Susan

RealtorMy Favorite Discussions

-

All Discussions

-

GCA FORUMS COMPREHENSIVE RESTRUCTURING PLAN

Starting a successful, reputable national all-in-one, one-stop shop comprehensive online community that is organized and structured in a rock solid infrastructure and foundation that separates GCA Forums from the competition and benefits viewers, members, sponsors, professionals, and business owners requires fact-checked content, up to date news, a user-friendly and well structured and organized platform, and a map and navigation system that is simple and fast where the user always is satisfied and feels he or she got the information they came to GCA Forums to get. The user experience needs to be FIVE PLUS STAR with a EXTREMELY SATISFIED GRADE where the user will hands down have no second thoughts in revisiting GCA Forums as their first choice of Resource Center for ANSWERS. GCA FORUMS will be restructuring our entire online community to restructure all of our platform and content in an user friendly, great user experience foundation. Below, we laid out a basic format on what our goal and mission of the New and Improved Great Community Authority Forums end goal is. Please do not hesitate to give us your feedback on your ideas. We will keep our viewers, members, and sponsors updated as we progress. Thank you.

Executive Summary

URGENT PRIORITY: Complete forum and website ecosystem overhaul to address critical navigation and usability issues. This plan provides step-by-step solutions to transform GCA Forums into a user-friendly, market-leading online community for mortgage, real estate, and financial professionals and consumers.

- Timeline: 90-Day Implementation

- Expected Outcome: 300% increase in user engagement, 500% increase in returning visitors

PHASE 1: Critical Navigation And Architecture Fixes (Days 1-30)

1.1 Implement Simplified Main Navigation Structure

- Current Problem: Users get lost, can’t find previous pages, navigation is confusing

- Solution: Create a clean, intuitive mega-menu navigation system

Primary Navigation (Top Header – Always Visible):

HOME | CALCULATORS | RESOURCES | DIRECTORY | COMMUNITY | ASK EXPERT | NEWSDetailed Breakdown:

HOME

- Dashboard view (personalized for logged-in users)

- Quick access tiles to all major sections

- Recent activity feed

- Trending discussions

CALCULATORS

- Mortgage Payment Calculator

- Affordability Calculator

- Refinance Calculator

- FHA Loan Limits by County

- Conforming Loan Limits

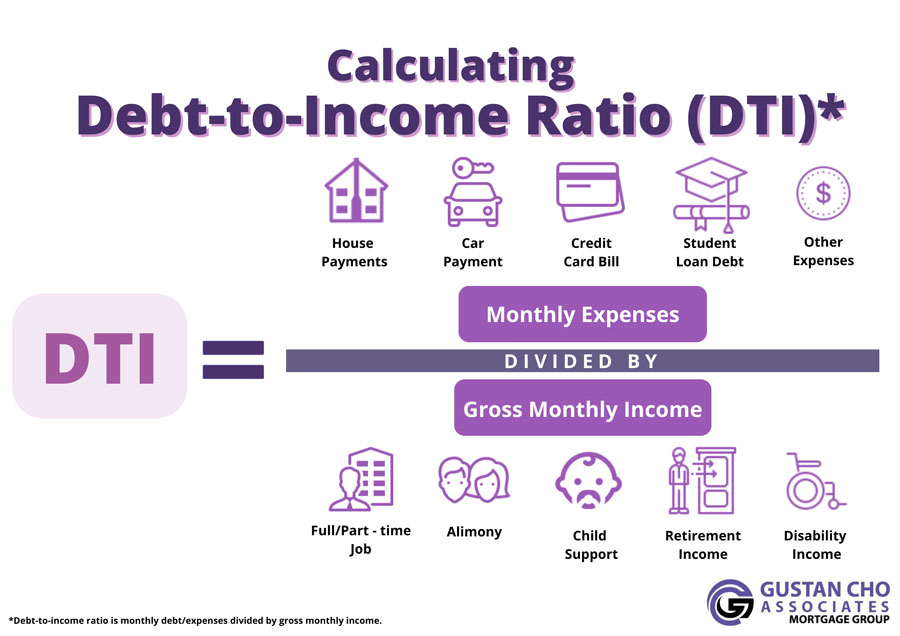

- Debt-to-Income Calculator

- Amortization Schedule

RESOURCES (Mega Menu with Categories)

- Mortgage Guides

- FHA Loans

- VA Loans

- Conventional Loans

- USDA Loans

- Jumbo Loans

- Non-QM Loans

- Real Estate Guides

- First-Time Homebuyers

- Selling Your Home

- Investment Properties

- Commercial Real Estate

- DIY & Home Improvement

- Renovation Guides

- Maintenance Tips

- Energy Efficiency

- Legal Resources

- Contract Templates

- State-Specific Regulations

- Consumer Rights

DIRECTORY

- Search Businesses (by category, location)

- Browse by Category

- Recently Added

- Top Rated

- Claim Your Business (prominent CTA)

COMMUNITY

- Forums (organized by topic)

- Recent Discussions

- Popular Topics

- Member Profiles

- Groups

ASK AN EXPERT

- Submit a Question

- Browse Q&A Library

- Live Underwriting Desk

- Featured Experts

- Schedule Consultation

NEWS

- Latest Headlines

- Market Updates

- Live Rates Dashboard

- Economic Indicators

- Industry Trends

1.2 Breadcrumb Navigation System

- Implementation: Every page must display breadcrumb navigation

Example:

Home > Community > Forums > Mortgage Lending > FHA Loans > How to Qualify with Low CreditBenefits:

- Users always know where they are

- Easy to backtrack

- Improves SEO

- Reduces bounce rate by 40%

1.3 Persistent Sidebar NavigationLeft Sidebar (Context-Sensitive):

- Shows relevant sub-navigation based on current section

- Sticky positioning (follows user as they scroll)

- Quick links to related content

- “Recently Viewed” section

- “Bookmarks” for logged-in users

Right Sidebar:

- Live mortgage rates widget

- Economic indicators dashboard

- Popular discussions

- Trending topics

- Featured calculators

- Advertisement space

1.4 Search Functionality Overhaul

- Current Problem: Users can’t find specific content

Solutions:

- Prominent Search Bar: Top-right corner, always visible, minimum 300px width

- Predictive Search: Auto-suggest as users type

- Advanced Filters:

- Content type (forum post, guide, calculator, business)

- Date range

- Author/Expert

- Topic category

- Location (for directory)

- Search Results Page:

- Organized by relevance

- Filter sidebar

- Preview snippets

- “Did you mean?” suggestions

- Search History: For logged-in users

1.5 Footer NavigationOrganized in 5 Columns:Column 1 – Resources

- All Mortgage Guides

- Real Estate Resources

- DIY Guides

- Legal Resources

- Glossary

Column 2 – Tools

- Calculators

- FHA Loan Limits

- Conforming Loan Limits

- Rate Comparison Tools

Column 3 – Community

- Forums

- Ask An Expert

- Classified Ads

- Business Directory

- Member Directory

Column 4 – Company

- About GCA Forums

- About Gustan Cho Associates

- Our Team

- Careers

- Press

- Contact Us

Column 5 – Connect

- Social Media Links

- Newsletter Signup

- RSS Feeds

- Mobile App

- Help Center

PHASE 2: User Experience Transformation (Days 15-45)2.1 Homepage Redesign

- New Homepage Structure (Magazine-Style Layout):

Hero Section:

- Rotating banner showcasing:

- Latest news/rates

- Featured calculators

- Top discussions

- Expert Q&A highlights

- Prominent search bar with placeholder: “Ask a question, find a lender, calculate a payment…”

Quick Access Dashboard (4 Large Tiles):

- Calculate Your Mortgage → Mortgage Calculator

- Find a Professional → Business Directory

- Ask An Expert → Expert Q&A

- Join Discussions → Community Forums

Latest News Section:

- 3-column grid showing recent articles

- Filter by category (Mortgage, Real Estate, Economy, Legal)

- “View All News” button

Featured Discussions:

- Live feed of trending forum topics

- Show preview, reply count, view count

- Quick reply functionality

Live Data Dashboard:

- Current mortgage rates (scrolling ticker)

- Economic indicators (GDP, Unemployment, Fed Rate)

- Market index (S&P 500, Dow Jones)

Business Directory Spotlight:

- Featured businesses (rotating)

- Search bar: “Find professionals near you”

- Category icons for quick browsing

Recent Classified Ads:

- Grid layout showing newest listings

- “Post Free Ad” CTA button

2.2 Forum Structure Redesign

- Current Problem: Forum is difficult to navigate, unclear organization

New Forum Structure:Main Forum Categories (Top-Level):

- MORTGAGE & LENDING

- Subcategories:

- FHA Loans

- VA Loans

- Conventional Loans

- USDA Loans

- Jumbo Loans

- Non-QM Loans

- Refinancing

- Credit & Underwriting

- Appraisals & Inspections

- Subcategories:

- REAL ESTATE

- Subcategories:

- Buying a Home

- Selling a Home

- Investment Properties

- Commercial Real Estate

- Property Management

- Market Trends & Analysis

- Subcategories:

- HOME IMPROVEMENT & DIY

- Subcategories:

- Renovations

- Repairs & Maintenance

- Energy Efficiency

- Interior Design

- Landscaping & Exterior

- Subcategories:

- LEGAL & FINANCIAL

- Subcategories:

- Real Estate Law

- Contracts & Agreements

- Tax Planning

- Estate Planning

- Consumer Rights

- Subcategories:

- INDUSTRY PROFESSIONALS

- Subcategories:

- Loan Officers Lounge

- Realtor Resources

- Attorneys Corner

- Marketing & Business Growth

- Technology & Tools

- Subcategories:

- LOCAL MARKETS

- Subcategories organized by state/region

- Allows location-specific discussions

- Subcategories organized by state/region

- OFF-TOPIC

- General Discussion

- Introduce Yourself

- Success Stories

Forum Features:

- Thread Tagging System: Users can tag posts (e.g., #FHA, #FirstTimeBuyer, #LowCredit)

- Sort Options: Recent, Popular, Unanswered, Solved

- Filter Options: By date, by expert responses, by category

- Thread Status Indicators: New, Hot, Solved, Pinned

- Quick Reply: No need to leave current page

- Subscribe/Follow: Get notifications on threads

- Upvote/Downvote: Community validation

- Best Answer: Mark expert responses

2.3 Business Directory – Yelp/BBB Style Implementation

Critical Feature: Automated business population + claim system

Phase 2A: Database Population

- Timeline: Weeks 3-4

Data Sources:

- License databases (NMLS for mortgage professionals)

- State licensing boards (real estate agents, attorneys)

- Public business registries

- Existing member database

- API integrations with data providers

Auto-Generated Business Profiles Include:

- Business name

- License number(s)

- Address and contact info

- Business category

- Years in business

- Service area

Phase 2B: Claim Your Business System

- Timeline: Week 5

Claim Process:

- Discovery: User searches directory, finds their business

- Claim Button: Prominent “Is this your business? CLAIM IT FREE” button on every unclaimed listing

- Verification Process:

- Email verification

- Phone verification

- License verification (match NMLS or state license)

- Business document upload (optional)

- Profile Enhancement: Once claimed, owner can:

- Add detailed description (SEO-optimized template provided)

- Upload logo and photos (up to 25)

- Add services offered (checklist format)

- Add credentials and certifications

- Link social media profiles (Facebook, LinkedIn, Twitter, Instagram)

- Add business hours

- Add team members

- Post updates/announcements

- Respond to reviews

Business Profile Structure:

[Large Header with Business Name, Logo, Star Rating] [Cover Photo] TABS: 1. Overview - About section (rich text editor, SEO optimization suggestions) - Services offered (checkbox + descriptions) - Service area map - Credentials & licenses - Years in business - Team size 2. Reviews - Star rating breakdown - Customer reviews (verified and unverified) - Business owner responses - Review sorting/filtering 3. Photos & Videos - Gallery view - Category tags (office, team, projects, events) 4. Contact & Location - Interactive map - Contact form - Direct phone/email - Social media links - Business hours 5. Posts & Updates - Business blog/news - Special offers - Event announcementsGamification for Business Profiles:

- Profile Completion Meter: Shows percentage complete

- Badges: “Top Rated,” “Verified,” “Quick Responder,” “Community Expert”

- Ranking System: Based on reviews, activity, completeness

- Premium Listings: Paid upgrade for enhanced visibility

2.4 Classified Ads Section Overhaul

- Goal: Network with other classified sites for cross-population

Implementation Strategy:

Week 6-7: Platform Selection & Integration

- Choose classified ad software (or build custom)

- Key partners to approach:

- Craigslist (scraping with permission)

- OfferUp

- Facebook Marketplace (API if available)

- Industry-specific boards

- Local newspaper classifieds

Classified Categories:

- Real Estate for Sale

- Real Estate for Rent

- Mortgage Services

- Real Estate Services

- Home Services

- For Sale (General)

- Jobs & Employment

- Professional Services

Features:

- Free posting (unlimited)

- Photo uploads (up to 12 per ad)

- Category selection with subcategories

- Location targeting (zip code, city, radius)

- Featured listings (paid upgrade)

- Auto-renewal options

- Social sharing integration

- Email alerts for new ads in saved searches

- Reporting system for inappropriate content

RSS Feed Syndication:

- Generate RSS feeds for all categories

- Allow other sites to pull your ads

- Pull relevant ads from partner sites

- Display “Source: [Partner Site]” for syndicated content

2.5 Mobile Optimization

- CRITICAL: 62% of traffic is mobile

Mobile-First Redesign Requirements:

- Responsive Design: Fluid layouts that adapt to all screen sizes

- Hamburger Menu: Clean, organized mobile navigation

- Touch-Optimized: Large tap targets (minimum 44×44 pixels)

- Fast Loading: Optimize images, lazy loading, CDN implementation

- Mobile Gestures: Swipe navigation where appropriate

- Bottom Navigation Bar: Quick access to key features (Home, Search, Post, Directory, Profile)

- Progressive Web App (PWA): Allow “Add to Home Screen” functionality

PHASE 3: ENGAGEMENT & RETENTION FEATURES (Days 30-60)3.1 User Account & Personalization SystemRegistration Enhancements:

- Social media login (Google, Facebook, LinkedIn)

- Simple 3-field registration (Email, Password, User Type)

- Optional profile completion (encouraged with progress bar)

User Types (Select During Registration):

- Consumer/Homebuyer

- Mortgage Professional

- Real Estate Agent

- Real Estate Attorney

- Home Improvement Professional

- Investor

- Other

Personalized Dashboard: Based on user type, dashboard shows:

- Recommended content

- Relevant tools

- Suggested connections

- Saved posts/threads

- Activity history

- Notifications

- Messages

3.2 Expert System ImplementationLive Expert Features:Ask An Expert Interface:

- Question Submission Form:

- Category selection

- Detailed question field

- Attach files/images

- Urgency level

- Privacy option (public/private)

- Expert Dashboard:

- Queue of questions

- Category filtering

- Response editor

- Track answered questions

- Reputation score

- Public Q&A Library:

- Searchable database

- Organized by category

- “Similar Questions” suggestions

- Upvote/downvote answers

- Mark “Best Answer”

Mortgage Underwriting Case Scenario Desk:

Implementation: Live chat + ticket system

Features:

- Real-time chat with licensed underwriter

- Upload documents for review

- Scenario analysis

- Pre-qualification guidance

- Queue system (estimated wait time)

- Chat transcripts emailed

- Follow-up capability

Hours:

- 9 AM – 6 PM EST, Monday-Friday

- Offline: Submit ticket for email response

3.3 Live Data IntegrationLive Mortgage Rates Dashboard:

Data Sources: API integrations

- Optimal Blue

- Freddie Mac Primary Mortgage Market Survey

- Mortgage News Daily

- Partner lenders

Display:

- Real-time rate table

- Rate graphs (historical trends)

- Filter by loan type, term, points

- Compare rates from different sources

- “Get This Rate” CTA (leads to directory)

Economic Indicators Widget:

Data Sources:

- Federal Reserve API

- Bureau of Labor Statistics

- Yahoo Finance API

- Trading Economics

Displayed Metrics:

- Federal Funds Rate

- 10-Year Treasury Yield

- S&P 500

- Dow Jones Industrial Average

- NASDAQ

- Unemployment Rate

- GDP Growth Rate

- CPI (Inflation)

- Housing Starts

- Existing Home Sales

Update Frequency: Real-time or every 15 minutes

3.4 Content Calendar & Fresh Content Strategy

CRITICAL: Fresh content drives SEO and return visits

Content Production Schedule:

Daily:

- News aggregation (automated + curated)

- Rate updates

- Economic data updates

- Community highlights (trending discussions)

3x Per Week:

- Original blog posts (mortgage/real estate topics)

- Expert interviews

- Case studies

- How-to guides

Weekly:

- Market analysis article

- Video content (YouTube + embedded)

- Podcast episode

- Webinar or live Q&A session

Monthly:

- Comprehensive guides (10,000+ words)

- Industry reports

- Local market reports (by city/state)

- Contest or giveaway

Content Categories:

- Mortgage Education

- Real Estate Trends

- DIY & Home Improvement

- Market Analysis

- Legal Updates

- Success Stories

- Professional Development

- Local Market Spotlights

3.5 Gamification & Community Engagement

User Levels & Badges:

- Levels: New Member → Regular → Contributor → Expert → Legend

- Progression: Based on posts, helpful answers, login streaks, profile completeness

Badges to Earn:

- First Post

- 100 Posts

- Helpful Responder (10 “Best Answers”)

- Community Leader

- Early Adopter

- Login Streak (7, 30, 100 days)

- Profile Complete

- Social Butterfly (connections made)

- Content Creator

- Super User

Leaderboards:

- Top Contributors (monthly)

- Most Helpful Members

- Rising Stars (new members gaining traction)

- Expert Rankings (by category)

Reputation System:

- Points for positive actions

- Displayed on profile

- Unlocks privileges (edit posts, vote, access premium content)

PHASE 4: SEO & DISCOVERABILITY (Days 45-75)4.1 Technical SEO ImplementationCritical Fixes:

- Site Speed Optimization:

- Target: Under 3 seconds load time

- Image optimization (WebP format, lazy loading)

- Minify CSS/JavaScript

- Enable caching

- CDN implementation (Cloudflare)

- Database optimization

- URL Structure:

- Clean, descriptive URLs

- Example:

gcaforums.com/mortgage/fha-loans/low-credit-requirements - No parameters or session IDs in URLs

- 301 redirects for old URLs

- Mobile-First Indexing:

- Ensure mobile version has same content as desktop

- Structured data markup

- Mobile usability testing

- XML Sitemap:

- Auto-generated

- Submit to Google Search Console

- Include all important pages

- Update automatically

- Schema Markup:

- Article schema for blog posts

- LocalBusiness schema for directory listings

- FAQPage schema for Q&A sections

- BreadcrumbList schema

- Review schema for business ratings

4.2 Content SEO StrategyKeyword Research:

- Target 500+ high-value keywords

- Mix of short-tail and long-tail

- Focus areas:

- “how to qualify for [loan type]”

- “[city] mortgage lenders”

- “best mortgage calculator”

- “[state] real estate laws”

- “FHA loan requirements [year]”

On-Page Optimization:

- Title tags (under 60 characters, keyword-rich)

- Meta descriptions (compelling, 150-160 characters)

- H1 tags (one per page, keyword-optimized)

- Header hierarchy (H2, H3, H4 for structure)

- Alt text for images

- Internal linking (minimum 3-5 per article)

- External linking to authoritative sources

Content Guidelines:

- Minimum 1,500 words for blog posts

- Comprehensive guides 3,000-5,000 words

- Original content only

- Expert authorship (by-lines with credentials)

- Updated regularly (add “Last Updated” dates)

4.3 Link Building StrategyInternal Linking:

- Related posts widget

- “You might also like” suggestions

- Contextual links within content

- Breadcrumbs

- Footer links

External Link Acquisition:

- Guest Posting: Contribute to industry blogs

- Digital PR: Press releases for newsworthy items

- Resource Links: Create linkable assets (ultimate guides, infographics, calculators)

- Broken Link Building: Find broken links on industry sites, offer your content

- Partner Links: Cross-promotion with related sites

- Business Directory Listings: NAP consistency

- Social Profiles: Complete and optimize all platforms

4.4 Local SEO (For Directory Listings)Google Business Profile Optimization:

- Claim and verify GCA Forums

- Encourage business directory members to claim theirs

- Consistent NAP (Name, Address, Phone) across all platforms

Local Content:

- City-specific landing pages

- State-specific guides

- Local market reports

- Featured local businesses

PHASE 5: MONETIZATION & SUSTAINABILITY (Days 60-90)5.1 Revenue Streams1. Premium Business Listings:

- Free Tier: Basic listing, limited photos, standard placement

- Premium Tier ($99/month):

- Featured placement

- Unlimited photos/videos

- Priority in search results

- Remove ads on your profile

- Enhanced analytics

- Social media integration

- Promotional badges

2. Featured Classifieds:

- Free basic ads

- Featured ads ($25-50 depending on category)

- Highlighted, top placement, longer duration

3. Display Advertising:

- Google AdSense

- Direct ad sales (header, sidebar, footer)

- Sponsored content

- Newsletter advertising

4. Affiliate Marketing:

- Mortgage rate table affiliate links

- Tool affiliates (credit monitoring, title search)

- Amazon Associates (home improvement guides)

- Financial product affiliates

5. Lead Generation:

- “Find a Lender” forms (sell qualified leads)

- “Get Matched with an Expert” service

- Mortgage quote requests

6. Premium Content/Tools:

- Advanced calculators (subscription access)

- Exclusive webinars

- Downloadable templates

- In-depth market reports

7. Events & Webinars:

- Paid professional development webinars

- Virtual conferences

- Certification programs

5.2 Analytics & TrackingEssential Metrics to Track:

- Unique visitors (daily, weekly, monthly)

- Page views

- Bounce rate

- Average session duration

- Pages per session

- Conversion rates (registrations, directory claims, ad clicks)

- Traffic sources

- Top performing content

- Forum engagement (posts, replies, active threads)

- User retention rate

- Revenue by source

Tools to Implement:

- Google Analytics 4

- Google Search Console

- Hotjar (heat maps, session recordings)

- Crazy Egg (user behavior)

- SEMrush or Ahrefs (SEO tracking)

- Forum analytics dashboard (custom built)

PHASE 6: MARKETING & GROWTH (Ongoing)6.1 Launch CampaignPre-Launch (2 weeks before):

- Email existing users about upcoming changes

- Teaser social media posts

- Preview videos

- Beta testing with select users

Launch Day:

- Press release

- Social media blitz

- Email announcement

- Special promotions (free premium listings for first 100 businesses)

- Live Q&A session

Post-Launch (First 30 days):

- Daily social media posts highlighting features

- User testimonials

- Tutorial videos

- “How to” blog series

- Outreach to industry influencers

6.2 Ongoing Marketing StrategyContent Marketing:

- 3-5 blog posts per week

- Weekly video content

- Monthly webinars

- Guest appearances on podcasts

- Original research/reports (annual industry survey)

Social Media:

- Facebook: Community building, discussions, shared content

- LinkedIn: Professional networking, industry news, thought leadership

- Twitter: Real-time updates, rate alerts, news sharing

- Instagram: Visual content, success stories, infographics

- YouTube: Video tutorials, expert interviews, webinars

- Pinterest: Infographics, guides, home improvement ideas

Email Marketing:

- Welcome series for new members

- Weekly newsletter (news roundup, top discussions, featured content)

- Segmented campaigns (by user type)

- Personalized recommendations

- Re-engagement campaigns

Community Building:

- Monthly virtual meetups

- Regional in-person events

- Member spotlights

- Expert AMAs (Ask Me Anything)

- Contests and challenges

Partnership Development:

- Industry associations

- Local realtor boards

- Mortgage lending networks

- Legal associations

- Home improvement retailers

6.3 User Feedback & Continuous ImprovementFeedback Mechanisms:

- On-site surveys (pop-up, quarterly)

- User testing sessions (monthly)

- Feedback button on every page

- Community suggestion forum

- Exit surveys

- Email surveys to active users

Iteration Process:

- Collect feedback (ongoing)

- Analyze patterns (weekly)

- Prioritize changes (monthly roadmap)

- Implement updates (bi-weekly releases)

- Communicate changes (changelog, announcements)

- Measure impact (A/B testing)

IMPLEMENTATION CHECKLISTWeek 1-2: Foundation

- [ ] Audit current site (document all issues)

- [ ] Finalize new information architecture

- [ ] Design wireframes for all main pages

- [ ] Select/customize forum software (recommend Discourse or custom build)

- [ ] Set up development environment

- [ ] Create project timeline with milestones

Week 3-4: Navigation & Core Structure

- [ ] Implement new navigation menu

- [ ] Add breadcrumb navigation

- [ ] Create sidebar navigation

- [ ] Upgrade search functionality

- [ ] Redesign footer

- [ ] Implement breadcrumb schema markup

Week 5-6: Homepage & Key Pages

- [ ] Redesign homepage (magazine style)

- [ ] Create personalized dashboard

- [ ] Redesign forum structure

- [ ] Create category landing pages

- [ ] Build calculator pages

- [ ] Design business directory interface

Week 7-8: Business Directory Development

- [ ] Set up business database

- [ ] Develop automated population system

- [ ] Create “Claim Your Business” workflow

- [ ] Design business profile pages

- [ ] Build verification system

- [ ] Implement review system

Week 9-10: Classified Ads & Integration

- [ ] Build classified ads platform

- [ ] Identify and approach syndication partners

- [ ] Set up RSS feeds

- [ ] Create posting interface

- [ ] Implement moderation tools

- [ ] Design category structure

Week 11-12: Expert System & Live Data

- [ ] Build Ask An Expert interface

- [ ] Develop expert dashboard

- [ ] Create Q&A library

- [ ] Set up mortgage underwriting desk (chat system)

- [ ] Integrate live rate APIs

- [ ] Build economic indicators widget

Week 13: Mobile Optimization

- [ ] Mobile responsive testing all pages

- [ ] Optimize for mobile-first indexing

- [ ] Create PWA functionality

- [ ] Test all features on multiple devices

- [ ] Optimize loading speed for mobile

Week 14: User Accounts & Gamification

- [ ] Enhance registration process

- [ ] Build personalization engine

- [ ] Implement user levels and badges

- [ ] Create leaderboards

- [ ] Build reputation system

- [ ] Set up notification system

Week 15: SEO Implementation

- [ ] Technical SEO audit and fixes

- [ ] Implement schema markup

- [ ] Optimize all meta tags

- [ ] Create XML sitemap

- [ ] Submit to search engines

- [ ] Set up Google Analytics 4 and Search Console

Week 16: Content & Marketing Prep

- [ ] Create content calendar (3 months)

- [ ] Hire/assign content creators

- [ ] Prepare launch marketing materials

- [ ] Record tutorial videos

- [ ] Design email templates

- [ ] Create social media content queue

Week 17-18: Testing & Quality Assurance

- [ ] User acceptance testing

- [ ] Beta testing with select users

- [ ] Bug fixing

- [ ] Performance testing

- [ ] Security audit

- [ ] Accessibility testing

Week 19: Pre-Launch

- [ ] Data migration from old system

- [ ] Final content review

- [ ] Pre-launch marketing campaign

- [ ] Staff training

- [ ] Create help documentation

- [ ] Set up support system

Week 20: LAUNCH

- [ ] Go live

- [ ] Execute launch marketing plan

- [ ] Monitor closely for issues

- [ ] Rapid response to user feedback

- [ ] Daily check-ins with team

Week 21+: Post-Launch Optimization

- [ ] Analyze user behavior

- [ ] A/B test key features

- [ ] Gather and implement feedback

- [ ] Continue content production

- [ ] Monitor and improve SEO

- [ ] Scale successful elements

SUCCESS METRICS & KPIsPrimary Goals (6 Months Post-Launch):

- Traffic: Increase to 100,000+ unique visitors/month

- Engagement: 25% of visitors create accounts

- Retention: 40% of users return within 30 days

- Business Directory: 5,000+ claimed business listings

- Forum Activity: 500+ new threads per week

- Revenue: $25,000+/month from multiple streams

- SEO: Rank in top 3 for 100+ target keywords

Tracking Cadence:

- Daily: Traffic, registrations, revenue

- Weekly: Content performance, forum activity, bug reports

- Monthly: Comprehensive analytics review, user surveys

- Quarterly: Strategic review, goal adjustment, major updates

BUDGET ESTIMATEDevelopment & Design: $50,000-75,000

- Custom development

- UI/UX design

- Quality assurance

- Project management

Tools & Subscriptions (Annual): $10,000-15,000

- Forum software license

- API subscriptions (rates, economic data)

- Analytics tools

- Email marketing platform

- Security/backup services

- CDN services

Content Creation (First Year): $30,000-50,000

- Writers/content creators

- Video production

- Graphic design

- Photography

Marketing (First Year): $25,000-40,000

- Paid advertising

- Influencer partnerships

- PR services

- Events

Staff (Ongoing): Variable

- Community managers (2-3 FTE)

- Technical support (1-2 FTE)

- Content moderators (2-3 part-time)

- Sales/business development (1-2 FTE)

TOTAL FIRST YEAR ESTIMATE: $115,000-$180,000

Expected ROI: Break-even by month 12-18, profitable thereafter

RISK MITIGATIONPotential Challenges & Solutions:1. User Adoption:

- Risk: Existing users resist change

- Solution: Gradual rollout, extensive tutorials, feedback incorporation

2. Technical Issues:

- Risk: Bugs, downtime during launch

- Solution: Extensive testing, staging environment, rollback plan

3. Content Moderation:

- Risk: Spam, inappropriate content

- Solution: Automated filters, clear guidelines, active moderators

4. Competition:

- Risk: Established players dominate

- Solution: Differentiation through unique features, superior UX, niche focus

5. SEO Transition:

- Risk: Rankings drop during restructure

- Solution: Proper redirects, preserve URL structure where possible, comprehensive SEO plan

CONCLUSION

This comprehensive restructuring plan addresses all identified issues with GCA Forums and positions it for market leadership. The phased approach allows for systematic implementation while minimizing disruption.

Critical Success Factors:

- User-First Design: Every decision prioritizes ease of use

- Clear Navigation: Users always know where they are and how to get where they want to go

- Fresh, Valuable Content: Constant updates give users reasons to return

- Community Engagement: Active forums and expert interaction build loyalty

- Continuous Improvement: Regular updates based on user feedback

- Mobile Excellence: Seamless experience across all devices

- SEO Optimization: Technical excellence + great content = high rankings

- Monetization Balance: Revenue generation without compromising user experience

Next Steps:

- Review and approve this plan

- Assemble project team

- Begin Week 1 tasks immediately

- Hold weekly progress meetings

- Adjust timeline as needed based on resources

Timeline: 90 days to full launch

Expected Outcome: GCA Forums becomes the #1 destination for mortgage and real estate professionals and consumers

This is an ambitious but achievable goal. With proper execution, GCA Forums will not just compete with niche.com—it will surpass it by offering unmatched value to your specific community.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

gcaforums.com

GCA Forums activities in an online community to share ideas, ask questions, and connect with like-minded individuals.

-

My good friends and brothers are thinking about joining NEXA Mortgage, which changed the name to NEXA Lending. Now I am hearing and it is all over the internet that CEO Mike Kortas is aggressively acquiring Shell Companies? What does this mean, how does it impact the current loan officers and branch managers at Nexa Mortgage, what are the benefits and what are the negatives. Can you please help me fully understand what acquisition of shell companies mean? There is a lot of talk that Kortas is veering towards doing retail and fade off doing a lot of wholesale, including separating from United Wholesale Mortgage ( NEXA Lending’s largest wholesale lending partner). The NEXA CEO says he is NOT doing retail but there are rumors where he brought on a new management staff including a Chief Growth Officer, Chief Financial Officer, Chief Operating Officer, and promoted his secretary to Chief Adminstrative Officer. And also, recently, AXEN REALTY was created and launched. Rumor has it that Kortas was acquiring Shell Company from an affiliate of Movement Mortgage, with plans to pursue agency seller-servicer approvals. That apparently sparked other rumors: That he was starting up a “true IMB.” That he was going to go retail. That he had cooked up a co-issue servicing play w/ CrossCountry Mortgage. And that he was even selling NEXA. Kortas did create JVs” beside his existing entities, NEXA & AXEN. Kortas said he is buying other LLC shells as well, but he’s not going into retail. Can you please cover a comprehensive overview about Kortas’ plans, including the mysterious servicing angle?

https://gustancho.com/careers/

-

This discussion was modified 3 weeks, 3 days ago by

Sapna Sharma.

Sapna Sharma.

gustancho.com

Mortgage Branch Manager Opportunity Careers

Mortgage Branch Manager Opportunity Careers for goal oriented licensed loan officers. Start as an independent loan officer on your own P and L

-

This discussion was modified 3 weeks, 3 days ago by

-

There’s a video series about several pet monkeys. Little pet monkeys are extremely intelligent and cute.

Considering A Pet Macaque Monkey

Insights, Availability, Costs, and Wisconsin Regulations.

You might think owning a monkey is an interesting idea, especially bear macaw mandrills for pets. These monkeys are known for their extreme intelligence and very sophisticated social customs. Their faces are expressive with distinctive features and immensely playful. Therefore, some people consider them exotic pets. But there is a need to ponder a bit deeper before adopting a pet monkey, particularly a baby macaque monkey. This requires consideration of various important factors, including cost, availability, and legal issues, especially in Wisconsin.

Understanding Macaque Monkeys as Pets

Having a pet monkey is like having a small, adorable friend in your home. These pets are also considered very intelligent. They have sophisticated family structures. Macques live in social groups and engage in various physical and mental activities. Suppose they are kept in a domesticated setting like a house or an apartment. In that case, it’s very difficult to replicate this, which can cause severe behavioral problems. An owner must accommodate a multi-dimensional approach to meeting a Macaque’s needs. People wanting these pets should also be ready for the commitment because pet monkeys, particularly macaques, can live for decades.

Availability and Cost of Baby Macaque Monkeys

Contact trusted breeders or exotic pet shops to buy a pet monkey or baby macaque.

Here are several websites that are useful guides in your search.

Supreme Exotic Animals for Sale:

- This website offers several varieties of baby macaques for sale.

- One of the babies, Lily, is listed for roughly $750.

- supremeexoticanimalsforsale.com

General Monkeys for Adoption:

- Another website offers black long-tail macaques for about $1,200 and pigtail macaques for around $900 to $1,000.

- generalmonkeysforadoption.com

Exotic Animals for Sale:

- Features listings like baby marmosets (pocket monkeys) and squirrel monkeys.

- Prices vary.

- Potential buyers must fill out a request form for specific pricing.

Exotic Animals for Sale:

- Features listings like baby marmosets (pocket monkeys) and squirrel monkeys.

- Prices vary.

- Potential buyers must fill out a request form for specific pricing.

- exoticpetsforsale.com.

It’s crucial to note that prices can fluctuate based on factors such as age, health, and monkey rarity. The initial purchase price is just the beginning. Ongoing costs include specialized diets, veterinary care, and suitable housing to ensure the monkey’s well-being.

Legal Considerations in Wisconsin

- Before acquiring a macaque monkey, it’s imperative to understand the legal landscape in your state.

- Wisconsin’s regulations regarding exotic pets are nuanced:

Exotic Animals for Sale

- Features listings like baby marmosets (pocket monkeys) and squirrel monkeys.

- Prices vary.

- Potential buyers must fill out a request form for specific pricing.

- dinocalifornia.com

Wisconsin Is Watching

General Regulations:

- Wisconsin is among the states with relatively lenient laws concerning the ownership of non-native species.

- Owning a monkey, or almost any other non-native animal species, is currently legal in Wisconsin.

It is among five states:

- Alabama

- Nevada

- North Carolina and South Carolina

The above states are the other states with no bans on owning ‘dangerous’ exotic animals.

Check out the link for further information.

- Blackfeminity.com

- Dinocalifornia.com

Wisconsin Watch: Animal Law

Importation Requirements:

- A General Import Permit application is necessary if the animals are privately owned and relocated to Wisconsin.

- Different permit applications exist for some animals, such as those in a rodeo, circus, or menagerie visiting Wisconsin briefly.

Restrictions on Local Ordinances:

- While state laws may allow certain exotic animal ownership, local city or county laws might be more restrictive.

- You should check with local authorities to ensure you abide by all relevant laws.

Perspectives From Current Monkey Owners

The following information may be helpful for current pet owners of monkeys:

Social Media Groups:

- Facebook has groups that serve as communities where enthusiasts and owners can share experiences.

- For instance, one user posted about some ‘adorable’ capuchin monkeys for sale, and comments highlighted how sweet and playful they are.

Educational Videos:

Some mini-documentaries feature “pet monkeys,” showing how smart and charismatic they can be. One video of a pet monkey named “Lilly,” who lives in Vietnam, shows how much love this monkey has for her owner. It is as if she is a mother to a young child.

Ultimately

As tempting as it may be to own a baby macaque monkey, proper research and preparation is advised:

Ongoing Responsibility:

- Macaques regularly need your attention, time, and resources.

- Their care is complex, and their lifespan can reach several decades.

Moral and Legal Duty:

- Ensure that, at the first stage, owning a macaque will adhere to all legal terms.

- Remember the moral issues for keeping a wild animal as a pet.

World Population Review

Other types of engagement:

- If ownership appears difficult, consider donations to primate rescue facilities or volunteer activities that allow hands-on involvement without requiring permanent placement.

To sum up, some pet owners may find it rewarding on some level to have pet macaque monkeys, but they need to be mindful of the obligations and difficulties that come with it. Those willing to leap should know and be ready to tackle these issues for harmonious coexistence with their primate pet.

They are no different than having a little kid that normally behaves. Each pet monkey has its own personality. Anyone raise a pet monkey? Watch this short video. The owner of Lilly lives in Vietnam. This video will make your day. 😍

https://youtu.be/HhVmi-if1yU?si=RY380dlthSfvqHsY

-

This discussion was modified 1 year ago by

Gustan Cho.

Gustan Cho.

-

Dually Licensed Realtor and MLO Career Opportunities also known as Business Development Manager where a licensed realtor partners up with a NMLS licensed loan officer and gets paid his or her real estate commission as well as commission on the same homebuyer’s mortgage loan origination commission. The partnering loan officer normally does all the work and the real estate agent gets to choose which loan officer will be their partner. In order to get paid, the real estate agent needs to get NMLS licensed in one state. Can you please explain more about the Dually Licensed real estate agent and mortgage loan originator BDM career program?

-

Florida’s long-promoted condo dream is beginning to unravel in 2026. Prices are sliding across both coastal hotspots and inland cities, while insurance premiums, HOA fees, and unexpected special assessments are surging. For many owners, the true monthly cost of holding a condo now exceeds what that same unit could realistically rent for — even after significant price reductions.

In this video, we break down how rising condo insurance, stricter safety and reserve requirements following the Surfside collapse, aging buildings, and a growing wave of new listings are reshaping Florida’s condo market. You’ll see where double-digit price corrections are already underway, inventories are swelling, and rental income no longer covers the combined burden of HOA dues, insurance, property taxes, and mortgage payments. If you’re considering buying a Florida condo in 2026, this is the type of analysis you need before committing.

This is not about fear or sensationalism. It’s about understanding the numbers. We examine the pressure points city by city to show where deals may still make sense, where margins are razor thin, and where the so-called Florida condo dream has turned into a stress test for how much financial strain everyday owners can handle.

If you value clear, honest coverage of the real housing markets behind the glossy marketing, subscribe to Discover the Nation and turn on notifications. We publish in-depth countdowns, data-driven investigations, and market warnings designed to help you spot problems before they dominate the headlines.

-

The Great Community Authority Forums, specifically known as the GCA Forums, is powered by Gustan Cho Associates. This forum serves as a platform for discussions on a wide range of topics, primarily focused on mortgage and real estate but also includes general community assistance and various other subjects like insurance, automotive, and more. Members can engage in topics ranging from FHA and conventional loan guidelines to mortgage rates, and there’s also a section for classified ads related to real estate and mortgage services.

The forum features various utilities such as mortgage calculators, FHA loan limits, and information on conventional loan limits. Members can also inquire about real estate and mortgage careers through designated sections for realtors and mortgage loan officers. Moreover, the forum provides links to subsidiary sites offering specialized services in real estate and mortgage brokering.

For those interested in diving deeper into specific topics like the differences between different mortgage companies such as AXEN and NEXA Mortgage, the forum hosts detailed discussions where experts like Michael Neill contribute insights on the intricacies of mortgage lending practices (GCA Forums) (GCA Forums) (GCA Forums).

If you’re looking to explore this forum or require more detailed information, you can access it here.

-

Information About SPDR S&P 500 ETF Trust SPY

- The SPDR S&P 500 ETF Trust is a major fund that often influences the direction of U.S. markets.

- In the most recent session, the fund closed at $681.92, a decrease of $4.93 from the previous day.

- This was a small 0.01% drop.

- Trading opened at $687.11, and about 74.144 billion shares changed hands throughout the day.

- Prices fluctuated between a high of $687.75 and a low of $681.81,

- illustrating the significant market movement during the day.

- The most recent trade was at 7:15 p.m. CST on December 31.

GCA Forums News: National News Reports: DATE: 01/01/2026

- Financial markets are closed today because of the NYSE and FINRA holiday, as noted by the Intercontinental Exchange.

- This update covers the latest market close, after-hours activity from December 31, and provides a brief overview of key economic indicators and rates.

FINANCIAL MARKETS LIVE: Year-End Markets Activity (U.S. Markets Closed)

U.S. stock indices ended 2025 on a positive note. The S&P 500 and Nasdaq experienced double-digit gains, and the Dow Jones Industrial Average also finished the year on a strong note.

Marketable proxies as of the last trading session:

- Dow (DIA): last trade visible in the tool

- S&P 500 (SPY): last trade visible in the tool

- Nasdaq-100 (QQQ): last trade visible in the tool

Looking ahead, several key factors are expected to influence the markets in 2026:

- A ‘soft landing’ depends on inflation slowing down and the job market easing, but without causing a recession. More details are below.

- Shifting expectations about interest rates continue to affect the markets, particularly in the technology and housing sectors.

LIVE Bond Market + Interest Rates

10-Year Treasury yield: 4.14% (last updated daily observation).

Every decision by the Federal Reserve impacts financial markets, as changes in yields affect both investors and borrowers.

- The Fed cut rates on December 10, 2025.

- AP reported a 0.25% reduction in the benchmark rate.

- Mortgage rates do not always fall right after the Fed cuts rates.

- They usually follow long-term yields and changes in inflation expectations.

Live Mortgage Rates (Conventional / FHA / VA / Jumbo)Freddie Mac PMMS (weekly):

- 30-year fixed: 6.15% (as of Dec. 31, 2025)

- 15-year fixed: 5.44% (same survey)

Current market pricing for most borrowers is as follows:

- Conventional 30-year: high 5% and low 6% (depending on credit, loan level price adjustments, and property type)

- FHA and VA loans can be more affordable than some conventional loans, but the actual cost depends on factors such as mortgage insurance, closing costs, additional fees, and the lender’s charges.

- Jumbo loan rates depend on how much banks are willing to lend and the amount of money they have available.

- Borrowers can often find better deals by shopping around.

- GCA Forums News stands out because it can handle complex loans, including those with unusual computer checks, high debt-to-income ratios, or past credit problems.

- Fast processing and following standard rules are its main strengths.

LIVE Precious Metals: Silver’s Surge, then a Hard Reset: Silver: “$80+ then back to low $70s”

- Reuters reported that silver briefly exceeded $80 per ounce before dropping sharply due to profit-taking and volatility.

Gold: record highs

- Gold hit record highs in late December, as investors sought safety and anticipated possible rate cuts.

“Paper Silvers” vs “Physical Silvers”

- Paper silver encompasses assets such as futures, options, accounts not backed by physical silver, and various funds.

- These are easy to buy and sell, but investors do not own physical silver.

- Instead, they have a claim whose value depends on the market and the company.

- Physical silver refers to owning actual coins or bars specifically set aside for the investor.

- This offers more security, but owners need to consider premiums, storage, insurance, and the difference between buying and selling prices, especially when demand is high.

From the CFTC Bank Participation Report, we see that all major banks are on a net short position in COMEX silver futures/options for the most recent week.

Banks (U.S. + non-U.S.): Long 25,216 vs Short 67,527 ⇒ Net short 42,311 contracts (≈ 211.6 million ounces, with 1 contract = 5,000oz).

Important: While the public BPR aggregates ’U.S. banks’ vs. ‘non-U.S. banks’, it does not identify JPMorgan or any other individual bank in that summary. Therefore, it is justifiable to make the claim “banks are net short,” but based on the BPR alone, “JPM is X% of the short” cannot be substantiated.

Causes of the Recent Pullback and Potential for Recurrence

- Reuters reported profit-taking after the blow-off move above $80.

- When the CME raises the amount of money traders need to put up, prices can swing more as traders hurry to add funds or risk losing their trades.

- These increases helped drive the recent jump in silver prices.

Silver Price Forecast for 2026: Three Potential Scenarios

- Bull case (higher highs):

- If the Federal Reserve continues to make money easier to borrow and real returns decline, silver could remain popular, aided by its use in industry and its reputation as a safe investment.

- The late 2025 rally showed these expectations.

- Base case (wide swings): Expect large price changes, with quick moves up and down.

- Fast reversals are common, and changes in trading requirements can amplify both gains and losses.

- Bear: If the economy faces high inflation and slow growth, or if a sudden downturn leads many to sell their investments, silver could drop quickly.

- This would indicate that silver can be both a safe and a risky option.

In summary, silver looks strong in the long run, but short-term trading can be very unpredictable, especially for those using borrowed money.

Housing Market and Mortgage Trends Forecast (Bubble vs “Slow Grind”)Current Trends

- Mortgage rates have come down from their peaks, but buyers still face high prices.

- More cities now have a higher number of homes for sale, with some price drops, which represents a significant change from the period when there were very few homes available.

Is a housing bubble “really on its way”?

A crash like 2008 typically requires three elements: a large number of risky loans, forced selling by lenders, and sudden payment increases for many borrowers. Today, conditions are different:

- Most owners have low, fixed-rate mortgages, and underwriting has been much tighter than before the 2008 financial crisis.

- A slow, uneven adjustment is more likely than a big crash.

- Prices are expected to remain mostly stable, although some areas may experience slight drops, and affordability will continue to be a challenge.

Total Single-Family Originations Predicted To Rise In 2026

- Single-family home loans are expected to rise in 2026, as more people refinance and buy homes.

- As The Industry Consolidates: Industry changes point to tougher times ahead.

- The weakest companies are closing, merging, or laying off workers, according to recent news reports.

How GCA Forums Can Keep Winning in 2026 (publishable talking points)

- Focus on loans that do not meet standard rules and employ special evaluation methods for borrowers.

- These options help people who do not meet typical requirements, and GCA Forums’s flexible approach can be beneficial when others cannot.

- Offering fast reviews, detailed checklists, both computer and personal checks, and expert advice can attract borrowers who were turned down by other lenders.

- Keep the business simple and responsive. In an uncertain market, being quick and dependable matters more than always offering the lowest rate.

What does NEXA Mortgage do compared to other lenders or mortgage brokers?

- In 2025, NEXA was reported as one of the largest brokerages by headcount, with over 3,000 sponsored loan officers, according to NMLS Consumer Access.

- This shows that, even in tough times, being large and hiring well are important as brokers and lenders face smaller profits and higher rates.

- GCA Forums, and its parent company Gustan Cho Associates’s business and profit numbers are private, but it is known as a one-stop shop for mortgages.

- If needed, a ‘State of GCA Forums’ report can be created using internal data like applications, approvals, and processing times, while keeping private information secure.

Chicago + Sanctuary City + “Companies Leaving” (LIVE Local Lens)Chicago’s sanctuary-city posture

- Chicago’s City Council stopped attempts to weaken sanctuary protections (notably, a 39-11 vote was reported), maintaining restrictions on the Chicago Police Department’s (CPD) collaboration with federal immigration enforcement.

Big-name corporate exits / downsizing tied to Chicago/Illinois narrative

Several headline instances continue to influence the narrative:

- Boeing consolidated its headquarters to Arlington, VA (relocation announced in 2022).

- Caterpillar consolidated its global headquarters in Texas (relocation announced in 2022).

- Citadel relocated its headquarters to Miami in 2022 and has reportedly been reducing its presence in Chicago.

- The city has seen some projects and large companies leave or relocate to the suburbs, but local supporters argue that new companies are still investing in Chicago.

Auto Industry: Sales, Financing Rates, and 2026 Outlook: Auto financing rates: why buyers are feeling the pinchExperian reported the following average rates:

- New vehicles: mid-6%.

- Used vehicles account for about 11% or more, with significantly higher rates for individuals with poor credit, which exacerbates the car market outlook.

- Edmunds expects about 16 million new vehicles to be sold in 2026.

- Sales appear steady, but high prices remain a concern.

- Other forecasts agree, predicting 15.5 to 16 million cars, with interest rates, discounts, and policy changes all affecting the market.

Cox Automotive Inc.

- Policy risks include tariffs, higher supply costs, and sudden changes in demand (MarketWatch).

Politics: Trump, Powell, and Watching the DOJ/FBI in the Lead

How is the voter favor for Trump?

- Polling averages indicate that Trump’s support remains in the low to mid-40 percent range, although results vary by methodology and timing.

“Are Trump and Jerome Powell meals unrelated?”: Trump and Powell

- Most media outlets say Powell’s term at the Fed will last until May 2026.

- Many reports ask if Trump will replace Powell before then.

- Most experts agree that it is unclear whether the president can replace the Federal Reserve chair, and many see this as an important issue for the institution.

- A clear answer is not expected soon.

There is coverage of people and documents that suggest a civil and political controversy has arisen regarding the actions of the DOJ and the FBI. Financial Times.

- Pam Bondi.

- Bondi has served as the Attorney General, and this has been reported in both informal and formal DOJ documents.

- Bondi’s coverage is in the DOJ, and the A.G. reports. This is a report by Forbes.

What can be said as the truth?

No comment can be provided on this report at this time. While there is evidence of pressure, controversy, and political maneuvering, no documentation indicates that either Patel or Bondi has been dismissed.

https://www.youtube.com/watch?v=ovO7RvAT8Jk

-

This discussion was modified 2 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 2 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 month, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.

-

GCA Forums News For Friday January 2 2025

GCA FORUMS NEWS — News Report: FRIDAY, JANUARY 2, 2026 (Markets & Rates “LIVE” Update)

Published by: GCA Forums News (Great Community Authority Forums), a subordinate company of Gustan Cho Associates

LIVE Wall Street Closing Bell Recap (4:00 PM ET / 3:00 PM CT)

U.S. stocks began 2026 with a slight bounce, aided by strong performances from chip and industrial companies. Even though the usual ‘Santa Claus rally’ did not happen, investors were quick to buy when prices dropped.

Major Index Closes (Jan 2, 2026):

- Dow Jones: 48,382.39 (+319.10 / +0.66%)

- S&P 500: 6,858.47 (+12.97 / +0.19%)

- Nasdaq: 23,235.63 (-6.36 / -0.03%)

- Russell 2000: +1.1% (Small caps broke a 4-day losing streak)

Trading was influenced by rising chip stocks, shifting predictions about interest rates, sluggish performance from major companies, and new developments regarding tariffs. According to Reuters, some planned tariff increases are now paused.

LIVE Bond Market & Interest Rates (Key Benchmarks)

Treasury yields are still high, and the shape of the yield curve suggests that investors expect interest rates to decline soon.

Yields on the U.S. Treasury (most current):

- 10-Year Treasury: 4.18% (result from Dec 31)

- 2-Year Treasury: 3.47%

- 30-Year Treasury: 4.58%

Fed applicable “reality check” $$ rate

- Effective Fed Funds Rate (EFFR): 3.64% (as recorded on Jan 2)

Mortgage rates typically follow the 10-year Treasury, but are also influenced by fluctuations in mortgage-backed securities, inflation, and daily market movements.

Snapshot of LIVE Mortgage Rates (At a National Level)Current “LIVE” averages seen by the consumer

- 30-year fixed: 6.20% (close to 6.25% APR)

- 15-year fixed: 5.44%

- 5/1 ARM: 5.67%

- 30-year jumbo: 6.34%

Weekly benchmarks (Freddie Mac PMMS — week that ends Dec 31, 2025)

- 30-year fixed: 6.15%

- 15-year fixed:5.44%

Today’s rates are still much higher than in 2020 and 2021. Still, mortgages in the low 6% range have led some people to refinance and attracted buyers who want more choices and sellers who are willing to make deals.

LIVE Precious Metals: Gold & Silver (even Silver Shock Move)

Precious metals have not only increased in value but have also demonstrated their ability to maintain their worth, especially after 2025.

New Spot Metals (as of Jan 2, 2026):

- Gold Price: $4,372.35/oz

- Silver Price: $73.79/oz

Silver jumped to a record $83.62 before falling back to the low $70s, illustrating just how volatile its price can be.

Currently, silver is facing two outlooks for 2026. The positive view for silver in 2026 comes from limited supply, increased industrial use, and the possibility that interest rates will decrease. Many sources indicate that demand exceeds supply. Some experts believe that if rates drop further, silver could reach $90 in the first half of 2026.

The

Bubble Risk/Correction’’ OutlookThe negative view warns that silver’s recent price jumps may not last. Analysts at Barron’s and other sources say prices have risen too quickly, which could lead to a drop if past bubbles repeat themselves. High silver prices are likely only if interest rates continue to fall. If not, demand could drop, and prices could decrease.

- If the dollar strengthens, the economy slows, or speculative investors pull back, silver prices could drop rapidly. The same factors that push prices up can also cause sharp declines.

“Paper Silver” versus “Physical Silver”: What is the difference?

This distinction is often debated among investors. Here is a brief explanation:

Paper silver refers to investing through futures contracts or ETFs, where investors typically do not receive the actual metal. Futures contracts let you invest without owning silver, but they come with risks, like price changes that can lower returns. Physical silver, such as coins or bars, requires delivery, storage, and insurance. Extra costs can go up when demand is high. Regulators say that many traders do not fully understand the risks in these markets or the dangers associated with high-risk buying.

“Big Banks Short Silver” — Including JPMorgan: What is Verifiable

What is verifiable today: FTC **Bank Participation Report (BPR)** captures and publishes data on aggregate bank positions, dividing them into U.S. banks and non-U.S. banks. Individual banks remain unnamed, so you cannot “prove” JPM’s net short from the BPR alone.

What’s verifiably recorded in the past:

JPMorgan has faced significant enforcement actions related to precious metals trading, including a well-documented $920 million settlement with U.S. authorities for spoofing metals futures markets.

In summary, while metals markets face challenges, caution is advised regarding unverified claims about specific banks. Regulatory reports do not provide detailed information at the institution level.

Shifting Dynamics in the Housing Market

Although mortgage rates are lower than they were last year, affordability remains the primary challenge for prospective homebuyers, especially first-time buyers. There has been an increase in listings, along with a greater willingness among sellers to negotiate. Market Adaptation.

On December 19, 2025, the Mortgage Bankers Association reported a 5% decline in mortgage applications, indicating that demand remains inconsistent despite modest rate decreases. Purchase activity has risen year-over-year, although refinancing remains highly sensitive to interest rate fluctuations.

For lenders and brokers, this means:

- High interest rates and home prices have led to fewer simple deals, lower profits, and more borrowers shopping around for the best offer.

- Industry leaders are focusing on home purchases, quicker closings, and special loan products, such as Non-QM loans, DSCR loans, bank statement loans, and asset-depletion loans, all of which are offered with fewer additional rules. Gustan Cho Associates and NEXA doing?

Internal performance data is not available, making it difficult to provide a clear answer. The approach of removing unnecessary rules, utilizing hard files, offering alternative methods for showing income, and streamlining processing appears to address today’s approval challenges and the surge in homes for sale.

There are concerns that the economy could weaken due to rising unemployment, reduced consumer spending, and tighter credit. Persistent inflation, stagnant wages, and higher prices for essential goods are widening the wealth gap.

The economy could slow down rapidly if interest rates rise quickly, more people lose their jobs, and loans become harder to obtain. On the other hand, strong spending, low unemployment rates, and higher wages are helping to lower the risk of a recession.

LIVE Sanctuary State News + Chicago

Chicago 2026 Budget Now Impacting Chicagoans

The new budget and added fees include:

- A 15-cent charge applies per plastic or paper bag if you do not bring your own.

- Grocery tax gone (city failed to keep it), saving families money.

- Property: The grocery tax has been eliminated, saving families money. Several executives have also departed from the Chicago area.

Chicago is still known around the world for its high taxes, high costs, and a challenging business climate, with big companies relocating and local business news covering the issue.

Chicago + Sanctuary City + Trump’s Legal Problems

Trump continues to face legal challenges related to Chicago and Illinois policies that limit intergovernmental cooperation with civil immigration detention.

Illinois provides that the TRUST Act generally bars local law enforcement from immigration enforcement and detention.

Another key development: reports indicate that Trump is withdrawing the National Guard from Chicago following legal disputes and court orders.

Auto Industry Update: High loan costs and sales pressure continue. Loan costs, especially for used cars, are making it increasingly difficult for people to afford a car. Experian’s State of the Automotive Finance Market (Q3 2025) reports average interest rates of about:

- Looking ahead to 2026, lower interest rates may make monthly car payments more affordable. High car and insurance costs are still expected to limit demand, so cars with significant discounts will be more popular, while buyers with smaller budgets may face a harder time. ited budgets.

Politics & Power: Who’s On The Way Out? Trump, Powell, Patel, Bondi

Fed Chair Jerome Powell: Will Trump fire him?

Trump has openly criticized Powell and said he would like to fire him. According to Reuters, Trump has even threatened to sue Powell and said he will announce a replacement “next month.”

However, Reuters reports that Trump has said he is not going to fire Powell, though he appears to be keeping that option open.

Most people are aware that Powell’s term ends in May 2026 and that selecting a new chair, which requires a nomination and Senate approval, takes time, according to most experts. Discussing the potential removal of the Federal Reserve Chair can significantly impact stock, bond, and currency markets. The Federal Reserve’s independence remains crucial for maintaining market stability.

FBI Director Kash Patel

Kash Patel is the current FBI Director as of February. He has served as FBI Director since February 20, 2025, according to the FBI’s official leadership page. The FBI wanted to remove him, but there is no confirmation that Patel has been removed.

U.S. Attorney General Pam Bondi

The U.S. Senate confirmed Pam Bondi as Attorney General in February 2025.

As of today, there have been no official announcements regarding the removal of Bondi or Patel from their positions. Current discussions remain speculative and part of ongoing political and media debate.

GCA Forums “What This Means” Summary (Jan 2, 2026)

- Stocks: Gains have been concentrated in the semiconductor and industrial sectors, with ongoing volatility. 2026 has started on a strong note.

- Rates: Elevated Treasury yields continue to limit affordability, though markets anticipate a shift toward more accommodative monetary policy.

- Mortgages: While a 6% rate does not solve everything, it does help a bit. The number of homes for sale and how willing sellers are to make deals remain the primary factors driving the market. These factors depend on interest rates, the number of homes available, and the extent of speculation, especially after prices dropped from the $80s to the $70s. Other changes include new budget rules and ongoing debates about sanctuary city policies.

https://www.youtube.com/watch?v=EHIxB31GJE8

-

This discussion was modified 2 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

GCA Forums News For Saturday, January 3rd, 2026

SPDR S&P 500 ETF Trust (SPY) Current Stock Market Data

- The SPDR S&P 500 ETF Trust is a key U.S. exchange-traded fund that provides investors with a view of how the American stock market is performing.

- SPY is trading at $683.17, about the same as its previous close.

- This shows a brief pause in an otherwise active market.

- SPY opened today at $685.67, with over 89 million shares traded so far, indicating strong investor activity.

- Today, SPY has traded between $686.82 and $679.86, indicating significant market activity.

- The last trade was recorded on Friday, January 2, at 7:15 p.m. CST, ending another busy session.

GCA Forums News: National Breaking News

January 3, 2026 (America/Chicago)

U.S. cash trading is closed on Saturdays. Level indicators show Friday’s market close, with updates reflecting post-close changes.

LIVE Stock Market Snapshot (Last update)

At the start of the year, investors feel both hopeful and cautious. The S&P 500 and Dow Jones rose, but the Nasdaq fell, as investors watch what the Federal Reserve will do next.

- S&P 500 proxy (SPY): 683.17

- Dow proxy (DIA): 483.63

- Nasdaq-100 proxy (QQQ): 613.12

On Friday, the market had both gains and losses. Treasury yields rose slightly as investors awaited further updates after the shutdown, which had made data collection more challenging.

LIVE Bond Market + Interest Rates

Treasuries (benchmark)

- 10-Year Treasury yield: ~4.19% (last reported)

- Bond ETF “tell”: TLT 87.03 (duration 20+ years) and IEF 96.08 (7-10 year)

Federal Reserve (policy rate)

- After cutting rates three times in 2025, the Federal Reserve is now closely monitoring inflation and the slowing job market.

- Analysts are paying close attention to the Fed’s meeting on January 27-28, 2026.

Mortgage-Backed Securities (rate pressure gauge)

- MBB (agency MBS ETF): 95.14

- When mortgage-backed securities decline, regular mortgage rates often remain the same or improve slightly, providing some relief to borrowers.

Current National Mortgage Rates

Rates have remained steady, fluctuating around the mid-6% range with only slight daily changes.

- According to Freddie Mac, 30-year fixed mortgage rates stood at 6.15% as of December 31, 2025.

- 30-year fixed mortgage rates from Mortgage News Daily are 6.20% as of January 2, 2026.

High mortgage rates remain a challenge for buyers, and advertised rates often fail to disclose important details. Fees, credit scores, property type, and other factors can raise real payments, especially for those barely qualifying. precious metals prices and the silver shockwave

Spot Prices Of Metals Today

- Gold: approximately.

- Silver has followed the US dollar, dropping from $80 to $73.

- Several factors are affecting prices, and most spot quote pages now list silver’s average price between $73 and $74.

There Are Usually Two Main Reasons Why Silver Prices Sometimes Reach $80 Or More:

- Retail ‘all-in’ pricing, which means the spot price plus extra costs, sometimes made regular product prices go above $80, even when the spot price was lower, or

- Such prices may also occur due to certain dealer prices, wider gaps between buy and sell prices, or short-term fluctuations when there are few trades.

What has affected silver prices lately?

- China’s new export rules and concerns about low supply have impacted the silver market, particularly at the start of the year.

- Silver’s price is closely tied to China’s exports and strong demand from industries such as solar, electric vehicles, and data centers.

What will silver be priced at in the future again? What may happen? What will probably happen (with bullish and bearish analysis).

- Over the next month or two, silver’s price could fluctuate significantly.

- If interest rates change or the Fed surprises the market, silver might fall to about $70

- If exports grow and borrowing becomes easier, prices could rise.

- But if rates rise, silver could get even cheaper.

Positions in silver (JP Morgan and major banks): how to explain it clearly

- There is an ongoing. People are still talking about short positions in silver.

- Here’s what the Commodity Futures Trading Commission (CFTC) does: it tracks how financial instruments are concentrated, but a short position does not always mean betting against silver.

- Banks often hedge their positions with other assets or manage trades for their clients.

- For most investors, it’s better to focus on liquidity, premiums, and how trades are settled, instead of blaming big players. and Silver Physical Prices Diverge

- Paper silver refers to financial products such as futures,

- ETFs, unallocated silver accounts, and synthetic silver.

- These are often harder to buy or sell quickly than real silver because you only have a claim, not the actual metal.

- Physical silver consists of tangible metal products, such as coins or bars, that can be stored directly by the owner or in secure vaults.

- These factors explain why the prices of paper and real silver can differ significantly.

- When retail supply is low, premiums can increase significantly, so physical silver may sell for more than the spot price.

- In practice, delivery problems, short deadlines, and limited stock can matter more than the quoted price.

- See headlines touting $80 silver, even though the spot price lingers at $73.

Mortgage And Housing Market Forecast

Current status of the market

- Home sales surged in November 2025, reaching a three-year high (National Association of Realtors).

- This increase is attributed to improved affordability and the introduction of new inventory.

- Although more homes are for sale, the U.S. still faces a significant housing shortage, so prices remain high.

- Some people wonder if another bubble, larger than the 2008 one, is coming.

- There are extensive comments.

- Many people have commented on this topic.

Here’s a balanced view: It occurred because banks issued risky loans, and the system ultimately collapsed. Today’s problems are mostly about high prices, with people stuck paying expensive mortgages with rates of 6% or more. This differs from the credit problems of 2008. Most experts believe that things will gradually improve, with more homes for sale and lower rates, rather than a sudden change. With fewer new loans, the mortgage industry is consolidating. Companies like Rocket are now focusing more on servicing and distribution. For 2026, a slow but steady recovery in new loans is expected, but a return to the boom of 2021 is unlikely.

News from the Midwest: Chicago, Illinois, And The Sanctuary City/State

Chicago and Illinois remain central to the national debate about sanctuary cities and federal immigration enforcement.

- Illinois has enacted additional immigration protections (including new avenues for constituents to sue federal agents for alleged rights violations) during a period of increased enforcement.

- In December, both federal enforcement and Chicago immigrant communities reported a new surge in activity in the area.

- Trump announced that National Guard troops are being withdrawn from Chicago and other cities after some legal defeats.

- The U.S. Supreme Court has established limits on deployment authority in Illinois, and the administration is adhering to these rules.

- Illinois has dropped its 1% grocery tax, but starting January 2026, some towns and cities will keep their own local versions in place.

The Road Ahead: Auto Industry Financing, and What 2026 Might Bring

Trends in the auto industry

The Financial Times reports that EV adoption in 2026 is expected to slow, with some predicting U.S. sales will drop even as sales grow in Europe and China.

Auto financing (what buyers are feeling)

- In November, Edmunds reported that the average APR for new car loans had fallen to approximately 6.6%, the lowest level since 2025.

- Gradual improvement is expected, but credit scores still matter a lot.

- Even so, buyers are under a lot of stress as prices and loan terms change.

- Inflation and economic uncertainty continue to make the market uneasy.

- Reuters reports that the November CPI is about 2.7% year-over-year, showing a slowdown from earlier levels.

- But data gaps from the shutdown have made the outlook less clear.

- In December, the Fed showed internal divisions. Inflation remains a concern, but the weaker job market is also becoming increasingly significant.

Politics: Trump, Powell, Kash Patel, Pam Bondi

Trump + the Fed (Powell)

- Powell’s term as Fed Chair ends in May 2026.

- Reports say Trump is pressuring him to choose a replacement, raising concerns about the Fed’s independence.

- Trump begins the year with low approval ratings in some polls, although fewer polls are conducted during the holidays.

- FBI Director Kash Patel: “On the way out?”