-

All Discussions

-

Manufactured Homes and Modular Homes are becoming very popular. What are the requirements for manufactured homes and modular homes to be eligible for FHA loans?

-

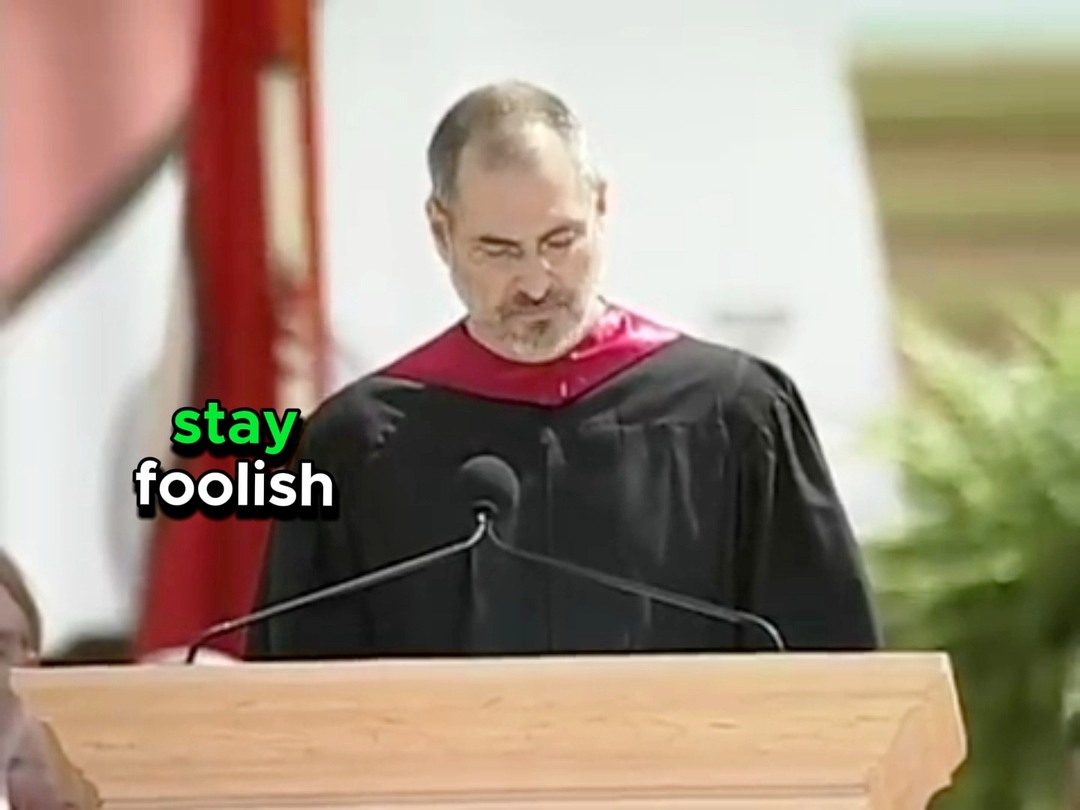

I was moved listening to Steve Jobs inspirational commencement speech. A must watch.

https://www.facebook.com/share/v/RvFx6CkNhH9uftHo/?mibextid=OTybqR

facebook.com

#SteveJobs’ timeless #CommencementSpeech at #StanfordUniversity is one of the best speeches to listen to - full of lessons. Which lessons resonate more...

-

Check out this manufactured home. Many manufactured homes are better than stick built hones

-

Polls show that former President Barack Obama was the worst President in the history of the United States. Barack Obama was not just the most incompetent President but a corrupt President where he overlooked corruption of his vice president Joe Biden and other members of his party.

wsj.com

Poll Ranks Obama 'Worst' President Since WWII

A new Quinnipiac University survey of 1,446 adults finds 33% of respondents ranked Barack Obama as the worst president since WWII. Tim Malloy, Quinnipiac University assistant director, joins the News Hub with Sara Murray. Photo: Getty Images.

-

Anyone know where I can buy this cute white tiny teacup Pomeranian puppy? I head the Russian Pomeranian puppy have the best bloodlines

-

-

Fulton County Georgia District Attorney Fani Willis is in hot water. What comes around goes around. Her mission in life was to get Trump indicted, arrested, tried, convicted, sentenced and incarcerated for a very long time. Now the ball has turned against the Fulton County Georgia District Attorney Fani Willis. Success is the best revenge. Seems whatever Fani Willis wished on Former President Donald Trump is backfiring where she may have committed crimes and may be a defendant in the coming weeks.

-

I have been with NEXA Mortgage LLC going on 2 years as of February 24th. NEXA MORTGAGE is hands down the best mortgage company I have worked for in the mortgage industry. No other company comes close. NEXA MORTGAGE LLC has the states, lowest rates, and the products. No other mortgage company comes close. Tge reason why NEXA Mortgage is the best of the best is because of its founder and CEO, CEO Mike Kortas. Since the day I started working with NEXA, CEO Mike Kortas has never told me what to do, how to do things, or flex his muscles to show he is the boss. A man who is humble, honest, transparent, and is always supportive and backe you up on anything you want to do to further your career. A true leader who is loved and respected by all and gives you the key to succeed. A man who if you are loyal to him with give you ten fold back. CEO Mike is available seven days a week and have never not returned a call or text when you try to get a hold of him. We are all proud of CEO Mike Kortas for him being him. A true legend and Godsend.

https://www.facebook.com/share/v/2fqq6JHamHXgvh8a/?mibextid=21zICX

facebook.com

From Mike Kortas, CEO of NEXA Mortgage: "Staying closely connected with our Loan Officers is key to our success. That's why I'm personally ensuring we...

-

-

Many people wonder how manufactured homes are built. Many manufactured homes are better, sturdier, and cheaper than stick built homes. Look at the video attatched about how manufactured homes are at built Solitaire Homes.

-

I understand Art appraisers examine and evaluate paintings, sculptures and antiques to determine the authenticity and the market value of the subject art they appraising by identifying the creators and the quality of the art. Art appraisers thoroughly inspect, evaluate, analyze, and examine the artwork’s color values, brushstrokes, lines, engravings, and other factors in order to identify the artist and date of creation. But can anyone tell me what does an art appraiser do to come up with what the art is worth and is art appraisal a uniform set standard or is it arbitrary. How do you determine what a piece of painting is worth. What determines such high price for art.

-

Here’s the second day of me working with Chase my one year old German Shepherd puppy. Walked around the pond three times around. Teaching Chase how to walk on a leash. He’s kinda of not domesticated and needs a lot of work.

I am first going to leash training Chase then I will training him off leash train him. Tge sit, down, stay, and heel.

-

If you are detained by a police officer, DO NOT ARGUE and do as the cop says whether you agree with the officer or not. Here’s a typical case where you are guaranteed a death sentence by a cop

https://www.facebook.com/share/v/nTsgu1h8pitAanoy/?mibextid=21zICX&startTimeMs=81635

facebook.com

Man Gets Shot After Opening Fire On Deputies At Florida Gas Station.

-

Fani Willis is the Fulton County Georgia District Attorney trying Former President Donald Trump for Fraud of the 2020 Presidential election. However, Fani Willis is the one committing fraud via kickbacks from trips of her third party independent prosecutor

-

Here is a video clip of what not to do when you get stopped by a police officer

https://www.facebook.com/share/v/TmDkUFC1XGwC9S78/?mibextid=21zICX&startTimeMs=29509

facebook.com

What NOT To Do During a Traffic Stop

-

How many states have NMLS Branch Office to Residence requirement to get licensed as a mortgage loan originator.

-

Can someone explain the difference between a mortgage banker and correspondent mortgage lender?

-

The mortgage industry is hurting due to the high surging mortgage rates, low housing inventory, skyrocketing home prices, and tough competition among mortgage lenders. This thread is geared towards experienced veteran mortgage loan officers and managers. Which mortgage company is best to launch your career as a mortgage loan officer? Mortgage banker, mortgage broker, FDIC bank, credit union, buying a mortgage franchise or independent loan officer. Thank you in advance. I just ran into this informative blog from GCA Mortgage Group and want to thank GCA Mortgage Group sharing this informative blog on Choosing The Right Mortgage Company To Work as a loan officer.

https://gustancho.com/choosing-the-right-mortgage-company/

gustancho.com

Choosing The Right Mortgage Company For Loan Officers

Choosing The Right Mortgage Company For Loan Officers is so very important. There are now hiring experienced remote loan officers nationwide.

-

Many loan officers are often curious about working for an FDIC Bank as a loan officer versus a state licensed mortgage company

-

Is buying a house near an apartment complex a bad investment? Many homebuyers think buying a house will affect their resale value. Here is an article about buying a house near an apartment community.

https://gustancho.com/buying-house-near-apartment-community/

gustancho.com

Buying House Near Apartment Community or Commercial Areas

Buying house near apartment community or Backing Into businesses may be cheaper but expect to have a harder time selling it at lower value.

-

Does anyone do manufactured new construction home loans where they finance the acquisition of the land and the purchase price of the modular or manufacturer home from the manufacturer. Is is FHA, VA, USDA, or conventional loans? Or is it non-QM manufactured home loans? Alot of these manufacturer homes are better than stick built homes.

-

-

Here is funny military 🪖 jokes videos

https://www.facebook.com/share/v/bw1JVKwyWBYtBgNR/?mibextid=21zICX&startTimeMs=161442

facebook.com

Happy Veterans Day! Here's a compilation of some of my favorite military stories

-

Florida homebuyers and homeowners have a major crisis when it comes to buying homeowners insurance. Many giant homeowners insurance carriers have moved out of the state and no longer do business in Florida.

-

-

Can you qualify for VA loans with bad credit? Do you have to pay outstanding collections and charge-off accounts to qualify for VA loans?

-

Mortgage lenders require credit tradelines. What does credit tradelines mean when asked from a mortgage lender?

-

What does manual underwriting mean on VA Loans? What are the VA manual underwriting guidelines? What is the difference between VA approve/eligible and VA manual underwriting? When is manual underwriting required on VA loans? Do all mortgage lenders do manual underwriting on VA loans?

-

What is the credit score guidelines on VA loans. What is it that Veterans United says their minimum credit score requirements is 620 and CrossCountry Mortgage says their credit score requirements is 580? Yet other lenders want a 640 credit score on VA loans. I read a blog on GCA MORTGAGE GROUP And it says that Gustan Cho Associates can do VA loans with credit scores down to 500 FICO. SO what is the skinny and the minimum credit score for VA LOANS?

-

I sent a money order from the United States Post Office and my friend lost it. The recipient of the money order threw it out along with other junk mail accidently. Does anyone know the procedure of getting the U.S. POST OFFICE to re-issue the money order?