Otis

OtherMy Favorite Discussions

-

All Discussions

-

Are there corrupt cops? How could that be when the recruitment and hiring process of police officers include a thorough assessment of the police applicant’s background. Background investigation includes interviews of former and current employers, co-workers, supervisors, neighbors, classmates, and teachers. Background investigators of police officer recruits will check the candidates credit and employment backgrounds, criminal arrests and convictions, public records, and medical and psychological history records. Many law enforcement agencies will conduct written psychological examinations as well as an oral interview with a board certified psychologist. Other police agencies will have polygraph examinations as part of the background investigation process. Like many other professions, there are bad apples in law enforcement. Here are some videos of corrupt police officers caught on tape.

https://www.facebook.com/share/v/8rZBrhjnZ3sU7GQR/?mibextid=D5vuiz

facebook.com

When Evil Cops Got Caught Red Handed | Mr. Nightmare #cops #police #thinblueline #lawenforcement #policeofficer #UK #usa

-

🅽🅴🆆 American Greed 2026 | Season 16, Episode 49 | The Black Widows Helen Golay and Olga Rutterschmidt

American Greed Exposed is a true-crime documentary channel exploring the dark side of money, power, and ambition in the United States.

Behind luxury lifestyles, billion-dollar deals, and the American Dream lie financial fraud, white-collar crime, deception, and moral collapse. Each episode breaks down real cases involving:

💰 Massive financial scams and Ponzi schemes

🕴️ Corrupt executives, financiers, and power brokers

📉 Corporate greed, insider trading, and market manipulation

⚠️ The human cost of unchecked ambition

Our storytelling is calm, analytical, and unsettling, focusing not just on what happened—but why.

This channel doesn’t glorify crime. It exposes it.

Because every fortune has a story… and not all of them are clean.

https://youtu.be/f8-C84FMHfE?si=gB1HjAkEILFAjAcq -

How does Proposition 19 in California work? How does the Proposition 19 Property Tax Rule Benefit Homeowners buying a new house? What are the eligibility requirements for PROP 19 in California?

-

Behind the political smiles and speeches lies a record of questionable ethics and concealed controversy. Minnesota Governor Tim Walz is viewed by some as a progressive leader but others argue he’s mastered the art of political manipulation. From backroom deals to allegations of hypocrisy and misuse of power, the truth behind Walz’s rise deserves a closer look.

This episode unpacks the network of influence surrounding Walz: campaign donors, education policies, veteran claims, and the shifting narratives that have followed his career. With interviews, public records, and verified reports, we examine whether his leadership represents public service or self-preservation.

Corruption doesn’t always wear a villain’s face. Sometimes it hides behind good intentions. -

Is there a reason why silver and gold is getting crushed today? Both silver and gold tanked the past couple of days, especially silver where is plummeted over $32.00 plus an ounce which is a major blow to silver stackers. Price of silver plummeted hards in the past two days where many precious metals investors are panicking and on life support? Is silver going to continue crashing and tank in 2026 after skyrocketing from $30.00 to $120.00 an ounce in a matter of a few months> .Why is prrice of silver plummetting over 30% today? Both Gold and Silver are getting hammered where the spot price of silver is trading at $79.00 and spot price of gold is at $4,700.00 and ounce. In terms of percentage, silver is down 31% and gold is down 11%. Are the big banks manipulating the price of silver or is it a market correction. The sudden crash of precious metals, especially silver, seems like someone is manipulating the globally widely talked about precious metal of choice. If you can share any information why silver go down so much today, it would be greatly appreciated. Financial Analysts and Economists at Great Community Authority Forums (GCA FORUMS) still have a strong buy recommendation on both gold and silver and have not changed their stance on their strong buy recommendation and forecast of silver at surpassing $1,000 per ounce in the next six to eighteen months.

-

Left alone on an island after 65 other lab chimpanzees perished, Ponso became known as ‘the loneliest chimp on Earth.’ His heartbreaking story captured the world’s attention — but it was the arrival of chimpanzee expert Estelle Raballand that brought him hope. What started as a rescue visit turned into something much deeper, as Estelle formed a powerful bond with Ponso and made it her mission to change his life.

With a dream to build a sanctuary in the Ivory Coast and a plan to introduce Ponso to a possible companion named Nikla, Estelle’s journey is full of heart, patience and purpose. From emotional first meetings to moments of cautious joy, this is a moving story of resilience, second chances and the quiet strength of connection. Don’t miss this unforgettable story in this episode of Dodo Heroes.

-

I am sure everyone saw cute pet monkey videos on YouTube and Facebook as well as other Social Media channels. However, the things the Pet Monkey owner does not show the audience and viewers is there is the bad side of owning pet monkes. Pet monkeys need to get confined to a space whether it is caged or tied to a leash and secured when the owner or guardian cannot supervise the pet monkey. Monkeys are extremely intelligent high energy wild animals and will wonder and stray if they are not under human supervision. It also costs a lot of money to feed, and raise a pet monkey. Please watch the attached YouTube video about the pros and con’s of adopting and raising a pet baby monkey. Remember that baby pet monkeys are wild animals and not domesticated.

-

You do not need perfect credit or high credit scores to qualify for a mortgage loan. Every loan program require a minimum credit score. Besides HUD, VA, USDA, FANNIE MAE, FREDDIE MAC, or non-QM portfolio lenders requiring a minimum credit score, each lender can impose lender overlays on credit scores. Lender overlays are additional credit score requirements above and beyond the minimum agency mortgage guidelines imposed by each individual mortgage lender. Regardless of the minimum credit scores required, all lenders will normally want to see timely payment history in the past 12 months. Regardless of the prior bad credit you have, having timely payment on all of your monthly debt payments that report on the three credit reports is crucial. Do not worry about prior collections, charge-off accounts, late payments, or other derogatory credit tradelines unless you are going though a manual underwrite on FHA loans. HUD manual underwriting guidelines require timely payments in the past 24 months. VA manual underwriting guidelines require timely payments in the past 12 months. In many instances when you get an approve/eligible per automated underwriting system but late payments in the past 24 months, the lender may down grade your file to a manual underwrite. The best solution for you to increase your credit scores and strenghen your credit profile with recent late payments is adding positive credit with new credit. Please read this guide on how to boost your credit to get approved for a mortgage: Capital One Secured Credit Card will get you a $250 secured credit card with a $50 deposit. Self.Inc is a bank that has a phenomenal credit rebuilder program where you can make a monthly deposit as small as $25.00 per month. That monthly deposit goes towards a savings account but it reports as an installment loan to all three credit bureaus. Get a Discover secured card. Secured credit cards are the same as unsecured traditional credit card. The only difference is you need to put a deposit. The amount of deposit is the amount of credit you get by the credit card company. You need to make timely minimum monthly payments on your secured credit cards. Just start with these three creditors and you will see wonders in the weeks and months ahead. I will cover some quick fixes for you to increase your credit scores fast and at the end of this topic thread, I will list helpful resources on boosting your credit to qualify for a mortgage, how to reach a human at the credit bureaus, and how to rebuild your credit:

1. Capital One Secured Credit Card

2. Self.Inc

3. Discover Secured Credit Card

As time pass and you make timely payments, your secured credit card company will increase your credit limit without asking your to put additional deposit. If you can get more secured credit cards, it will expedite your credit rebuilding process. However, you should at least start with the above three creditors.

Improving your credit scores and rebuilding credit can be crucial when seeking mortgage approval. Here are some effective strategies to consider:

Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion. Identify and dispute any errors or inaccuracies that may be negatively impacting your credit scores.

Pay bills on time: Payment history is the most significant factor affecting your credit scores. Make sure to pay all your bills (credit cards, loans, utilities, etc.) on time, every time. Set up automatic payments or payment reminders if necessary.

Reduce credit card balances: High credit card balances can hurt your credit utilization ratio, which accounts for a significant portion of your credit scores.

Aim to keep your credit card balances below 30% of your total available credit limit. Consider paying off credit cards with the highest balances first.

Don’t close unused credit cards: Closing credit cards can inadvertently increase your credit utilization ratio and decrease your overall available credit. Keep unused credit cards open, but avoid using them to maintain a low credit utilization ratio.

Increase credit limit: Request a credit limit increase from your credit card issuers, which can improve your credit utilization ratio. Be sure to handle the increased credit limit responsibly and avoid overspending.

Limit new credit applications: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit scores. Limit credit applications only to when absolutely necessary.

Use different types of credit: Having a mix of different types of credit (e.g., credit cards, auto loans, personal loans) can positively impact your credit scores. Consider taking out a small loan or opening a new credit card account if you have limited credit types.

Monitor your credit regularly: Check your credit reports and scores periodically to ensure accuracy and track your progress. Consider signing up for a credit monitoring service to receive alerts for any changes to your credit profile.

Be patient and consistent: Rebuilding credit takes time and consistent effort. Stick to responsible credit habits, and your credit scores should gradually improve, increasing your chances of mortgage approval.

Remember, lenders evaluate various factors beyond just credit scores when considering mortgage applications. However, improving your credit scores and maintaining a healthy credit profile can significantly increase your chances of getting approved for a mortgage with favorable terms.

https://gustancho.com/boost-your-credit-with-new-credit/

gustancho.com

Boost Your Credit With New Credit To Qualify For A Mortgage

Boost your credit with new credit to qualify for a mortgage . New secured credit cards and credit builder loans increases credit scores for mortgage

-

. If Biden dies or gets impeached do we have to worry about this ding bat becing our President?Kamala Harris is being questioned by millions of Americans on her mental health state and her intelligence level. Is this idiot pretending to be dumb and stupid or is Kamala Harris a real idiot. Kamala Harris has zero brains 🧠 and seems this goof 🤪 is pretending to be a creature with a single digit IQ. Is this brainless moron the number 2 in charge of the United States? How humiliating to have this creature to represent the nation and be a power leader. The Imbecile in Chief. She has zero respect and is not a liked person in any way or form.

https://youtu.be/k7TCTQQWIZI?si=-hQw0rw-TbyD7SxJ

-

This video includes 2025 Mopar, Chevy, Ford, Pontiac, Buick, Oldsmobile, Dodge, Plymouth, Chrysler, and Mercury. Muscle car models include Charger R/T, Malibu SS, Mustang Fastback, Mustang Mach 1, Firebird Formula, Impala SS, Road Runner, Riviera, Shelby Cobra, Oldsmobile 442, Caprice, GTO, GTO The Judge, Skylark Gran Sport GS, Nova SS, Barracuda, Barracuda Formula S, Camaro, Camaro Z28, Camaro RS/SS, Cutlass Pace Car, Bel Air, Corvette, Corvette Convertible, Charger, Thunderbird, Chevelle SS, Firebird, Firebird Convertible, Impala, Cougar, Cougar XR-7. The cars for sale are at the Classic Auto Mall in Morgantown, Pennsylvania 2025. This is information on the most recent, 2025, classic car prices.

-

GCA Forums News Weekend Edition Report

Coverage Period: Monday, August 10, 2025 – Sunday, August 17, 2025

Welcome to the GCA Forums News Weekend Edition, your go-to source for the week’s biggest headlines, mortgage market updates, housing trends, and critical political and economic events. Our community tells us that timely, relevant coverage drives membership, and we agree. Whether you are a homebuyer, real estate investor, mortgage professional, or entrepreneur, the insights below are designed for you.

This week featured shocking political disclosures, key shifts in the housing and mortgage markets, vital economic updates, and strategies aimed squarely at real estate investors.

I’m sharing here your complete summary.

Breaking Political and Legal News: DNI Tulsi Gabbard’s Bombshell Allegations

DNI Tulsi Gabbard rocked the capital by accusing former President Obama, former Secretaries Clinton and Comey, former Directors Clapper and Brennan, Congressman Schiff, and other senior Democrats of treasonous conduct. The stunning claims have ignited a national debate over accountability and the republic’s security.

Guest List from Epstein’s Private Island Released

Fresh documents spilled the names of the VIPs who partied at Epstein’s Virgin Island Sex Island. Across social media and the halls of justice, the roster is sparking fresh fire for more probes and louder demands for accountability.

Letitia James Faces Mortgage Fraud Claims

New York’s AG Letitia James is now dodging multiple mortgage fraud accusations, and the online rumor mill is buzzing about everything from paperwork to jaw-dropping gossip about her wedding. Every new post adds another doubt about whether she’ll keep her job.

Conservative Figures Still in the News

Pam Bondi, Kash Patel, and Dan Bongino kept the conservative engine humming. Fresh clips of their rallies, podcasts, and investigations got tons of shares, and our readers can’t get enough.

Mortgage Market Pulse & Rates: Possible Powell Exit—Trump Says 3% Rate Slide Possible.

Stocks skidded when word leaked that the White House might remove Jerome Powell from the Fed. Trump jumped in, tweeting that mortgage rates could drop nearly 3% if the change happens, a move that would rewrite how Americans borrow for decades.

Today’s Mortgage Rate Roundup

- Conventional loan: Rates drifted down a tick.

- FHA loans: Still steady.

- Lenders are opening the door wider for folks with less-than-perfect credit.

- VA Loans: Veteran interest grew again as borrowers readied for potential lower rates.

- Non-QM & DSCR Loans: Investors zeroed in on options, eyeing opportunities for less expensive capital on properties.

- These headlines signal important changes for mortgage pros.

- They must advise clients smartly if rates slide and gear up for a refinancing surge.

Housing Market Indicators: Affordability Crisis Deepens

Fewer homes and climbing prices squeeze first-time buyers.

Best & Worst Markets

Sunbelt cities still attract investors; meanwhile, pricey coastal areas are seeing affordability slide further.

Rental Market Insights

Demand for apartments and short-term rentals is so strong that investor competition is heating up.

Inflation and the Federal Reserve

CPI and PCE numbers showed prices inching down, but they’re still over the Fed’s 2% goal.

Home Affordability is still struggling, as pay raises are not matching home price growth in most areas.

- Investor Speculation: Many are betting on a potential rate cut in September, which echoes Trump’s recent bold forecast.

Economic Reports & Job Market Trends

- Jobs Report: Hiring stayed steady, but pay increases aren’t keeping up with rising living costs.

- GDP Data: Economic growth is steady but slow, stoking chatter about a possible soft landing.

- Stock Market Moves: Wild swings showed that traders are on edge about what the Fed might do next and how shaky the global economy looks.

Government Policy & Housing Rules

- Proposed Loan Caps: Plans for new limits on FHA, VA, and conventional loans in 2026 are starting to appear.

- Homebuyer Tax Breaks: Both parties in Congress support a fresh round of credits for new buyers.

- Rent Rules: Cities in California and New York are rolling out fresh tenant protections, but landlords warn that they could scare off investors.

Business & Finance

- Lender Shutdowns: A few small mortgage companies went under, caught in the squeeze of the current high-rate world.

- Crypto Homes: Bitcoin and other digital coins still appear in luxury home deals.

- Tighter Small Business Loans: New rules mean startups spend more time and get fewer bank yeses.

Foreclosures & Troubled Homes

- Foreclosure Surge: As bills stay high, more homeowners in several states are getting that scary notice.

- Investor Deals: Short sales and bank-owned homes are popping up more often, especially in the Midwest and Southeast.

- Help for Borrowers: People ask for tips on changing their loans and using FHA programs to avert foreclosure.

Community Buzz

- Hot Topics: Mortgage scams, must-see listings, and the never-ending affordability chat light up our forums.

- Expert Q&A Sessions: Members got quick answers about FHA, VA, DSCR, and non-QM loans straight from specialists.

- Membership Surge: People signed up fast for our alerts on breaking news and hands-on mortgage trends.

Full Takeaway

The plan for GCA Forums News is simple:

- Send breaking stories paired with insider analysis.

- Post daily rates and housing news for borrowers, lenders, and investors.

- Keep everything talk-worthy and shareable with real estate stories, hot debates, and expert chats.

- Encourage readers to jump into discussions and invite others to GCA Forums.

GCA Forums News has become the daily stop for homebuyers, investors, mortgage pros, and entrepreneurs nationwide. It mixes fast political news, mortgage know-how, economic snapshots, and buzz-worthy property stories.

-

GCA Forums News – Friday, June 20, 2025

Welcome back. This is your GCA Forums News hit for today. We were talking fresh updates on the housing market, the economy, ongoing federal probes, shifting politics, and those big splash headlines that keep the country buzzing.

Housing and Mortgage News

- The U.S. housing scene feels stuck, almost like a car idling at a red light.

- Mortgage rates hover in the 6s, inventory sits stubbornly low, and many would-be buyers are still sitting on the sidelines.

- Bankrate put the average 30-year fixed loan at 6.82 percent today, with the 15-year version at 6.00 percent and the 5/1 ARM at 6.15 percent.

- Those numbers are only a whisker below last month’s peak of 7.22 percent.

- Even the slight dip isn’t enough to pry open wallets that feel pinched.

- Jerome Powell reminded everyone last week that this housing crunch isn’t just a math problem tied to interest rates.

- He called out a persistent shortage of available homes and said solving it well requires root-and-branch fixes.

- April 2025 did bring in the most new listings we’ve seen since January 2020, so supply is creeping up.

- However, prices are still high, and folks are nervous about the economy, so demand isn’t roaring back the way some economists hoped.

- Multiple-offer scenarios are back in the Northeast and Midwest. At the same time, cities across the South see growing inventory matched by slipping home prices.

Mortgage Rate Forecast

- Most Wall Street pros believe the average mortgage rate will stay above 6.5% through 2025.

- Some even worry it could nudge higher if fresh inflation surprises show up.

- They point to two or maybe three. Fed moves in the quarter-point trim that might kick off in December if the price numbers cool.

Rent vs Buy

- As of early 2025, home shoppers face a $416,900 median sticker price, which, paired with roughly 7% borrowing costs, tilts the scales toward renting for now.

- But climbing monthly rents in red-hot markets like Boston and New York keep pushing everyone to ask whether waiting for lower rates is wishful thinking or a smart delay.

Powell and the Fed

- On June 18, the FOMC paused again, keeping the federal funds band at 4.25% to 4.5% for the fourth time in 2025.

- Powell told reporters the central bank is well-positioned to sit tight.

- However, the economy looks sturdy at 4.2% unemployment and May inflation at 2.4%.

- He still flagged inflation heat from the tariffs President Trump slapped on imports.

- The Federal Reserve recently released its Summary of Economic Projections, and the numbers tell a cautious story.

- Growth for 2025 has been trimmed from 1.7% to 1.4%, inflation expectations now sit at 3.1% instead of 2.8%, and the jobless rate could increase to 4.5%. Jay Powell described the labor market as surprisingly sturdy, brushing aside fears of an immediate slowdown.

- He still sees room for two quarter-point rate cuts this year, possibly starting in September if inflation bends back toward 2%.

- Powell isn’t only fending off market pressure; the White House is leaning on him, too.

- President Trump has called the chairman stupid and loudly demands a full one-percentage-point rate cut.

- Powell, treading carefully, insists the Fed will stick to its independent dual mission of managing prices and helping people find work.

- This is even while tariffs throw fresh darts at both targets.

- On the ground, the U.S. economy feels strong yet lumpy.

- Inflation dropped from 3% in January to 2.4% in May, still above the 2% benchmark, and imported tariffs are likely to nudge prices up again.

- Job gains slowed to 139,000 in May, leaving unemployment at 4.2%.

- Households are feeling the pinch.

- This is especially true when 20% of car borrowers are glued to monthly payments above $1,000, and credit card rates are now topping 20%.

- Trump stuck on his tariffs, and Jerome Powell once warned that they’d probably hike prices and almost sit on the economy.

- Some economists now pin the phrase dangerous landing on our trade mess, saying it chips away at consumer prices and business nerves.

- Oddly enough, everyday folks still feel better.

- Fannie Maes’s monthly sentiment number nudged to a 2025 peak this past May.

- Moving to home sales, talk of a chilled environment keeps cropping up.

- Buyers pause, sellers won’t budge much, and the scene feels flat.

- Sky-high mortgage rates, spiky insurance, and property tax bills make things heavier.

- The Mortgage Bankers Association doesn’t see rate movement any time soon- the Fed, for now, is on pause.

- Pros say that a real, lasting dip in inflation is the only way to get lower rates that might wake up demand and stabilize the market.

Stock and Bond Markets

- Before the Fed spoke on June 18, stocks tooled along quietly.

- The Dow ticked up 0.35 percent, the S&P climbed 0.37, and the Nasdaq gained 0.48.

- None of it felt huge, yet nobody was complaining.

- Bonds, by contrast, flash somebody worried.

- Yields on the ten-year Treasury slipped after cheerful inflation numbers.

- Still, they stayed high enough to make folks glance at the tariff chatter and ballooning debt.

- Rising government red ink and Trump’s take-no-prisoners budget ideas still threaten to nudge yields and raise mortgage rates.

New York Attorney General Letitia James and Mortgage Fraud Allegations

- New York AG Letitia James keeps turning over rocks in the mortgage world, zeroing in on lenders who look like they don’t play fair.

- The calendar is full as of June 20, 2025, but the indictment list isn’t.

- James’ office, the CFPB, the FBI, and even the U.S. Attorney General have issued almost nothing resembling a court countdown.

- Even reporters chasing leaks can mostly file wait-and-see updates.

- Building these cases takes legwork, paper trails, and sometimes years of quiet subpoenas, not press releases.

- The spotlight is on the industry, but big names haven’t yet been pinned to the wall.

Trump Administration and Cabinet Updates

- Donald Trump, who took office on January 20, 2025, is well into his second term and still divides the country.

- Social media posts show cheers for the economy but plenty of groans about promises left hanging.

- Many die-hard supporters keep waiting for fireworks.

- Swift indictments and headline-grabbing arrests.

- Yet the Department of Government Efficiency, under Elon Musk, has made no public splash, and no hard evidence has turned up, leaving that audience frustrated.

Attorney General Pam Bondi

- Once Florida’s attorney general, Pam Bondi, has leaned heavily on immigration crackdowns and rolling back red tape.

- Critics quickly gathered her time back home and said some prosecutions felt more political than principled.

- So far, no major federal indictments have appeared on her watch, even if whispers of ongoing probes refuse to die.

FBI Director Kash Patel

- Kash Patel leads the FBI, a pick that shocked plenty of former agents.

- Courtroom years as a public defender and a handful of agency stints dot his résumé.

- Yet, he skipped the rank-and-file step ladder most directors climb.

- Supporters say that a fresh eye is exactly what the bureau needs.

- Critics say that his loyalty to Trump bought him the chair.

Deputy FBI Director Dan Bongino

- Bongino, once a beat cop in New York and a Secret Service detail man, is now more familiar with headphones than handcuffs.

- Most folks know him from streaming apps like Rumble, where he chats for hours and plays armchair detective.

- Because he hasn’t run a federal case in years, some critics say his tool belt is starting to rust.

- They add that Tech has leaped ahead of the FBI, and Bongino’s older playbook doesn’t fit the field.

- Legal minds who read a lot into org charts still push for bosses who have logged time in courtrooms or crisis rooms.

- Yet Donald Trump keeps reaching for people who say yes first and ask questions later.

- That habit keeps the audience-divide debate very much alive.

Trump and Elon Musk Relationship

- Their bond still glows like a neon sign.

- Musk now runs the Department of Government Efficiency.

- This title sounds better in headlines than on an office door.

- They keep tossing phrases around, the latest being the Big Beautiful Bill, though no actual paper with that stamp has hit Congress as of June 20, 2025.

- The label floats while Musk’s aides comb through federal budgets.

- So far, no microphone has announced a signature change, but both men love to keep the room guessing.

Los Angeles Riots and Major Headline News

- So far, nobody has spotted crowds, fires, or police lines in Los Angeles on or around June 20, 2025.

- The big wires, local blogs, and even a quick scroll through GCA Forums show nothing matching the word riot, which leans toward rumor or plain misinformation.

Batter Blues

Aaron Judge of the New York Yankees is stuck in a hitting rut: 3-for-27 since the team gave him one day off. Fans are arguing about whether he needs more rest or a mental reset.

Birthday Throwback

June 19 marked Lou Gehrig’s 122nd birthday, and old-school Yankees fans took the opportunity to honor the Iron Horse and spread the word about ALS. A simple hashtag on social media flooded timelines with vintage clips and heartfelt stories.

Economic Tightrope

On the numbers side, the Federal Reserve is holding rates steady. Still, Jerome Powell keeps warning about tariffs tightening the squeeze on shoppers. Markets reacted with a yawn, yet everyone knew the next meeting could flip the script. Back at street level, the housing scene is flat.

High mortgage rates still eat up paychecks, and rising costs linked to new tariffs put extra pressure on renters. Political chatter isn’t quieter, either.

Eyebrows are raised over the Trump administration’s cabinet picks, questioning who is truly qualified.

Federal probes into various scandals are inching along. Despite the noise, officials haven’t landed any headline-grabbing indictments. At least not yet.

For its part, Los Angeles has kept the peace, with no major break in the calm that some rumors promised.

For real-time updates, swing by GCA Forums News and skip the guessing game.

Quick Heads-Up

This post relies on what we knew up to June 20, 2025. However, facts can shift overnight, so please take a second to check anything that sounds off.

https://youtu.be/0xnyHo8r87s?si=uwNbQday1ge9gp2q

-

This discussion was modified 8 months, 2 weeks ago by

Gustan Cho.

Gustan Cho.

-

Here’s your live GCA Forums News Update for Tuesday, August 12, 2025

GCA Forums News for Tuesday, August 12, 2025-BREAKING NEWS

Housing and Mortgage Alert: Trump to Oust Fed Chair Powell, Rates May Dip 3%

- In a major shock to Wall Street and homebuyers, Donald Trump declared he will replace Federal Reserve Chair Jerome Powell, accusing him of damaging Main Street with too many rate hikes.

- Trump’s circle says the next Fed chief will push for fast rate cuts.

- If he gets his way, fixed mortgage rates could slide 3 points by Halloween.

- The reveal lands just before the FOMC meeting tomorrow, where investors are scanning every word for a hint the committee might finally cut.

- On top of that, Fed office upgrades budgeted at $150 million are running 45% over schedule.

- Leaks suggest sloppy management and even whisper about fraud tied to Powell.

- So far, no one has put a name on the rumors, and the Fed has not filed a complaint.

- Mortgage lenders and agents in the housing market are cautiously hopeful, even as buyers hold back and the number of homes for sale keeps dropping.

- Prices still hover near record highs, and the slight easing in inflation hasn’t yet reduced the costs facing first-time buyers and growing families.

Mortgage Fraud Allegations Heat Up: NY AG Letitia James and CA Senator Adam Schiff Under Investigation

- High-profile leaders in New York and California are now under serious mortgage fraud investigations.

- Federal authorities are probing New York Attorney General Letitia James for allegedly altering mortgage records and boosting appraisal values to assist favored political allies and generate campaign cash.

- The inquiry raises questions about her office’s record of probing financial crime.

- In a separate case, California Senator Adam Schiff faces a federal investigation tied to a series of questionable loan applications for a luxury property portfolio worth more than $15 million.

- Authorities are examining whether Schiff’s financial forms improperly hid the true sources of down payments and income over the past five years.

- Both officials have publicly denied any illegal conduct but are facing growing demands to clarify their financial records and dealings.

Growing Questions About California Governor Gavin Newsom’s Wealth

- Governor Gavin Newsom is under fresh public pressure after a close examination of his finances reveals how a public servant with a salary of about $200,000 can own two homes worth a combined $10 million in California.

- Good-government groups say the dramatic growth in his real estate holdings—acquired after he took office—deserves a full public accounting, especially given soaring living costs.

- Demand for answers ratcheted after Newsom’s 2022 campaign filed new disclosures showing he bought a lavish Lake Tahoe property in a questionable shell-company transaction.

- Critics warn that the opaque ownership could mask hidden debt, undisclosed loans, or conflicted valuations.

- At a news conference, Newsom insisted he followed the law, dismissing the questions as “noise.”

- Nonetheless, lawmakers from both parties are urging the state auditor to examine the timeline of his property purchases and the terms of the loans.

- The sources of his wealth, asking whether they reveal undisclosed income or sweetheart deals that would embarrass a public officeholder.

Tesla’s Cybertruck Nightmare: Stock Dives, Musk’s Focus Questioned

- Tesla’s stock dropped 15 percent today, the biggest one-day fall since 2023, after the Cybertruck crisis pushed investors to the brink.

- Multiple Cybertrucks have ignited under crash conditions, with two fires blamed for the deaths of three passengers this fall.

- The National Highway Traffic Safety Administration has opened a full investigation, and six state attorneys general are demanding a statewide stop to all Cybertruck production and sales.

- Elon Musk’s defenders say accidents are a normal life-cycle risk for any new vehicle, but most experts see a deeper concern.

- They warn that Musk’s unrelenting pace—now split between Twitter, SpaceX’s Starship fixes, Neuralink’s lab animal outcomes, and a new national political movement—erodes the attention he once offered Tesla during its fastest growth years.

Credit Analysts Describe the Dual Risk

- Operational weaknesses in battery supply chains and regulatory backlash could delay Cybertruck deliveries for months.

- A production ramp originally planned for 100,000 trucks in 2024 appears doubtful as negative sentiment envelops the once-high-flying brand.

- Today’s pity-caution at Wall Street firms shows Musk is fast losing his habit of turning crisis headlines into turnarounds.

- Reports show that tensions between Elon Musk and Donald Trump are running high, climaxing with Trump’s outlandish tweet suggesting that Musk should be deported over alleged safety failures at Tesla.

Tulsi Gabbard Drops Shocking Evidence of Russian Collusion Cover-Up

- In a jaw-dropping briefing, National Director of Intelligence Tulsi Gabbard released classified documents which, she argues, tie Barack Obama, Hillary Clinton, James Comey, John Brennan, James Clapper, and other top Democrats to a plot to tilt the 2016 vote.

- Gabbard says the operation involved spying on Trump’s campaign and feeding the media fake Russian dirt designed to silence Trump and his supporters.

- Trump immediately trumpeted the claims, demanding treason indictments against every named official.

- Partisan skirmishes are raging anew, and a few lawyers warn that, if Gabbard’s evidence holds, it might warrant the first-ever indictments for a coordinated election sabotage by government employees.

Ghislaine Maxwell Will Testify on Epstein’s Elite Network

- Now months into her latest jail sentence, Ghislaine Maxwell has reportedly agreed to turn state’s witness.

- Once a loyal gatekeeper for Jeffrey Epstein, she may name names of powerful men who allegedly abused minors while visiting Epstein’s private islands and lavish jets.

- Prosecutors expect her testimony to breathe new life into probes of a hidden, wealthy, and still-unpunished network of pedophilia and trafficking.

- This announcement starkly contrasts comments made by former Florida Attorney General Pam Bondi, FBI Director Kash Patel, and Deputy Director Dan Bongino, who have stubbornly maintained that a verified “Epstein list” does not exist.

- Their repeated denials have prompted anger across social media and fueled allegations that crucial evidence is being deliberately hidden.

DOJ Pursues Sitting Officials: More Indictments Loom

- Federal prosecutors are ramping up corruption probes targeting several Biden-era officials, with new indictments anticipated in the next few weeks.

- The inquiries cover allegations of fraud, influence peddling, and the improper use of government power.

- The Justice Department says the push is designed to rebuild public confidence that officials can and will be held accountable.

Market Signals: Dow Drops, Gold and Silver Climb, Inflation Slows

Here’s the live, up-to-the-minute financial and economic update for Tuesday, August 12, 2025, focusing on key market indicators and Federal Reserve developments:

📈 U.S. Stock Market Performance

- Dow Jones Industrial Average: Closed at 44,458.61, up 483.52 points (1.1%), marking a new record high. Yahoo Finance+3WTOP News+3Magnolia Tribune+3

- S&P 500: Finished at 6,445.76, gaining 72.31 points (1.1%), also reaching a record close. WTOP News

- Nasdaq Composite: Ended at 21,681.90, up 296.50 points (1.4%), setting a new all-time high. WTOP News+1

The market rally was driven by investor optimism following a July inflation report that came in slightly better than expected, fueling hopes for potential Federal Reserve rate cuts.

💰 Precious Metals Prices

- Gold (Spot Price): Trading at $3,348.00 per ounce, reflecting a slight decline from earlier in the day. Fortune

- Silver (Spot Price): Currently at $37.78 per ounce, showing a modest increase. FXStreet+2USAGOLD+2

Both metals have experienced fluctuations today, influenced by market dynamics and economic data.

🏠 Mortgage Rates

- 30-Year Fixed-Rate Mortgage: Currently at 6.58%, unchanged from the previous day

- 15-Year Fixed-Rate Mortgage: Holding steady at 5.99%, consistent with recent trends.

These rates remain relatively stable, providing some predictability for homebuyers and refinancers.

🏦 Federal Reserve Update

- Recent Enforcement Action: The Federal Reserve Board announced an enforcement action against Khalila Cooper, a former employee of First Horizon Bank in Memphis, Tennessee, for embezzlement of bank funds.

- Upcoming FOMC Meeting: The Federal Open Market Committee (FOMC) is scheduled to meet next month, with market participants closely watching for any indications of potential interest rate changes.

- Jobs: Claims for unemployment benefits ticked up to 230,000 last week, prompting fresh worries that the labor market is losing momentum.

- Corporate Bankruptcies: The pace of company bankruptcies is climbing, with several mid-range retail and tech firms revealing job cuts alongside their filings.

Housing Market: Demand Cools as Prices and Rates Stay High

Far fewer buyers are signing contracts, caught between still-high home prices and mortgage rates close to 8%. Many experts hope for cuts after tomorrow’s Fed meeting, but inventory is still low, frustrating shoppers and complicating agents’ jobs. Lenders are tightening credit scores even further, making it harder for families to get loans.

Trump vs. Powell: The Prize is U.S. Interest Rates

Trump and Fed Chair Powell are trading jabs over who should steer U.S. borrowing costs. Trump says Powell’s high rates are hurting wages and homebuyers. Powell says tougher rates are the price for beating inflation. Investors are waiting for tomorrow’s Fed meeting to see who scores the next round.

The Bromance Ends: Tesla vs. Trump Gets Ugly

Elon Musk and Donald Trump were once friends, but now they are trading insults. Trump questioned whether Musk still cares about Tesla and floated the idea of deporting him. Musk’s launch of the American Party is the latest twist, running even larger circles around their once-close bond.

Right now, U.S. news is shaking with major political and economic stories. Officials are facing serious accusations of mortgage fraud, new details about Russian election meddling keep coming, and the stock market is jittery about Tesla and the Federal Reserve. As the country prepares for tomorrow’s key Fed meeting, everyone is focused on interest rates, housing costs, and the escalating fights inside Washington and big companies.

Check back for real-time updates as these stories keep unfolding.

-

Value of Silver will outpace Value of Gold as precious metals skyrocket. Silver trade in a thin market. Plus Silver has investment Value as well as practical industrial Value. In 2011 Value of Silver doubled to $45 per ounce. Trading of Silver opened higher today. Start stacking Silver today.

-

GCA Forums Headline News Weekend Edition: June 23–29, 2025

Welcome back to this weekend’s GCA Headlines, your go-to spot for the freshest numbers and stories if you’re buying a home, flipping a property, or working in the mortgage game. From tricky loan updates to headline-worthy policy moves, we mix plain talk with expert takes so you can keep one step ahead.

Let’s jump into the news currently steering the housing and finance markets.

Mortgage Rates at a Glance

- Mortgage rates kept everyone talking this week, and the slight nudges up or down do matter for anyone planning a deal.

- The Mortgage Bankers Association reports that the average rate on a standard 30-year fixed loan was 6.85% for the week ending June 27.

- FHA and VA products stayed close behind, landing at 6.45% and 6.30% respectively.

- On the non-QM and debt-service coverage ratio (DSCR) side, lenders pushed rates up slightly, now falling between 7.10% and 7.50% as they tighten their underwriting belts.

- The Federal Reserve hinted that it will keep interest rates where they are for a while.

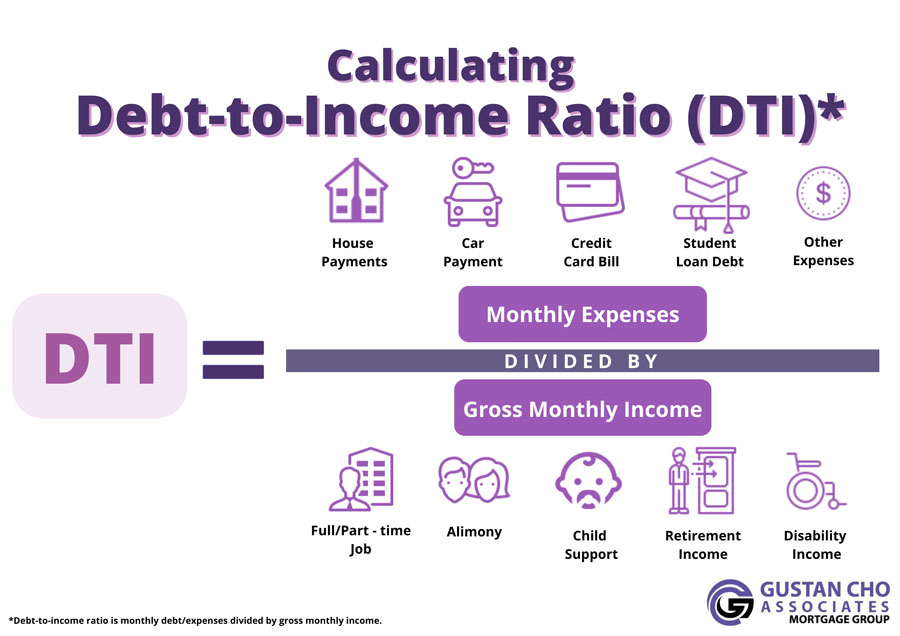

- With new rules from Fannie Mae and Freddie Mac, lenders are now capping debt-to-income (DTI) ratios for most conventional loans at 43 percent.

- They are also looking at credit scores more closely.

- FHA loans now require at least a 620 score.

- These updates show how quickly the lending landscape can change, so anyone considering buying or refinancing a home should keep up.

Why does that matter?

- Buyers and people looking to refinance check mortgage rates almost daily to decide when to act.

- Loan officers do the same thing to give clients solid advice.

- By following the numbers, you can spot trends early and tweak your financing plan before a big move hits the market.

The Housing Market

- Turning to the housing market, news this week is a mixed bag.

- The National Association of Realtors reports that existing home sales climbed 2.3 percent in May 2025.

- Part of that boost comes from a tiny increase in available listings, giving buyers more options.

- Still, the median sale price jumped 4.1 percent over the past year, landing at $425,000 and making life harder for first-time shoppers.

- Regionally, Austin, Texas, and Raleigh, North Carolina, remain hot seller markets.

- At the same time, places like San Francisco and Chicago offer better chances for buyers thanks to growing inventories.

- Rental markets, especially for apartment buildings, have picked up steam this year.

- Cap rates in cities now average around 5.8 percent, giving buyers a solid return on investment.

- At the same time, the Case-Shiller Home Price Index showed home prices rising 5.6 percent over the past twelve months.

- However, that pace slows in pricey coastal areas like San Francisco and New York.

- Why this matters: These numbers give homebuyers and sellers something to work with—guiding listing prices and starting offers—while investors use the data to spot deals and decide when to pull the trigger in tight markets.

Inflation and the Fed’s Next Move

- Inflation is still the headline story for mortgages and housing.

- The Consumer Price Index (CPI) for May 2025 ticked up 3.1 percent year-over-year, slightly above the Fed’s 2 percent goal.

- The Personal Consumption Expenditure (PCE) index, which the central bank favors, climbed by 2.7 percent, reinforcing the sense that price pressures aren’t backing off anytime soon.

- Because of this, talk of a possible rate cut in September is heating up, even though the Fed keeps saying it will act based on hard data, not speculation.

- Steady inflation squeezes affordability by pushing up the cost of lumber, steel, and everything else that goes into building a house.

- That, in turn, nudges new-home prices higher, pinches budgets.

- Investors are watching these inflation numbers closely since they directly affect loan costs and rental returns.

Why this matters:

- By understanding how inflation feeds into interest rates, borrowers and investors can get ahead of the curve instead of chasing it.

Economic Snapshot and Job Market Trends

- The latest Bureau of Labor Statistics report shows that the U.S. economy added 200,000 jobs in May 2025.

- At the same time, the unemployment rate held steady at 3.9 percent.

- While those numbers are encouraging, GDP growth cooled to an annualized 2.1 percent, and wage gains, although healthy at 4.2 percent over the year, are being watched closely to see if they keep up with everyday bills.

- Not surprisingly, cooler growth and steady wages led to a jumpy stock market.

- The S&P 500 slipped by 1.8 percent as firms reported mixed quarterly results.

- Business owners expressed caution, which trickled down to commercial real estate lenders tightening their standards because of that, mortgage approvals now hinge even more on a reliable work history and steady income.

Why You Should Care

- Shifts in jobs, pay, and production numbers flow straight to the desk of every mortgage broker and would-be buyer.

- When lenders loosen or tighten their rules, search timelines and budget limits change overnight, so staying current on the economy is vital for anyone battling high home prices.

Policy Moves and Housing Rules

- In housing news, the Federal Housing Administration raised its loan limits for 2026.

- The new cap is $510,400 for standard single-family properties and a noteworthy $1,149,825 for areas where the cost of living is especially high.

- On Capitol Hill, lawmakers are reviving talks of bigger tax credits for first-time buyers to help offset the climb in home prices.

- In addition, both California and New York rolled out stronger tenant protection laws this week, adding fresh rent-control measures that multifamily investors will need to factor into their business plans.

- The U.S. Department of Housing and Urban Development (HUD) recently announced stronger programs to help homeowners avoid foreclosure.

- The agency is also stepping up its fair housing efforts, meaning there are now heftier fines for banks and lenders that practice unfair discrimination.

Why should you care?

Every time lawmakers move the dial, they change the rules banks, investors, and buyers have to play by. Staying ahead of those changes lets real estate agents and ordinary homeowners decide when to jump in, when to hold back, and how to stay in the law’s good graces.

Tips on Investing in Real Estate and Building Wealth

- This past week, new investment chances began popping up nationwide, with Orlando, Florida, and Phoenix, Arizona, standing out for rental-property LLCs.

- Both cities are seeing a surge in demand, which is pushing cap rates between 6.2% and 7.0%.

- At the same time, debt-service coverage ratio (DSCR) loans are catching on fast.

- They let investors with several houses simplify the paperwork and keep cash flowing.

- Short-term rentals, especially those listed on Airbnb, are buzzing in tourist magnets like Miami and Nashville, where the foot traffic feels endless.

- Tax experts are once again buzzing about 1031 exchanges and cost-segregation studies as must-have tools for squeezing every dollar out of an investment.

- Multifamily buildings are getting extra attention, too.

- Even with interest rates creeping up, apartments in city centers continue to spit out stable cash flow, a trait every investor loves.

So why mention all this?

- Because serious investors want playbooks written by pros.

- These little glimpses into what’s working today help ordinary buyers and veterans map plans for real wealth.

Business and Financial News in Focus

- The banking world recently hit a rough patch when two regional mortgage banks said they were low on cash.

- That announcement made many people wonder how steady the entire market is.

- In the stock arena, however, the mood seemed a little brighter.

- Real estate investment trusts, or REITs for short, managed to do better than most other companies.

- Cryptocurrency fans also turned their gaze toward property-linked digital coins, looking for new investment methods.

- On the lending side, the average rate for small business loans climbed to 8.5%.

- That squeeze will make it tougher for many entrepreneurs who want to buy or improve commercial real estate.

- Taken together, these stories show how closely money markets and housing are tied together.

Why It Matters

- Keeping track of these developments makes GCA Forums a trusted source.

- Investors and small-business owners prefer a one-stop shop where they can see the whole picture, not just bits and pieces.

Foreclosures, Distressed Properties, and Housing Crisis

- According to RealtyTrac, foreclosure filings crept upward in the second quarter of 2025, rising 3.5% from the previous quarter.

- Banks’ real-estate-owned (REO) homes and short sales are still magnets for bargain-hunters, especially in cities like Detroit and Cleveland.

- Wobbly job numbers add pressure, but government aid programs have helped soften the blow.

- Online auction sites are buzzing, showing a 15% jump in bids for distressed properties.

- That spike shows plenty of investors are eager to roll up their sleeves and turn a rundown house into a profitable rental.

Why It Matters

- Up-to-the-minute data on foreclosures and relief programs can make a real difference for investors and families struggling to keep their homes.

- When the numbers are fresh and easy to understand, people are likelier to read, share, and act on what they learn.

Hot Topic of the Week

This week’s topic, lighting up the comment threads, isn’t homes on the brink of foreclosure. It’s New York Attorney General Letitia James and some serious allegations of mortgage fraud. The conversation heated up inside the GCA Forums after Newsweek and CBS New York published reports that a recent Federal Housing Finance Agency (FHFA) referral was before the U.S. Department of Justice.

Here’s a quick summary of the key claims flying around:

Norfolk Claim in 2023:

The Attorney General is said to have labeled a house in Norfolk, Virginia, her main home. Critics point out that since she lives and works in New York, making that claim would be tricky for any public official trying to score sweetheart loan terms.

Brooklyn Brownstone in 2021:

Allegations also suggest she listed the Brooklyn rental as a four-unit building rather than five, qualifying for lower interest rates.

Older Papers:

Some documents from 1983 and 2000 reportedly show her father named as her spouse, raising big eyebrows about how mortgages were filed and whether rules were bent.

James has pushed back on the accusations, calling them “baseless” and hinting they are payback for her lawsuit against former President Donald Trump. Her lawyer, Lowell, said the claim about the Virginia property is nothing more than a clerical mistake and insisted that other papers show the house is meant for her niece. As of June 29, 2025, the FBI and the U.S. Attorney’s Office are still looking into the case, yet no formal charges have been filed.

Inside the GCA Forums, users have been debating what these claims could mean for mortgage-fraud cases and whether politics are driving the prosecution. Some questioned whether James listing her father as her spouse holds up, pointing out that the records are several years old. In contrast, others argued that mortgage applicants should always be completely honest. During an “Ask an Expert” segment, a lawyer warned that falsely describing how a property will be used can bring serious trouble, with possible wire-fraud or bank-fraud charges under federal law sections 1341, 1343, 1344, and 1014.

Why should we care? Stories like this get people talking, pulling in readers who usually stick to celebrity gossip rather than loan rates. They also remind everyone—from real estate agents to first-time buyers—why careful paperwork matters.

Expert Q&A and Forum Buzz This Week

This week, the GCA Forums were busier than ever, with hot topic threads zeroing in on high interest rates and the latest FHA loan limits. During our latest “Ask an Expert” chat, mortgage pros tackled some of the most pressing questions, including:

How can borrowers boost their DTI while interest rates are up?

Several lenders suggested paying off high-interest credit card debt first and then considering bringing in a co-signer if that fits the situation.

Are DSCR loans a smart move for first-time property investors? Advisers praised the loans’ flexibility but warned that they come with steeper rates and tighter cash-flow checks, so budgeting is necessary.

A thread about buying distressed homes drew a lot of eye attention. Users shared success stories about flipping bank-owned houses in overlooked parts of town. These real-life accounts highlight that folks keep returning to the GCA Forums for solid advice and friendly peer support.

Why It Matters

Shining a spotlight on forum activity keeps our community lively. It shows readers that GCA Forums News is the first place to turn for trusted mortgage and real estate know-how.

Final Thoughts: The Secret Sauce for Success

This week’s edition of GCA Forums Headline News Weekend Report is packed with fresh updates, sharp expert takes, and stories that keep readers coming back. By breaking down tricky mortgage subjects, handing out practical pointers, and sparking lively forum chats, we want to give buyers, investors, and pros the necessary tools. Pass these stories along, jump into the talk on GCA Forums, and watch our daily posts to prepare you for whatever the real estate market throws your way.

-

Charlie Sheen was once one of Hollywood’s biggest stars, known for his role in Two and a Half Men and his extravagant lifestyle. But in 2025, things have taken a dramatic turn. In this video, we take a deep dive into Charlie Sheen’s current life—his home, financial struggles, what’s left of his car collection, and his real net worth after years of reckless spending.

Has Charlie Sheen’s luck finally run out? Watch until the end to uncover the truth about his lifestyle in 2025!

-

GCA Forums News for Tuesday, July 22, 2025

Breaking: Ghislaine Maxwell to Testify in Epstein Investigation

- Ghislaine Maxwell, sentenced for sex trafficking and a close associate of Jeffrey Epstein, is negotiating with federal prosecutors to reveal what she knows about Epstein’s actions and a possible list of his clients, the Department of Justice and her attorney say.

- Deputy Attorney General Todd Blanche announced plans to meet with her soon for her statement, following public demands and a call from former President Trump to release all credible evidence in the case.

- Maxwell’s attorney stated she plans to testify honestly.

- Still, in a July 6 notice, the DOJ reiterated that no new indictments in the Epstein case will occur until grand jury documents are unsealed.

- Federal Judge Paul Engelmayer is now weighing the DOJ’s plea to make more Epstein records public and has asked for more details before making a decision.

- Even with the push for full openness, officials say they don’t have proof to launch wider investigations. Political tensions have risen, with some analysts criticizing the DOJ and FBI for a slow response.

Political Earthquake: DNI’s “Treason” Claims Shake Washington to the Core

- National Director of National Intelligence Tulsi Gabbard has dropped a bombshell, saying newly unsealed documents provide “overwhelming evidence” of a planned operation by Obama-era officials to prop up the “Russiagate” narrative against Trump in 2016.

- The list includes Barack Obama, James Comey, Hillary Clinton, James Clapper, John Brennan, Andrew Weissmann, and others.

- Gabbard charges that these officials colluded to poison the 2016 election’s outcome by faking intelligence and prepping the Russia-collusion investigation.

- She is calling the entire operation “treasonous.” Her testimony has sparked a chorus demanding charges of treason and conspiracy, while critics—mainly House Democrats—blast her for alleged political bias and mistakes.

- They stand by previous bipartisan findings that Russia mostly pushed influence campaigns, not voter fraud.

White House on Edge: AG Hit with Mortgage Fraud Claims

New York’s Letitia James

- New York Attorney General Letitia James is staring down a federal criminal referral for purported mortgage fraud tied to a Norfolk, VA, property and a Brooklyn, NY, multi-family building.

- The referral argues that she doctored documents to secure better loan terms and misled lenders about residency, leaving attorneys and watchdogs to consider her compliance and integrity over decades of public service.

- Attorney General Letitia James says her office did nothing wrong.

- She calls the complaints against her pure political retribution.

- James says her mission is to hold everyone accountable—including former President Trump—for fraud and financial misconduct.

Senator Adam Schiff of California

- Senator Adam Schiff is now under Justice Department review for alleged mortgage fraud tied to properties he owns in Maryland and California.

- A formal complaint claims Schiff falsified documents to secure better loan terms and misstated occupancy on multiple Fannie Mae loans between 2003 and 2019.

- Schiff calls the claims false and says they come from Trump and his political allies.

Market Jitters: Trump Attacks Fed Chair Powell on Rates

- President Trump slammed Federal Reserve Chair Jerome Powell today, labeling him a “numbskull” for keeping rates high.

- Trump predicted Powell would be gone “in eight months,” even though the law protects the chair from being removed without cause.

- Trump’s ongoing campaign to replace Powell with someone he views as loyal fuels anxiety on Wall Street, especially since the Fed is also being examined for costly office upgrades.

- It has yet to signal any rate cuts.

- Speculation is heating up that Trump’s latest policy moves and his hand-picked Fed leadership could spark a fast string of interest rate cuts, potentially pushing rates down to around 3%.

- While that would open up some attractive windows for investors, it also heightens the risk for the entire economy and the housing market.

- Still, many analysts think real-world rates will stay higher for longer, thanks to climbing bond yields and stubborn inflation that will not let up.

- The Trump–Musk drama has moved to a new level, marked by a public breakup that’s more personal and political than ever.

- Disputes over EV subsidies, dusty policy bills, and growing animosity have widened the gulf.

- Trump even joked about deporting Musk—an American citizen—after Musk criticized the “Big Beautiful Bill” and pushed for tighter government belt-tightening.

- Musk responded by going full-bore on social media, leveling wild accusations and hinting that he might yank big projects from federal programs.

- However, he deleted most posts almost before they went live.

- At the same time, he’s quietly pushing a new “American Party” that’s meant to rattle the political cages and pull voters from both the GOP and the Democrats.

- Once a powerful coalition driving tech and policy change, their partnership is now irreversibly fractured.

- Musk’s habit of chasing ventures unrelated to Tesla and his erratic management worries Wall Street and policy watchers.

Troubles Mounting for Tesla’s Cybertruck

- Tesla’s Cybertruck is under fire as the number of spontaneous-blaze, battery-drain, and safety problem reports keeps climbing.

- In Texas and Colorado, units have caught fire—one nearly sparking a major wildfire—highlighting the special hazards that electrics present.

- The spike in incidents has renewed calls for stricter federal oversight.

- Even insiders admit a sales halt on the Cybertruck remains possible until risks are squared away.

- Owners are piling up complaints about shaky reliability, poor battery performance, and fire fears, jeopardizing Tesla’s brand and future profit.

Justice, FBI, and the Epstein “List”: Reaction to the Official Answer

Attorney General Pam Bondi, FBI chief Kash Patel, and Deputy Director Dan Bongino say no usable “Epstein client list” has turned up, and the probe is closed—even though Maxwell is still open to helping. Skeptics say the investigation is half-finished and that the administration cares more about headlines than the deep truth.

Some of President Trump’s supporters still loudly express frustration with the Department of Justice. They are calling for bolder actions and greater transparency from the officials involved.

Housing, Mortgage & Economic Update

Home Purchase and Mortgage Trends

If Trump returns and the Fed aggressively cuts rates, more people might buy homes. However, many still worry that continued inflation and high government deficits will keep mortgages more expensive than some expect.

Housing Supply vs. Demand

Should rates decrease, many homeowners locked in low mortgages might finally sell. This added supply could help reduce the shortage of homes for sale, but prices could fall if enough buyers don’t appear.

Bankruptcies and Layoffs

More companies report financial trouble due to rising interest rates, weak real estate demand, and tighter loan conditions. This raises worries about lost jobs and the broader economy.

Financial Markets and Precious Metals

Stock markets have been shaky because of unclear policy moves, changes in Fed leadership, and incoming rules for big firms. Meanwhile, gold and silver prices climbed as investors sought safety in an uncertain economy.

Mortgage and Realty Firms

Mortgage companies and real estate agents are struggling because rates are constantly changing, new rules are constantly being implemented, and the number of new loans is dropping fast.

Other Key Developments Beautiful Bill

Trump’s big push for new roads, bridges, and government changes is stuck because Democrats and Republicans keep arguing over money, efficiency rules, and whether to pay for renewable energy.

DOJ Crackdown

The Justice Department feels the heat to act against Biden’s former staff, opening more probes and sending more referrals. But critics say the timing makes it look biased.

This roundup will inform you about the news shaking up Washington, Wall Street, and small-town America.

-

GCA Forums News for Monday, July 21, 2025Trump’s Fresh Fight to Fire Fed Chair Powell Raises Fresh Worry on Wall Street

Former President Donald Trump has ramped up talk of firing Federal Reserve Chair Jerome Powell, with reports saying he’s written a letter proposing Powell’s ouster and urging a new, more rate-cut-friendly leader—Trump’s goal is to slash rates by a full three percentage points. The ex-president has shared his plan with House GOP members, saying Powell’s $2.5 billion Fed headquarters overhaul could count as misbehavior. However, he later insisted removal is “highly unlikely” without proof of fraud. Legal scholars argue that the Supreme Court has already ruled that Trump can’t simply fire Fed leaders, meaning any push could lead to a messy court fight and unsettled markets. Deutsche Bank warns that kicking Powell to the curb could knock the dollar down 3 to 4 percent and trigger a wave of bond selling, echoing the damage Turkish markets suffered under top-down intervention. Chatter on X suggests Treasury Secretary Scott Bessent might slide into the chair job, and traders are already on edge: 30-year Treasury bond yields have jumped to 5 percent.

Economic Impact

A 3% cut in the federal funds rate could push it down to 1.25–1.5%. This move might make mortgages and consumer loans cheaper. Still, it also raises the risk of higher inflation, which was 2.7% year-over-year last month. Analysts caution that any signal of weakened Fed independence may push long-term Treasury yields higher, offsetting Trump’s goal of lowering the cost of servicing the national debt.

Housing and Mortgage Market: Volatility Amid Rate Cut Speculation

The housing market is experiencing bumps as Trump presses for lower rates while the Fed treads carefully. Mortgage rates, which move with the 10-year Treasury yield, jumped after rumors of Powell’s firing but settled after Trump denied the reports. If the cut happens, 30-year fixed rates could slip to 5.5–6% by December, but lasting inflation from Trump’s tariffs might keep rates stubbornly high. Demand for housing is solid, fueled by population growth, but available homes are scarce. New construction is stalling because of pricey materials and a tight labor market. Realty firms are feeling the pinch: several regional companies have announced layoffs and smaller commissions as the number of transactions slows.

Trump and Musk’s Falling Out: From Bromance to Bitter Feud

What started as a buddy act has turned into a full-on fight. Donald Trump and Elon Musk used to swap compliments and selfies. Now they’re trading insults on social media. Trump fired first, calling Musk a “jack of all trades, master of none” for trying to run Tesla, SpaceX, and still tease a new American Party. Musk shot back, insisting he’s redefining imagination—then accused Trump of slowing down American innovation. People around Trump say he’s joked about deporting Musk, even though he can’t legally act against a U.S. citizen. The smack-talk comes right after Musk criticized Trump’s tariffs, warning they choke the supply lines Tesla needs to keep cars rolling.

Musk’s American Party

Now, Musk is quietly eyeing a new political toy—he calls it the American Party. The goal is to poke Democrats and Republicans and pitch a vision that loves free markets and speedy tech. No one knows the full game plan yet, but Musk keeps tweeting hints that the idea is buzzing with Gen Z and millennial voters who’ve already ghosted the two big parties.

Tesla’s Woes: Cybertruck Troubles and Regulatory Scrutiny

With experts worried, Tesla is running into fresh headwinds with the Cybertruck, which is now linked to unexpected battery drain, software bugs, and a few fire reports. The NHTSA and other federal agencies are looking into these problems, raising the chance that the company might have to recall the truck or face a pause on new sales. The stock has dropped 15% this month as these reports, plus a shaky market, have rattled investors. Critics suggest that Elon Musk’s attention on SpaceX, Twitter, and other projects has kept Tesla from tightening quality control, and that the delays and defects are starting to sink buyer trust.

DOJ Shakeup: Bondi, Patel, and Bongino Under Fire in Epstein Fallout

U.S. Attorney General Pam Bondi, FBI Director Kash Patel, and Deputy Director Dan Bongino are facing a storm of backlash for how they’ve dealt with the Jeffrey Epstein investigation. The three officials just insisted that there’s no official “client list” of Epstein’s associates, directly clashing with earlier leaks and fueling worries of a cover-up for powerful names, including Trump. Social media is buzzing, labeling them “the three stooges” and accusing them of deliberately protecting Trump.

The Epstein saga, tied to child sex trafficking, was officially closed by Bondi, sparking fury among survivors’ advocates. They argue that mountains of evidence—flight logs, witness statements, and sealed documents—point to a wider web of offenders. The fallout hurts Trump’s image, with critics noting that his new stance echoes the “Biden-era politicians” he vowed to oppose.

DOJ Actions

The Justice Department has started inquiries focused on former Biden administration officials, and multiple arrests have reportedly been made on corruption charges. So far, the DOJ has released some specifics, but the timing suggests that these cases align with Trump’s renewed vow to “drain the swamp.”

Economic Indicators: Inflation, Stocks, and Precious Metals

Inflation has settled at 2.7%, and Trump’s tariffs on imports are partly to blame, raising prices on overseas goods. The stock market is jittery; the S&P 500 fell 2% last week on speculation of a Powell dismissal, but then bounced back after Trump’s reassurance. Gold has jumped to $2,800 an ounce as traders hunt for safer bets. Job data is still promising, with unemployment at 4.1%, yet corporate bankruptcies are climbing. Retail and tech startups are feeling the pinch. In tech alone, layoffs hit 50,000 in Q2 2025.

Big Beautiful Bill: Trump’s Ambitious 4-Trillion Dollar Plan

Trump’s “Big Beautiful Bill” would drop a $4 trillion blueprint on the nation, designed to turbocharge roads, airports, and the military. But its sticker shock is waking up deficit fears everywhere. Ex-Fed Vice Chair Lael Brainard fears that if Washington pressures the central bank to slash rates to cover this tab, the result will be fiscal dominance and a renewed inflation fight. House GOP members are itching to get on board, but a few are still clutching their calculators over that $4 trillion figure.

The Fed: Hold the Line

The battle for Fed independence is hot. Trump’s inner circle—OMB boss Russell Vought and FHFA chief Bill Pulte—are hitting Chair Jay Powell for the refurbished D.C. tower and some alleged bias. Powell stays on the line, saying the Fed is still dialed into inflation and jobs. No resignation, no quit.

Business and Realty Headwinds

The pain isn’t limited to housing. Businesses are being hit hard by pricey loans and higher tariffs. Realty firms report a 20% drop in sales, forcing Redfin, Zillow, and others to trim payroll. Meanwhile, bankruptcies among small and mid-sized firms jumped 30% from a year ago, with retail and construction feeling the squeeze.

Key Takeaways

Trump’s Powell impeachment talk is still on the table, and markets are bracing for the fallout.

- Trump-Musk Rift: The old buddies are at odds.

- Trump says Musk is too distracted, while Musk is quietly exploring a new party.

- Tesla Struggles: Cybertruck delays and a growing pile of red-tape headaches are dragging the stock and the brand down.

- Epstein Fallout: Bondi, Patel, and Bongino keep saying there’s no Epstein list, but the silence only fuels more doubt about Trump’s team.

- Economic Wobble: Inflation is rising at 2.7%, stocks keep swinging, and more companies are collapsing.

- People are worried.

- Housing Headache: Not enough homes and high rates mean fewer sales. Realty companies are already cutting staff.

Trump’s Big Bet

The new $4 trillion budget has big ideas, but is already meeting “no way” from the deficit hawks.

This news wave shows a country bouncing between dollars-and-cents worry, wild politics, and new partners. Trump’s next move is the main question.

https://www.youtube.com/watch?v=2RCjtoIFMDk&list=RDNS2RCjtoIFMDk&start_radio=1

-

Headline News: Thursday, July 17, 2025Breaking: Housing and Mortgage Market Rattled by Trump’s Attack on the Fed

President Donald Trump ramped up his criticism of the Federal Reserve on Thursday, sending calm markets into chaos in minutes on both Capitol Hill and Wall Street. The President questioned a $2.7 billion renovation of the Fed’s Washington building and hinted he might fire Chair Jerome Powell if an investigation uncovers fraud or negligence. Later, he cautioned that such a dramatic step was “highly unlikely” unless clear wrongdoing appears, leaving everyone wondering what comes next. Under the law, a sitting President can remove the chair only for cause, and no modern administration has dared to test that kernel of independence.

Market whispers now suggest that a new, more dovish Fed leader would rush to slash borrowing costs, fueling speculation that rates could plummet by nearly three percentage points. Yet that talk unsettlingly backfired—the S&P 500 slid sharply, and the dollar ricocheted up and down as traders reassessed the prospect of a politically interfered central bank.

Trump Asks Elon Musk to Run New Efficiency Agency — “DOGE” Chief

President Trump stirred the news again by offering Tesla and SpaceX boss Elon Musk a Cabinet post to lead the brand-new Department of Government Efficiency, or DOGE. His job would be to tear down red tape, cut rules that slow things down, and remake federal offices so they run faster and cheaper. Musk would share the spotlight at DOGE with entrepreneur Vivek Ramaswamy. Still, folks wonder if the department can even be born, what power it would have, and whether Musk’s business empire creates awkward conflicts.

Trump has also reassured his Cabinet that Musk is mainly there as an adviser. The existing leaders of each agency will keep the reins, a move aimed at calming fears that Musk might walk in and fire people left and right.

Elon Musk: Is He Spreading Himself Too Thin?

Elon Musk’s ever-growing to-do list now stretches from Tesla cars to SpaceX rockets and even Twitter-tinted politics, and haters are watching closely. Many observers worry that by chasing so many goals at once, Musk might weaken his reputation and the future of his companies. Right now, it looks like Tesla is feeling that strain the most:

Cybertruck Crash

Interest in the odd-looking pickup is sinking fast, thanks to rushed production, design flops, and dramatic headlines like flaming batteries and nighttime arson. Official recalls keep piling up-eight and counting, and counting, and with only 4,300 trucks sold last quarter, forecasts have evaporated. Fears over battery failures have rattled buyers and grabbed regulators’ attention.

Regulatory Headwinds: Because of all these quality slips, U.S. regulators are circling Tesla, and every fresh story chips away at the brand it worked so hard to build.

DOJ, FBI, and Epstein: Fresh Questions Lift Trump’s Team

Angry headlines returned this week after Attorney General Pam Bondi, FBI Director Kash Patel, and Deputy Director Dan Bongino insisted that no secret “client list” belongs to Jeffrey Epstein, thus closing that chapter with no new proof. Bondi once suggested such files might be real; critics now say she and the White House are burying what they know and robbing Epstein’s victims of real justice. Speaker Mike Johnson demanded a full public answer about those records, while voices from both parties in Congress urged full transparency and the quick release of every page tied to Epstein.

Trump and Musk: Colleagues Split, Third Party Buds

Once a cozy team, Donald Trump and Elon Musk drifted apart as public tensions grew and their goals moved in different directions. Musk is quietly building an American Party—a gamble that could shake up the tired, two-color system voters complain about. Their friendship soured during power plays for Cabinet seats, clashing policies, and Musk’s string of headline-grabbing scandals[9].

U.S. Economic Pulse: Housing & Mortgage Market

- Rates in Flux: Rumors about who will lead the Fed next have sent mortgage rates bouncing up and down.

- If Trump returns and cuts come fast, borrowing could get much cheaper, the thinking goes.

- Until that question settles, home shoppers are stuck waiting, even though lower rates usually attract more buyers.

- Company Turbulence: On the ground, lenders and real estate firms are still hurting.

- Fewer applications and big losses from past refinances, added to tighter rules, make day-to-day operations tough.

- High prices and thinner budgets keep many would-be buyers on the bench, pushing some companies to lay off staff or close completely.

- Housing Inventory: Even with sales slowing, a tight supply of homes stops prices from falling far.

- Sellers who once held out are now cutting lists, but the shortages still keep a floor under values.

Business, Jobs, and Markets

- Stock Market: Wall Street lurched up and down as traders tried to make sense of fresh headlines from Washington and mixed signals from the Fed.

- Inflation: Prices at the store keep rising faster than planned, with overall inflation still slightly above the 2-percent goal because energy and housing costs refuse to ease.

- Employment Numbers: Hiring has leveled off, and new cuts, especially in tech, real estate, and finance, push more people to file for jobless benefits each week.

- Bankruptcies: An increase in high-profile bankruptcies and cutbacks deepens the drumbeat about a slowing economy and leaves investors on edge.

Washington Big Beautiful Bill