in home prices.

- In addition, both California and New York rolled out stronger tenant protection laws this week, adding fresh rent-control measures that multifamily investors will need to factor into their business plans.

- The U.S. Department of Housing and Urban Development (HUD) recently announced stronger programs to help homeowners avoid foreclosure.

- The agency is also stepping up its fair housing efforts, meaning there are now heftier fines for banks and lenders that practice unfair discrimination.

Why should you care?

Every time lawmakers move the dial, they change the rules banks, investors, and buyers have to play by. Staying ahead of those changes lets real estate agents and ordinary homeowners decide when to jump in, when to hold back, and how to stay in the law’s good graces.

Tips on Investing in Real Estate and Building Wealth

- This past week, new investment chances began popping up nationwide, with Orlando, Florida, and Phoenix, Arizona, standing out for rental-property LLCs.

- Both cities are seeing a surge in demand, which is pushing cap rates between 6.2% and 7.0%.

- At the same time, debt-service coverage ratio (DSCR) loans are catching on fast.

- They let investors with several houses simplify the paperwork and keep cash flowing.

- Short-term rentals, especially those listed on Airbnb, are buzzing in tourist magnets like Miami and Nashville, where the foot traffic feels endless.

- Tax experts are once again buzzing about 1031 exchanges and cost-segregation studies as must-have tools for squeezing every dollar out of an investment.

- Multifamily buildings are getting extra attention, too.

- Even with interest rates creeping up, apartments in city centers continue to spit out stable cash flow, a trait every investor loves.

So why mention all this?

- Because serious investors want playbooks written by pros.

- These little glimpses into what’s working today help ordinary buyers and veterans map plans for real wealth.

Business and Financial News in Focus

- The banking world recently hit a rough patch when two regional mortgage banks said they were low on cash.

- That announcement made many people wonder how steady the entire market is.

- In the stock arena, however, the mood seemed a little brighter.

- Real estate investment trusts, or REITs for short, managed to do better than most other companies.

- Cryptocurrency fans also turned their gaze toward property-linked digital coins, looking for new investment methods.

- On the lending side, the average rate for small business loans climbed to 8.5%.

- That squeeze will make it tougher for many entrepreneurs who want to buy or improve commercial real estate.

- Taken together, these stories show how closely money markets and housing are tied together.

Why It Matters

- Keeping track of these developments makes GCA Forums a trusted source.

- Investors and small-business owners prefer a one-stop shop where they can see the whole picture, not just bits and pieces.

Foreclosures, Distressed Properties, and Housing Crisis

- According to RealtyTrac, foreclosure filings crept upward in the second quarter of 2025, rising 3.5% from the previous quarter.

- Banks’ real-estate-owned (REO) homes and short sales are still magnets for bargain-hunters, especially in cities like Detroit and Cleveland.

- Wobbly job numbers add pressure, but government aid programs have helped soften the blow.

- Online auction sites are buzzing, showing a 15% jump in bids for distressed properties.

- That spike shows plenty of investors are eager to roll up their sleeves and turn a rundown house into a profitable rental.

Why It Matters

- Up-to-the-minute data on foreclosures and relief programs can make a real difference for investors and families struggling to keep their homes.

- When the numbers are fresh and easy to understand, people are likelier to read, share, and act on what they learn.

Hot Topic of the Week

This week’s topic, lighting up the comment threads, isn’t homes on the brink of foreclosure. It’s New York Attorney General Letitia James and some serious allegations of mortgage fraud. The conversation heated up inside the GCA Forums after Newsweek and CBS New York published reports that a recent Federal Housing Finance Agency (FHFA) referral was before the U.S. Department of Justice.

Here’s a quick summary of the key claims flying around:

Norfolk Claim in 2023:

The Attorney General is said to have labeled a house in Norfolk, Virginia, her main home. Critics point out that since she lives and works in New York, making that claim would be tricky for any public official trying to score sweetheart loan terms.

Brooklyn Brownstone in 2021:

Allegations also suggest she listed the Brooklyn rental as a four-unit building rather than five, qualifying for lower interest rates.

Older Papers:

Some documents from 1983 and 2000 reportedly show her father named as her spouse, raising big eyebrows about how mortgages were filed and whether rules were bent.

James has pushed back on the accusations, calling them “baseless” and hinting they are payback for her lawsuit against former President Donald Trump. Her lawyer, Lowell, said the claim about the Virginia property is nothing more than a clerical mistake and insisted that other papers show the house is meant for her niece. As of June 29, 2025, the FBI and the U.S. Attorney’s Office are still looking into the case, yet no formal charges have been filed.

Inside the GCA Forums, users have been debating what these claims could mean for mortgage-fraud cases and whether politics are driving the prosecution. Some questioned whether James listing her father as her spouse holds up, pointing out that the records are several years old. In contrast, others argued that mortgage applicants should always be completely honest. During an “Ask an Expert” segment, a lawyer warned that falsely describing how a property will be used can bring serious trouble, with possible wire-fraud or bank-fraud charges under federal law sections 1341, 1343, 1344, and 1014.

Why should we care? Stories like this get people talking, pulling in readers who usually stick to celebrity gossip rather than loan rates. They also remind everyone—from real estate agents to first-time buyers—why careful paperwork matters.

Expert Q&A and Forum Buzz This Week

This week, the GCA Forums were busier than ever, with hot topic threads zeroing in on high interest rates and the latest FHA loan limits. During our latest “Ask an Expert” chat, mortgage pros tackled some of the most pressing questions, including:

How can borrowers boost their DTI while interest rates are up?

Several lenders suggested paying off high-interest credit card debt first and then considering bringing in a co-signer if that fits the situation.

Are DSCR loans a smart move for first-time property investors? Advisers praised the loans’ flexibility but warned that they come with steeper rates and tighter cash-flow checks, so budgeting is necessary.

A thread about buying distressed homes drew a lot of eye attention. Users shared success stories about flipping bank-owned houses in overlooked parts of town. These real-life accounts highlight that folks keep returning to the GCA Forums for solid advice and friendly peer support.

Why It Matters

Shining a spotlight on forum activity keeps our community lively. It shows readers that GCA Forums News is the first place to turn for trusted mortgage and real estate know-how.

Final Thoughts: The Secret Sauce for Success

This week’s edition of GCA Forums Headline News Weekend Report is packed with fresh updates, sharp expert takes, and stories that keep readers coming back. By breaking down tricky mortgage subjects, handing out practical pointers, and sparking lively forum chats, we want to give buyers, investors, and pros the necessary tools. Pass these stories along, jump into the talk on GCA Forums, and watch our daily posts to prepare you for whatever the real estate market throws your way.

-

GCA FORUMS NEWS-Friday, June 28, 2025.

Mortgage and Real Estate News – June 2025Mortgage Rates Steady Out of Spring

June has brought good news for anyone looking to buy a home: average mortgage rates have settled at 5.2%, and they are staying there now. After months of wild ups and downs, that steadiness feels almost refreshing. It also allows buyers to breathe, plan, and finally pin down monthly payments without worrying that the number will change overnight. Experts say the calm is largely due to inflation showing signs of cooling and the Fed not making any big, surprise moves. Because lenders have clearer signals about the economy can offer predictable rates instead of jumping at every headline. Buyers should especially pay attention to the 30-year fixed option, which remains a smart way to lock in those numbers for the long haul.

Big Change to FHA Loan Eligibility

The U.S. Department of Housing and Urban Development (HUD) made a major policy update: non-permanent residents can no longer get a Federal Housing Administration (FHA) loan. The rule takes effect right away, so it will hit thousands of future homebuyers who hold temporary visas. FHA loans have been a lifeline for first-time buyers because of their small down payment and forgiving credit score standards. The government hopes to reduce risk by focusing on permanent residents, but the move is stirring criticism. Many worry it will leave deserving families out in the cold and hold back homeownership in parts of the country with diverse immigrant communities. Prospective buyers who are affected will now have to look at conventional loans or state-backed programs, which usually ask for higher credit scores and bigger down payments.

Home Prices Keep Climbing

Across the country, home prices have edged up about four percent since last year. The main reasons? There still aren’t enough houses for sale, and people in big cities keep looking for places to live. Cities adding jobs fast, like Austin, Seattle, and Miami, are feeling the pinch most. With so many buyers chasing so few listings, prices have nowhere to go but up. Right now, the typical home sells for around $425,000.

In contrast, prices in rural and some suburban areas are rising more slowly, but the big price hikes are still happening in the city’s heart. Builders aren’t putting up new homes fast enough to change that picture. Because of all this, experts tell buyers to move quickly in hot ZIP codes or shift their search to up-and-coming neighborhoods where prices are a little friendlier.

Real Estate Market Outlook

As we look toward the second half 2025, housing experts are sounding hopeful. They believe the real estate market is moving toward a healthier balance between buyers and sellers. Mortgage rates have been all over the place lately and appear steadying. When rates stop jumping, more people shop for homes, and that’s a good sign for buyers. At the same time, new construction is picking up, and more homeowners who have held off selling are finally ready to list, so we should see a gradual increase in available properties.

Many of those sellers had been uneasy about putting their home on the market while rates were above 7 percent. Now that the average has settled around 5.2 percent, they feel the pressure is off and are willing to make a move. When inventory goes up, bidding wars cool down, giving buyers a little breathing room. On top of that, inflation is moderating, and the job market remains steady, so families feel more confident about making big financial decisions. That mix usually fuels both buying and selling.

That said, not every neighborhood will play by the same rules. With its tight supply and stubborn demand, the Northeast will continue favoring sellers. In contrast, some Midwest cities are already showing signs of buyer-friendly pricing, and that trend could deepen if local inventories keep climbing. Overall, the second half 2025 looks promising, but paying attention to local conditions will still matter most.

First-Time Homebuyer Programs

Buying your first home should be exciting—not stressful because of money worries. To help with that, many new programs have popped up recently, all focused on one big hurdle: the down payment. Thanks to money from the federal government, state budgets, and even local city funds, these initiatives are working together to make homeownership easier for first-timers.

Depending on where you look, assistance can show up in different forms. Some programs hand out grants that cover 3 to 5 percent of the home’s purchase price, while others offer low-interest loans that you can use for the down payment or closing costs. A few even bundle the money with free classes or online workshops that walk you through the buying process. Most of these options are aimed at low- and moderate-income households, so the support is targeted exactly where it is often needed.

The hope behind these programs is simple: raise the homeownership rate, which has been creeping downward lately because of high prices and shaky job markets. If you qualify, check with your local housing authority or ask your lender what’s available. The help is out there; you must look in the right places.

Commercial Real Estate Recovery

The commercial real estate market is returning as more employees return to the office. Cities such as New York, Chicago, and San Francisco are seeing a fresh demand for traditional office space because many owners no longer want to rely on remote work full-time. That renewed appetite is helping lower vacancy rates and bringing new lease deals to the table. Retail and hospitality properties are joining the recovery, too, especially within mixed-use projects that stack offices, apartments, and shops under one roof. Investors are taking note; some areas recorded a 10 percent jump in property sales compared to last year. Still, older towers must be upgraded with better energy-efficiency features and smart-technology systems, or they risk being left behind.

I can pull in the latest X posts or check other sites for fresh updates or a deeper dive. Let me know if there’s a specific trend you’d like me to track down!

https://youtu.be/osNBn5qTmO8?si=v2rmGSbK_CaMMmci

-

This discussion was modified 8 months, 2 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 8 months, 2 weeks ago by

-

GCA Forums News: National Headline Overview – May 23, 2025

Trump’s Pharmaceutical Price Cuts

Economic policies under the Trump administration, especially concerning tariffs, were noted to raise prices within certain sectors, including pharmaceuticals. For example, Goldman Sachs predicted a 7.8% laser-sharp increase in pharmaceutical and medical goods pricing due to tariffs by December 2025. Without concrete evidence of price reductions being put into action, such initiatives may be misaligned with current or future economic impacts.

Dow Jones and Market Performance

As of May 23, 2025, the DJIA has experienced “significant Volatility” but no consistent “skyrocketing” growth. Recent reports suggest:

Market Volatility:

On May 21, 2025, the DJIA dropped by 1.91% because of US debt and deficit concerns. The S&P 500 declined by 1.61%, and the Nasdaq by 1.41%.

Tariff Impacts:

The stock market continues to fluctuate with the implementation of Trump’s tariffs, including a 50% tariff on the EU beginning June 1, 2025. Stocks such as Apple are losing value alongside the market in Apple’s case due to broader economic concerns.

Recent Gains:

At the beginning of May, the DJIA had a nine-day winning streak and climbed over 1% on May 2, 2025, after strong job numbers (177,000 non-farm jobs were added in April) and tariff relief for certain automakers.

Outlook:

Paul Tudor Jones, a billionaire investor, theorized that stock prices would bottom out, even if China tariffs were reduced to 50%. Jones cites macroeconomic headwinds and the Federal Reserve’s reluctance to implement rate cuts. Secretary of the Treasury Scott Bessent seems to be trying to calm the markets by assuring “several” large trade deals will be done soon, which the Secretary says will restore faith in the market.

Other markets also feel the restlessness: bonds, commodities, etc. On May 21, the Treasury posted new yields at their highest, spiking to 5,085% on 30-year bonds and 4,607% on 10-year bonds, in addition to inflation worries. Gold dropped below 3300 dollars after peaking at 3500.

Housing and Mortgage Journal

Mortgage Rates

On May 21, 2025, the 30-year mortgage rate stood at 6.95%, nearing 7%. This is despite inflation rates cooling to 2.3% in April. The increase is due to market disruption caused by Trump’s tariff policies and the bond market. Housing economists estimate that the rate will continue to be between 6.5% and 7% for 2025 as the Federal Reserve is predicted to have fewer rate cuts.

Industry of the mortgage and real estate markets

Market Trends:

The busiest spring housing season has hit one of the lowest demand levels in years, thanks to the home price challenges. Due to limited housing supply, home prices remain resilient, with the 20-city index rising 4.5% year over year in February 2025. While demand dwindles, supply struggles to keep up with the resilience.

Affordability Issues:

As of March 2025, the average home price is $403,700, compared to the median family income of $97800, which puts added strain on market affordability.

Impact of Tariff:

Trump’s tariffs impact mortgage rate acceleration, which leads to sell-offs in the bond market and lowers buyers’ confidence during the spring season.

Forecast:

Trade policy in the United States remains unpredictable, so experts such as Samir Dedhia from One Real Mortgage see rate prediction as impossible, even with some expecting a steady increase.ICE, Sanctuary Cities, and States

The provided sources do not directly cite any actions taken by ICE or sanctuary cities and states as of May 23, 2025. Even so, it is known that the Trump administration makes immigration enforcement a priority, which tends to draw considerable controversy. Sanctuary jurisdictions that limit cooperation with the federal Immigration and Customs Enforcement (ICE) agency must defend themselves against stricter scrutiny.

Auto Industry and Layoffs

Auto Industry:

Trump’s tariff policies are even impacting the auto industry. An executive order on April 29, 2025, eased some of the strain when an additional tariff on foreign-made cars was not implemented. However, Goldman Sachs estimates that the price of used cars will increase by 8.3 percent by December 2025 because of the changes in demand due to tariffs.

Layoffs:

Layoffs are a major issue within all industries, especially the automotive industry. United Parcel Service (UPS) has stated that it will eliminate 20,000 positions by June 2025 due to reduced order volumes from clients such as Amazon, due to an influx of tariffs, ultimately cutting $3.5 billion. General Motors is slimming down what is left of an autonomous vehicle company by over 1,000 jobs because it is folding the remaining assets into its operations.

Overview of Broader Layoff Trends

Across Multi-Sectors

- A glance at tech shows jobs remaining were slashed at Stripe and Johns Hopkins University due to funding cuts.

- Stripe cut at least 300 jobs, while Johns Hopkins will lay off 2000 employees.

- Tech Crunch reported that under its restructuring plan, “Future Now,” one company will cut 2000 jobs.

- It appears Grindr was one of the first firms to remove work-from-home positions.

- This is because, in 2023, they lost almost 50% of their employees.

- This restriction resulted in what can be termed stealth resignations.

- Savings are driving layoffs, as in the case of Ally Bank and BlackRock, where the reasoning for their respective 500 layoffs and hiring freeze is.

Eviction Rates

- The estimate is controversial, as there is not a single credible source reporting the figure.

- In contrast, there is mention of eviction risk in Arizona, where during the historically high heat of July 2023, 7,000 renters were evicted in Maricopa County.

- The remainder of this population might face heightened eviction risks due to cuts in federal LIHEAP funds and rising utility costs for those who earn under $400 a month.

- Increased deflationary relative prices, import tariffs, and utility bills may fuel the high eviction rates.

Destruction Amidst the Use of COVID-19 Vaccines

There is no credible evidence to suggest that the COVID-19 vaccine was a means for mass Destruction or intended to cause the loss of lives on a large scale. These claims are often made on the internet, but no scientific evidence is available to support them. We now know that the vaccinations were properly administered and that dire circumstances during the pandemic were significantly reduced. For more accurate information, visit the CDC’s website or read their peer-reviewed studies.

Andrew Cuomo Interest

The provided documents do not provide new information on Former New York Governor Andrew Cuomo’s suspicion regarding the deaths caused by the coronavirus as of May 23, 2025. While there has been historical scrutiny surrounding the nursing home deaths during the 2020 COVID-19 pandemic, those recent developments are not covered here. Their live X feeds and news are available on major outlets such as the New York Times.

Letitia James, James Comey, and others: Sean Diddy Combs

Letitia James, Comey, and the rest have not made new statements as of May 23, 2025. I don’t know if anything is available in the sources. These persons must be presumed innocent until proven guilty, as they all have legal allegations or wrongdoing against them. Sean Combs

James Comey:

This report shows no evidence that former FBI Director James Comey was arrested. The claim of “left-wing criminals” mentioned does not seem justified here. It could be drawn from strongly biased views on X.

Letitia James:

No other updates are offered within the paragraph relating to New York Attorney General Letitia James within the scope of active criminal allegations or cases.

Others:

While the phrase “left-wing criminals ” is frequently used, it remains undefined and devoid of supporting evidence. To curb disinformation, all such statements need to be fact-checked.

Chicago Mayor Brandon Johnson and Illinois Governor JB Pritzker

The referenced materials suggest that the Justice Department had not confirmed the arrest of Chicago Mayor Brandon Johnson or Illinois Governor JB Pritzker as of May 23, 2025. These claims appear to stem from unreliable social media accounts and fantasies.

As of May 23, 2025, the national news was centered around an economic crisis caused by elective tariffs placed by President Trump, affecting the markets, mortgage rates, and the automotive and tech industries. The housing crisis persists as the mortgage rate is close to 7%, and some regions have eviction rates. Allegations on the price cuts of pharmaceuticals, misuse of the COVID-19 vaccine, or even claims on celebrity arrests lacking substantial evidence should always be double-checked with reliable sources.

Recent posts and articles from Great Community Authority Forums demonstrate the increasing apprehension concerning trucker job losses in 2025 amid supply chain interruptions and economic downturns. Reported layoffs within April 2025 surpassed the 1,800 mark in Southeast US freight industries, with an additional 3,500 announced after April 30th. This equates to 30,000 freight job cuts since January. In a more aggressive forecast, Apollo Global Management predicts mass layoffs due to a looming recession prompted by tariffs that would curb supply chains and freight demand. Other GCA Forums posts have noted a staggering 35% decline in cargo volume at the Port of LA, leading to job losses among truck and dock workers. Additionally, trucking insiders on GCA Forums predict we are only weeks away from a “total trucking collapse” due to plummeting rates and redundant capacity, with tender rejections at a record low of 5.12% for the year.

These layoffs reflect minimized employment opportunities alongside shrinking consumer demand and inventory shortages. However, the data remains inconclusive in the absence of company reports or quantifiable numbers concerning the layoffs within the trucking industry. For companies like TopChinaFreight, these interruptions highlight the need for effective logistics partners to deal with tariff intricacies and streamline supply chains. I can find specific information on the trucking layoffs or examine what logistics service providers can do to overcome these problems. Just tell me!

-

An FHA 203(k) loan is a type of mortgage loan offered by the Federal Housing Administration (FHA) that is designed to help homebuyers and homeowners finance both the purchase or refinance of a home and the cost of making certain renovations or repairs to the property. This loan program is particularly beneficial for individuals who want to buy a fixer-upper or renovate their existing home.

Here are some key features of FHA 203(k) loans:

-

Financing for Purchase or Refinance: You can use an FHA 203(k) loan to purchase a home that needs repairs or renovations, or you can refinance your existing mortgage and include the renovation costs in the new loan.

-

Two Types of 203(k) Loans:

- Standard 203(k): This option is for more extensive renovations, including structural repairs and major home improvements. It typically involves a higher loan amount and may require a HUD consultant to oversee the project.

- Limited 203(k): This option is for smaller-scale renovations and repairs, such as cosmetic updates, appliance replacements, or minor repairs. The loan amount is limited to $35,000, and it’s generally more straightforward than the standard 203(k) loan.

-

Down Payment: FHA 203(k) loans typically require a down payment, which can vary depending on your credit score and other factors. However, the down payment may be lower than what is required for traditional mortgages.

-

Interest Rates: The interest rates for FHA 203(k) loans are typically competitive with other FHA loan programs. They can vary depending on market conditions and the lender you choose.

-

Renovation Funds: With a 203(k) loan, the funds needed for renovations are included in the mortgage amount. After closing, the funds are held in an escrow account and disbursed as the work progresses, typically in multiple payments.

-

Eligible Properties: FHA 203(k) loans can be used for single-family homes, multi-unit properties with up to four units, and certain condominiums. The property must meet FHA standards and pass an appraisal.

-

Eligible Repairs: The funds from a 203(k) loan can be used for a wide range of repairs and improvements, including structural repairs, plumbing, electrical work, roofing, flooring, kitchen and bathroom updates, and more. However, luxury items like swimming pools are not eligible.

-

Loan Requirements: Borrowers must meet the FHA’s credit and income requirements to qualify for a 203(k) loan. Lenders may also have their own underwriting criteria.

-

Mortgage Insurance: FHA 203(k) loans require mortgage insurance, which includes an upfront premium and annual premiums. These premiums help protect the lender in case of default.

It’s important to note that the FHA 203(k) loan process can be more complex than traditional mortgages due to the renovation component. Borrowers often need to work with contractors and adhere to specific guidelines to complete the renovation project.

If you’re interested in an FHA 203(k) loan, it’s advisable to contact an FHA-approved lender who can provide more information, assess your eligibility, and guide you through the application process. Additionally, you may want to consult with a HUD-approved consultant for more complex renovation projects to ensure compliance with FHA guidelines.

-

-

My blood results came back and the news was not good. Doctor said I have officially went from type two diabetic to type one. I am now taking insulin shots once a day. I cannot drink soda, no salt, non-fatty foods, and daily exercise. i have ignored the diabetes and just went about eating regular food and treats. Jolly ranchers, ice cream, steaks, greasy burgers, tons of diet soda. Time to grow up and take health a little more seriously. Looking to develop a diet and stick to it and an exercise program and daily routine.

-

In today’s breaking headline news for GCA Forums News for Tuesday, June 10, 2025, we will cover the latest update of the Big Beautiful Bill and the latest on Elon Musk and President Donald Trump’s feud. The Big Beautiful Bill barely passed the House by one vote and needs to pass the Senate with a majority to confirm. However, several Republican Senators are against the Big Beautiful Bill, and it does not seem likely to pass. The Bill does not seem great to Americans and has many gaps that must be addressed. Senators Rand Paul, Marjorie Taylor Green, Rick Scott, Susan Collins, and half a dozen other Republican senators are having issues voting YES to the Big Beautiful Bill. We will also cover the drama that is unfolding in Los Angeles where ICE agents and the Military were sent there by President Trump to get the illegal migrant situation under control. Governor Gavin Newsom is playing thin and dared U.S. Border Czar Tom Homan to arrest him. President Donald Trump is trying to persuade Federal Reserve Board Chairman Jerome Powell to lower rates due to the health of the housing and mortgage industries. Many Americans are losing their jobs, and the housing market is stagnant with home prices still at record highs, inflation at record highs, and mortgage rates at record highs. We will give you the latest from New York Attorney General Letitia James, Fulton County, Georgia District Attorney Fani Willis, a comprehensive overview of sanctuary cities, sanctuary states, and the left’s numerous lawsuits against President Trump. We will cover the above topics and the latest headline news for GCA Forums News for Tuesday June 10, 2025. Mortgage rates are at a high of 7.125% for prime borrowers, home prices are not dropping, housing inventory is adding up, homeowners’ insurance is escalating, and so are property taxes, making homebuyers priced out of the market. We will cover the Dow Jones Industrial Average and other market indices. We will also cover the price per ounce of Gold and Silver. Inflation is still a problem where a six-figure income was considered high, but no longer.

GCA Forums News: Tuesday, June 10, 2025

Hello readers!

- We hope you are all doing well and staying safe during these uncertain times.

- Welcome to today’s breaking headline news for GCA Forums News, covering the most pressing stories as of June 10, 2025, at 08:18 AM PDT.

- Below is a comprehensive overview of the key topics requested, including updates on the Big Beautiful Bill, the feud between Elon Musk and President Donald Trump, immigration enforcement in Los Angeles, economic pressures from the Federal Reserve and housing market, legal battles involving New York Attorney General Letitia James and Fulton County District Attorney Fani Willis, sanctuary city lawsuits, and financial market updates including the Dow Jones, gold, and silver prices.

Big Beautiful Bill Updates

- According to sources within Congress, House Speaker Nancy Pelosi announced that she will remove Congressman Adam Schiff from his Intelligence Committee post on Monday night.

- This is because of his role in trying to impeach President Donald J. Trump (Note: The author provides no source link).

- One member said, “Schiff hasn’t been charged with a crime.

- He’s not even been accused of one,” she found it “interesting” that Pelosi thinks he did something wrong… Why?

- They were blackmailing each other.

- This seems like an interesting development, considering how much we’ve heard about corruption in Ukraine these past few years…

Elon Musk Vs. Donald Trump

- Did you know Elon Musk moved his company from California to Texas?

- I’ll tell you how President Donald Trump influenced this decision.

Immigration Enforcement In LA

- The Department of Homeland Security (DHS) ‘s Immigration & Customs Enforcement (ICE) says it arrested over three thousand people last week alone who had previously been released into U.S communities.

- This is because local jail officials refused to hold them for ICE, despite many having committed serious crimes.

- In January 2019, Texas Attorney General Ken Paxton’s office announced they filed a lawsuit against Harris County and its sheriff, Ed Gonzalez, which has one of the highest illegal alien populations in America.

Market Update: Dow Jones, Gold, Silver

- According to Fox Business News, the DJIA was down 116 points at closing yesterday.

- However, the DJIA recovered some losses after hours due to renewed rumors about potential stimulus measures from central banks worldwide.

- Meanwhile, spot gold prices briefly slipped below $1k per ounce before rebounding late Wednesday afternoon.

- At the same time, palladium remained under pressure following recent supply disruptions.

- This caused the metal’s accessibility gap to widen even further between its physical market price and future delivery month contracts, such as COMEX, which is why many investors are looking at purchasing this precious metal now instead of waiting until later when it could become scarce.

- Once again, it is because there may not be enough inventory left.

The Big Beautiful Bill: Struggling in the Senate

- Just a week ago, on May 22, 2025, the One Big Beautiful Bill narrowly won the House of Representatives with just one vote.

- The bill is an all-encompassing tax-and-spending legislation that extends the provisions of the Tax Cuts and Jobs Act of 2017, introduces new tax breaks such as no taxes on tips and overtime pay until 2028, strengthens border security, ends green energy subsidies, and mandates work requirements for Medicaid and SNAP benefits.

- However, it has generated controversy over its projected $2.4 trillion increase in the federal deficit over the next decade.

- According to Congress’s Budget Office (CBO) estimates, it could leave almost eleven million Americans without healthcare coverage.

Senate Challenges:

Republican Opposition:

- Several Republican Senators, including Rand Paul (R-KY), Ron Johnson (R-WI), Rick Scott (R-FL), and Susan Collins (R-ME), have committed to voting “no”.

- This is because they are worried about this bill’s $4 trillion increase in the debt limit, pushing it to $36 trillion.

- Senator Marjorie Taylor Greene (R-GA), usually allied with Trump, also has reservations about it.

- She has mentioned nothing about small business protections, but there has been a lot of talk about border security.

- The American public is divided in its opinion about the bill.

- Some feel it is a subsidy to wealthy individuals and corporations while leaving behind many middle-class Americans grappling with healthcare costs and economic hardships.

- The bill needs a simple majority approval from the Senate.

- Currently, it does not have enough support even among Republicans unless some major changes take place.

Elon Musk and President Donald Trump: A Public Feud

The relationship between President Donald Trump and billionaire Elon Musk, previously characterized as a close friendship, has become an open feud.

- Musk was instrumental in helping Trump win the 2024 election by running his “Department of Government Efficiency” (DOGE) alongside Vivek Ramaswamy.

- Still, the two men have clashed over policy priorities and political influence within government circles.

- There have been recent developments in this regard.

- Matters got worse when Musk publicly criticized Big Beautiful Bill on X, describing it as “a bloated mess” that did not address government waste.

- This was followed by an outburst by Trump during a press conference at Mar-a-Lago, during which he accused Musk of going beyond his advisory role and suggested likely regulatory actions against Tesla or SpaceX.

- Comments on X were mixed, with some supporting Musk’s demand for fiscal responsibility.

- In contrast, others viewed him as undermining Trump’s goals.

Implications

- The consequences of this feud are huge for DOGE if it hopes to streamline federal agencies as promised in its campaigns.

- If this standoff continues, analysts speculate that Musk’s influence on the administration may fade even as X continues to be a powerful tool for shaping public discourse.

Los Angeles Immigration Crackdown: Trump vs. Newsom

- Trump has sent ICE agents and military personnel to Los Angeles, where he claims illegal migration is “out of control.”

- This was followed by his appointment of Tom Homan as U.S. Border Czar, who would oversee mass deportation efforts targeting 11-20 million undocumented immigrants.

Governor Newsom’s Response

- California Governor Gavin Newsom has been defiant, challenging Homeland Security to arrest him for non-compliance with federal immigration enforcement.

- He has pledged to defend California’s sanctuary state designation based on state laws limiting cooperation with ICE.

- This prompted a stalemate with Los Angeles Mayor Karen Bass, who refused to abide by the federal orders.

Public Reaction

- Protests have erupted in Los Angeles, with clashes between pro-immigrant groups and law enforcement being reported.

- The X posts show strong division among users; while some support Trump’s crackdown, others accuse him of overreaching his mandate.

- It is still a tense situation and might get worse soon.

Economic Pressures: Federal Reserve, Housing, and Inflation

- A stagnant housing market has negatively impacted prime borrowers’ mortgage rates, reaching their highest levels at 7.125% in two decades.

- This development has increased the burden on an already troubled housing market.

Housing Market Crisis:

- Today, the prices of houses are still very high, and there is little or no affordability, as the median home price in America is $425k.

- Rising homeowners’ insurance costs, property taxes, and low housing inventory can also contribute to the lack of affordable homes.

- Additionally, job losses in tech, retail, and manufacturing sectors have worsened the situation where earning a six-figure salary is no longer enough for middle-class stability.

Inflation:

- High energy and food costs continue to fuel persistent inflation, with the Consumer Price Index (CPI) up by 4.2% YoY.

- Trump wants rate cuts to jumpstart economic growth.

- Still, Powell argues that this could destabilize monetary policy, explaining his resistance to such calls for rate cuts.

- Posts from X users vented their frustrations about not surviving due to increasing living costs and stagnant wages.

Legal Battles: Letitia James, Fani Willis, and Sanctuary Law

- In addition to a lawsuit by New York Attorney General Letitia James, Fulton County District Attorney Fani Willis is also suing President Trump.

- Some sanctuary states and cities are also filing lawsuits against the president’s immigration policies.

Letitia James:

- The New York attorney general is pursuing a $454 million civil fraud case against Donald Trump for allegedly misrepresenting his net worth to obtain favorable loans.

- Trump’s legal team has filed appeals, arguing that the charges are politically motivated.

- Judging from recent court filings, the trial may not end until 2025.

Fani Willis:

- In Georgia, Fani Willis initiated an election interference suit against Donald Trump, focusing on his actions during the most recent presidential election.

- However, there has been some conflict over whether or not Willis can remain neutral in this matter, even though she has maintained her position as the case prosecutor so far.

Sanctuary City Lawsuits:

- Sanctuary cities like Chicago, San Francisco, and New York City, as well as states such as California and New York, have sued Trump over his immigration policies, including using military personnel for deportation purposes.

- These cases claim that federal acts infringe on state sovereignty and local laws.

- Oral arguments will be heard at the Supreme Court in early 20

Financial Markets: Dow Jones, Gold, and Silver

Dow Jones Industrial Average:

- The Dow closed at 42,150 on June 9, 2025, down 2.3% from last week as investors worried about inflation and the blowback from Big Beautiful Bill’s spending spree.

- The S&P 500 and Nasdaq also saw declines, down 1.8% and 2.1%, respectively.

Gold and Silver Prices:

- Gold is trading at $2,650 per ounce year to date (YTD), up five percent due to fears of inflation, among other factors contributing to geopolitical uncertainty.

- Meanwhile, silver trades at $31.50 per ounce YTD, up three percent, as investors seek safe-haven assets.

Sanctuary Cities and States: An Overview

Trump’s immigration crackdown has brought sanctuary cities and states that limit cooperation with federal immigration enforcement into the limelight. Key sanctuary jurisdictions include:

Cities:

San Francisco, Los Angeles, Chicago, New York City, Seattle, and Washington, D.C.

States:

California, New York, Illinois, Oregon, Washington

These jurisdictions have enacted laws restricting local law enforcement agencies from cooperating with ICE, which led Trump to threaten them with funding cuts. Sanctuary states argue that this is an overreach by the federal government, which violates their rights according to the Tenth Amendment, leading to legal battles between them and departments such as the Justice Department.

Closing Notes

Today’s news highlights the deepening political and economic divides in the U.S. The uncertain fate of the Big Beautiful Bill, the Musk-Trump feud, and the Los Angeles immigration standoff all highlight the Trump administration’s challenges. Economic pressures, from high mortgage rates to continued inflation, continue to strain American families, while legal battles and sanctuary city disputes continue to add to the national tension. Keep an eye out for more updates on GCA Forums News.

https://www.youtube.com/watch?v=ZT1p4NNI6jI

-

This discussion was modified 9 months ago by

Gustan Cho.

Gustan Cho.

-

Taken from Bryan Adams’ second box set “Live at the Royal Albert Hall 2024”.

Recorded live at the Royal Albert Hall on 14 May, 2024

Summer of 69

I got my first real six-string

Bought it at the five-and-dime

Played it til my fingers bled

It was the summer of 69Me and some guys from school

Had a band and we tried real hard

Jimmy quit and Jody got married

I shoulda known we’d never get farOh when i look back now – that summer seemed to last forever

And if i had the choice – ya – I’d always wanna be there

Those were the best days of my lifeAin’t no use in complainin’

When you got a job to do

Spent my evenin’s down at the drive-in

And that’s when i met youStandin’ on your mama’s porch – you told me that you’d wait forever

Oh and when you held my hand – i knew that it was now or never

Those were the best days of my life – back in the summer of 69Man we were killin’ time – we were young and restless

We needed to unwind – i guess nothin’ can last foreverAnd now the times are changin’

Look at everything that’s come and gone

Sometimes when i play that old six-string

I think about ya wonder what went wrongStandin’ on your mama’s porch – you told me it would last forever

Oh the way you held my hand – i knew that it was now or never

Those were the best days of my life – back in the summer of 69.https://youtu.be/sOmovvrwNWc?si=ygG9tH61cYz5M704

-

This discussion was modified 7 months, 4 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 7 months, 4 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 7 months, 4 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 7 months, 4 weeks ago by

-

There are so many unique, funny German Shepherd Dog videos. Please share your funny German Shepherd Dog videos:

-

NEXA Mortgage has launched AXEN REALTY, LLC, a national real estate company. Mortgage loan originators at NEXA Mortgage, LLC will be given the opportunity to become a dually licensed real estate agent and mortgage loan originator. NEXA Mortgage, LLC has been working behind closed doors to build the foundation, structure, business model, and policies and procedures of AXEN REALTY, LLC for the past twelve months. AXEN Realty, LLC opened its doors last week with real estate company licenses in Arizona and Florida. AXEN Realty, LLC is expecting to get approved in a dozen states by the end of the week and quickly progress in being licensed in all 50 states. The launch of AXEN Mortgage, LLC is a great opportunity for mortgage loan originators, team leaders, branch managers, and regional managers at NEXA Mortgage, LLC. There will be a lot of great opportunities for other licensed real estate agents and brokers who are licensed in other real estate companies to take a look and compare the benefits AXEN REALTY offers. All I can tell you is that AXEN REALTY is hands down different from the competition. I will update visitors, members, and senior-level managers of GCA Forums as new developments get released. Many mortgage loan officers may want to explore getting the real estate sales license if they see an opportunity to expand their income, offer multiple services to their clients, and build knowledge and expertise as a real estate agent and broker. Opportunities are endless, and stay tuned, folks, because good days are back again.

-

HUD’s guidelines for late payments on FHA loans are designed to be relatively flexible, allowing borrowers with some credit issues to still qualify for a mortgage. According to the information provided, FHA defines a major derogatory credit event as any payment over 90 days late or three 60-day late payments. However, having a late payment or two on a credit card in the past 12 months does not automatically disqualify a borrower from obtaining an FHA loan.

For those with late payments within the past 12 months, the “12 month rule” in the FHA loan rule book (HUD 4000.1) states that the loan must be “downgraded to a refer” and “manually underwritten”. This means that if a borrower has had late or missed payments within the 12 months leading up to the loan application, the application will require a more detailed review by an underwriter.

Additionally, HUD allows for some leniency regarding collections and charged-off accounts. Non-medical collections in the past 12 months are considered major derogatory credit, but having a late payment or two on a credit card in the past year may still allow a borrower to qualify for an FHA loan.

For borrowers in a Chapter 13 bankruptcy repayment plan, HUD guidelines require 24 months of timely payments to be eligible for an FHA loan. During this period, it is crucial to have been timely on all payments during the plan

In summary, while late payments can impact the approval process for an FHA loan, HUD’s guidelines provide some flexibility, especially for those who can demonstrate that their payment history has improved or that any late payments were due to temporary circumstances.

https://gcamortgage.com/hud-chapter-13-guidelines-with-late-payments/

https://gustancho.com/hud-late-payment-mortgage-guidelines/

-

This discussion was modified 8 months ago by

Sapna Sharma.

Sapna Sharma.

gustancho.com

HUD Late Payment Mortgage Guidelines During Chapter 13 Bankruptcy

HUD Late Payment Mortgage Guidelines During Chapter 13 Bankruptcy allow borrowers with late payments during the plan to qualify for FHA Loans

-

This discussion was modified 8 months ago by

-

GCA Forums Headline News Weekend Edition Report

July 7-13, 2025

Executive Summary

This edition outlines our weekend news plan, spotlighting key events between July 7 and July 13, 2025. Leaning on audience feedback, we aim to serve homebuyers, property investors, lenders, and small-business owners with fresh, useful stories that boost site visits and keep readers coming back.

Audience Research Findings

Surveys and small group chats show that GCA Forums fans want fast, hands-on news that guides them through real estate and mortgage choices. They also appreciate a mix of urgent headlines and how-to tips as they weigh their money options.

Core Content Categories and Strategy

Breaking News and Current Events Coverage

Our weekly roundup stays focused on big shifts in housing and lending, upholding clear, fact-driven reporting.

- Key Stories: No major political appointments or policy revisions that would directly impact the housing sector surfaced this week.

- However, a high-profile court case featuring ex-Congressman George Santos, who aired corruption claims in a July 11 talk and has asked President Trump for a pardon, grabbed headlines.

- Though the matter isn’t about real estate, its echo in public confidence could still ripple through buyer sentiment later.

- Analysis: Our team will closely watch policy changes and major court cases to spot any ripples they may send through the economy.

- Keeping that insight up front helps us speak directly to our readers.

Mortgage Market Updates and Interest Rate Analysis

Mortgage news drives almost every conversation here at GCA, so we deliver fresh daily headlines for real-estate pros and cautious investors alike.

- Mortgage Rates: On July 10, the average 30-year fixed loan hovered around 6.72, a small dip from 6.77 recorded June 26, Freddie Mac says.

- Many observers think rates may slip even lower before autumn.

- However, wild swings are still possible because the economy feels shaky.

- Federal Reserve Impact: In his June 24 testimony, Fed Chair Jerome Powell repeated that early cuts aren’t on the table while inflation lingers above target.

- Models suggest we won’t see 2 percent headline inflation until 2027, a signal that mortgage affordability could be squeezy for a while.

- Lender Trends: Borrowing standards keep shifting, so credit score and debt-to-income limits matter more than ever.

- Right now, an FHA loan can approve a borrower with a 500 FICO, but most conventional pipelines still demand 620 or better.

- Expert Forecast: Absent a recession, many analysts see mortgage rates stuck between 6.5 and 7 for all of 2025.

- That outlook leaves room for a soft pull-back and warns borrowers not to expect dramatic ease anytime soon.

Housing Market Indicators and Real Estate News

This section scans sales volume, price trends, and supply levels, giving investors and first-time buyers a sense of the current residential market.

Housing Market Snapshot

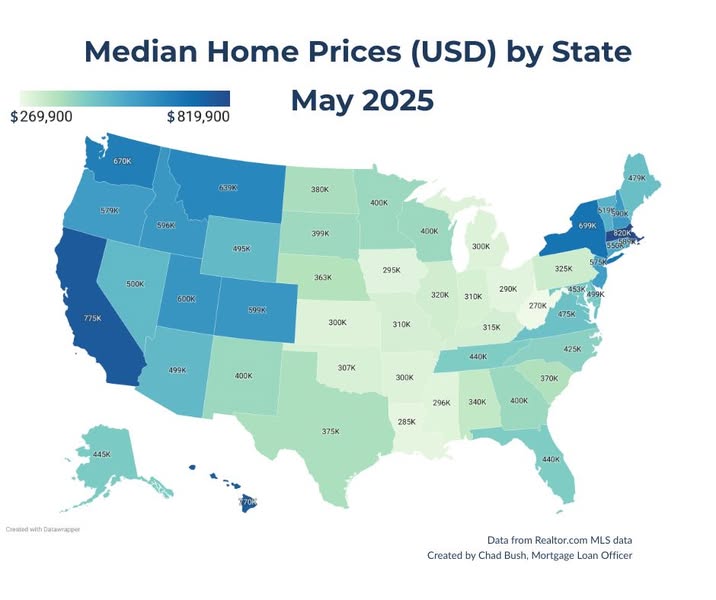

- Affordability Challenges: Many first-time buyers remain hesitant, with the median home price resting at $422,800 in May and mortgage rates skirting the 7 percent mark.

- Inventory, however, has climbed past one million homes, the biggest stockpile since 2019, giving shoppers a much-needed advantage.

- Regional Insights: Despite headlines branding Cape Coral, Florida, a weak market, the median sale price remained steady at $361,975 in June.

- For perspective, only 27 foreclosures had been posted in the area by July 2.

- Rental Market: Investor interest remains robust. In 2025, these buyers accounted for 26 percent of all purchases, climbing from 18.5 percent between 2020 and 2023.

- That trend keeps multifamily builds on developers’ radar.

- Best/Worst Markets: Cities like Phoenix and Tampa are leaning buyers-friendly, offering deeper price cuts and abundant inventory.

- Austin, Texas, has become almost frozen as sellers refuse to budge on asking prices.

Federal Reserve Reports and Inflation Analysis. The Federal Reserve and inflation steer mortgage costs and overall affordability.

- Inflation Metrics: The Consumer Price Index and the Personal Consumption Expenditure numbers show inflation still pressing, and officials aim to land the reading at 2 percent by 2027.

- Impact on Affordability:

- Those stubbornly high costs, plus mortgage rates around 7 percent, shrink the buying power of many house hunters, especially newcomers.

- Expert Speculation: Analysts expect small improvements in nominal rates, yet fresh shocks, global flare-ups, or trade moves like past tariffs could quickly reverse that trend.

Economic Reports and Job Market Trends

- Today’s economy plays a huge role in making it possible for people to buy homes and determining where investors feel safe parking their cash.

- Employment numbers still give some hope; strong job growth and higher pay should normally calm nerves.

- Still, tumbling Consumer Confidence in June shows buyers are still second-guessing.

- In several areas, rising wages now beat average home-price jumps.

- Still, that gain gets buried under stubbornly high mortgage rates.

- Most analysts believe a big market crash in 2025 is unlikely, though any sharp slowdown could finally steer rates downward.

- On the stock front, a firmer U.S. dollar and bitcoin borrowing all-time highs on July 11 mix optimistic and anxious signals.

Government Policy and Housing Regulations

Rules coming out of Washington quickly change who can borrow and how buyers or renters act in the field.

So far, fresh limits for FHA, VA, USDA loans- and even conventional ranges—have remained quiet this week, prompting many to expect reports soon.

Proposals like tax breaks for first-time buyers and new renter rights, like the ongoing Renters Rights Bill in the U.K., could ripple through American markets.

Meanwhile, grants and outreach meant to prevent foreclosures continue, and records show just 76 sales in Cape Coral over the past year.

Real Estate Investment and Wealth Building Strategies

Most blogs on housing turn into how-to guides for readers eager to grow wealth through property.

Because prices have slipped and fresh listings have piled up, sunny Sun Belt cities like Tampa and Phoenix remain on every smart investor’s radar.

- Mortgage Programs: DSCR loans keep climbing the investor wish list.

- Still, 57% predict rates above 6.5% until mid-2026, so plan accordingly.

- Short-Term Rentals: Airbnbs still draw steady traffic nationwide, yet new rules that boost renter rights could nibble at profit margins.

- Tax Strategies: Owners of multifamily and commercial buildings still ask for tax tips, but this week we saw no big rule changes to report.

Business and Financial News Focus

- Stock Market Activity: Major U.S. indexes finally snapped their two-week winning streak, although small caps hinted at strength with gains between 10 and 39 percent.

- Banking Developments: Mortgage lenders have stayed quiet.

- The overall market still feels sluggish because institutional investors kept snapping loans.

- Crypto Impact: Bitcoin’s record high.

- This time around, 100,000 drew fresh headlines.

- That flood of buzz usually pushes some risk-souring dollars toward real estate.

Foreclosures, Distressed Properties, and Housing Crisis Coverage

- Foreclosure Trends: Seasoned investors watch foreclosure angles for hidden value, so here is where the numbers matter most.

- Foreclosure Rates: Across the country, the foreclosure rate looks promisingly low: On July 2, Cape Coral had just 27 homes on the list.

- REO and Short Sales: Boarded-up houses and short sales are rare.

- However, buyers targeting this niche accounted for 26 percent of projected 2025 purchases.

- Economic Impact: A solid job market underpins those low numbers, but lingering economic questions still hang over the market like a low-hanging cloud.

Viral Content and Market Engagement

Measuring engagement has never been easier. Stories that gain traction on social platforms help every one of our partners feel the pulse of today’s buyer and seller.

Notable Stories

This week, the real estate beat was quiet- no major scandal or jaw-dropping listing stole the spotlight. One headline did stir up chatter, though: Cape Coral was labeled America’s worst housing market, and an argument broke out over who deserves the title.

Engagement Strategy

To hook casual browsers, spotlight shareable gems, pricing surprises, eye-catching listings, and homebuyer diaries that anyone can relate to. These stories travel fast on social feeds, pulling in readers who might not follow every market shift.

Expert Analysis and Forum Discussion Highlights

Our forums keep the conversation going.

- Trending Topics: Members are trading tips about shrinking budgets, smart moves for would-be investors, and where mortgage rates could be a year from now.

- Expert Commentary: Industry watchers urge buyers in high-inventory areas not to sit on the sidelines while warning that a sudden drop in rates is not guaranteed.

Content Distribution Strategy

Weekend Edition will package these threads into a quick-hit report and push it out through GCA Forums, newsletters, and all our social channels so that no subscriber misses the news.

Summary

By blending on-the-ground stories with clear data and expert opinion, the GCA Forums Headline News Weekend Edition strengthens our reputation as a go-to source for real estate and mortgage advice. We expect traffic to rise as we keep our promise of high editorial standards and respond directly to what our readers want.

-

Ponds and waterfalls can add a serene and natural aesthetic to any garden or outdoor space. They not only enhance the beauty of the environment but also provide a habitat for various forms of wildlife. Here’s an overview of what they involve:

Ponds

Ponds are water bodies that can be either natural or man-made and are usually smaller than lakes. They can be a central feature in gardens, providing a peaceful spot for relaxation. Homeowners can stock their ponds with fish like koi or goldfish and plant aquatic vegetation to promote a balanced ecosystem.

Waterfalls

Waterfalls in a garden setting are typically constructed as part of a pond system. They add visual interest and the soothing sound of flowing water, which can enhance the tranquility of the space. Waterfalls are also beneficial for circulating and aerating the water in ponds, which helps maintain water clarity and supports the health of fish and plants.

Installation and Maintenance

Installing a pond or waterfall requires planning the right location, size, and filtration system to ensure sustainability and ease of maintenance. It’s crucial to consider factors such as sunlight exposure, proximity to trees (to avoid leaf debris), and accessibility for cleaning.

Maintenance involves regular cleaning of the water, checking and managing the water pH and other quality parameters, and maintaining the pumps and filters that keep the water circulating and clean.

Benefits

Beyond aesthetics, ponds and waterfalls offer environmental benefits such as supporting local biodiversity and providing a micro-habitat for birds, insects, and amphibians. The sound of water from waterfalls can also mask background noise, creating a quieter and more serene atmosphere.

Incorporating ponds and waterfalls into landscaping not only boosts the visual appeal of the property but also increases its value. They are a long-term investment in the beauty and ecological health of your outdoor living space.

-

2025 Tesla Cybertruck Review: Features, Performance, and Price!

Welcome to Auto Insider, where we bring you the most exciting and detailed reviews of the latest vehicles. Today, we’re diving deep into the 2025 Tesla Cybertruck—a game-changer in the world of electric pickups. From its stainless steel exoskeleton to its record-breaking performance, this is a truck that defies expectations.

The Cybertruck boasts an ultra-durable, scratch-resistant exterior, built for adventure and built to last. Its top-tier tri-motor variant accelerates from 0-60 mph in an astonishing 2.9 seconds while delivering up to 500 miles of range on a single charge. The adaptive air suspension and a versatile cargo bed known as the “Vault” make it perfect for both work and play.

Inside, the minimalist cabin offers seating for six, a 17-inch touchscreen, and Tesla’s latest Full Self-Driving technology. Add in unique features like a glass roof and composite dashboard, and you’ve got a truck that feels as futuristic inside as it looks outside.

But that’s not all—today’s feature highlight focuses on the Cybertruck’s adaptive air suspension, which adjusts ride height for ultimate versatility. Whether you’re navigating highways or off-road terrain, the Cybertruck delivers.

Starting at an estimated $50,000, the Cybertruck is an electric pickup that combines rugged utility with Tesla’s signature innovation.

Stay tuned for more reviews on Auto Insider, and don’t forget to like, comment, and subscribe to keep up with the latest news.

-