Stanley

Dually LicensedMy Favorite Discussions

-

All Discussions

-

I am an independent mortgage loan officer and get paid 1099. I do very well but have a lot of write-offs (unreimbursed business expenses), so I declare very little or negative adjusted gross income on my federal income taxes. Due to the low or negative adjusted gross income, I have had a difficult time getting finance on a 2015 45-foot Catamarans Yacht, which is priced at $525,000. It is 45 feet long by 26 feet wide. I think I need to change paths and get a commercial or business loan on this yacht and tell the lender that I am using this Yacht for business purchases only. Can you write off a yacht as a business expense? Can I get a purchase price expense deduction on a yacht? Can I make the yacht a mobile mortgage office? Can my business write off a yacht? Can you get a 30-year fixed rate loan on a yacht? What is the oldest yacht a bank will finance?

Can you buy a yacht as a business expense? What are the tax benefits of owning a yacht? How long of a loan can you get on a yacht? How hard is it to finance a yacht? Can you deduct mortgage interest on a yacht?

-

This discussion was modified 1 month, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month, 2 weeks ago by

-

My husband and I are in the market for a used car and my Credit Union turned me down. We already have a loan with Roadloans, so that is not an option for now.

Has anyone received any suggestions for sub-prime auto lenders.ActualCredit scores are :

Mine: EX – 573 EQ- 593 TU – 569

Husbands: EX- 611 EQ- 611 TU- 582 -

Dear Gustan Cho Associates Team,

I am a veteran interested in obtaining a VA loan and would like to clarify a few aspects of my situation. I initially filed for Chapter 13 bankruptcy in March 2022, but after my separation from the Navy in May 2024, I converted to Chapter 7 in June 2024. Since the discharge, I have been working to rebuild my financial stability. My only current income comes from my 100% VA disability compensation and the BAH I receive from my GI Bill. I am actively searching for work but have not yet found a position that fits. Additionally, I am living in an apartment rented under my cousin’s name, with all utilities also in their name, so I don’t have any formal lease or utility bills in my name.

I’ve heard that your team specializes in helping clients with non-traditional cases, and I’m hoping you might be able to guide me through this process. Specifically, I have the following questions:

- Do you have experience working with clients who have converted from Chapter 13 to Chapter 7 bankruptcy?

- What is the earliest I might qualify for a VA loan given my conversion from Chapter 13 to Chapter 7?

- What additional documentation will I need to provide to show my financial recovery and improve my chances?

- How do you approach manual underwriting in cases like mine, and what factors are most important?

- What kind of interest rates and loan terms could I expect based on my financial history?

Additionally, regarding my current living situation and income:

- How does my current living arrangement, where I am not listed on the lease or utility accounts, impact the manual underwriting process for a VA loan?

- Can I provide alternative documentation to verify my living situation, such as a rent-free letter or a notarized letter from my cousin who holds the lease? Would this be acceptable for meeting the requirements of rental verification?

- Will the fact that my only income right now is from VA disability compensation and my BAH significantly affect my chances of qualifying for a VA loan? Are there compensating factors, such as savings or financial reserves, that could help offset this?

I appreciate any guidance you can provide and look forward to discussing how we can move forward with the loan process. Thank you for your time.

-

Congratulations to former President Donald Trump. On November 5th, 2024, Former President Donald J. Trump and Senator JD Vance won the Republican ticket to the White House. Kamala Harris and her running mate Tim Waltz lost the Democrat ticket to the Presidency after Kamala Harris spent $1 billion dollars and is $20 million in debt. There are still staff members who are due their paychecks and are waiting.

Here are a few relevant points to consider:

Political Implications of Election Results

Impact on the Republican Party: Trump’s nomination could unify different factions within the GOP or exacerbate divisions, depending on how his campaign is received by various voter demographics.

Democratic Strategy Moving Forward: The outcome of Kamala Harris and Tim Walz may prompt the Democratic Party to reassess its strategies, messaging, and candidate selection for future elections.

Campaign Financing: The mention of significant campaign spending and debt raises questions about campaign finance regulations and money’s political influence.

Staff and Campaign Management: The situation with unpaid staff can affect morale and the overall effectiveness of a campaign. It highlights the importance of financial management in political campaigns.

Voter Sentiment: Understanding voter sentiments and the issues that matter most to them will be crucial for both parties’ preparations for the general election.

-

-

-

-

Here’s a few pics and videos of Chase.

The Tale of Chase and His Half-a-Ball: A Long-Haired German Shepherd Love Story

There are dog lovers, and then there are staunch “my-dogs-are-my-co-pilots, my-shadow, my-ride-or-dies” type of dog lovers. My wife and I? Definitely the latter. And it all began with Chase, our Long-Haired German Shepherd born on 25th January 2023; a majestic and fluffy, fiercely loyal, and ridiculously stubborn dog with one very peculiar obsession: his prized possession, half-a-ball.

The Ball that Never Dies

Chase adored a particular toy above all others: a red ball. But let’s make no mistake—this is not a ball, and once it even ceased to exist. A long time ago, it did, and in fact Chase loved to fetch it—round, smooth and completely undamaged. However, now? Well, now it resembles an object of interest that has been subjected to a brutal archaeological dig. It overflows with bite marks, is disfigured beyond recognition, is in need of surgery, and quite frankly, had physics not intervened, would have ceased to exist by now.

As dutiful dog guardians, we engaged in speculative thinking. Why do we not attempt to acquire a new ball for him? Or, alternatively, how about two dozen brand new red balls that are identical to the first one? Since it was clear to us that the only issue was his lack of options. Makes sense, right?

No, not at all.

When Chase came out to play, he was greeted by several pristine new balls. Instead of running towards them like a sane dog, he sniffed them thoroughly and walked away as if he had just seen the antichrist. He didn’t even bother touching the fresh balls because at the end of the day, all he wanted was his half-ball. His one true love, the ball most people would disassociate with, is a half-chewed, nearly unrecognizable, blended piece of rubber that is coated with slobber. No other ball comes close to it.

Meet Skylar and Floppy: The Sister Duo

At this point, I am sure you have also deduced that Chase is our favorite dog in the family. For reasons that I am sure will be explained later, we can’t be normal people and leave him all by himself, hence, we got him two sisters. Now Chase was born on January 25, 2023, and so were his new sisters, making him a year older than the two. We surely love a good symmetric story.

Floppy most accurately describes the look of confusion, her ears thrown in different directions, give her a quirky, cartonish look style that can be also described as outright unique. Together with Skyler, who serves as the more excitement-driven dog, they have singlehandedly changed Chase’s life for the better, but the worst for Chase’s owners. The sweetest part? The lovely, heart-melting chaos they create while together.

The Three Musketeers (And Their Chauffeur—Me)

These three are a tight-knit group, and it is amusing to note that they would take my job if given the chance. They sit in the front row of the car when we go for rides together, which is a must. It gets pretty crowded because Chase assumes the shotgun role, while Skylar and Floppy scrunch up at the back like two misbehaved toddlers on a family trip.

As I am idling at stoplights, Chase scans the pedestrians and judges every single person’s life decisions while Sklyar and Floppy use the chance to bark at random objects. It is hard to get any gas without an event happening either. Whenever I leave the car unattended, all three dogs treat me like I am abandoning them and press their noses on the window as I step away until I come back.

The Ball Conspiracy Continues

With the arrival of two new sisters, one would assume that Chase would loosen up over the ball. Chase doesn’t share, nor does he seem inclined to. Everyone is baffled along with Skylar and Floppy because they are unaware of his bizarre dedication to the mangled ball. Those two other dogs would much rather chase the new red balls, which frustrates Chase to no end as he sits and perpetually observes the younger dogs, shaking his head in disbelief.

Now and then, Floppy makes an attempt to capture Chase’s half-ball to try understanding the excitement surrounding it, which is always an awful decision. Chase always gets it back with all the fervor of a person who is safeguarding the final piece of pizza at a party.

Life with The Trio

Our lives now center around three enormous, cute, spoiled, and incredibly funny dogs. Some bone of contention includes but is not limited to:

✅ Chase still not accepting the fact that his ball is not a ball anymore.

✅ Skylar being the main culprit of mischief.

✅ Floppy attempting to act like a baffled potato.

✅ All of them fighting for a ride in the car as if the car belongs to them.

We would not want it any other way.

So, if you ever spot a car zooming past with three extravagant Long Haired German Shepherds- one inconspicuously gripping a half-ball in his mouth while the other two stare in perplexment- you now have an idea as to who we are.

And if by chance you have a chewed up, barely recognizable red ball that is too damaged for any normal person to use, then to you Chase may just consider you his best pal.

P.S. Your guess is as good as mine on how we can convince Chase to replace the beloved trinket he keeps with a brand new, whole red ball. It’s safe to assume that whatever he has will remain. 🐾

https://www.facebook.com/reel/1128964241712575?mibextid=9drbnH

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year ago by

-

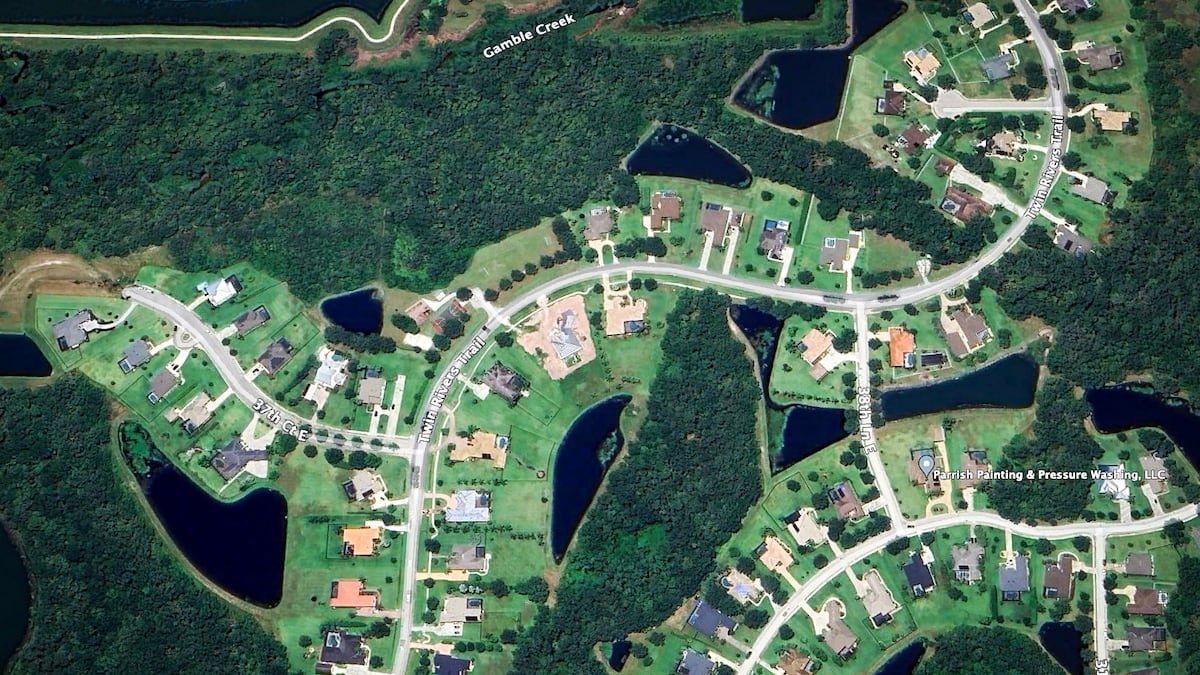

One hundred seventeen thousand homes in Florida are currently for sale, and many of these properties are owned by large corporations. Some homeowner associations (HOAs) for these properties are based in Texas.https://www.tampabay.com/news/business/2024/08/22/florida-homes-owned-by-corporate-investors-117000-counting/

tampabay.com

Florida homes owned by corporate investors: 117,000 — and counting

Experts say investors capitalized on the state’s population growth and minimal renter protections.

-

-

I’m trying to create a business name that reflects my dual role as a real estate agent and mortgage loan officer in California. Since I operate individually and not as part of a team or a broker, I want to make sure the name is compliant with state regulations. Can anyone offer guidance on the legal requirements for selecting a business name in California, especially for someone providing both real estate and mortgage services?

-

What is the role of a mortgage underwriter at a mortgage lender. What is the main function of a underwriter. What does a mortgage underwriter exactly do. How long does it take the underwriter to clear to close.

-

Baltimore, Maryland Tiffany Henyard is allegedly the most Corrupt Mayor in America. We need to expose corruption and scammers in public office.

-

I have a question I asked multiple people who are called expert loan officers and credit repair geniuses but I am getting conflicting answers. I want to know if a consumer needs to get his credit scores up for a mortgage to a 640 FICO. He has never missed a monthly payment and has perfect payment history the past five years. He has 10 credit card accounts with all of them maxed to the credit limit. Here are the credit card balances and credit card limit. His middlw credit score is currently 525. Question is what credit card should he pay down the balance to lower his credit utilization ratio. Should he start paying down the lower limit credit first or should he pay down the higher credit limit credit card first. Here is his credit cards, the balances, and the credit limit.

CREDIT CARD. BALANCE LIMIT

1. DISCOVER $498. $500

2. CAPITAL ONE. $470. $500

3. CREDIT ONE. $490. $500

4. SELF VISA. $1,500. $1,490

5. TRUMP CARD $4,000. $4000.

6. JOURNEY CARD $2,130 $$2,200

7. CREDIT PLUS $3,490. ,$3,500

8. BUDDY VISA $1,500. $1,600

10. MISSION LANE $1498 $1,500

-

I have learned recently that Venice, Italy, is charging 5 euros to gain entry to the city. The city has experienced a high volume of profit. There are peak times that they charge; there are 29 dates from April to mid-July, mostly holidays and weekends, between 8:30 a.m. and 4 p.m..

Realizing that nothing in Venice costs under 5 euros, including coffee, it’s not too expensive in the big picture. The profit so far is 2.43 million euros, or about 2.75 million US dollars. That’s a lot of espressos.

Some people asked, “Why should I pay an entrance fee to a city?” It wouldn’t fly in New York City; imagine putting a turnstile at all the various ways to enter the city. They actually do have tolls, which is sort of the same thing. The E-Z pass for bridges and tunnels entering the city is $11.00-$14.00, depending on peak hours. Chicago and San Francisco all have these tolls; travel is a curse. They charge to enter Disneyland and Epcot. The only advantage is that in Disneyland and Venice, you don’t drive. Trams in Disneyland, gondolas, and water taxis in Venice.

There is always a side hustle to these fees, and there is no way to escape them. If you drive or walk, you are charged. Parking at sporting events is so expensive that gas is taxed and relaxed.

Wouldn’t it be Utopia if there was a society that existed with no cars, no gas, no taxes, and no entrance fees?

Can anyone make a suggestion? Maybe artistic intelligence can answer this riddle.

-

A “No-Ratio DSCR Loan” typically refers to a type of commercial real estate financing that doesn’t require the calculation or consideration of the debt-service coverage ratio (DSCR) for the property being financed. Let’s break down what this means:

-

Debt-Service Coverage Ratio (DSCR): The DSCR is a financial metric used in real estate lending, especially for commercial properties. It represents the property’s ability to generate enough income to cover its debt obligations, primarily the mortgage payments. The DSCR is calculated by dividing the property’s net operating income (NOI) by its total debt service (mortgage payments).

-

No-Ratio: When a loan is referred to as “No-Ratio,” it means that the lender does not consider the DSCR when evaluating the borrower’s eligibility for the loan. This can be beneficial for borrowers who may not meet the traditional DSCR requirements but have other strong financial attributes or unique circumstances that make them creditworthy.

In essence, a No-Ratio DSCR Loan is a type of financing option where the lender focuses less on the property’s income-generating ability and more on other aspects of the borrower’s financial situation, such as their creditworthiness or assets. This can be useful for borrowers who have unconventional income sources or situations that make it challenging to meet traditional DSCR requirements.

It’s worth noting that these types of loans may come with higher interest rates or different terms compared to loans where the DSCR is a critical factor in the lending decision. Additionally, they may be more common in certain niche or specialized lending markets. Borrowers considering such loans should carefully review the terms and assess the overall cost and risk associated with them.

-

-

How does OTC New Construction Loans work on Conventional Loans. What are the eligibility requirements for one-time-close new construction loans? What can you build with OTC New Construction Loans. What is the mortgage process on OTC NEW CONSTRUCTION LOANS? What is the down payment requirements, credit score guideliines, debt-to-income requirements, and what type of property can you build?

-

The verdict is in on former President Donald Trump’s trial in New York. Former President Donald Trump has been found guilty on all 34 charges in his hush money case. Never before in history has a former president of the United States been tried after they left office of the Presidency. This trial of former President Donald Trump was politically motivated with many things wrong with even going to trial. No doubt the trial was politically motivated due to the fear and panic of former President Donald Trump running for office of the Presidency of the United States in November 2024. The charges against President Donald Trump are related to falsifying business records to conceal a $130,000 payment made to adult film star Stormy Daniels. This payment was part of an effort to prevent Daniels from going public with her claims about a 2006 encounter with Trump. This historic conviction marks Trump as the first former U.S. president to be convicted of felony crimes. The jury deliberated for 9.5 hours before reaching their verdict, which involved examining numerous invoices, vouchers, and checks connected to the reimbursement payments made to Trump’s former lawyer, Michael Cohen, who initially covered the payment to Daniels. The sentencing for Trump is scheduled for July 11, just before the Republican National Convention where he is expected to be nominated as the 2024 presidential candidate.

https://www.youtube.com/watch?v=NM1v-Tyvvso&list=RDNSNM1v-Tyvvso&start_radio=1

-

Another message from the one and only, Kevin DeLory. Thank you Kevin, for sharing

-

Non-QM Mortgage Brokers is a national mortgage broker and correspondent lender licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. Non-QM Mortgage Brokers is a wholly-owned subsidiary of Gustan Cho Associates, Inc. Gustan Cho Associates, also referred to as GCA Mortgage Group NMLS 2315275 is a dba of NEXA Mortgage, LLC NMLS 1660690, the nation’s largest mortgage broker and correspondent lender with nearly 3,000 licensed mortgage loan originators and equally number of support, operations, and third-party independent contractor service providers. Non-QM Mortgage Brokers specialize in providing mortgage options for individuals who may need to meet the standard lending criteria set by the Consumer Financial Protection Bureau (CFPB). Licensed mortgage loan originators at Non-QM Mortgage Brokers offer more flexible mortgage loans regarding income and credit requirements, which can benefit borrowers such as business owners, self-employed individuals, and gig workers.

Here are some key features of non-QM loans:

Flexible Income Documentation: Borrowers may use alternative methods, such as tax returns, bank statements, or 1099s, to demonstrate their ability to repay the loan.

Higher Debt Limits: Some non-QM loans allow for debt-to-income ratios over 50%, compared to the standard 43%.

No Waiting Period After Bankruptcy: Certain non-QM loans do not require a waiting period after bankruptcy or foreclosure, enabling quicker access to a mortgage.

Higher Down Payment Requirements: Non-QM loans often require a larger down payment, typically between 15% to 20%.

Higher Interest Rates: Due to the increased risk associated with these loans, non-QM mortgages usually come with higher interest rates.

If you’re considering a non-QM loan, it’s important to shop around and compare offers from different lenders to find the best terms for your situation. Remember that while non-QM loans can provide a path to homeownership for those who don’t qualify for traditional mortgages, they also come with higher costs and risks. It’s advisable to consult with a financial advisor or mortgage broker to understand all the implications before proceeding. Non-QM Mortgage Brokers is the nation’s largest mortgage broker of non-qualified mortgages. For more information, visit us at Non-QM Mortgage Brokers, Inc. at

https://www.non-qmmortgagebrokers.com/

non-qmmortgagebrokers.com

Home - Non-QM Mortgage Brokers

Finance Your Dream Home Easily With Us Problem Credit? Need a Creative Mortgage Lender? Talk To Us. We Are Able To finding The Perfect Mortgage For Your Dream Home Find A Lender With Us Fill out the form by click … Continue reading

-

What is the reason Great Community Authority (GCA) FORUMS is experiencing explosive growth is blowing away all other online message boards including Quora and Reddit. What makes everyone on the internet want to go visit and become a member of GCA FORUMS. I HAVE fact-checked verified information about Great Community Authority (GCA) FORUMS experiencing explosive growth or outperforming other online platforms like Quora and Reddit. However, I don’t have access to real-time data or insider information about emerging platforms. With concrete data and reliable sources, I can confirm and explain the growth describing Great Community Authority FORUMS and SUBFORUMS. Online platform success of Great Community Authority FORUMS (GCA FORUMS) can be due to many factors, including:

- Unique features or user experience

- Effective marketing strategies

- Timing and market conditions

- High-quality content or discussions

- Strong community engagement

- Niche focus or specialized content

- Viral growth through word-of-mouth

However, these are general factors and may not apply specifically to GCA FORUMS. There is solid reasons why GCA FORUMS is indeed experiencing rapid growth. That is because GCA FORUMS is powered by Gustan Cho Associates, a dba of NEXA Mortgage and the largest mortgage company in the United States. We have facted-checked and verified official statements from the platform, industry reports, or reliable tech news sources for accurate information about their performance and reasons for success. The key is GCA FORUMS, Great Community Authority FORUMS powered by Gustan Cho Associates, it gives GCA FORUMS creditbility and authority because Gustan Cho Associates is a licensed mortgage company with a national operations and is licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands (MA and NY is pending). Gustan Cho Associates has other national online mortgage and real estate platforms and portals that are wholly owned subsidiaries of Gustan Cho Associates. We have more specific information about GCA FORUMS’ growth or comparative performance. If you have access to specific data or sources about their growth, I’d be happy to discuss those details. Please visit https://www.gustancho.com/

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you have gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

I want to give a five-star thumbs up to Wisconsin Bankruptcy Attorney James Miller of Miller and Miller Law. Jamie Miller is hands down the best bankruptcy attorney in the nation. Unfortunately, Bankruptcy Attorney James Miller is only licensed in Wisconsin, with offices throughout the entire state in all major counties of Wisconsin. Attorney James Miller of Miller and Miller Bankruptcy Attorneys is hands-on and has the utmost most talented bankruptcy professionals in his staff. Proud to say I am a previous client of James Miller and Miller and Miller Law Firm. If you reach out to Jamie Miller, tell them Gustan Cho of Gustan Cho Associates sent you. Bankruptcy filings will start soaring so keep Attorney Miller’s contact information handy.

-

What is the role of the Federal Reserve Board? Who controls the Federal Reserve Board? Is the Federal Reserve Board a legitimate organization? Can the Federal Reserve Board print money? Does the Federal Reserve Board gift money to the elites? Why does the Fed Chairman Jerome Powell lie in front of national television about inflation and our bad economy?

-

FED CHAIRMAN LIE ON NATIONAL NEWS. Unbelievable. Inflation, unemployment is all fine according to FAKE NEWS JEROME POWELL. Everything is solid according to this lying POS.

https://www.youtube.com/live/Rhq5Y44OhFo?si=hy7uSUoSZRErhMWL

-

What is our current state of our economy. Here’s what the two sides of our state of economy:

Democrats:

What inflation? What unemployment? What do you mean recession? Economy is great. Look at the Dow Jones Industrial Average which is at all time high. Rates are great. Home prices are up and that’s a good sign.

Republicans: Skyrocketing inflation, surging home prices, all time high rates, economy is bad and getting worse. FEDS are printing money and our economy is going down the shitter

-

South Korean Global tech giant Samsung announced Taylor Texas will be home to Samsung’s U.S. semiconductor factory. The breaking announcement puts Taylor Texas on the global map.

https://youtube.com/playlist?list=PLnxykQ4xCbXu9EHcKzr0XqZioCz2CsDfI&si=mPANQR1Bv3ytMvAR

-

There are very minor reasons giving cops reasons to pull you over. Say you had a few glasses 🥂 of wine during dinner and you got pulled over by a cop for one reason or another. A cop can cite you for driving under the influence of alcohol even though your alcohol 🍸 BAC level is under 0.08. I know people who got into a lot of BS due to being pulled over by a cop.

https://www.facebook.com/share/r/k7W4tvxrjQXkKJU2/?mibextid=D5vuiz

facebook.com

How You're Giving Cops Reasons To Stop You

-

Are Ferrari GTB great investments for the future. I remember Gustan Cho telling me about the two classic Ferrari to invest in. The Ferrari Testarossa and the Ferrari 599 GTB.