Lisa Jones

Dually LicensedForum Replies Created

-

Thank you for your feedback. You raised several important questions. Below, I address each point, clarify key considerations, and introduce additional questions for further evaluation.

Your Questions, Clarified and Expanded

How Net Branch Mortgage Managers Are Compensated. Inquire not only about the pay structure but also request a detailed example illustrating how gross lender-paid compensation is converted into your net take-home pay. Identify all company deductions applied before any splits.

Determine whether there are production requirements and whether the revenue programs are mandatory or optional. Verify the maximum compensation a loan officer can earn per loan and whether any caps exist.

Ask if compensation is available in both lender-paid and borrower-paid scenarios. Confirm the timing of payment after closing and whether payments are disbursed per loan or on a monthly basis. Finally, clarify the implications of paying off a loan early or of lender penalties applying.

Self-Generated Leads Versus Branch Leads

Determine whether the company provides leads, their costs, and sources. Ascertain if leads are exclusive to you or shared. Clarify ownership of leads and the client database if you leave. Identify any restrictions on independent marketing or requirements to use company materials. Inquire about collaborating with real estate agents or builders and the compliance procedures for such partnerships. Request written documentation for all terms before signing.

Request a comprehensive list of all branch-related fees, including administrative, compliance, errors and omissions insurance, bookkeeping, training, background checks, wire, NMLS processing, CRM, point-of-sale, and technology fees.

Determine whether these fees are assessed per loan, per month, or per loan officer, and whether they increase as your team grows. Ask if any fees exceed the company’s actual costs, which may indicate profit from overrides. Confirm if there is a minimum production requirement.

Mortgage Net Branch Operatibg As A DBA Of The Parent Company

Determine whether the company permits operation under a doing business as (DBA) name distinct from its corporate name. Clarify if prior approval is required, the approval process, and any guidelines or restrictions on permissible words or phrases. Establish who is responsible for filing the DBA and the associated costs at both the state and county levels.

Confirm whether the DBA will appear on business cards, marketing materials, websites, and loan documents, and whether the company’s name will also be displayed.

Inquire about the ownership and continued use of the DBA if you leave the company. Determine whether pre-approval or firm vetting is necessary. Clarify quality control and compliance oversight for processing, including responsibility for processor errors. Ask if the company recommends a processing partner and whether any contractual obligations or financial incentives exist for using that partner, as this may present a conflict of interest.

Hiring Your Own Processors, LOs, Assistants, and Marketers

Determine whether you may hire your own processors, loan officer assistants, and marketing assistants, or if company approval is required. Inquire about licensing requirements for these roles and whether the company provides financial support for licensing. Clarify whether your staff will operate under your company’s Employer Identification Number (EIN) or the company’s EIN. Assess liability and workers’ compensation coverage for your team. Identify any restrictions on the content your marketing staff may create or distribute on your behalf.

Engaging an Overseas Virtual Assistant Company

This is a key compliance question that is often missed. Ask if the company allows overseas virtual assistants in mortgage operations. Find out if there are tasks overseas VAs cannot do because of confidentiality, state licensing, or federal rules. Since VAs handling nonpublic personal information can create compliance risks under the Gramm-Leach-Bliley Act, ask if the company has a policy on overseas contractors and if your VA company needs a business association.

Confirm if there are NMLS-related restrictions on overseas staff performing specific functions. Clearly define the responsibilities of your virtual assistant team and seek explicit approval from the compliance officer for those tasks.

Ask about the costs and logistics if you need two assistants at once. Also, ask what happens if the net branch company gets licensed in Illinois, and if your contract would require you to move your Illinois business under their company.

Engage a qualified mortgage attorney in Illinois to review any contract prior to execution. This ensures that no provisions inadvertently restrict your business operations within the state.

Other Important Questions You Should AskThe Agreement And Termination Conditions

Clarify the duration of the initial contract phase and whether it renews automatically. Determine the required notice period for termination, specifying whether it is 30, 60, 90 days, or another timeframe.

Ascertain the existence and scope of any non-solicitation agreement, including whether it restricts the transfer of loan officers, employees, referral partners, or customers.

Confirm the presence of a non-compete agreement and whether it is governed by your state’s laws. Identify the financial consequences of early termination. Clarify the status of loans in your pipeline upon providing notice and whether continued use of the company’s system is required for pipeline management after notice is given.

Compliance and Licensing Supervision

Determine who holds the mortgage broker or lender license for your branch in each state. Clarify whether you will operate under the company’s license or require your own in certain jurisdictions. Identify who is responsible for loan officer license renewals and continuing education. Inquire about the process and frequency of compliance audits. Establish procedures for managing regulatory complaints against your branch and for handling legal defense. Confirm the availability of a dedicated compliance officer for ongoing inquiries.

Insurance Protection

Inquire about the company’s errors and omissions insurance, including coverage limits and whether it extends to your branch and loan officers. Determine if you are required to obtain separate coverage. Ask about the necessity of fidelity or surety bonds and the party responsible for payment. If you maintain a physical office, confirm whether general liability insurance provides adequate protection.

Accessibility of Lenders and Available Products

Determine the number and identity of approved wholesale lending partners. Verify whether any of your current lenders are excluded, and the process for adding them. Inquire about the existence of preferred lenders, associated incentives for directing business to them, and the disclosure of such incentives to borrowers. Ensure that your branch can offer the full range of required loan products, including conventional, FHA, VA, USDA, jumbo, non-QM, renovation, reverse, and construction loans.

Technology Platform

Inquire about the loan origination system utilized by the company and whether it aligns with your prior experience. Determine the availability of a point-of-sale system for online applications and document collection. Ask about the functionality of the pricing engine and access to real-time lender pricing. Confirm the CRM system’s compatibility with your existing tools or virtual assistant arrangements. Establish whether the technology platform is developed in-house or relies on established third-party solutions. Finally, request information regarding training, support, and the onboarding process for the technology platform.

Training and Support

Clarify the onboarding support structure for new branch managers and their teams. Determine whether your branch will have a dedicated account manager or support contact. Inquire about the process for addressing compliance questions, including the designated contact for complex loan scenarios and expected response times. Additionally, ask about the availability of training webinars, mastermind groups, or other resources to support ongoing education for loan officers.

Ownership and Equity

Inquire about opportunities for ownership within the company and whether revenue or profit-sharing arrangements can result in an ownership stake. Determine if the revenue share plan includes a vesting schedule that mandates a minimum tenure before full vesting. Additionally, clarify the disposition of your revenue share if you depart prior to full vesting.

References

Request references from current branch managers who operate brick-and-mortar profit and loss (P&L) branches similar to your intended model. Do not rely solely on references from top producers or corporate staff. Seek to engage with managers who have been with the company for at least two to three years and can provide candid feedback regarding daily operations, organizational strengths, and areas for improvement. Consider reluctance to provide such references as a potential warning sign.

One Final Piece of Advice

Do not sign any agreement until it has been reviewed by a reputable mortgage industry attorney. While this may incur additional costs, it is a prudent investment. Although the preceding questions are valuable, the best way to protect yourself and your team is to ensure all commitments and agreements are clearly documented in the contract.

-

This guide is organized into clear, easy-to-read sections.

NEXA Lending and Mortgage Net Branch vs. Independent Broker: The Definitive Guide NEXA Lending: The Actual Numbers

Understanding the compensation structure is key. The “100%” pay offer can be misleading. While the main rate is 275 basis points, NEXA keeps 25 and puts 30 into the revenue pool, so you actually get 220 basis points. The “100%” only applies after NEXA takes its 55-basis-point share. Make sure to consider this before deciding.

Cost Of Running a Mortgage Net Branch

Running a physical branch at NEXA is a lot like managing your own small business, except you use the NEXA brand. As a branch manager, you cover all the expenses. Here are some key budget points and financial details to keep in mind.

Most branch managers pay their loan officers between 100 and 160 basis points, depending on experience. New hires usually get 100 to 120, mid-level officers get 130 to 150, and top performers get 150 to 160 or more if they hit their goals.

Profits can go down quickly. For example, if you start with 220 basis points and pay an experienced officer 140, you’re left with only 80 for everything else: rent, salaries, technology, compliance, marketing, insurance, your own pay, and office costs. On a $350,000 loan, that’s just $2,800 to cover all expenses. Depending on your branch’s volume and spending, that money can run out fast.ent alone can range from $2,000 to $6,000 a month, depending on your space and location.

Payroll And Expenses In Running A Mortgage Net Branch

A full-time receptionist costs $3,000 to $4,500 per month, plus taxes and benefits. High-volume branches may need several loan processors, each costing $4,000 to $7,000.

A loan officer assistant adds another $3,000 to $4,500. If you want to grow, budget $1,000 to $5,000 for marketing, especially for digital ads or mailers. Errors and omissions insurance is $200 to $600 per month.

Licensing and compliance fees are $300 to $800, utilities $300 to $700, and accounting or bookkeeping $300 to $800. Remember to keep reserves for slow months, compliance issues, or staff changes. These costs can change each month. A small office with a limited team usually costs $15,000 to $30,000 per month, not including your own pay. personal compensation.

Payroll Taxes Associated with W-2 Employees

If you’re used to working as a 1099 contractor, hiring W-2 employees brings new expenses. Besides base pay, you have to pay Social Security and Medicare taxes at 7.65%, Federal Unemployment Tax at 0.6% for the first $7,000 of wages, and State Unemployment Tax between 1% and 5%. These are all extra costs for you as the employer.

For example, if your processor earns $55,000 a year, payroll taxes add another $4,500 to $5,500. If you hire three or four W-2 employees, you’ll pay $15,000 to $22,000 more each year just in payroll taxes. Many branch managers forget to include these costs when making their budgets.

The Truth About Junk Fees

Hidden fees in the net branch world are a real concern. Many agreements include technology fees of $50 to $300 per loan officer each month, compliance and audit fees of $100 to $500, and accounting fees of $100 to $400, plus your own bookkeeping costs. Parent companies often charge higher premiums for errors and omissions insurance. Add in fees for training, marketing tools, and admin services, and your monthly costs can reach $500 to $1,500 per loan officer. As your team grows, these expenses go up too.

Closing A Branch With A $3 Million Production Volume

Suppose your branch closes $3 million a month, which is about 8 to 10 loans at $350,000 each. At 220 basis points, that’s $66,000 in revenue. If you have three loan officers, each earning 140 basis points, their total pay is $126,000—almost double your revenue before you pay any bills. Unless you increase your volume, it’s tough to offer good pay and cover office costs with just 220 basis points.

Most successful branches need $8 million to $15 million or more in monthly business, or they have to pay loan officers at the lower end of the pay range.

This makes it hard to attract and keep top talent. Some managers keep things small, with small teams, remote processors, shared assistants, and by handling much of the branch’s work themselves. It’s a tough path that can slow your growth.

C2 Financial

C2 Financial is one of the largest mortgage brokerages in the country and offers net branch options with different compensation structures. They give you access to many lenders and strong support, which is helpful if you want the backing of a big company. As with NEXA, make sure to review C2’s deductions, fees, and your actual take-home pay. The headline numbers rarely tell the full story.

Barrett Financial

Barrett Financial stands out in the net branch space, especially if you focus on non-qualified mortgages or investor loans. If your clients are self-employed, real estate investors, or have unique financial profiles, Barrett could give you an edge.

Their net branch terms are flexible and negotiable, depending on your contract and production. On the other hand, offers strong compensation splits, making it a good choice for high-volume originators who want to earn more per loan.

Barrett Financial provides advanced technology but less hands-on support than bigger net branch firms. This setup works best for experienced, independent loan officers who can handle most administrative tasks independently.

Edge Home Finance

Edge Home Finance is another big name in the net branch world. No matter which provider you look at, always ask for a detailed, itemized list of all fees before you sign anything. This way, you’ll know exactly what your net compensation will be after deductions. Edge Home Finance is a great fit for experienced originators who are ready to go independent. As an independent broker, you own your business, build direct relationships with lenders, and keep all lender-paid compensation after your expenses. There are no corporate overrides, revenue shares, junk fees, or hidden deductions cutting into your earnings.

You can often earn more with this model.

For example, if a lender pays 275 basis points and you keep 260 after technology and compliance costs, that’s more than the 220 basis points you usually keep as a net branch manager before other expenses.

A 40-basis-point difference on $5 million in monthly business adds up to $20,000 per month, or $240,000 a year, that would otherwise go to the parent company for branding and support. Consider whether this trade-off aligns with your goals. State mortgage broker licenses cost $500 to $2,500 or more, depending on the state.

Licensing and Surety Bond Costs

Surety bonds are required in every state and cost $1,000 to $5,000 per year, based on the bond amount and your finances. Loan origination systems like Encompass and BytePro cost $1,000 to $3,000 per month. Legal and business setup fees range from $1,500 to $5,000 and are paid once. NMLS registration, errors and omissions insurance, and compliance software add $3,000 to $8,000 per year. Total first-year costs are usually $15,000 to $40,000, depending on how many states you are licensed in and which systems you choose.

Costs Per Loan

Once you’re set up, the cost per loan is usually lower than in a net branch model, since there are no extra company layers to pay for. You keep control, get the full value, and shape your company’s culture, lender relationships, and growth. The branch model is best for those who need help with compliance, lender access, branding, and parent company support, and can’t set these up on their own.

In these cases, the extra cost may make sense. However, many professionals have enough experience to manage a branch and their finances. Most net branch setups help you consider going fully independent.

You can have more control over your long-term goals, and ongoing net branch fees may eventually limit your freedom. The net branch model is a lot like a franchise: you get a quick start and steady support, but you’ll always share your revenue. Decide if the support is worth the ongoing cost. For many experienced teams, it’s not.

No matter which path you choose, always have a mortgage industry attorney review any net branch agreement before you sign. Pay close attention to exit terms, non-solicitation and non-compete clauses, who owns your clients and referrals, and every fee, especially the recurring ones. Missing these details can cause major headaches if you ever want to switch models or go independent.

-

This reply was modified 3 days, 10 hours ago by

Sapna Sharma.

Sapna Sharma.

-

This reply was modified 3 days, 10 hours ago by

-

Lisa Jones

MemberFebruary 10, 2026 at 10:55 pm in reply to: Why NEXA Lending CEO Mike Kortas Is Acquiring Shell CompaniesIs NEXA Lending a safe company to join amid these acquisitions

-

A wild animal should never be captured and confined to a kennel or tied up. It should never be kept as pet.

I agree with this perspective. Wild animals have evolved over millennia to thrive in specific environments with complex social structures, territorial ranges, and behavioral patterns that captivity simply cannot replicate.

Keeping wild animals as pets creates several serious problems:

For the animal: Even well-intentioned captivity causes stress and suffering. Wild animals have instincts and needs—like hunting, roaming vast distances, or living in social groups—that a domestic setting can’t fulfill. This often leads to psychological distress, physical health problems, and abnormal behaviors.

For ecosystems: Capturing animals from the wild can disrupt populations and ecosystems. And when exotic pets escape or are released, they can become invasive species that harm native wildlife.

For human safety: Wild animals retain their instincts and can be unpredictable and dangerous, even when raised from infancy. They can carry diseases transmissible to humans, and many people lack the expertise to provide appropriate care.

For conservation: The exotic pet trade fuels illegal wildlife trafficking, which threatens endangered species and undermines conservation efforts.

There are important distinctions to make, though. Wildlife rehabilitation by licensed professionals serves to return injured or orphaned animals to the wild. And accredited sanctuaries provide necessary care for animals that cannot be released. These are fundamentally different from keeping wild animals as pets.

Is there a particular aspect of this issue you’re most interested in discussing, or a specific situation that prompted this reflection?

https://youtu.be/waIgvPbz7hs?si=2GgKLFveuUUPvBNI

-

This reply was modified 1 month, 1 week ago by

Gustan Cho.

Gustan Cho.

-

This reply was modified 1 month, 1 week ago by

-

Silver price per ounce is out of control. Heared through the grapevine that countless of Americans are regretting for selling Silver

Mom and pop folks are extremely disappointed with selling Silver at $70.00 an ounce. Gold is $5,300 an ounce. Many name brand experts have increased their price forecast of silver that silver should surpass $1,000 per ounce while GCA FORUMS NEWS raised their silver price per ounce forecast to $2,000 an ounce in the short term with potential to hit $5,000 to $8,500 an ounc3 within the next 18 to 24 months. Stay tuned folks

-

Lisa Jones

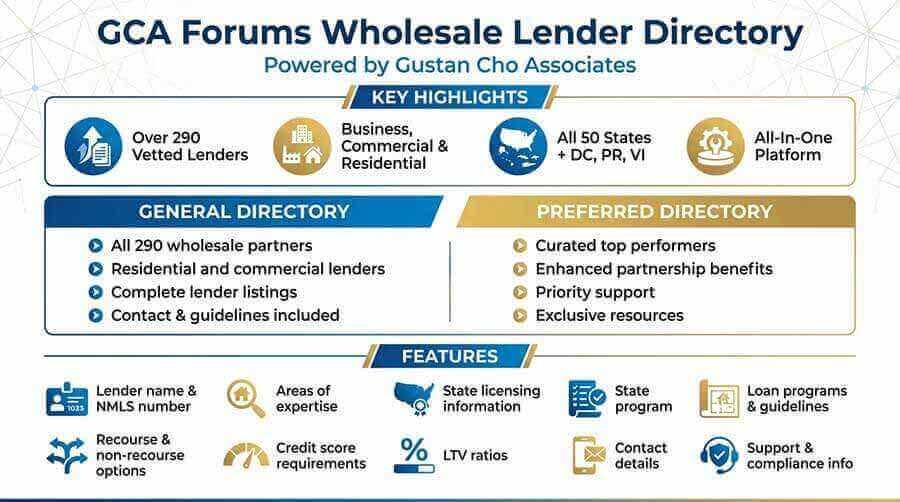

MemberJanuary 29, 2026 at 2:36 am in reply to: Categories on Business Directory Listings on GCA FORUMSLooking forward to GCA FORUMS Wholesale Lender Directory management of GCA FORUMS has in the pipeline. I cannot wait until it gets created, developed and launched

I saw a slight preview of the rebranding of GCA FORUMS as well as the business directory classified ads and Wholesale lender directory and hands down it looks greats

The rebranding of GCA FORUMS and Subsidiaries is now more clearer and defined unlike it used to be which was tone of topics and difficult to navigate through

https://gcaforums.com/wholesale-lender-directory/

gcaforums.com

Wholesale Lender Directory - GCA Forums

Welcome to GCA Forums Wholesale Lender Directory, powered by Gustan Cho Associates and Subsidiaries.

-

Lisa Jones

MemberJanuary 24, 2026 at 1:01 am in reply to: Dually-Licensed Realtor and Mortgage Loan OfficerMy pleasure Marcos, if I am sending you too much info and you know the topics, tell me to stop. Talk to you soon. As of your current compensation, for mortgage loan originators under our branch GCA, Loan Officers make 125 basis points of the loan amount which is 1.25% of the loan amount on self generated loans and 75 basis points on company provided referred loans or 0.75%. There are no fees or charges out of your pocket. I cover everything from credit reports, lock extensions, rapid rescores, desk fees, monthly tech fees, and Branch Licensing and Bond Fees. You are responsible for your individual NMLS state Licensing fees and any optional CRM, LOS (Independent Loan Origination System). Many loan officers get ARIVE on their own which is a super duper easy streamlined LOS that shoots out pre-approval letters, runs credit, runs Automated Underwriting System Approvals, etc.

$50 bucks a month. I cover main LOS System which is called Lending Pad (Sucks Big Time and I still don’t know how to use it. My assistants do it for me). Anyways, all this will be on your employment agreement (contract). Let me know if you have any questions.

-

This reply was modified 1 month, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.

gcamortgage.com

Mortgages & Home Loan Lenders | GCA Mortgage Group

Conventional Loans with No Overlays | W2 Income Only Mortgages | Manufactured Homes | Manual Underwriting | Mortgages Down To 500 FICO | FHA 203k Loans | Down

-

This reply was modified 1 month, 2 weeks ago by

-

Lisa Jones

MemberJanuary 24, 2026 at 12:54 am in reply to: Dually-Licensed Realtor and Mortgage Loan OfficerMarcos

I will send you important guides or pages you will run into that all loan officers need to know. Disregarding them can delay or even be the reason of a loan denial

Here’s one important blog on credit disputes

-

Lisa Jones

MemberJanuary 20, 2026 at 9:13 pm in reply to: Mortgage Branch As A DBA of Large Mortgage CompanyThank you, Bill. Very informative. Tom and I have been talking to Gustan for the past several months. I am a realtor but my husband Tom is the mortgage broker. His partner owne his own mortgage office and they been meeting with Gus and he has been very helpful. I think Tom and Manual are very interested if the website organic lead system comes into play. From what I understand, you need to register as a dba in each state you want to be licensed. The only answer is that we could not get the final answer on whether you can work on the brand of the dba or disclose that you are NEXA and are working as a dba. Great questions.. This is a significant business decision, so let me break down how this transition typically works and the key considerations. Correct me if I am wrong but this is why we are so interested in being a dba with a larger national company is due to being able to go from a few states to a national broker business model. Licensing the mortgage brokerage is what takes time and money.

How the Transition Generally Works

When you join a national mortgage company like Nexa Mortgage as a branch/DBA:

Your Company Structure:

- Your current ABC Mortgage Group would typically cease operating as an independent licensed entity

- You’d become a branch of Nexa Mortgage operating under their licenses

- You could operate as “ABC Mortgage Group, a division of Nexa Mortgage” or similar branding (exact naming depends on state regulations and Nexa’s policies)

The Transition Process Usually Involves:

- Licensing changes – Your state licenses would go inactive or be surrendered, as you’d operate under Nexa’s multi-state licenses

- Personnel transfers – Your LOs would need to move their NMLS sponsorship from ABC Mortgage Group to Nexa Mortgage

- Operational integration – You’d use Nexa’s compliance, policies, procedures, and systems while maintaining your local operations

- Wholesale relationships – You’d lose direct access to your current 10 wholesale lenders and instead use Nexa’s wholesale relationships and pricing

Pros of This Move

- Multi-state licensing – Immediate access to all states where Nexa is licensed without the cost/hassle of obtaining and maintaining individual state licenses

- Reduced compliance burden – They handle regulatory compliance, audits, and state examinations

- Lower overhead – No licensing fees, bonds, or compliance infrastructure costs

- Brand retention – You can typically keep your ABC Mortgage Group brand identity in the market

- Operational control – You maintain your office, team, and day-to-day operations

Cons and Considerations

- Loss of independence – You’re no longer the owner of a licensed entity; you’re a branch manager/loan officer

- Profit sharing – You’ll pay Nexa a portion of revenue (splits vary, commonly 10-25% or more)

- Loss of wholesale relationships – Your existing relationships with your 10 wholesale lenders go away; you must use Nexa’s lender partners and pricing

- Potential pricing disadvantages – You may lose competitive pricing you’ve negotiated directly

- Corporate policies – Must follow Nexa’s guidelines, product restrictions, and operational procedures

- Your company goes inactive – ABC Mortgage Group licenses would be surrendered or go inactive; you can’t easily restart as independent

- Exit complexity – If you want to leave later, rebuilding an independent operation requires re-licensing, re-establishing wholesale relationships, etc.

- Part-time LO challenges – Your 15 part-time LOs might not meet Nexa’s production minimums or requirements

What Happens to ABC Mortgage Group?

Your ABC Mortgage Group entity itself doesn’t disappear, but:

- State licenses are typically surrendered or go inactive (you’re not actively using them)

- The business entity (LLC/Corp) can remain in existence but dormant

- Reactivation is difficult – If you later want to go independent again, you’d need to reapply for all licenses, which can take 6-12+ months and significant cost

Critical Questions to Ask Nexa (or Any National Company)

- What’s the exact revenue split structure?

- Can you see their wholesale lender partners and rate sheets to compare with your current pricing?

- What are minimum production requirements for you and your LOs?

- What’s the exact branding allowed – can you truly operate as “ABC Mortgage Group”?

- What happens if you want to leave – what’s the exit process?

- Do they have restrictions on loan types or niches you currently serve?

- What systems/technology must you use vs. what you can choose?

Alternative to Consider

Before making this move, have you explored expanding your own licenses state-by-state? While it requires upfront investment, you maintain:

- Full independence and control

- Your wholesale relationships and pricing

- Complete profit retention

- Flexibility in operations

The cost might be $10K-$25K per state initially, plus ongoing maintenance, but you keep 100% control and economics.

This is really a trade-off between growth convenience (immediate multi-state access) versus independence and economics (keeping full control and profits). Given your 5 full-time LOs and established operation, you have something valuable to preserve. I’d strongly recommend getting the specific terms from Nexa in writing, comparing their wholesale pricing to yours, and running detailed financial projections before making this decision.

What states are you looking to expand into, and what’s driving that growth plan?

-

This reply was modified 1 month, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.