-

Discussions tagged with 'bank statement loans'

-

-

A bank statement loan, also known as a self-employed mortgage or a non-QM (Non-Qualified Mortgage) loan, is a type of mortgage loan designed for individuals or businesses who may have non-traditional income sources or difficulty documenting their income through traditional means, such as pay stubs and tax returns. These loans are typically used by self-employed individuals, freelancers, small business owners, and others who have variable or unconventional income streams.

The key characteristic of a bank statement loan is that it relies on bank statements, typically personal or business bank statements, to verify income. Instead of providing tax returns or W-2 forms, borrowers provide their bank statements, often for the past 12 to 24 months. Lenders will review these bank statements to assess the borrower’s income and determine their ability to repay the loan.

Here are some key points about bank statement loans:

-

Flexible income documentation: Bank statement loans are designed to accommodate borrowers with fluctuating income or those who have a significant portion of their income in cash. This flexibility can be helpful for self-employed individuals who may not have consistent pay stubs or tax returns.

-

Higher interest rates: Bank statement loans typically come with higher interest rates compared to traditional mortgage loans. This is because they are considered riskier for lenders due to the unconventional income verification method.

-

Larger down payment: Borrowers may be required to make a larger down payment compared to traditional mortgages to mitigate the lender’s risk.

-

Credit score requirements: While credit score requirements can vary by lender, borrowers may need a decent credit score to qualify for a bank statement loan.

-

Loan types: Bank statement loans can be used for various types of mortgages, including purchase loans, refinancing, and home equity lines of credit (HELOCs).

It’s essential to note that bank statement loans have become less common in recent years, as they were associated with the housing market crash of 2008. However, some lenders still offer these loans to qualified borrowers, and the specific terms and requirements can vary widely between lenders. If you’re considering a bank statement loan, it’s essential to shop around, compare offers, and carefully review the terms and conditions to ensure it’s the right option for your financial situation.

-

-

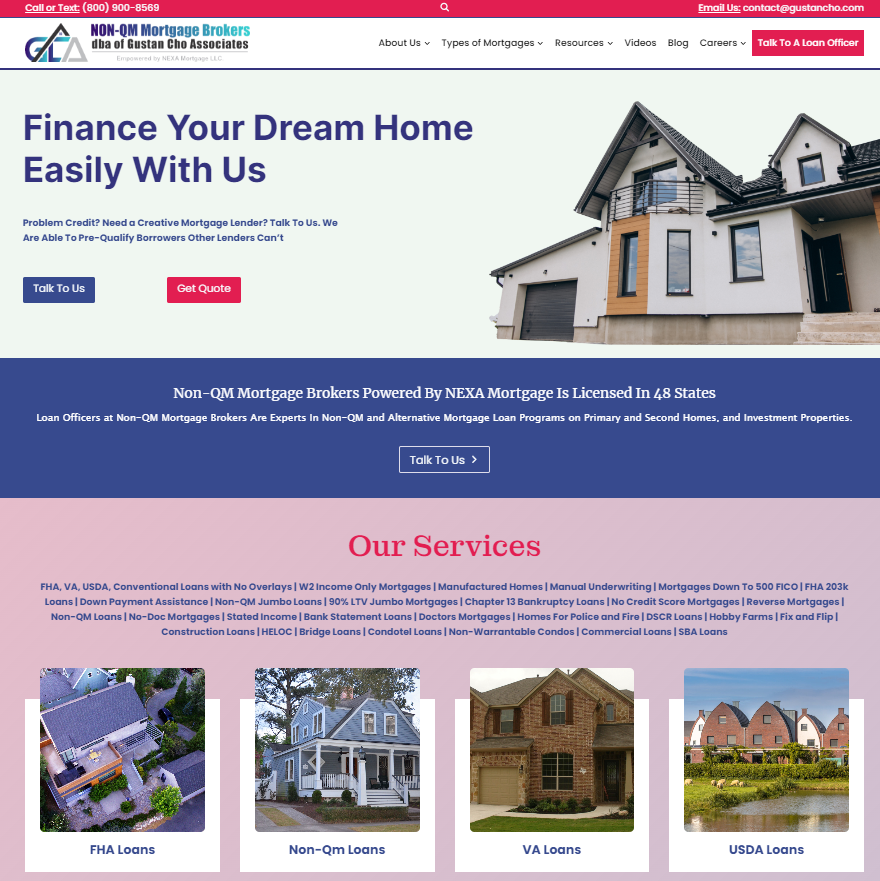

Non-QM Mortgage Brokers is a national mortgage broker and correspondent lender licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. Non-QM Mortgage Brokers is a wholly-owned subsidiary of Gustan Cho Associates, Inc. Gustan Cho Associates, also referred to as GCA Mortgage Group NMLS 2315275 is a dba of NEXA Mortgage, LLC NMLS 1660690, the nation’s largest mortgage broker and correspondent lender with nearly 3,000 licensed mortgage loan originators and equally number of support, operations, and third-party independent contractor service providers. Non-QM Mortgage Brokers specialize in providing mortgage options for individuals who may need to meet the standard lending criteria set by the Consumer Financial Protection Bureau (CFPB). Licensed mortgage loan originators at Non-QM Mortgage Brokers offer more flexible mortgage loans regarding income and credit requirements, which can benefit borrowers such as business owners, self-employed individuals, and gig workers.

Here are some key features of non-QM loans:

Flexible Income Documentation: Borrowers may use alternative methods, such as tax returns, bank statements, or 1099s, to demonstrate their ability to repay the loan.

Higher Debt Limits: Some non-QM loans allow for debt-to-income ratios over 50%, compared to the standard 43%.

No Waiting Period After Bankruptcy: Certain non-QM loans do not require a waiting period after bankruptcy or foreclosure, enabling quicker access to a mortgage.

Higher Down Payment Requirements: Non-QM loans often require a larger down payment, typically between 15% to 20%.

Higher Interest Rates: Due to the increased risk associated with these loans, non-QM mortgages usually come with higher interest rates.

If you’re considering a non-QM loan, it’s important to shop around and compare offers from different lenders to find the best terms for your situation. Remember that while non-QM loans can provide a path to homeownership for those who don’t qualify for traditional mortgages, they also come with higher costs and risks. It’s advisable to consult with a financial advisor or mortgage broker to understand all the implications before proceeding. Non-QM Mortgage Brokers is the nation’s largest mortgage broker of non-qualified mortgages. For more information, visit us at Non-QM Mortgage Brokers, Inc. at

https://www.non-qmmortgagebrokers.com/

non-qmmortgagebrokers.com

Home - Non-QM Mortgage Brokers

Finance Your Dream Home Easily With Us Problem Credit? Need a Creative Mortgage Lender? Talk To Us. We Are Able To finding The Perfect Mortgage For Your Dream Home Find A Lender With Us Fill out the form by click … Continue reading

-

Are there any two-to-four unit multifamily non-qm loans with 10% down payment? Bank Statement Loans, DSCR loans, asset-delpetion, or any other alternative lending programs?

-

What is the requirements for a borrower to be eligible for bank statement mortgage loans? Do you need to have a bona fide business to be eligible for bank statement loans? Can a sole proprietor without an LLC, corporation, or legal partnership be eligible for bank statement loans? Can W2 wage earners qualify for bank statement loans? Can 1099 wage earners qualify for bank statement loans? If I am a cash wage earner buying and selling cars without a legal form of business, can I qualify for bank statement loans? Does the lender need to see income tax returns? How many years in business do you need to be to qualify for bank statement loans. Do you need to be self-employed to be eligible for bank statemnent loans? Can you have a co-borrower that is a W2 wage earner on the main borrower is self-employed? How is qualified income calculated on bank statement loans on personal and business bank statements. Can you use both personal and business bank statements? Thank you in advance @Annie @Dale_Elenteny @john @John_Strange

-

Hello Everybody on GCA!

I wanted to create a discussion regarding all Questions & Concerns regarding all NON-QM products.

I am Sales Account Executive & I will be going through Generics & specifics on guidelines & also details to pay attention to with your loan process as Broker, Client, AE & Agent.

Will be also posting FAQ’s as well.

Please feel free to reply with any comments 🙂

I look Forward to hearing all your thoughts!

Thank you!

Cameron Leclair

Viewing 1 - 6 of 6 discussions