Sub Forums

-

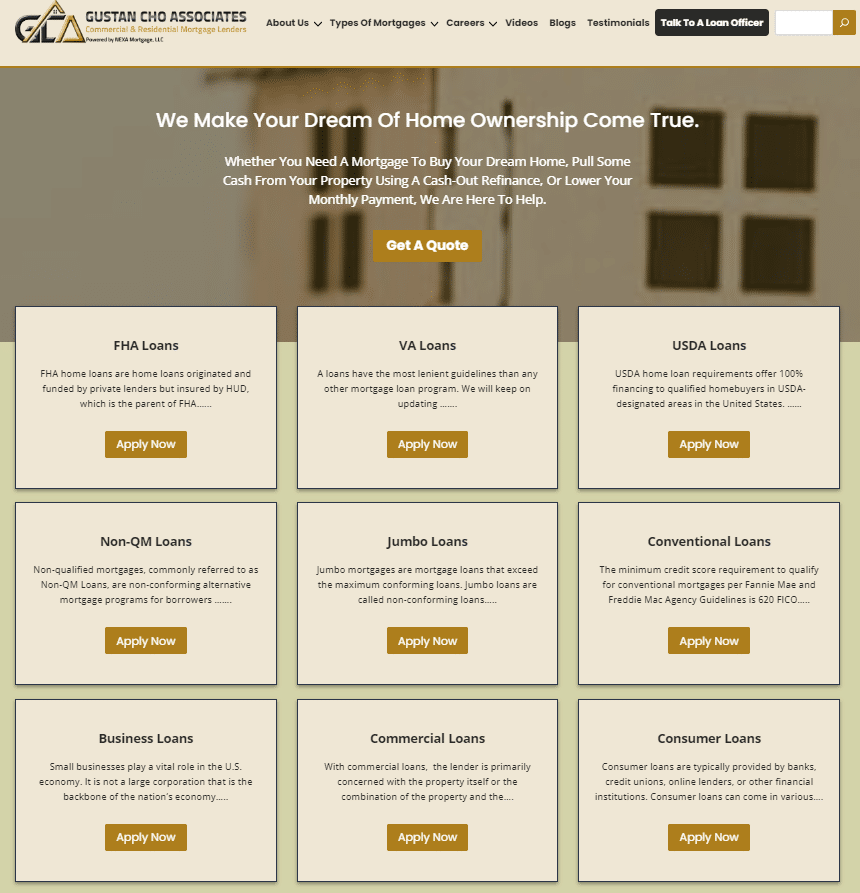

Welcome to the Sub-Forums of Fix and Flip Loans at GCA FORUMS, powered by Gustan Cho Associates. Fix…

-

High-end homebuyers can now qualify for non-QM jumbo loans with credit scores down to 550 FICO, and no…

-

FHA loans are the most popular mortgage loan program for first-time homebuyers, borrowers with high debt-to-income ratios, buyers…

-

In this FORUM on VA Loans, we will cover everything about VA loans: COE, Credit Score requirements, debt-to-income…

-

Conventional loans are mortgage loans not backed by a government agency, such as HUD, VA, or USDA. Conventional…

-

Welcome to the Non-QM loans Sub-FORUM of Gustan Cho Associates. Non-QM loans are back. No-doc mortgages are back.…

-

Welcome to the Sub-Forum on USDA Loans. In this Sub-Forum, we will cover anything USDA loans. From the…

-

All Discussions

-

Refinancing your mortgage can be confusing. It’s not always easy to decide if you should refinance or keep your current loan. You need to do some research, get advice, and compare your options. The right time to refinance depends on your situation. Before you decide, make sure to – Get the expert advice.

- Look at your current financial situation.

- Use a refinance calculator to compare options.

- Understand the pros and cons of refinancing.

- Learn the steps and fees involved.

When Do Most Homeowners Decide to Refinance?

Most people refinance to get a lower interest rate with another lender. Other reasons include when their fixed-rate term is ending or every 3 to 4 years, even with a variable rate. By then, their loan balance might be lower and property value higher, making it a good time to look for better rates or flexible options. Some refinance if their lender won’t release equity for buying an investment property or for debt consolidation to combine debts into a home loan at a lower interest rate.

How to Know if You Are Eligible to Refinance

- Owe less than 80% of property value: Your mortgage should be less than 80% of your property’s value to avoid paying Lenders’ Mortgage Insurance (LMI).

- Variable rate: You can refinance every 6 months, but each application will add an inquiry to your credit file.

- Refinance from low doc to full doc: If you had a low doc mortgage but now have enough income evidence, you might qualify for a standard home loan with a better interest rate.

- Refinance out of a bad credit loan: If your Loan-to-Value Ratio (LVR) is 80% or less and your credit has improved, you can refinance a bad credit home loan back to a major lender.

Refinance Your Home Loan in Easy Steps

- Understand the Situation: Refinancing can be challenging. Check out our refinance guide to help you get closer to paying off your loan faster and for less money.

- Know Your Savings: Contact our mortgage experts to see how much money and time you could save by refinancing.

- Apply for a Refinance: Schedule an appointment with a Home Loan Experts mortgage broker by calling 1300 GET LOAN or book a consultation. We’ll help you choose the best loan and handle all the details for you.

How Frequently Should I Refinance My Home Loan?

It depends on your financial situation and goals. If it’s your family home and you’re not planning to move, consider refinancing at the end of your fixed term. If you have a variable rate, you can refinance anytime. This is useful for investment properties when you want to access equity to grow your portfolio.

Does It Make Sense to Refinance During a Fixed Term?

Yes, you can refinance during your fixed term, but you might have to pay break costs. If you can recoup these costs within two years, it might be worth it. Use the refinancing calculator to compare costs and savings. Talking with an experienced mortgage broker can help you fully assess your financial situation.

Alternatives to Refinancing

Refinancing can be costly and time-consuming. Here are some alternatives:

- Negotiate with Your Bank: Call your lender to see if you can get a lower interest rate or fix your repayments.

- Extend Your Loan Term: Consider extending your loan term to reduce repayments.

- Switch to Interest-Only Repayments: This can temporarily reduce your repayments, freeing up cash flow.

Keep in mind these should be considered short-term solutions as they can make your mortgage more expensive in the long run.

Not Sure When is the Right Time to Refinance?

Our refinance checklist will help you gather all necessary documents. We can assist you in running the numbers to see if refinancing makes sense for you. Call us at 1300 GET LOAN or book a consultation call to speak with one of our home loan refinance specialists.

Frequently Asked Refinancing Questions

When should I consider refinancing?

- When interest rates are falling

- Your home’s market value has increased

- You want to renovate or invest

What documents are required?

- Recent pay slips

- Tax assessment notice

- Pay confirmation letter

- ID documents (driver’s license, passport)

- Financial and credit documents

How long does the process take? Usually, it takes between two and four weeks.

Does refinancing affect the credit rating? Yes, refinancing is seen as a credit application and can lower your credit score if done often.

What are the costs to refinance? You might need to pay break fees, application fees, and closing costs.

How frequently can I refinance? There’s no rule, but some lenders might want you to wait a few months after closing on a loan or after refinancing.

Is refinancing and topping up your loan the same thing? Refinancing means switching to a new loan, while a loan top-up means increasing your existing loan.

Who should I refinance with? Different lenders offer different options based on your situation. Our mortgage experts can help you find the best option.

-

Who Pays for Lenders’ Mortgage Insurance?

In Australia, if you’re buying a house with a small deposit (less than 20% of the home’s price), you might need Lenders Mortgage Insurance (LMI). This insurance protects the lender if you can’t make your mortgage payments and they have to sell the house for less than what you owe. Usually, it’s the homebuyer who pays for it, not the bank. Think of it as an extra cost to help the lender feel secure about giving you the loan also feel free to reach out.

How is LMI Calculated?

LMI is primarily calculated based on the loan-to-value ratio (LVR), which is how much of the house’s value you’re borrowing. The higher the LVR, the more expensive the insurance. Other factors, like the size of your loan, also play a role. Typically, you can pay LMI as a one-time fee upfront or include it in your loan repayments. Different lenders have their own methods for calculating it, but they all consider similar factors like the amount you’re borrowing and the property’s value.

Can LMI Be Avoided?

Yes, you can avoid paying LMI by saving up a deposit of 20% or more of the home’s price. This makes you less risky to lenders. If saving that much isn’t possible, you might still avoid or reduce LMI by:

- Saving more to borrow less.

- Getting a guarantor, like a family member, to back your loan.

- Finding lenders offering no LMI deals for certain professions or conditions.

- Negotiating with your lender if you have strong finances.

Is LMI Transferable Between Loans or Properties?

No, LMI isn’t transferable. If you switch loans or buy a new property, you’ll likely have to pay LMI again if your deposit is less than 20% of the new property’s price. Each new loan application requires an evaluation of your borrowing amount and property value to determine if LMI is necessary.

What Happens to LMI If I Refinance?

When you refinance your mortgage in Australia, the LMI you paid on your original loan usually doesn’t carry over. If your new loan is more than 80% of your property’s value, you might need to pay LMI again. Each new loan application involves a fresh assessment of your borrowing needs and property value.

Does LMI Protect Me If I Can’t Make My Loan Payments?

No, LMI does not protect you if you can’t make your loan payments. It protects the lender. If you default on your mortgage and the lender sells your property for less than what you owe, LMI covers their losses. It doesn’t provide any financial help to you if you’re struggling with payments.

How Can I Reduce the Cost of LMI?

You can reduce the cost of LMI by:

- Saving more upfront to borrow less and lower the LMI cost.

- Shopping around for lenders with cheaper LMI rates.

- Getting a guarantor to avoid LMI altogether.

- Negotiating with your lender if you have a strong financial profile.

- Looking for special deals or discounts for certain professions or areas.

Are There Any Tax Implications with LMI?

For most people, there aren’t any direct tax implications with LMI. You usually can’t claim it on your taxes like mortgage interest. However, if LMI helps you get a bigger loan, you might pay more mortgage interest, which is tax-deductible for investment properties. If the property is used to earn income, the LMI cost might be deductible. It’s best to consult a tax professional for personalized advice.

How Do I Know If I’m Getting a Fair LMI Rate?

To ensure you’re getting a fair LMI rate:

- Shop around and compare rates from different lenders.

- Understand how your loan amount, deposit, and property value affect the rate.

- Compare multiple quotes to find the best deal.

- Consider the overall mortgage package, including interest rates and fees.

- Seek advice from a mortgage broker or financial advisor.

Can I Pay LMI Upfront or Does It Have to Be Capitalized on the Loan?

You have two options:

- Pay the full LMI cost upfront to reduce overall interest.

- Include the LMI cost in your loan amount and pay it off over time with your regular repayments.

What Factors Affect the Cost of LMI Apart from the Loan-to-Value Ratio (LVR)?

Other factors that affect LMI cost include:

- The loan amount: higher loan amounts usually mean higher LMI premiums.

- Property type: certain property types may be considered riskier.

- Your credit history: a good credit history might result in lower LMI rates.

- Loan term: longer loan terms can increase LMI costs.

- The lender’s LMI provider: different providers have varying rates.

Is There a Difference in LMI Rates Between Owner-Occupied Homes and Investment Properties?

Yes, LMI rates for investment properties are generally higher than for owner-occupied homes. Investment properties are seen as riskier because of potential rental income fluctuations and the borrower’s financial stability. This difference in rates should be considered when calculating the overall cost of purchasing an investment property.

Can LMI Be Refunded If I Pay Off My Mortgage Early?

No, in Australia, LMI is typically non-refundable. Once you’ve paid it, you can’t get a refund, even if you pay off your mortgage early.

What Are the Alternatives to Paying LMI for Low-Deposit Borrowers?

Instead of paying LMI, consider:

- A family guarantee, where a family member uses their home’s equity to secure your loan.

- Government schemes like the First Home Loan Deposit Scheme (FHLDS) for first-time buyers.

- Special offers from lenders that waive LMI if you meet certain conditions.

In a Nutshell

Understanding Lenders Mortgage Insurance (LMI) in Australia is essential for homebuyers. Knowing who pays for it, how it’s calculated, and ways to reduce costs can help you make smarter choices when getting a mortgage. By exploring these FAQs, you’ll feel more confident managing LMI and finding the best deal for your situation.

-

5 Pillars of a Home Loan

Become the qualified Buyer that Lenders are looking for!

Understanding what components make up a home loan will give you the advantage of being able to take the right steps towards homeownership.

I’ve been in the home lending industry since Fall of 2011. In that time, I’ve had to go through the highs and lows of understanding the home lending process. In my experience, I’ve had numerous conversations with clients that simply did not understand the home lending process. As I gained more experience, I coined the “5 Pillars of a Home Loan”. When I started explaining the lending process in this fashion during my initial consultation calls, my clients were able to quickly grasp the concept of the risk assessment of lending. This led to a boost in confidence in my clients which gave them the courage to take action. In writing this post, I’m hoping that I can go from a limited one-on-one conversation and expand my reach to communicate this concept to a larger audience to help more people find their confidence to realize that the process of homeownership doesn’t need to be this mysterious or unattainable process. It’s open to whomever is willing to obtain it.

The 5 Pillars are:

- Credit

- Repayment Ability

- Funds Needed for Closing

- Subject Property

- Loan Program

As a Borrower, before you even get started the first three pillars are the most important actionable categories you will be preparing for BEFORE you try and get pre-approved or go under contract for purchase.

Credit:

Of course this is an obvious point. But the key to understand here is this concept: “Before the lender extends you more credit, they must first determine your creditworthiness by evaluating your current credit profile”. Think about it this way: If you have a friend, and they ask you to borrow $200.00, but that has a history of never paying people back on-time/ever. If you had it to lend, would you do it? If we’re honest with ourselves, we would say no; of course a strong emotional attachment would say otherwise, but even in that statement we must deal with the reality that lenders don’t have a strong emotional attachment to their customers, outside of paying their bills on-time. This isn’t a charity, as they would say. If you want to know how to go about working on your credit, I would suggest going to https://www.myfico.com/credit-education. There you will get a TON of free information on how credit REALLY works. If you are in a position where you need credit repair, then my good friends at Kredit Kleanse have a very good track record of helping people Kleanse their credit.

Repayment Ability:

Think “personal cash-flow”. The technical lending term is debt-to-income ratio “DTI”. This is what mortgage licenses were originally created to address: to ensure lending professionals are taking the appropriate action of making sure the borrower can actually afford the home loan so that we don’t have the 2008 housing crisis all over again. The equation I use is (credit debts + court debts + proposed subject property housing expense) / (Total calculated gross income). The numbers used will vary program to program, but overall this is the basis in which all DTI is calculated. There are two distinct DTIs:

- “Housing DTI” which is ONLY: (proposed subject property housing expense) / (Total calculated gross income). A ratio of 30% is considered “healthy”

- “Total DTI” This is the complete equation: (credit debts + court debts + proposed subject property housing expense) / (Total calculated gross income). A healthy ratio is 45%.

- Key takeaway. Knowing EXACTLY what your DTI is will vary based on (1) the market in terms of what the fed-rates are, (2) which lender you are getting approved through since lenders decide their own margins and loan-pricing-levels which will dictate the final interest rate used for your housing payment, (3) the selected loan program, due to the requirements for things like debt-calculations and housing expenses like PMI, and (4) The subject property housing expenses like property taxes, homeowners insurance premiums, and community dues like HOAs.

Funds:

There’s 4 REALISTIC categories that you must consider when trying to purchase a home with a loan:

- Down-payment: People like to lump this into closing costs, but by true definition that’s simply not the case. Down-payment is a “MIR” minimum investment requirement, meaning that it’s not truly a cost (a cost is something you “spend” to acquire something). In the sense of a down-payment you are converting your liquid-cash into a hard-asset which is home equity. With this clarity, you can expect to get your money back at a later date whether that’s through selling or cash-out refinancing your home. You can put down as little as 3% of the purchase price, and there are loan programs available that don’t require a down-payment like with VA loans, USDA loans, and down-payment assistance loan programs.

- Transactional Costs: This includes appraisal costs, title costs, government fees, inspections, lender costs, etc. Typically this amount ranges from 3-6% of the purchase price and greatly depends on what market your home is in along with the final loan structuring. There are ways to get most of these costs covered. It’s best to consult with a mortgage professional to know what your options are.

- Reserves: This is not always required for a home loan, but if it does come up during your approval process, it’s good to know just what the heck lenders are talking about. In short what this means is: “after all the necessary transactional funds”, how many monthly total housing expense payments do you have remaining in your account(s). Example: If your proposed total housing payment is $3,865/mth, and you have $52,862 left in your account(s), then you have 13-months of reserves remaining in your account.

- After transaction expenses: This last point has no bearing on whether you will get approved for a home loan or not, but it is something that needs to be addressed, as some people are so excited about becoming homeowners that they forget non-transactional costs like: moving expense, deposits for utilities, time away from work for relocating, housewarming parties etc. These costs are completely unknown and not factored into your home buying process, and falls in the category of “living expenses”.

Subject Property:

Of course buying the right home for you and your family is most important to you, but when it comes to finalizing your loan approval to get to the closing table, these are the factors that the lenders care about:

- Loan-to-Value “LTV”. Without losing you with all the LTVs that there really is, in this context is do you have the minimum required equity requirement in the home according to the loan program. In ALL cases even if you have 50% equity in the home, if the loan program requires a MIR down-payment then you would have to bring those eligible funds to the closing table.

- Property Condition: Is the property habitable? Is the property safe in terms of potential obstacles that could cause injury to you or another person. In the appraisal report, there’s a property condition report that outlines these conditions. Different programs have different program requirements, so you may hear Sellers say I only want to sell to a person that has a conventional home loan knowing that conventional loan programs are the most lenient when it comes to property conditions required for final loan approval.

Loan Program:

This last pillar is more along the lines of the first 4 pillars being weighed against. In other words does your credit, DTI, Funds needed for closing, and subject property fit within the guidelines of the loan program. As you change loan programs the whole lending process changes, and even “meaningless” changes can affect your ability to close on the home. Working with the right company and professional will make all the difference in getting that home you want. Some lenders ONLY work VA loans, or don’t do USDA loans, or have “lender overlays”. A “lender overlay” is an additional guideline the lender places on-up of the actual loan program guideline. Having a consultation call with a lending professional to determine what they are capable of can save you a lot of time and stress.

A couple of my deals:

There’s one deal that comes to mind, and for the sake of privacy I will refer to the client as Gina. Gina was looking to purchase a home, but everything she went to a lender, she always got denied, but never received a clear explanation as to why. Eventually she got connected with me and we began to address each loan pillar. In doing so, it was uncovered that the funds that she was using were considered unsecured loan funds which is a no go for ANY loan program. Upon further inspection, I noticed that the funds were deposited into her account in about 45-days, with this knowledge I was able to leverage the proper interpretation of the lending guidelines. In short, we held closing another 2 weeks that way the deposited unsecured funds would be seasoned for 60-days and now would be considered eligible funds for closing. If the previous lending professional knew this they would have gotten the deal done.

Another deal I did, and again for the sake of privacy I will refer to the client as Ben. Ben had found a home that he wanted to buy, however when the appraisal report came back, there were some property conditions that neither the Seller or Buying was willing to fix, because it totaled over $40,000.00. Instead of denying the loan, we changed the loan from FHA to FHA 203k which is a renovation purchase loan, and was able to finance the cost of the repairs into the loan. A lot of lenders don’t even offer this special loan program let alone know how to actually do it late in the lending process.

What I always tell people:

Most people are just too afraid to buy a home, because it seems like such a lot of steps to get into a home. And to those people I would say you’re ABSOLUTELY correct (not what you wanted to hear huh?). The truth of the matter is that the home buying process is difficult, but the great thing about it is that you don’t need to know everything, you just have to know the right person that does know.

Another misconception is that you have to have perfect credit to buy a home, and that’s not true! I’ve gotten a lot of people with sub-600 credit scores into a home.

Lastly, getting with an experienced and knowledgeable professional early could make a huge difference. For instance there was a wonderful lady I helped become a homeowner, but it was a whole 2 years before she was ready! The key was that she had her free consultation call early, when she didn’t know which way was up. I was able to give her an action = plan that actually works, and she took my advice and implemented everything I told her. During those two years, she had challenges and unexpected financial situations that came up that ended up delaying her progress. However, she preserved and never gave into the setbacks, and now she’s a proud homeowner. You could be next!

My take on it:

Through my 12+ years of experience, I’ve seen a lot of different financial situations, and the overarching commonality is that there’s always a creative way to get anyone into a home. It could be on your part in the form of financial changes, discipline, knowledge, etc.; or the experience, knowledge, creativity, etc. of the loading professional. Is this a difficult process, yes! But it doesn’t have to be hard! ANYONE can own a home, and if you have made it this far, then that means you have the ability to become a homeowner.

When looking to use ANY financial loan instrument, the first 3 pillars are what you should be constantly working on. Focus on becoming a well qualified borrower and lenders will love lending you money because your behaviors display financial & credit worthiness. Ask yourself: “What if I am considered financial & credit worthy to lenders?” & “How do I go about becoming this person?”. Swallowing the red pill and putting in the work, will open doors that you could never have had imagined.

There was a client of mine a couple years ago that implemented the strategies I gave her. I’ll refer to her as Susie, and this is her story: Susie reached out to me about buying her first home. She had good intentions: more space for her kids, tired of paying her landlord, building towards generational wealth, and a lot of other great points. She imagined “what if” I could make this work. When she reached out to me in the Fall of 2021 and had her free home loan consultation we were able to come to the conclusion that she was not financially ready to purchase a home. Instead of allowing the reality of her situation to destroy her dreams, she asked “how do I get ready”. At this point I had to get her to willingly swallow the red pill, so I asked if she was ready for me to be brutally honest? She said, “Yes, please! I really want to do this!”. Then I said to her, “This is REALLY what the banks are saying behind closed doors, you simply don’t make enough money for the home you want. You got to make more money!”. She replied, “OK, then that’s what I’m going to do”. Now, in my experience, normally people don’t actually do what it takes to live the dreams they have. A few months went by, and she reached out to me the following Spring. When we reconnected over the phone, she said in a very confident tone, “OK , I’m ready now!”. We restarted her pre-approval process and she provided her bank statements. When I reviewed them I thought she was going to jail for criminal activities! Susie had saved over $200k, mind you her previous qualifying income was $50,000.00/year. So, how on earth did you get that much money in roughly 6-months? Come to find out, she became a tax preparer and made more money in 6-months than she’s made in the last 4+ years! I still had to do some creative loan structuring due to the loan guidelines on employment history, but she’s a homeowner now!

Final Thoughts:

By understanding the 5 Pillars of the home loan, you can come up with a good plan to work towards homeownership. If you are trying to get prepared to buy a home, then focus on the first three pillars to become a well qualified borrower. They are:

- Credit

- Repayment Ability

- Funds needed for closing

- Subject Property

- Loan Program

The time between when you have a good idea and the moment you act on that idea is the #1. #2 is executing a plan consistently over time in spite of the hardships that may arise. The first step is getting the right information from an experienced & knowledgeable professional. If you made it this far then you can become a homeowner.

-

This discussion was modified 1 year, 5 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 5 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 12 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 12 months ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 4 months, 2 weeks ago by

Sapna Sharma.

Sapna Sharma.

myfico.com

Credit Education Resources to Improve Your Score | myFICO

Credit Education Resources to Improve Your Score | myFICO

-

-

-

Debt-to-income ratios is one of the biggest hurdles in getting approved for a mortgage loan. Not all income counts when it comes to mortgage qualification. Verified and qualified income is the only income that can be used for debt-to-income ratio qualificatin. The debt-to-income ratio (DTI) is a key financial metric used by lenders to assess a borrower’s ability to manage monthly payments and repay debts. It is particularly important in the context of mortgage loans. The debt-to-income ratio is calculated by dividing the borrower’s total monthly debt payments by their gross monthly income and expressing the result as a percentage.

The formula for calculating the debt-to-income ratio is as follows:

Debt-to-Income Ratio=(Gross Monthly IncomeTotal Monthly Debt Payments)×100

The total monthly debt payments typically include housing-related expenses (such as mortgage payments, property taxes, and homeowners insurance) as well as other debts like car loans, student loans, and credit card payments.

For mortgage loans, lenders often look at two types of debt-to-income ratios:

Front-end ratio (or housing ratio): This ratio includes only housing-related expenses (mortgage, property taxes, homeowners insurance, and sometimes homeowners association fees). Lenders usually prefer this ratio to be below a certain threshold, often around 28% to 31%.

Back-end ratio (or total debt ratio): This ratio includes all monthly debt obligations, not just housing-related expenses. This includes housing expenses along with other debts. Lenders typically have a maximum allowable back-end ratio, often around 36% to 43%, although this can vary.

Different lenders may have slightly different criteria for acceptable debt-to-income ratios, and these ratios can also depend on the type of mortgage and the borrower’s overall financial profile. It’s essential for borrowers to be aware of their debt-to-income ratio and work to keep it within the acceptable range to improve their chances of qualifying for a mortgage loan at favorable terms.

-

This discussion was modified 1 year, 1 month ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 year, 1 month ago by

-

-

Many borrowers think that your are set home free after a conditional mortgage loan approval. This is normally the case but not always so. I have seen many mortgage loan denials after a conditional loan approval. What a conditional loan approval means is when the mortgage underwriter feels the borrower qualifies for a mortgage loan but need to comply with the list of conditions the mortgage underwriter states. Once a mortgage processor submits all conditions, the underwriter can come back with additional conditions on the of the conditions of the first conditional loan approval. This is the stage of the mortgage process where a mortgage underwriter can drive everyone crazy including the loan officer. I have seen mortgage underwriters condition the dumbest things over and over again. It may be that the underwriter had a bad day. Here is a blog that was updated about the mortgage process after the conditional loan approval:

https://gustancho.com/mortgage-process-after-the-conditional-approval/

gustancho.com

Mortgage Process After The Conditional Approval

The mortgage process after the conditional approval is clearing conditions for the CTC, which means the lender is ready to fund the loan.

-

How does the 3-2-1 mortgage rate buydown work? Can you get seller concessions plus credit for 3-2-1 buydown on conventional loans and FHA loans?

-

-

What is the Loan Estimate or LE. What information is the categories and data in the LOAN ESTIMATE?

-

-

-

Gustan Cho Associates (NMLS 2315275) and its affiliates is a dba of NEXA Mortgage (1660690), the largest mortgage brokerage in the nation. follow Fannie Mae’s DU AUS and LP AUS. They are renowned for having little to no lender overlays. Mortgage loan customers dealing with judgments, open collections, foreclosures, tax liens, overdrafts, and late payments have all benefited from my assistance. People with credit scores below 600 FICO can receive assistance from the Gustan Cho Team at Gustan Cho Associates, and the lowest credit score borrower I can assist is one with a 500 FICO. 10% of the purchase price is needed from people with credit scores between 500 and 580. A 3.5% down payment is needed for credit scores higher than 580 FICO. I work with consumers whose mortgage loans have been rejected by other lenders because of their overlays for a significant portion of my business. Suppose a borrower signs their 1003 mortgage application and provides me with the necessary documentation.

In that case, I can often give them an official mortgage approval in less than a day. The Gustan Cho Team at Gustan Cho Associates typically closes my loans in three weeks or less. Under the direction and guidance of Sapna Sharma, Gustan Cho Associates’ Chief Technical & Marketing Officer, the company’s marketing division maintains partnerships with real estate experts. Love. Gustan Cho Associates is accessible seven days a week. I get in touch with realtors all the time. To connect with customers, realtors, mortgage brokers/bankers, insurance agents, appraisers, attorneys, and other professionals, please visit me at http://www.gustancho.com and join our forum at http://www.lendingnetwork.org. Our in-house IT department will jointly promote open homes and recommend certain realtors to pre-approved clients looking to buy or sell a property as part of NEXA Mortgage’s collaboration program with realtors. Get in touch with me for further information. Gustan Cho Associates is a reputable mortgage company that offers various services, including mortgage loans for various scenarios, debt consolidation and credit restoration, and personalized support throughout the loan application process. One of the main reasons to choose Gustan Cho Associates is their reasonable prices, quick and efficient loan approval process, and commitment to customer satisfaction and support. Regarding your mortgage requirements, it is recommended that you consider Gustan Cho Associates. They offer debt reduction and credit repair assistance, personalized loan application assistance, and reasonable loan rates. Their commitment to customer satisfaction and support makes them a reliable mortgage lender, and they provide contact information for further assistance.

I. Overview of Gustan Cho Associates in Brief: Their Services Explained Selecting a trustworthy mortgage provider is crucial.

II.Gustan Cho Associates’s past customer testimonies and reviews; the company’s history and establishment; the team’s expertise and experience

III. Gustan Cho Associates’ Services are available for FHA, VA, conventional, and other types of mortgage loans. They also provide assistance with credit repair and debt consolidation. They also provide personalized assistance with the loan application procedure

IV. Motives for Selecting Gustan Cho Associates: Reasonably priced loans and interest rates A prompt and effective loan approval procedure A dedication to ensuring client assistance and happiness

V. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Information on whom to contact in the event that you need further support or details Assistance with credit repair and debt consolidation Personalized assistance with the loan application procedure Reasons to Select Gustan Cho Associates IV: Reasonably priced interest rates and loans Ensuring client pleasure and assistance via a fast and efficient loan approval procedure.

VI. Summary: An overview of the significance of choosing a trustworthy mortgage lender. Your mortgage needs should be carefully considered while considering Gustan Cho Associates. Gustan Cho Associates provides support with loan applications, debt reduction, and credit restoration, in addition to affordable interest rates. As a trustworthy mortgage lender, they provide contact details for further help and demonstrate a strong dedication to client satisfaction and support. Gustan Cho Associates is a reputable mortgage provider offering services such as FHA, VA, conventional, and other types of mortgage loans, credit repair and debt consolidation assistance, and personalized loan application assistance. The company’s history, expertise, and experience are highlighted. Reasons for choosing Gustan Cho Associates include reasonably priced loans and interest rates, a prompt and effective loan approval procedure, and a commitment to customer satisfaction and happiness. They provide support with loan applications, debt reduction, and credit restoration, along with affordable interest rates. Customers can use their contact details to contact Gustan Cho Associates for further support, and they can demonstrate a strong dedication to customer satisfaction and support. The company’s commitment to customer satisfaction and support is evident in its commitment to providing the best possible service to its clients.

The Gustan Cho Team at Gustan Cho Associates has licenses in most 50 states. Contact Gustan Cho seven days a week, nights, weekends, and holidays, at 800-900-8569 or mobile at 262-716-8151.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 11 months ago by

Gustan Cho.

Gustan Cho.

gustancho.com

GCA Mortgage | Mortgage Experts With No Overlays

Whether you’ve gone through bankruptcy, divorce or you are a first-time homebuyer, Gustan Cho Associates are experts in difficult loans

-

This discussion was modified 1 year, 11 months ago by

-

How are solar panels work and how can I get solar financing. Can anyone help. I heard you can get tax credit on solar panels.

-

How will having a car lease affect my debt-to-income ratio when getting approved for a mortgage loan?

-

What do mortgage lenders mean by borrower paid versus lender paid compensation in mortgage loan transactions. Why does the borrower need to pay discount points on borrower paid compensation and does not pay any upfront discount points on lender paid compensation.

-

In residential mortgage lending, what do they mean that a mortgage loan does not pass high-cost? What is a high-cost mortgage loan.

-

I used to know this answer but what are the HUD guidelines and Fannie Mae Guidelines on qualifying for a mortgage with a federal tax lien? This would be qualifying for an FHA loan or Conventional loan with federal tax liens.

-

Why are homebuyers buying a house in rursl areas have a difficult time getting qualified and pre-approved for a home mortgage?

-

You must be logged in to create new discussions.