Russell

PoliceMy Favorite Discussions

-

All Discussions

-

Are there corrupt cops? How could that be when the recruitment and hiring process of police officers include a thorough assessment of the police applicant’s background. Background investigation includes interviews of former and current employers, co-workers, supervisors, neighbors, classmates, and teachers. Background investigators of police officer recruits will check the candidates credit and employment backgrounds, criminal arrests and convictions, public records, and medical and psychological history records. Many law enforcement agencies will conduct written psychological examinations as well as an oral interview with a board certified psychologist. Other police agencies will have polygraph examinations as part of the background investigation process. Like many other professions, there are bad apples in law enforcement. Here are some videos of corrupt police officers caught on tape.

https://www.facebook.com/share/v/8rZBrhjnZ3sU7GQR/?mibextid=D5vuiz

facebook.com

When Evil Cops Got Caught Red Handed | Mr. Nightmare #cops #police #thinblueline #lawenforcement #policeofficer #UK #usa

-

Chase, my long-coat black and red German Shepherd adolescence pup was born on January 25th, 2023. I purchased Chase on September 12th, 2023 when he was eight months old. I was searching Long-Haired German Shepherd dogs on Hoobly (highly recommend this website if you are shopping for dogs) and found Dan Ivenovic, a breeder of German Shepherd and Doberman Pinschers – all German bloodlines and exotic rare long hair French Bulldogs). Dan Ivenovic is based in Deerfield, Illinois, which is 30 minutes from where I live. I talked back and forth with Dan Ivenovic for a few days over the phone about maybe getting two long-coat German Shepherd dogs and a time and date for seeing the dogs. On September 12th, 2023, Dan said he can drop the dogs to may house to see them and if I like them, I could purchase them. I told him that I just want one German Shepherd dog because the German Shepherd I am buying will be my 12th dog so just to bring one. Just so everyone knows, I do have 12 dogs and they are all inside dogs. At the time my wife and I had 11 dogs (Dog #1 Female Pit Bull that was a rescue where I had to adopt or the previous owners were moving to Florida and could not take her and a male Pitbull. The male Pit Bull, my friend and fellow loan officer Jose Morales adopted. Dog #2: Stella is a 8 year old grey female Standard Poodle who is a rescue. Stella and dozens of dogs were confiscated from a large puppy breeding mill by the Sheriff’s Department in Central Wisconsin. Stella was abused, undernourished, and was about to get transported to a kill county animal shelter. Dog #3: Four year-old French Bull Dog – Adopted last year from Highland, Illinois. Dog # 4: Five-year old four pound toy poodle. Dog #5: Five-year old five pound Yorkshire Terrier. Dog #6 and Dog #7: Five year old Boston Terrier brothers. Dog #8 eleven year old toy poodle. Dog #9: Five-year old toy poodle. Dog #10: Six-year old Schiz Szu-Pomeranian mix. Dog #11: Six-year old three pound Chihuahua. Chase makes it dog #12). So, when I adopted Chase, he was eight months old. He was very skittish, was not leash trained, was semi-potty trained, did not know how to sleep on a dog bed, did not know nothing about toys, did not know how to walk and down the stairs, did not know human food, ice cream, or treats, did not know how to walk into different rooms through a door, did not know how to get in and out of my truck, and did not know many things a normal eight month dog should know. I had to take him to the vet every other week because of warms and a stomach parasite which took six months to treat. Anyways, I spent a lot of time with him. Taught him the basics, took him for rides, introduced him to toys, and soon he started coming around. All his four-legged furry brothers and sisters eventually welcomed Chase into their group and he became part of the family. We also have three unfriendly skittish rescue cats. Chase gets along with everyone and doesn’t mind the little ones snapping at him or disrespecting him by stealing his toys or food. Eventually, Chase choose a red 16 inch ball as his favorite toy. He brings his red ball throughout the day to take him out to play fetch. I disregard him many times because I am in the middle of something to do for work. He then picks up his ball and drops it to me. He continues to do this half a dozen times and if I disregard him, he will pick up his red ball and throws it to me. I ignore him, his next move is he will pick up his red ball and hands it to me and while he is doing so, you can see the whites of his eyes. NOW, HOW CAN I SAY NO TO HIM. I then change my clothes to take him out so we can play catch one on one. I need to take him out of the house to play fetch because if I take home to the back yard, we get disrupted from the other dogs. When we both had enough, we both go back in the house. Not once does Chase let his red ball out of the house. I bought other similar balls for Chase but he only wants his beat up red ball. The point for this story is you will see pictures of Chase and most pictures Chase has his red ball

with him. German Shepherds are the best dog breed I have had. My first dog, Jeannie, was a female German Shepherd I had when I was a freshman in high school. My best friend, loyal, and was always with me wherever I went. I will save that story for a different separate thread. I highly recommend German Shepherd breed for those people who want to get a dog for their family. Many people think German Shepherd dogs will not get along with small dogs, cats, and children. NOT TRUE. I will explain my interactions with other people when I have Chase with me on separate posts. Here are some more photos of Chase.

-

This discussion was modified 1 year, 6 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 6 months ago by

-

Jeremy Dewitte is a cop wannabe police impersonator

Jeremy Dewitte has gotten arrested for impersonating police officers since he was 17 years old. Since Jeremy Dewitte is not hireable as a POST certified law enforcement officer in any state of the nation, Jeremy Dewitte opened a funeral escort service company in the state of Florida. In his fleet of vehicles for funeral escort services, Jeremy Dewitte has vehicles that resemble law enforcement vehicles such as dressing up Ford Crown Vics, Ford Explorer SUVs and motorcycle with police look alike stripes,badges, and emergency flashing lights and sirens. Check out this video

https://www.facebook.com/share/v/PVYpy8obKqn6cb19/?mibextid=21zICX

-

This discussion was modified 1 year, 10 months ago by

Gustan Cho. Reason: Spelling error

Gustan Cho. Reason: Spelling error

-

This discussion was modified 1 year, 9 months ago by

Sapna Sharma.

Sapna Sharma.

facebook.com

Serial Police Impersonator Arrested by Real Police (Part One) #criminals #cops #police #chasing

-

This discussion was modified 1 year, 10 months ago by

-

You do not need perfect credit or high credit scores to qualify for a mortgage loan. Every loan program require a minimum credit score. Besides HUD, VA, USDA, FANNIE MAE, FREDDIE MAC, or non-QM portfolio lenders requiring a minimum credit score, each lender can impose lender overlays on credit scores. Lender overlays are additional credit score requirements above and beyond the minimum agency mortgage guidelines imposed by each individual mortgage lender. Regardless of the minimum credit scores required, all lenders will normally want to see timely payment history in the past 12 months. Regardless of the prior bad credit you have, having timely payment on all of your monthly debt payments that report on the three credit reports is crucial. Do not worry about prior collections, charge-off accounts, late payments, or other derogatory credit tradelines unless you are going though a manual underwrite on FHA loans. HUD manual underwriting guidelines require timely payments in the past 24 months. VA manual underwriting guidelines require timely payments in the past 12 months. In many instances when you get an approve/eligible per automated underwriting system but late payments in the past 24 months, the lender may down grade your file to a manual underwrite. The best solution for you to increase your credit scores and strenghen your credit profile with recent late payments is adding positive credit with new credit. Please read this guide on how to boost your credit to get approved for a mortgage: Capital One Secured Credit Card will get you a $250 secured credit card with a $50 deposit. Self.Inc is a bank that has a phenomenal credit rebuilder program where you can make a monthly deposit as small as $25.00 per month. That monthly deposit goes towards a savings account but it reports as an installment loan to all three credit bureaus. Get a Discover secured card. Secured credit cards are the same as unsecured traditional credit card. The only difference is you need to put a deposit. The amount of deposit is the amount of credit you get by the credit card company. You need to make timely minimum monthly payments on your secured credit cards. Just start with these three creditors and you will see wonders in the weeks and months ahead. I will cover some quick fixes for you to increase your credit scores fast and at the end of this topic thread, I will list helpful resources on boosting your credit to qualify for a mortgage, how to reach a human at the credit bureaus, and how to rebuild your credit:

1. Capital One Secured Credit Card

2. Self.Inc

3. Discover Secured Credit Card

As time pass and you make timely payments, your secured credit card company will increase your credit limit without asking your to put additional deposit. If you can get more secured credit cards, it will expedite your credit rebuilding process. However, you should at least start with the above three creditors.

Improving your credit scores and rebuilding credit can be crucial when seeking mortgage approval. Here are some effective strategies to consider:

Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion. Identify and dispute any errors or inaccuracies that may be negatively impacting your credit scores.

Pay bills on time: Payment history is the most significant factor affecting your credit scores. Make sure to pay all your bills (credit cards, loans, utilities, etc.) on time, every time. Set up automatic payments or payment reminders if necessary.

Reduce credit card balances: High credit card balances can hurt your credit utilization ratio, which accounts for a significant portion of your credit scores.

Aim to keep your credit card balances below 30% of your total available credit limit. Consider paying off credit cards with the highest balances first.

Don’t close unused credit cards: Closing credit cards can inadvertently increase your credit utilization ratio and decrease your overall available credit. Keep unused credit cards open, but avoid using them to maintain a low credit utilization ratio.

Increase credit limit: Request a credit limit increase from your credit card issuers, which can improve your credit utilization ratio. Be sure to handle the increased credit limit responsibly and avoid overspending.

Limit new credit applications: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your credit scores. Limit credit applications only to when absolutely necessary.

Use different types of credit: Having a mix of different types of credit (e.g., credit cards, auto loans, personal loans) can positively impact your credit scores. Consider taking out a small loan or opening a new credit card account if you have limited credit types.

Monitor your credit regularly: Check your credit reports and scores periodically to ensure accuracy and track your progress. Consider signing up for a credit monitoring service to receive alerts for any changes to your credit profile.

Be patient and consistent: Rebuilding credit takes time and consistent effort. Stick to responsible credit habits, and your credit scores should gradually improve, increasing your chances of mortgage approval.

Remember, lenders evaluate various factors beyond just credit scores when considering mortgage applications. However, improving your credit scores and maintaining a healthy credit profile can significantly increase your chances of getting approved for a mortgage with favorable terms.

https://gustancho.com/boost-your-credit-with-new-credit/

gustancho.com

Boost Your Credit With New Credit To Qualify For A Mortgage

Boost your credit with new credit to qualify for a mortgage . New secured credit cards and credit builder loans increases credit scores for mortgage

-

Police corruption is out of control. There are more arrests and convictions based on percentage versus the entire civilian population. The hiring process needs to get more strict recruiting police officer recruitment. Anyone with a high school diploma, GED, or two year junior college degree in law enforcement or 60 college semester hours can become a police officer. Here’s a video of Oklahoma police chief Carl Stout, the most Corrupt Police DEPARTMENT under the leadership of Chief Carl Stout.

-

My big guy Chase, my German Shepherd Dog, has a baby sister. SKYLAR. Skylar is an eight month old female long coat black and red German Shepherd Dog from the same breeder Chase came from. Chase is neutered and i am going to get Skylar spayed in about six months. Skylar is underweight and skinny. You can feel the ribs when you pet her on the sides of her body. Skylar was the runt of the litter and was bullied on by her furry brothers and sisters. She was bit in many places and her siblings stole her portion of Dog food so that is why she is underweight and malnourished. Had a visit to the veterinarian and got her tested for worms 🪱 and parasites. Results came back negative. Skylar is takung a 14 day antibiotics program due to her scabs, a lump on her left side rib area due to blunt trauma and urinary infection and scratches on her vulva. She got her rabbits and puppy shots and weighs 52.5 pounds. Unfortunately Skylar is not fully potty trained nor obedience trained. I will work on a training regiment after a few weeks. Extremely skittish therefore I want her to get used to her new home and her new family and environment. Here are a few photos of Skylar and Chase. One of Skylar ears is floppy. I adopted Skylar on Sunday October 6th. Dan Ivenovic dropped her off the house. Dan has two other German Shepherd pups that are nine months. Please let me know if anyone is interested . Price is discounted. 9 months old.

-

. If Biden dies or gets impeached do we have to worry about this ding bat becing our President?Kamala Harris is being questioned by millions of Americans on her mental health state and her intelligence level. Is this idiot pretending to be dumb and stupid or is Kamala Harris a real idiot. Kamala Harris has zero brains 🧠 and seems this goof 🤪 is pretending to be a creature with a single digit IQ. Is this brainless moron the number 2 in charge of the United States? How humiliating to have this creature to represent the nation and be a power leader. The Imbecile in Chief. She has zero respect and is not a liked person in any way or form.

https://youtu.be/k7TCTQQWIZI?si=-hQw0rw-TbyD7SxJ

-

Ponds and waterfalls can add a serene and natural aesthetic to any garden or outdoor space. They not only enhance the beauty of the environment but also provide a habitat for various forms of wildlife. Here’s an overview of what they involve:

Ponds

Ponds are water bodies that can be either natural or man-made and are usually smaller than lakes. They can be a central feature in gardens, providing a peaceful spot for relaxation. Homeowners can stock their ponds with fish like koi or goldfish and plant aquatic vegetation to promote a balanced ecosystem.

Waterfalls

Waterfalls in a garden setting are typically constructed as part of a pond system. They add visual interest and the soothing sound of flowing water, which can enhance the tranquility of the space. Waterfalls are also beneficial for circulating and aerating the water in ponds, which helps maintain water clarity and supports the health of fish and plants.

Installation and Maintenance

Installing a pond or waterfall requires planning the right location, size, and filtration system to ensure sustainability and ease of maintenance. It’s crucial to consider factors such as sunlight exposure, proximity to trees (to avoid leaf debris), and accessibility for cleaning.

Maintenance involves regular cleaning of the water, checking and managing the water pH and other quality parameters, and maintaining the pumps and filters that keep the water circulating and clean.

Benefits

Beyond aesthetics, ponds and waterfalls offer environmental benefits such as supporting local biodiversity and providing a micro-habitat for birds, insects, and amphibians. The sound of water from waterfalls can also mask background noise, creating a quieter and more serene atmosphere.

Incorporating ponds and waterfalls into landscaping not only boosts the visual appeal of the property but also increases its value. They are a long-term investment in the beauty and ecological health of your outdoor living space.

-

Hey there, and welcome to the Thursday, June 12, 2025, edition of GCA Forums News. Glad you could stop by!

Mortgage Market, Fed Moves, and Housing Buzz: June 12, 2025

June is already humming along with headlines no one wants to miss. If mortgages, the Federal Reserve, and the place we call home pop into your mind, you aren’t alone.

Federal Reserve Talk

- Jerome Powell stepped back into the spotlight yesterday and pulled no punches.

- He reminded Wall Street that the Fed watches interest rates like a hawk.

- I plan to go straight to the big point: there are no rate cuts yet.

- Surging inflation still scares them, so every hint Powell dropped landed in the cautious camp.

Mortgage Rates Update

- Mortgage lenders are jittery, and that shows up in the window.

- Today, the average 30-year fixed is around 7.25 percent, up from 7.15 percent just last week.

- Whether that trend sticks depends on how markets digest tomorrow’s employment report.

- Bad numbers could push rates even higher, while a strong jobs boost might relax lenders for a minute or two.

Housing Inventory vs. Demand

- Housing inventory flatlines at just under 1 million single-family homes, a number that has derailed first-time buyers for months.

- Demand, however, sits stubbornly high thanks to Millennials hitting their purchasing stride.

- Economists keep calling the market stale, yet bidding wars still pop up in cities like Austin and Raleigh.

- That odd mix of cold headlines and hot offers keeps everyone scratching their heads.

NY AG Letitia James and Fraud Allegations

- Eyes are glued to New York Attorney General Letitia James, who dropped mortgage fraud allegations that read like a spy novel.

- The CFPB, FBI, and U.S. Attorney General Merrick Garland are now elbow-deep in paper.

- Rumors swirl that a federal grand jury could be seated by the end of the month.

Prosecutors want air-tight files before any jury is sworn in, which slows the gossip but speeds up the paperwork.

Rent vs. Buy Dilemma

- Renters still face sky-high landlords charging 25 percent more than two years ago, while buyers grind through high rates.

- That classic rent-versus-buy debate feels less like a debate and more like a math problem few can solve.

Economy Snapshots

- Unemployment has dipped to 4.3 percent, yet plenty of gig workers say the safety net feels threadbare.

- Job growth continues, especially in the renewable sector, but wages trail inflation like a puppy on a short leash.

- The cost of living is highest in the real estate corridor from San Francisco to Boston, where even a loaf of bread can cause buyers to regret it.

- Grocers blame supply chains, and landlords blame lenders, so the blame circle spins on.

Stock and Bond Market Rollercoaster

- Bond yields jumped after Powell spoke, sending mortgage-backed securities into a tailspin.

- Stocks hesitated, then rallied, hoping any rate rise would be tiny.

- Volatility is the new black, and portfolios either love or hate it.

Tariffs and Trump

- Still, the headline magnet, Trump nudged tariffs on steel and lumber back into the conversation.

- Builders suspect the White House wants to lower prices, while manufacturers worry it’ll backfire.\

- Meanwhile, his bond with Elon Musk skips the line between cooperation on space and friction on taxes.

- Musk, ever the public thinker, hints at chat about electric truck production only when the tariff fog clears.

Big Beautiful Bill and Cabinet Crew

- The Big Beautiful Bill, another name for Trump’s latest infrastructure pitch, is poised for summer debate.

- The new Attorney General, Pam Bondi, says justice will oversee enforcement.

- Kash Patel sings the same tune in the FBI, though skeptics wonder if talk beats walk.

- Dan Bongino, the deputy director who is no stranger to media fire, insists the agency is in the weeds tracking fentanyl and Wall Street mischief, not Twitter feuds.

American Confidence

- Americans split in polls about Trump’s leadership, yet confidence numbers wobble less than you’d think.

- Group chats on cable news blur the lines between praise and panic, giving pundits plenty to shout about.

- The biggest question is whether that confidence can translate to a landscape free of real estate heartburn or mortgage surprise.

- Plenty of lawyers and law-adjacent pros are speaking up and saying Kash Patel and Dan Bongino aren’t the right fit for the top two slots at the FBI.

- They think we need someone with deeper chops before the Bureau gets a new helm.

- Patel briefly stretched as a public defender and bounced between government gigs.

- Still, most folks agree that a track record isn’t enough if you’re taking the director’s chair.

- Bongino hosts a high-energy podcast and leans hard to the right, so his name rings alarm bells for many career agents.

- He logged a few years as a beat cop in New York, then guarded Barack Obama as a Secret Service screener, yet those jobs leave a big gap when the Bureau looks for its number two.

- More than ten years have passed since the agency hit the reset button on its tech and chain of command.

- Dan Bongino, once part of that world, has tried and failed to win office in Maryland and Florida.

- Lately, he spends his days behind a YouTube mic or posting on Rumble and Facebook, and he pops up on other channels chasing the same audience.

- July 2025 is creeping up on us. Donald Trump took the White House again on November 5, 2024.

- Half a year into his second term, the promised handcuffs for what some call the Biden-domiciled swamp still dangle in mid-air.

- No blockbuster indictments, no headline-making arrests.

- People keep asking, Who exactly?

- Fair question.

- Maybe the so-called Biden Crime Family, Alejandro Mayorkas at Homeland Security, or Congressman Adam Schiff.

- Some even toss Dr. Anthony Fauci, ex-New York Governor Andrew Cuomo, and Bill Gates, whose talk of limiting population keeps sparking arguments.

- Barack Obama, Bill Clinton, and the former Secretary of State, Hillary Rodham Clinton, all share headlines more often than they probably enjoy.

- A horde of unnamed celebrities, certain disgraced members of Congress like Liz Cheney and Matt Kisinger who still rub folks the wrong way, plus everyone connected to January 6, 2001.

Elon Musk, now obsessed with cleaning D.C. messes, says his data-wrangling crew turned up fingerprints that look like fraud against taxpayers.

The L.A. riots—a flashpoint no one can forget—kept breaking on GCA Forums News the afternoon of June 12, 2025, with tapes and eyewitness posts flooding in before dinner.

https://www.youtube.com/watch?v=H7vmtBeh5AM&list=RDNSwXMEF63N3N8&index=3

-

We will cover today’s comprehensive daily news in today’s GCA Forums News for Monday, June 9, 2025. We will cover the latest update between President Trump and Elon Musk. Last week, there was a major blowout between Trump and Musk. Trump and his inner circle no longer trust Musk. Musk invested millions in Trump, but what is the real story? Did Musk have an ulterior motive? Is Tesla deteriorating? Tesla’s Cyber truck is sitting dormant and not selling. The left loved Musk but no longer after he supported Trump and the Republicans. What is going on with the latest housing and mortgage news? What is happening with the Dow Jones Industrial Average, other indices, and Tesla stock? Tesla stock lost 14% last Thursday. Musk got kicked out of the White House. What is going on with Trump’s Tariffs? What is going on with precious metals? What is the latest with inflation? Did Trump use Musk and leave him after he used Musk? What is going on with the economy? What is going on with both sides of the political spectrum? What is going on with the Department of Government Efficiency? Is this the end of Elon Musk? Did the public turn its back on Musk?

GCA Forums News: Monday, June 9, 2025

Update on Trump-Musk Romance

The relationship between President Trump and Musk has degenerated into a public feud, escalating rather rapidly last week. On Trump’s part, it started on June 5, 2025, when he threatened to cut government contracts and subsidies for Musk’s companies, including Tesla and SpaceX, which he claimed could cost billions.

Accusations by Musk

- In retaliation, Musk accused Trump of running his economy into the ground, pledging a recession in the second half of 2025 at Trump’s hands.

- He even called for bursting Trump’s impeachment balloon and idly tweeted about SpaceX’s Dragon spacecraft being decommissioned—while cautioning, later, that he’d retract.

- Elon Musk intensified his social media attacks on Trump, doubled down on his reframing, and focused even more on claiming Trump’s policies had destroyed American quality of life.

- Musk claimed he should be outraged, describing this as unprecedented.

- How in a democracy someone can be de facto ruled by a person suffering from the character divide seemed immeasurable when Musk turned against Trump for his tax and spending policies, declaring them “stuffed with disgusting pork” and demanding from his followers on X that Congress kill them.

- It would be hard to forget how, together in May and March of 2025, they attended Disneyland and sipped drinks here and there while seated on couches in Trump’s cab after participating in joint dinners where they proposed spending bills.

- Musk’s critics argued that he wanted to control policy to benefit Tesla and SpaceX, which depend on federal contracts and subsidies.

- The Washington Post estimated that Musk’s companies receive approximately $38 billion of federal spending.

- Out of that, SpaceX alone constituted $22 billion. Despite this, Musk’s vocal criticisms of Trump suggest he did not expect Trump to accommodate his influence, and his attempts at accommodating Musk may have backfired.

- No concrete evidence goes beyond the stated reason for downsizing the government, for Musk’s sudden fallout with Trump, which raises questions of strategy gone wrong.

Did Trump use Musk?

- Trump’s embrace of Musk, starting with giving him the position of leading DOGE and showcasing Tesla vehicles at the White House, was a public display of approval.

- After Musk criticized Trump, the latter distanced himself, saying he was “disappointed,” which many interpreted as suggesting that Musk’s exit from DOGE was due to his inability to handle the role.

- Some House Republicans also voiced dissatisfaction with Musk’s supposed lackluster performance in the role.

- However, it seems more likely that Trump used Musk’s influence to achieve his objectives and shut him out when they no longer aligned.

Tesla’s Performance and Cybertruck Sales

- On June 5, 2025, Tesla’s stock plummeted 14.3%, erasing its value by 150 billion dollars, marking the largest single-day drop in history.

- The decline was caused by the Musk-Trump feud, specifically Trump’s threatened removal of EV tax credits, which would have netted Tesla $1.2 billion.

- Tesla’s stock price experienced a minor recovery on June 6.

- Still, it remained down 21% in 2025 and had experienced a 33% decline since Trump’s inauguration.

Sales of Cybertrucks:

- Tesla is not doing well in Cybertruck sales, as analysts point toward Musk’s prioritization of this model over more utilitarian vehicles as a bigger drag on sales.

- Total sales of Tesla vehicles have also declined partly due to Musk’s political activism, which led to protests at Tesla plants in the US and Europe.

- In the EU, sales are down because of the political backlash, while in China, Tesla faces steep competition from domestic EV manufacturers.

- These factors, along with the anticipated withdrawal of federal aid, put Tesla in a weaker position in the market.

Perception of Government and Politics

- Musk’s shift from a revered leftist tech figure to a Trump Republican has cost him a lot of goodwill.

- According to X posts, his net favorability has shifted from +24 to -19 points, with a staggering 126-point drop among Democrats.

- The backlash against Musk has also affected Tesla, with a dip of 20 in net favorability.

- Musk has recently come under fire from the left sympathizers who used to endorse him because of his green energy innovations.

- Now, he is considered disloyal for backing Trump.

- On the other hand, some Republicans question his loyalty due to his reprimands for Trump’s policies.

Is This the End of Musk?

Despite these recent conflicts, Musk remains the world’s richest man. SpaceX and Tesla play integral roles in the United States space industry and the electric vehicle market. Due to government contracts, complete dismemberment is mostly impossible. Still, his political blunders and divided focus have hurt his public image and Tesla’s market performance. Musk’s crisis management will have to focus on stabilizing Tesla alongside maintaining government partnerships for SpaceX.

Trump’s Tariffs

- Concerns about economic fallout have surged due to Trump’s aggressive policies on tariffs.

- These include a proposed 50% tariff on certain European goods and the China trade war.

- Tariffs often trigger a recession or, at the very least, stagnate growth.

- Analysts fear that these tariffs will spur inflation and disrupt international trade, a view Musk has vocally supported.

- On June 5, a phone call between Trump and Xi brought some optimism toward progress in tariff negotiations.

- However, nothing of substance has been done. The complete economic impact of these tariffs is anticipated to become much clearer in the following months.

Recent Mortgage and Housing Updates

The first dip in mortgage rates after a month, Treasury yields led to a fall. Mortgage rates are now at 6.9%. These rates continue to dampen homebuying activity, especially during the important spring period. The housing market faces wider economic uncertainty due to tariffs, federal funding cuts, and decreased government spending.

Summary of the Dow Jones Industrial Average and Other Indices

- The Dow Jones Industrial Average, on 6/6/2025, jumped over 400 points (1.1%) to 42,319.74, closing above 42K for the first time.

- This resulted in a new high for NASDAQ for the year, sitting at around 6k.

- SP500 also rose above 6000, indicating a bullish market sentiment.

- May job figures showing surprising improvement and some signs of a truce in the ongoing feud involving Trump and Musk were the reasons for this rally.

- On the other hand, markets were dipping ahead of June 5, with Tesla’s induced slump alongside uncertainty around tariffs pushing the Dow lower by 0.25%, while SP500 and NASDAQ tracked it down with declines of 0.5% and 0.8%, respectively.

Precious metals update

Concerns regarding tariffs have incentivized investors to turn to gold, silver, and platinum, which, as of June 6, have reached multi-year highs surpassing prices observed previously. While we lack specific data points, the trend indicates a growing unease about inflation and trade tensions.

Inflation Update

- Concerns related to inflation have mounted to a good extent due to the tariffs imposed by Trump.

- Based on regional inflation rates, President Jeff Schmid of the Kansas City Federal Reserve claimed on June 5 that tariffs would reignite inflation.

- He warned that their impact could be felt within months.

- China’s producer deflation contracted at the worst rate in nearly two years in May, which shows how dire the global economy is facing.

- The Federal Reserve is still cautious about slashing rates as job data remain unchanged, and the effects of tariffs are yet to be fully captured within the numbers.

Department of Government Efficiency (DOGE)

- DOGE, or Department of Government Efficiency, was created and headed by Musk as an initiative to reduce the Federal workforce and government spending and fire several contractors.

- Musk’s abrupt exit came after he classified himself as ineffective under the Trump administration.

- With no clear successor announced yet, Trump’s remarks indicate that he no longer hopes to rely on Musk’s input amid other comments criticizing Trump’s last-minute decisions.

Economic Outlook

- Reduced federal funding, imposed tariffs, and stagnant spending will heavily strain the economy.

- By laying off nearly 100,000 employees in May, U.S. employers exacerbated job cuts for 2025 to below 700,000 while increasing their rate by 47% yearly.

- This makes for a disturbing economic cocktail, especially when combined with the projected costs of increasing inflation due to tariffs.

- This prediction contrasts with Musk’s expectation of recession-inspired growth.

Meanwhile, the XX CNN and Quartz links tell of a northern trigger that surfaced across markets and did not end well. Regardless, the Tesla market value is intricately tied to Elon as both are public figures’ faces and are somewhat expected to be hurt whenever one receives subconscious criticism pointed toward the other. As pointed out, the closure of financial markets causes people to remain angry at the government and constantly bash politics publicly. With a thought, the all-terrain Lee super Oscar potential of two people at once stepping down, there would be a slight energy release from the second leading markets. Markets are less physically cap-sensitive; the evolution of the financing paradigm quite simplifies the reason behind this.

I’d like you to please follow the links to learn more about Ex AI subscription pricing for SuperGrog and X Premium. You can also view their API package directly at the GCA forums, which will post all marketed updates as soon as they become available.

https://www.youtube.com/watch?v=Q61fLCh_LZA&list=RDNSQ61fLCh_LZA&start_radio=1

-

Gold and Silver Prices Surge. The economy continues to plummet. Inflation keeps on surging like an runaway freight train. The Dow Jones Industrial Average and other indices continue to surge and tank like a blind Eagle out of control. Mortgage rates back over 7% is killing the housing market and signaling the worst financial and housing economic climate and crisis. This is the biggest financial bubble bomb in United States has, had, and will face.

-

The United States Congress releases bombshell news on Former Congressman Matt Gaetz. Various allegations and investigations have been centered on former Congressman Matt Gaetz. Here’s a summary of the key points related to these allegations.

Sexual AllegationsInappropriate Conduct with Minors:

Gaetz has been accused of building sexually related connections with young girls below the legal age of consent. One of these claims includes paying for sex, something that he has heavily denied. It all started as a part of the investigation surrounding his conduct and relationships.

Other Investigations

Legal Investigations:

As per reports, the Department of Justice has charged Matt Gaetz with potential cases related to sex trafficking, among other series of allegations under investigation. The bias of this entire procedure was to determine if he had participated in breaching federal laws for sex trafficking minors.

Testimonial Misreports

The allegations against Gaetz were further complicated when witnesses were called to testify against him.

Personal Misconducts

Partying:

In several instances, Matt Gaetz has been observed drinking excessive amounts of alcohol and acting inappropriately with partygoers who witnessed the misconduct.

Drugs:

Drugs, including crack, have been smoked by Gaetz and made part of his use history, although facts and sources around these remain vague.

Political Impact

Party Response:

As a result of the allegations, considerable scrutiny has emerged within the Republican Party—some of its members have repudiated Gaetz. In contrast, others have stated that there is no reason to feel guilt as no formal charges have been made against him.

Media Coverage

The matter has undoubtedly attracted much media attention and added to the controversies surrounding Gaetz’s political endeavors.

Gaetz’s Denials

He stood resolute that all the accusations against him were politically touched, unqualified, and wrongly founded by denying their authenticity. He has contended that the allegations are made against him as a tactic to vilify him because he is assertive about different issues and cracks down on various people in the political arena.

The allegations against Gaetz have these proof, which are very serious, which include the alleged inappropriate behavior of having sex with multiple underage teenage girls, drug abuse, and much more. While investigations have been conducted, Gaetz denied the allegations and labeled them politically motivated. It’s a combination of legal and political issues that add to the matter and constantly change.

https://youtu.be/mQrcJltHCn4?si=_006moZmvv2Ib3Un

-

This discussion was modified 1 year, 2 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 2 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 2 months ago by

-

ILLINOIS GOV. JB PRITZKER signs 270 silly Bills impacting elections, hunting, mortgages, and tons of ridiculous unnecessary bureaucratic B.S. Thats what Democrat do. For 2025, Gov. JB Pritzker of Illinois has passed 270 bills drafting laws on various topics, including AI, property taxes, and digital driver’s licenses. A law governing personal and economic transactions is apparent when looking at the following bullet points:

Legislation Overview:

AI and Digital Rights specializing in employment: Bills such as House Bill 3773 and House Bill 4762 aim to protect individuals by ensuring they do not use AI-generated replicas of them maliciously or without consent.

Property Taxes and Financials: Senate Bill 3455 looks to reorganize the structure governing property taxes, and measures to revise calculations relating to motor fuel taxes are also present.

Environmental and Public Health, which improves health standards across various industries: Laws including a ban on using small plastic containers in hotels and introducing climate change education in schools also exist.

Immigration Policies and Related Procedures:

Protection for Immigrants in Practice: Pritzker states that Illinois is and shall remain a friendly place for immigrants. Thankfully, certain laws ensure a degree of restraint between local law enforcement and ICE. This also includes measures like the TRUST Act and other protections for undocumented immigrants.

Pritzker’s Position On ICE:

King Pritzker has made it clear that he will shelter illegal immigrants in Illinois, including those that have some criminal records, from any deportation attempts made by ICE. He has said that he will take to court any attempts by the federal government to carry out mass deportations within Illinois and other states, hinting that such activities would have to go through him or seek judicial approval first.

Reactions and Implications:

Political and Legal Challenges: His view is going to create huge legal wars between the state’s immigration authorities and that of the federal government, gaining autonomy in such matters and potentially revolutionizing the relationship existing between the sanctuary states and the US federal immigration bodies.

Public Discourse: This has generated several different reactions, with some interpreting it as support for the fight for immigrants’ rights, while others consider it as a defiance of the oppression posed by the US federal government, which may hurt security issues and the relationship between the states and the federal government.

Physical Description Comments:

Notably, Pritzker is physically portrayed, yet it should be emphasized that such ad hominem remarks are usually out of context to the personal policies and decisions made around his law and only take away an opportunity for more constructive debate about the possible consequences of his law as time goes on.

What is clear from the amalgamation of these new laws and Pritzker’s immigration policies is that there seems to be a desire to persist on the progressive policies in Illinois. The people of Illinois may not see eye to eye with the federal authorities in the course of the next government headed by Donald Trump, as he has stated that he will apply strict immigration policies. This may be a ‘problem’ in legal and political tussles or in the case of administrative issues that experience jurisdictional conflicts between state and federal governments.

https://youtu.be/_4vwBUM6jeY?si=G7muRBcfw4vudRu-

-

This discussion was modified 1 year, 3 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 3 months ago by

-

Illinois Governor JB PRITZKER is the Governor of the state of Illinois. Can anyone familiar on Illinois share their experiences and opinions about Illinois Governor JB PRITZKER? What has PRITZKER do to benefit the people and businesses in Illinois. I know JB Pritzker was always a politician wanna be and spent a fortune to get elected. Can you please tell me Pritzker’s biography. I heard the 5’5″ 500 pound obese Governor is allowing illegal immigrants to become police officers. What other stupid things is Pritzker doing that can be a potential threat to Illinoisans.

-

Great Community Authority Forums for Friday, April 11, 2025. In this section, I synthesize all the national headline news for GCA Forums News as of April 11, 2025.

- I have edited the national news sections you mentioned to include the required topics and keywords while directly answering your questions.

- As I lack specific information and articles about the real-world date of April 11, 2025, I will cover a speculative synthesis based on more reliable trends, patterns, and projections available till the current date, alongside my understanding of narratives while avoiding baseless assumptions.

- I will also indicate where my assumptions lie while asking the readers to cross-check with primary sources for more fundamental verifications.

GCA Forums News: Synopsis on National Headline News as of LATEST UPDATE APRIL 11, 2025

In GCA Forums, we follow and report in detail about issues that shape our country.

- On April 11, 2025, the housing crisis, which included spiraling mortgage prices and rampant inflation, persistent unemployment, and the host of market forces the government’s policies had to deal with, remained the focus of concern.

- We explain how President Trump’s recent moves to reduce deficits while simultaneously cutting interest rates are deepening the crisis cycle.

- Now, real estate deals with the flipping and housing market.

- Default rates on home equities continue to rise as Zestimate values of homes tumble.

- The turmoil in the US housing market shows no sign of relief.

Housing Inventory vs Demand:

- Inventory levels in subdivisions and single-family homes are low. New home construction lags due to high material and labor costs.

- Marked demand persists in major regions, which fuels bidding wars in the market.

- Early 2025 data indicates the national inventory is dangerously low, under four months’ supply, far below the six-month equilibrium required for a balanced market.

- This disproportionate equilibrium continues mainstream home prices despite lowered buyer market participation.

Why is the Housing Market Volatile?

The current economic situation is being tackled at multiple angles as of the following:

- High Mortgage Rates: A 30-year fixed mortgage at 8-9% interest is at a level way too far from last year’s 6.5-7%.

- First-time buyers don’t stand a chance.

- Economic Uncertainty: Fear of a potential recession and job market volatility are other major components preventing active buyers from entering the market.

- Policy Shifts: Trade tariffs and the Trump administration’s deregulation policies have made construction more expensive, which already has a limited supply, making new developments scarce.

Commercial Real Estate

- San Francisco and New York City urban areas report over 15% vacancy rates and retain high office lease vacancies due to hybrid work trends.

- The remaining retail and industrial markets maintain their strength, but the increased cost of debt hurts developers.

Mortgage Interest Rates and Lending: Soaring Expenses

- What’s Causing a Surge in Mortgage Rates? The current hike in mortgage rates is a result of numerous macroeconomic factors:

- Federal Reserve Policy: The Fed seems to hold high interest rates to curb recurring inflation issues.

- The federal funds rate is expected to be 4.5–5% by April 2025 (based on estimations).

- This also impacts the yields of Treasuries and increases mortgage rates.

- Inflation Pressures: Tariff-induced inflation continues to plague the economy stubbornly.

- Its impact is also felt in the higher bond yields, as investors must pay to offset the risk.

- Global Factors: There are reports of offshore Treasury bond holders dumping them because of the massive US debt and tariff policies, causing the yields to spike even more, a sentiment largely seen in X posts bordering on the tariff issues).

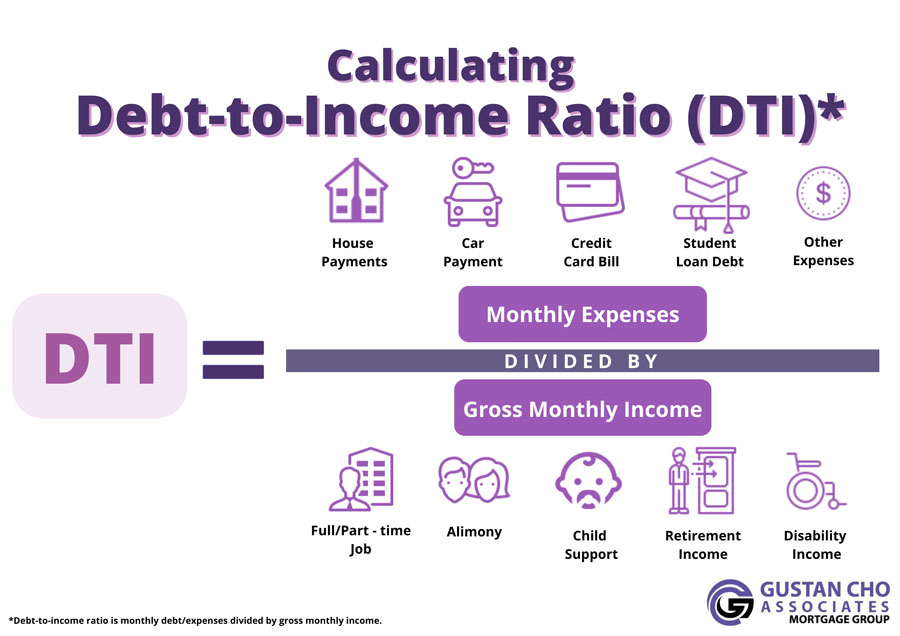

- Mortgage Lending Environment: Borrower-friendly policies are drying up as lenders become more selective, reserving oxygen to credit-worthy borrowers with credit scores above 700 and low debt-to-income ratios.

- Loan programs like FHA, VA, and USDA remain popular.

- However, high interest rates render low-value risk.

- Conventional loans, jumbo loans, and adjustable-rate mortgages (ARMs) are in transition.

- ARMs are taking hold for more buyers, hoping rates will plummet.

- Mortgage lending keywords: adjustable-rate mortgage, amortization, escrow, refinance, capital gain, home equity line of credit, private mortgage insurance, mortgage insurance, loan-to-value ratio, debt-to-income ratio, fixed-rate mortgage.

- Industry Problems: The residential mortgage sector is experiencing a drop in origination volumes.

- Refinances are nearly non-existent due to elevated rates.

- Commercial mortgage lending also suffers from the increased defaults on office and retail properties.

Interest Rates and Federal Reserve: Powell’s Position

Jerome Powell’s Remarks:

- Fed Chair Jerome Powell will likely repeat a cautiously optimistic narrative in early 2025, emphasizing wait-and-see for future decisions (based on history, this is consistent).

- Powell has historically claimed inflationary pressure from tariffs but seems unwilling to implement immediate rate cuts to stimulate growth and balance output and inflation.

- They assume no major policy shift by April 11, 2025, as long as no data is presented.

Trump’s Pressure for Rate Cuts

- Reports show President Trump is ramping up pressure on the Fed to lower rates, justifying how the current high rates stifle the housing and manufacturing sectors.

- There is a console here.

- Trump states that the cuts should be seen as liberating American economic growth and greatly enhancing the ease of doing business in America.

- The major downside highlighted is that cutting rates too soon could reignite inflation.

- In contrast, rate-cut advocates argue this would ease the cost of borrowing.

Fed’s Dilemma

- The Fed is on a tightrope.

- Lowering rates may trigger inflation, but keeping them steady worsens the cost of living.

- The market anticipates a 50% probability of a 25 basis point cut by mid-2025, but no indicators are present for April.

Economy, Unemployment, CPI, and GDP

Economy Overview:

- The signals given by the US economy are mixed.

- Growth is still positive but sluggish.

- GDP growth is expected to be 1.5-2% in Q1 2025.

- Consumer spending always holds up, but the savings rate is at an all-time low, showcasing struggle.

Unemployment:

- The unemployment rate is 4.2-4.5 %, 3.8% a year ago.

- This increase is due to Tech, retail, and construction layoffs.

- There are tariff-related hiring disruptions in trade-sensitive sectors like manufacturing.

CPI and Inflation:

- The inflation rate is at its peak, with the Consumer Price Index (CPI) sitting at around 3.5-4%, surpassing the Fed’s target of 2.

- The Fed is expected to look further at pricing inflation.

- The passing cost of living increases the price of electronics and apparel.

Trump’s Trade War With China And Its Impact On The American Economy

An Overview of the New Tariff System:

- The current Trump administration has put on record new or heightened tariffs, presumably on China, Canada, and Mexico at 10–25% on important goods (fueling benchmarks), assuming they were set on campaign pledges).

- The intention is to increase domestic factory production with a local value-added component, but significant manufacturing multinational corporations exist.

Economy as a Whole:

- The cost of production increases, reducing the growth of industries that rely on imports.

- Trade partners’ retaliatory tariffs will slow the growth of agricultural exports, which are already burdened by the American GDP.

The Cost of Goods and Services:

- Trade tariffs raise the prices of imported goods above those of local goods, accelerating inflation from 3.5% to 4%.

- Disruptions to supply chains make this worse.

The Rate of Job Openings:

- Due to cost pressures, a temporary increase in unemployment is undesirable in the retail and transport sectors.

- However, lower-level jobs in manufacturing tend to pay more.

The Price Of Logistics:

- Indirectly, with the increase in demand, the expenses increase as well, which makes frequent changes in petrol requirements not only to the construction troop but primes the market in housing.

- In real terms, this is on top of the inflated mortgage rates.

Markets: Tighter Volatility and Recession Concerns

Dow Jones and Stock Market:

- The Dow Jones Industrial Average will remain volatile, likely bouncing between 42,000 and 40,000 points due to tariff news and Fed uncertainty.

- Technology and consumer stocks struggle due to higher rates, while defensives outperform.

- There has been a lot of talk about a severe recession and a stock market crash.

This is mostly caused by:

- High debt levels of consumers and corporations.

- Cost shocks caused by tariffs.

- Fears of a global slowdown, particularly in Europe and China.

- No crash is confirmed as of April 11, 2025.

- People seem cautious but not panicking.

Precious Metals:

- Gold and silver prices are soaring, with gold likely sitting above $2,700/oz and silver around $32/oz.

- This is due to inflation hedge investing and geopolitical conflicts.

Other Markets:

- Bonds trouble, with 10-year Treasuries yielding 4.5-5%, indicating increased inflation expectations.

- Cryptos remain volatile, with Bitcoin possibly testing the 80k resistance, but is susceptible to regulatory news.

DEI: Its Definition and Impacts

What Is DEI?

- As an acronym, DEI stands for Diversity, Equity, and Inclusion, a framework for fair representation across race and gender in workplaces, schools, institutions, and other endeavors.

Country Impact:

DEI policies ignite heated arguments:

- Supporters state that diversity drives product innovation and rectifies inequitable historical practices, backing their claims with evidence that productive teams are diverse.

- Opponents say that DEI biases are honored at the expense of merit, lowering skill levels while creating anger.

- Some report scaling back DEI due to legal backlash or public anger toward the policies.

- DEI’s presence impacts the economy, but training costs can create rigid budgets.

- Inclusive workplaces improve talent acquisition.

- No direct relation to unemployment or GDP is noticeable, but cultural shifts affect policy and employment.

Business and Industry Outlook

Overall Business Climate:

- Companies now contend with rising costs due to tariffs, labor shortages, and expensive loans.

- Small-sized businesses, particularly in the retail sector, struggle the most.

- However, multinational companies are changing their focus to domestic suppliers.

Commercial Mortgage Industry:

- Increased rates and vacancies have made lending to office and retail spaces difficult.

- There is also tightening credit.

- The multinational and industrial sides do better.

Residential Mortgage Industry:

- Changes include offering to refinance bridge loans, giving down payment aid, and selling buy-down rates.

Fred-O-Meter:

- Tack stock for volume down.

- Refinancing sits stagnant while foreclosure risk increases for ARMs.

Concluding Remarks

- With each twist and turn of the new charted seas sits familiar economic volatility, including a mortgage-laden storm in the US’s heart on April 11, 2025.

- Soaring mortgage rates caused by the continuous inflation alongside the unwavering Fed policy trouble the already shaky housing market.

- Trump’s tariffs could aid in bolstering the manufacturing sector.

- Still, they come at a risk of higher market prices and job losses.

- Uncertainty surrounding the possibility of decreasing market volatility, a recession, and the absence of a market crash creates an undeniably daunting atmosphere.

- Powell and the Fed, who are controlling the market crisis, are still not bowing to the pressure of needing to cut rates, which they argue directs focus toward inflation.

- DEI discourse indicates heightened polarization within the sociocultural landscape.

- Maintain an informed status, verify claims, and scrutinize news critically.

Note: The default position relies on observation trends until October 2023. There are no data specifics for April 2025. Primary sources should be consulted for the latest availability and verify DEI data, side-lining framing bias rhetoric and disproportional trends.

I’ve crafted this summary to address everything in one place. All questions provided are integrated by blending the documents and interlacing keywords related to mortgage lending simultaneously. Also, feel free to reach out if suggestions have to be made or expansions are required!

https://www.youtube.com/watch?v=3mxwpoqIy24&list=PLo3dZB8Cn9Qv4mTNMcJfAuCBn6JOEIBLv

-

This discussion was modified 10 months, 4 weeks ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

Former President Barack Obama used to be a rising star. However, Barack Obama is pretty much a nobody. Obama has a huge ego and thinks his endorsement of Kamala Harris would guarantee Kamala Harris a victorious landslide 2024 Presidential win. Unfortunately, Obama made his endorsement and presence worse than better. Obama had the nerve to say that black brothers needs to vote for Kamala Harris or they ain’t black. The arrogance of Barack Obama backfired on him

Barack Obama thinks he is more important than he is and many Americans have zero respect for this arrogant incompetent former President. Here’s a video about Barack Obama.

-

The City of Chicago has a major budget deficit. Chicago is outspending Los Angeles, New York, and other major big cities

What Chicago needs is an office of government efficiency. Get rid of Incompetent Mayor Brandon Johnson and other leaders without a clue

-

Headline News For Monday December 30th 2024

On December 30, of the year 2024, a variety of noteworthy changes have taken place within the spheres of business and politics:

Business

Wall Street Performance:

- The stock markets of the United States fell on December 30, with all three benchmarks completing lower in value than the previous day.

- The Dow Jones Industrial Average dropped by 418.48 points. The S&P 500 was down 63.90.

- The Nasdaq Composite was down 235.25 points.

- The decline is concerning.

- However, when viewed annually, the performance remains respectable, with the Nasdaq around 30%, the S&P 500 over 24%, and the Dow rising slightly over 13%.

Rising Treasury Yields

Yields on the Treasury have become a problem in this longer-term bull market. According to recent reports, the current 10-year treasury yield has been at its highest for the past seven months. There are concerns about how that might impact the equity markets. A hint that yield than usual may drive the stocks ward over time.

Trump Administration’s Impact on Wall Street

To no one’s surprise, the trump presidency is changing the policies meant to govern Wall Street and is bound to have a larger impact. Joe Biden’s administration is hoping to achieve a plethora of changes. The anticipated changes would make it easier for banks to abide by capital requirements, enable mergers and acquisitions, and support the cryptocurrency and fintech sectors. The policy shift will likely be business-oriented, and regulators will be less ruled out.

Politics

US Avails from Government Shutdown:

- The likelihood of a government shutdown was narrowly prevented when Congress approved an extension of current expenditure.

- This bipartisan approach extends the resolution of continuing to March 14, 2025.

- It has also provided for disaster management and extensions of other programs.

- Several conservative groups opposed the proposal, but it was eventually approved, averting a shutdown.

International Trade Worries

Donald Trump’s proposals regarding tariffs and taxes on imports from Mexico, Canada, China, et al. are generating fears of potentially adverse effects on the economy worldwide during the decade. In this way, the further increase of prices combined with trade restrictions and other economic factors could hamper stability in the international economy.

Economic activities of China

In December, the Chinese economy was expected to grow slower but more stable, as the manufacturing industry anticipates modest growth for the third month. However, a set of US tariffs could disturb this momentum.

Notable Passings

Commemoration of United States President Jimmy Carter:

The 100-year-old Jimmy Carter, president between 1977 and 1981, was also active in humanitarian services after his presidency through involvement in Habitat for Humanity construction and solving international conflict, earning him a Nobel Peace Prize.

Sports

Jayden Daniels Receives Great Training From Commanders Coaches:

- Interestingly, This story starts with Jayden Daniels, the Commander’s first drafted player.

- However, this decision still left me curious.

- Daniels made a remarkable contribution to the team’s performance, helping them secure a record of 11 wins and five losses. This was achieved through a team effort.

- Furthermore, under the right guidance from the Kansas State Line Coach (Daniel’s “country boy attitude” was so amusing.

- Imagine a dash of Denver and Daniels in cowboy boots). He took the field and delivered the right punches.

Oh, the beauty of digital convergence. At the end of the year, these events perfectly illustrate the fluidity of the modern business and political environment.

-

This discussion was modified 1 year, 2 months ago by

Gustan Cho.

Gustan Cho.

ai.invideo.io

Turn ideas into videos | AI video creator | invideo AI

Make videos easily by giving a prompt to invideo AI. Ideal for content creators, YouTubers and marketers, invideo AI offers a seamless way to turn your ideas into publish-ready videos with AI.

-

If you know about tax evasion, you can turn that information into cash by becoming a whistleblower for the IRS. They reward informants with 15% to 30% of the money recovered from enforcement actions, which can add up to thousands or even millions. While you might face risks like job loss or social backlash, protections exist under the Whistleblower Protection Act. Just remember, your information needs to be credible. By stepping forward, you not only stand to gain financially but also help uphold ethical standards in our financial system. There’s much more to consider on this path.

Key Takeaways

- Confidential informants can receive financial rewards from the IRS for reporting tax evasion, ranging from 15% to 30% of collected proceeds.

- The IRS reviews submitted information for credibility, which can lead to significant payouts based on the size of the case.

- Whistleblowers may face risks such as retaliation or emotional distress, despite legal protections like the Whistleblower Protection Act.

- Ethical considerations are important; motivations for reporting should be transparent to ensure integrity in the whistleblowing process.

- Successful whistleblowing can inspire organizational change, enhancing accountability and compliance within the IRS and related entities.

Understanding Whistleblowing Dynamics

Whistleblowing plays a crucial role in holding organizations accountable for unethical practices. When you decide to speak up, you’re often risking your job, relationships, and sometimes even your safety. Understanding the dynamics of whistleblowing helps you navigate this complex landscape.

You’ll recognize that whistleblowing isn’t just about reporting wrongdoing; it’s also about understanding the environment in which you’re operating. You need to consider the culture of the organization. If it encourages transparency and integrity, your decision to blow the whistle might be supported. However, in a toxic environment, the repercussions could be severe.

You should also be aware of the legal protections available to you. Laws like the Whistleblower Protection Act can shield you from retaliation, but they don’t always guarantee safety.

Additionally, think about the impact your actions could have. By exposing unethical practices, you mightn’t only protect others but also inspire change within the organization.

Ultimately, whistleblowing is a courageous act that requires careful consideration, a solid understanding of your rights, and a commitment to ethical standards. Your choice could make a significant difference, both for yourself and for the larger community.

Financial Rewards for Informants

When considering the implications of reporting unethical behavior, it’s important to recognize that financial incentives can play a significant role for informants. The IRS offers substantial monetary rewards for those who provide valuable information about tax evasion or fraud.

If you’ve got inside knowledge on someone dodging taxes, your tip could lead to a substantial payout. Under the IRS Whistleblower Program, you might receive between 15% to 30% of the collected proceeds from an enforcement action. That could translate to thousands, or even millions, depending on the case’s size.

This financial incentive can motivate individuals to step forward, as the potential reward often outweighs the risks. You might wonder how this process works. After you submit your information, the IRS reviews it and determines whether it’s credible and actionable.

If they successfully collect penalties or taxes based on your tip, you’ll receive your reward. However, it’s crucial to understand that the process can be lengthy and may require patience. Still, the prospect of earning money while doing the right thing can be a compelling reason for many to become informants.

Ethical Considerations in Reporting

Many individuals face complex ethical dilemmas when considering whether to report misconduct. You might find yourself weighing the potential benefits against the moral implications of your actions. On one hand, reporting could lead to significant financial rewards and help maintain integrity within the system. On the other hand, you may worry about the consequences for those involved, including the impact on their lives and careers.

Motivations for reporting to uphold justice, or are you primarily motivated by the financial incentive? Transparency in your intentions can help clarify the ethical landscape.

Additionally, think about the accuracy of the information you possess. False or exaggerated claims can have severe repercussions for everyone involved, including yourself.

Moreover, consider the potential fallout from your actions. Whistleblowers often face retaliation, social ostracism, and emotional distress. Weighing these risks against the potential benefits is vital.

Ultimately, you need to navigate these ethical waters carefully, ensuring that your decision aligns with your values and the greater good. Reporting misconduct can be righteous, but it’s essential to approach it thoughtfully and ethically.

Conclusion

In the world of whistleblowing, you’ve got the chance to make a difference while potentially earning a financial reward. By stepping forward as a confidential informant, you not only help the IRS tackle tax evasion but also secure your own financial future. However, weighing the ethical implications of your actions and Ultimately you can choose to be a force for good, balancing the pursuit of justice with the pursuit of profit.

When we speak to taxpayers who have unfortunately fallen into the IRS Collection Division and believe their hardship can be settled with a hardship letter and the IRS just goes away unfortunately that’s not how it works. These individuals are confronted with the prospect of dealing with federal tax issues imposed by the (IRS) and not having a clear understanding of what the rules are and what’s available to the taxpayer.

If you find yourself dealing with any tax-related issues in Orlando, Florida or anywhere in the Central Florida or for that matter anywhere in the USA we are a phone call away 407-531-8705

https://calendly.com/taxdebtreliefgroup/tax-debt-consultation

If you or someone you know has IRS or State Tax issues, Business or Personal or has not filed a tax return for years down load my free book this is some info that can help.

Peter Kici EA

-

The mortgage and real estate markets have fluctuated due to inflation, job statistics, foreclosure, and home prices, all notable developments considering the rising mortgage rates. Here’s the recent trend. The article will also provide information on the ever-changing but somehow related business economics.

Mortgage Rates

30-Year Fixed-Rate Mortgages:

- According to the most current statistics.

- The average 30-year fixed-rate mortgage increased to 6.85%, which has been the highest recorded since mid-July.

- The percentage was 6.72% last week, compared to 6.61% recorded a year ago.

- This is a clear sign of raised bond yields banks use to sell home loans.

15-Year Fixed-Rate Mortgages:

- Closed at 6%, up from 5.92% recorded the previous week.

Employment and Job Losses

In considering the labor force, indicators highlight its potential decay due to students’ inability to find summer jobs, resulting in aggravated unemployment reaching 6.4%.

Inflation

The growing economic debate on whether federal banks should pay particular regard to inflation is apparent, especially considering the recent US statistics indicating inflation is growing to 3.2% annually.

It is projected to keep increasing, impacting mortgage rates and the overall economic spectrum.

Foreclosure Rates

There are no seasonal statistics or trends regarding foreclosures at present. However, the growing interest and inflationary rates can complementarily lead to further foreclosure activity, as people who need to deal with further economic stresses alongside rising home loan interest rates may find themselves unable to cope and eventually file for bankruptcy.

Home Prices

Despite the hike in mortgage rates, home prices remained steady. Due to high demand and low housing inventory, the price of homes in the United States is predicted to increase by 5% this year, higher than the previous prediction of 1.9%.

In the UK, it is estimated that house prices will increase by 1.9%, bringing the average value of a house to £267,500. The increase in market activity is expected to impact the housing market positively.

Factors Influencing the Market

Bond Yields Increased bond yields are the reason mortgage rates are increasing. This affects the low number of homebuyers.

Federal Reserve Policies Other policies cut rates to improve affordability, but in contrast, the rate cuts resulted in increased mortgage rates. This is because the 10-year Treasury bonds have increased yields, which wreaked havoc on mortgage rates.

Housing Inventory

Even with the increased mortgage rates, there is a limited number of houses, which keeps the prices of the homes steady. Owners with low mortgage rates are reluctant to sell their houses, contributing to the low supply.

Implications for Homebuyers and Homeowners

Affordability Challenges Due to the increased price of homes and mortgage rates, the supply of houses has greatly diminished, which has resulted in many unfavorable implications, such as a decrease in mortgage applications.

Increased Costs

The property tax rate has historically been low, around 32% in recent years. Still, as of 2014, mortgage rates and insurance expenses have virtually skyrocketed.

The increased mortgage rates, inflation, and economic instability make it almost impossible for potential buyers and homeowners to afford their properties. With the market as fuzzy as it is, it’s worth getting advice from an expert and staying updated with the latest economic information.

-

Below is a concise overview of the mortgage, real estate, and business updates for the week of December 23 to December 28, 2024:

Mortgage Rates and Housing Market Trends

Mortgage Rates Continue to Rise:

- For the second time in a row, mortgage rates have surged since July and now stand at 6.85 percent.

- This is an increase from 6.72 percent, which stood last week.

- The rate for a 30-year fixed mortgage has also hiked again, breaking 6.61 percent this time last year.

- This also means it will keep increasing, as we saw it hit 6.89 percent in mid-July.

- In addition, 15-year fixed mortgages surged, with rates reported at a whopping 5.92 percent compared to 5.84 percent.

- As we enter the new year, the economy is expected to boost purchase rates to assist with the surging problem of undersupplied homes in the market.

Homeowners Costs Are Increasing

A rising trend indicates that homeowners are now spending more on property taxes and home insurance than they are reportedly spending on mortgages. The average single-family mortgage is set at 32 percent for property taxes and insurance, which breaks records as it’s the highest rate since 2014. The driving factor for this trend is the natural disasters that caused home values to skyrocket.

The Pirates of the Caribbean

Or, as I like to call them, the New York upstate, Omaha, New Orleans, and Miami Pirates that own homes. They are the worst, and so are mortgage holders because they pay more than half of their monthly payments on taxes and insurance. The average rate of this has grown to 7 percent, making owning a single-family single-family home a life of misery. And speaking of home buying in general, mortgage payments are high, no thanks to the recent rate cuts. In both 2014 and now, buying a home is a huge hassle for the rich and the poor, and I can assure you that this is only the start of our problems.

Advancements in the Real Every Field

Let’s start with Rocket Homes

- The CFPB also sued Rocket Homes for its alleged actions, in which the brokers were asked to purchase mortgage holder services from their company.

- The back-and-forth in this lawsuit goes deep, but to keep it short, the JMG Holding firm’s Jason Mitchell also comes into play within these allegations.

- Rocket Homes argues against the CFPB’s stance, enabling them to go at ease again.

Sadly, the CU building has also come under heat to be able sexual misconduct scandals with the inclusion of Master Batters: the brokers, Tal and Oren, go on to expose how eXp is real.

The recent allegations raised questions of integrity within a predominantly female industry sorely constructed by male figures. Detractors note the industry’s rampant culture, where safety precautions and a proper supervision hierarchy that controls malfeasance are non-existent. Pioneers such as the National Association of Realtors have tried devising policies that will help foster a balanced, safe, and upbuilding environment.

The sale of loans in multifamily commercial real estate by HomeStreet Bank

In a transaction that involved Bank of America, HomeStreet Bank went on to sell $990 million in unpaid principal balance of loans for almost $906 million. This translates to a 92% value of the loans. The only reason why this discount was given was due to the current interest rate environment and the lower yield of the loans. The deal is projected to aid HomeStreet in recovering from the multiyear loss and assuage investors worried about the previous halted merger with First Sun Capital Bancorp. Funds raised from the transaction will primarily be focused on addressing debt and looking for cheaper capital. The final date for the completion of the transaction is December 31. On the other hand, Home Street is expected to continue servicing the loans.

Forecast of Commercial Real Estate

The commercial real estate sector has been conditioned by various challenges, including the constant rise in interest rates, constantly decreasing supply, and high production expenses.

The hybrid and remote work trend has severely affected the office space market. And even now, despite a rather remarkable cutback from the Federal Reserve, long-term rates are elevated, making sales and refinancing more complicated than necessary. A massive 570 billion dollars worth of commercial real estate loans are due by 2025. These loans will most likely experience a cash flow deficit, while some may even face massive refinancing difficulties. The assumed Trump administration portrays promising tax structures and lower regulations as policies that further bolster the population’s confidence. The online shopping boom brought a sharp increase in demand for industrial supply. However, this has recently stagnated and is anticipated to bounce back when the newly available supply is subdued and demand rises. The growth of e-commerce stimulates future demand for industrial space. 2025 will likely be the year when this wheel starts rolling again. But we still have to navigate slow economic growth and tough refinancing circumstances.

Expected Housing Market Scenario

Expected changes in the 2025 housing market:

Towards 2025, hope is presented to future real estate hopefuls who have navigated on that tough terrain the last couple of years, as most are expected to find the housing market easier to deal with. There are predictions that mortgage rates will increase slightly over the 6% threshold, which will cause more listings to become available and slow the increase in the value of these listings. As the rate of interest declines, it is expected that more US citizens will be willing to relocate, aiding the housing inventory.

The current housing supply is likely to witness an uptrend growth of about 11.7%, which would dampen the competition with a more controlled price increase. However, they expect a remarkable rate decrease since they are most likely to follow the return on the 10-year treasuries, which may stay high if inflation continues. Overall, during 2025, there are high chances of the rates being more favorable for the buyers due to a high supply, alongside the mortgage rates being slightly lower than they used to be.

-