Ollie

Dually LicensedMy Favorite Discussions

-

All Discussions

-

Are there corrupt cops? How could that be when the recruitment and hiring process of police officers include a thorough assessment of the police applicant’s background. Background investigation includes interviews of former and current employers, co-workers, supervisors, neighbors, classmates, and teachers. Background investigators of police officer recruits will check the candidates credit and employment backgrounds, criminal arrests and convictions, public records, and medical and psychological history records. Many law enforcement agencies will conduct written psychological examinations as well as an oral interview with a board certified psychologist. Other police agencies will have polygraph examinations as part of the background investigation process. Like many other professions, there are bad apples in law enforcement. Here are some videos of corrupt police officers caught on tape.

https://www.facebook.com/share/v/8rZBrhjnZ3sU7GQR/?mibextid=D5vuiz

facebook.com

When Evil Cops Got Caught Red Handed | Mr. Nightmare #cops #police #thinblueline #lawenforcement #policeofficer #UK #usa

-

Kevin O’Leary Warning – Silver Could Double Again in 2026!

In the shifting financial landscape of twenty-twenty-six, a “mathematically undeniable” setup suggests that silver prices could double again, offering investors the single greatest asymmetric trade of the year. While the mainstream media clings to the “soft landing” narrative, sticky service-sector inflation and a desperate industrial complex running out of physical metal are driving a massive rotation from paper assets to tangible wealth.

This video serves as a critical warning and a “second chance” for those who missed the initial breakout to position themselves before the window closes. By recognizing the transition from the era of easy money to the era of hard assets, smart capital is front-running institutional pension funds to capture the vertical upside of the most undervalued asset on the planet relative to its scarcity and utility.

Disclaimer: This is a fan-made channel and is not affiliated with Kevin O’Leary, or any individuals or organizations connected to him. All videos draw on Kevin O’Leary’s publicly available interviews, speeches, commentary, and creative work for educational and informational purposes only.

We use visual lip-syncing and narrated voiceovers to clearly communicate ideas, pairing explanations with on-screen footage solely to enhance understanding and viewer engagement.

We present his stated beliefs with respect, accuracy, and context—without any intent to mislead, impersonate, or imply personal involvement.

This is an opinion/analysis, not financial advice.https://www.youtube.com/watch?v=jeb01vKh-Sg

-

This discussion was modified 1 month, 1 week ago by

Sapna Sharma.

Sapna Sharma.

-

This discussion was modified 1 month, 1 week ago by

-

Florida’s long-promoted condo dream is beginning to unravel in 2026. Prices are sliding across both coastal hotspots and inland cities, while insurance premiums, HOA fees, and unexpected special assessments are surging. For many owners, the true monthly cost of holding a condo now exceeds what that same unit could realistically rent for — even after significant price reductions.

In this video, we break down how rising condo insurance, stricter safety and reserve requirements following the Surfside collapse, aging buildings, and a growing wave of new listings are reshaping Florida’s condo market. You’ll see where double-digit price corrections are already underway, inventories are swelling, and rental income no longer covers the combined burden of HOA dues, insurance, property taxes, and mortgage payments. If you’re considering buying a Florida condo in 2026, this is the type of analysis you need before committing.

This is not about fear or sensationalism. It’s about understanding the numbers. We examine the pressure points city by city to show where deals may still make sense, where margins are razor thin, and where the so-called Florida condo dream has turned into a stress test for how much financial strain everyday owners can handle.

If you value clear, honest coverage of the real housing markets behind the glossy marketing, subscribe to Discover the Nation and turn on notifications. We publish in-depth countdowns, data-driven investigations, and market warnings designed to help you spot problems before they dominate the headlines.

-

This poet covers Mortgage Loan Officers seeking to get Real Estate Agent License to become a dually licensed MLO and REAL ESTATE AGENT. We will also cover how Loan Officers at NEXA MORTGAGE can become dually licensed MLO with NEXA MORTGAGE AND REAL ESTATE AGENT WITH AXEN REALTY.

-

. If Biden dies or gets impeached do we have to worry about this ding bat becing our President?Kamala Harris is being questioned by millions of Americans on her mental health state and her intelligence level. Is this idiot pretending to be dumb and stupid or is Kamala Harris a real idiot. Kamala Harris has zero brains 🧠 and seems this goof 🤪 is pretending to be a creature with a single digit IQ. Is this brainless moron the number 2 in charge of the United States? How humiliating to have this creature to represent the nation and be a power leader. The Imbecile in Chief. She has zero respect and is not a liked person in any way or form.

https://youtu.be/k7TCTQQWIZI?si=-hQw0rw-TbyD7SxJ

-

California’s housing supply has bounced back sharply compared to just a few years ago. I put together a short video that looks at how California stacks up against the U.S. overall since 2016.

Highlights from the data:

· Both California and the U.S. hit their lowest point in early 2022, when competition was toughest for buyers

· Since then, the U.S. is up more than 200 percent, while California has climbed about 244 percent

· Even compared to last summer, supply is higher: the U.S. is up 25 percent and California is up 36 percent

· On an indexed scale, California sits at 139 versus the U.S. at 121, showing how much stronger the rebound has been locally

For buyers, this means more homes to choose from and less of the extreme competition we saw back in 2022.

You can watch the full breakdown below.

-

GCA Forums News Weekend Edition Headline Report: September 13, 2025 — Mortgage Rates, Housing, Fed Showdown, Tesla Turmoil, Political Battles, and Global Market Shocks

Breaking weekend mortgage, housing, Fed, Tesla, and political news for September 13, 2025. Full analysis of rates, inflation, markets, and scandals.

Mortgage Rates and Housing Market Snapshot

Current Average Mortgage Rates:

- 30-Year Fixed: 7.59%.

- 15-Year Fixed: 6.90%

- 5/1 ARM: 6.30%.

Annual percentage rates (APRs) quoted include one point and assume a 780 credit score.

Latest Trends

- After a mid-week rally in Treasury yields, mortgage rates briefly retracted before stabilizing around a volatile floor.

- Pricing on Agency and non-QM products widened, suggesting lenders are bracing for further economic surprises.

- New mortgage applications slowed, with a 7% week-over-week decline in purchase activity and 3% in refinances.

- For a deeper look at the mortgage process in today’s inflationary climate, check out our “2025 Homebuyer’s Action Plan” series.

How America’s Housing Market is Shaping Up

Housing starts are decelerating, with Census Bureau data showing a 6.6% drop in September permits. The logjam is partly due to rising material costs and a persistent labor shortage. However, a bigger factor is the affordability wall.

Key Markets In Focus

- Phoenix: Home to the biggest monthly drop, down 3.4% (often a harbinger for sunbelt bubbles).

- Chicago: Single-family values are the third-hottest behind Miami and Austin, but the Delinquency Index is up 16% on a 90-day basis.

- NYC: Co-op sales are cooling for the first time in years, with the median sale price showing an annual decline of 8.5%.

The Fed’s Showdown: What Traders Are Pricing In

- By the Federal Reserve’s October meeting, markets continue to price in a 25-basis-point increase, with the implied policy path rising to 6.252- 6.500%.

- Traders also attach a probability of 30% on the 25 bps defensive hike at the December meeting, pointing to a bumpy policy channel for the balance of 2025.

Core Takeaways:

- Inflation: Core services inflation is looming.

- Fed’s preferred measure, the PCE index, is stuck at 4.6%, evidenced by sticky shelter and historically slow transportation.

- Housing Tightrope Walk: Ongoing chatter of a cessation of MBS roll-off before the December meeting, yet tighter mortgage spreads are muting the impact.

- Consumer Resilience: Non-revolving credit and mortgage balances keep surging, stabilizing the RoC for bank net interest margins but undermining already thin consumer buffers.

Following Events:

- FOMC’s September 19 policy announcement.

- Kansas City Fed symposium on housing bubbles.

- A24 Treasury and Mortgage Finance conference in Coral Gables.

- Tesla’s Turmoil: Delivery Data and the Price War.

Key Data Points:

- September delivery figures come in at 817,000 units, surprising analysts by a surge of 11% primarily fueled by bigger sales in China, yet at an aggressive average discount of $7,000.

- Gigafactory Berlin halts production for a third time this year, citing delays in battery cell supplies.

- The new “FSD v.19 Beta” expansion rollout is stalled in regulatory limbo, delaying the feared subscription uptick and affecting the margins forecast for Q4.

- Insider Insight: Ongoing price cuts are triggering a race to the bottom with legacy auto, triggering fears of “mass de-leveraging” in the sector.

Domestic Political Battles: Budget Fights and 2024 Showdowns Default Showdown

Congress is racing to avert a shutdown at midnight on September 30, stumbling on a $25 billion border and defense allocation. Markets anticipate continued volatility in Treasury yields and the new frontline tranche on 4-week Libor.

Primary Pile-Up

- DeSantis headlines a Florida Sunbelt rally, attracting grassroots amid rising frustration with price controls on dry bulk shipping costs.

- Biden’s executive committee is considering waiving Monroe Doctrine tariffs on Puerto Rican economic labor imports, a possible move to curb inflation on cement and steel.

Global Market Shocks: China, Brazil, and the Liquidity Cash Calls

China

- Chinese import and export data show a deepening 11% annual decline, triggering a surge in temporary liquidity calls among cash-strapped infrastructure trusts.

- This pushes 2Y CNY yields to a 14-year high of 4.2%.

Brazil

- Brazil’s October IPCA number leaked at 6.8%, pushing the central bank to signal 50 bps of incremental tightening, causing a 3.5% drop in B3 heavy-crypto index and Brazil’s 2025 currency crisis live fears.

Takeaway: The prevailing fear of contagion is widening Asian credit risk indicators even further, and analysts recommend 1-2 medium-term Fed rate certs: overexposed RMBS and first-line EFSF European basis risk.

For expanding tactical thoughts, enter your email below and let us send a freshly brewed weekly “FOMC Watch” newsletter to your inbox tomorrow._

Intro: What This Weekend Means for You

The second week of September 2025 wraps up with three big shocks shaking up mortgage borrowers, real estate pros, and investors. First, mortgage rates dropped in the biggest one-week slide of the past 12 months. Second, the Federal Reserve is prepping for an important meeting in the coming days. Finally, another round of chatter in Washington hints that leadership changes at the Fed could be coming—again. Meanwhile, Tesla and Elon Musk are juggling multiple recalls, political headwinds, and growing doubt among investors. Over on the political side, fresh accusations and ongoing probes keep headlines buzzing for big names like Gavin Newsom, Tulsi Gabbard, Adam Schiff, Letitia James, and Ghislaine Maxwell. This Weekend Edition brings you the freshest updates on housing demand, new mortgage rules, key economic data, Fed strategies, global markets, political scandals, and corporate world chaos, all in one spot, so you’re ready for the week.

Mortgage and Housing Market Update Mortgage Rates Slip

This week’s Freddie Mac survey puts the 30-year fixed mortgage at 6.35%, the biggest one-week drop we’ve seen in nearly a year. Many borrowers ask whether we’ve hit a floor or if the market is offering a brief pause. Gustan Cho Associates has noted a surge in questions from buyers priced out a few months ago.

Fed Meeting Preview

The FOMC gets together September 16–17, and traders on Wall Street are leaning heavily toward a 0.25-point cut. A half-point cut is still in the realm of possibility, but it’s the fringe scenario. Inflation has edged lower, with the August CPI at **2.9% year-over-year and the core reading at 3.1%, and job growth is slowing. The unemployment rate increased to 4.3%, and only 22,000 jobs were added last month. Those numbers lean the Fed toward a friendlier stance. However, Jerome Powell is still dealing with heat over refurbishment costs at the Fed’s New York headquarters.

Housing Demand vs. Inventory

Pending home sales nudged upward from last year, but the number of available homes stubbornly refuses to budge. Sellers are still waiting, hoping to see mortgage rates drop, while cautious buyers are edge-walking back into the market. As a result, housing affordability stays tight, even with mortgage rates starting to soften. Agents and lenders are bracing for a possible spike in signed contracts if rates fall below 6% later in the year.

Economic Data and Business News

Employment and Inflation

Layoffs are coming in waves, especially in retail, finance, and tech. Job additions are still occurring, but the pace is cooling. Inflation is easing, hovering just a tick above the Fed’s goal of 2% for the core measure. At the same time, energy prices increased in August, stretching household budgets. Wage gains are decelerating, which may dampen consumer spending as the holiday season approaches.

Precious Metals and Cryptocurrency

Gold prices remain steady, offering a refuge during volatile market conditions. Bitcoin continues to trade above $115,000, and analysts debate whether its behavior is driven more by inflation fears or pure speculation. Investors are splitting dollars between traditional metals and digital coins, creating unusual patterns in overall wealth strategy.

Bankruptcy Watch: In the past two weeks, several medium-sized retail chains and tech companies filed for Chapter 11 bankruptcy. Soaring interest payments and a cooldown in shopper spending are pressuring these firms to reorganize. This pattern will likely pick up speed if loan rates remain high, even if the Fed makes only small cuts.

Federal Reserve and Jerome Powell Under Pressure Renovation Overruns and Political Firestorm

Upgrades to the Fed’s main building in Washington soared from around $1.9 billion to almost \$2.5 billion. Chair Powell has asked the Inspector General to investigate, but former President Trump and allies hint at possible fraud. Experts say dismissing a Fed Chair needs solid proof, so Trump’s threats look more like political theater. Still, the drama could rattle investors before the Fed’s next meeting.

Will Rates Drop 3%?

The idea of a sudden 3% interest cut is mostly chatter. Markets anticipate that mortgage rates will slip a little if the Fed lowers them by 25 basis points, but borrowers shouldn’t count on a quick plunge. Instead, expect a slow decline into late 2025 as inflation cools.

Tesla, Cybertruck Recalls, and Elon Musk’s Political Drama Cybertruck Problems and Recalls

The Tesla Cybertruck is having a rough start, with a string of recalls hitting in 2024 and 2025. The issues include faulty accelerator pedals and frame problems, affecting over 46,000 trucks. Things took a darker turn when a California crash left one person dead and a Cybertruck in flames. Investigators say drugs and speeding were the main causes, not a specific tech flaw, yet the incident put everyone on alert. Regulators in Washington, D.C., are watching every move Tesla makes, and the company’s quality team is feeling the pressure.

Musk vs. Trump: Bromance Ends

Elon Musk and Donald Trump have slid from buddies to public sparring partners. Trump hinted he might have a say in Musk’s immigration paperwork. Musk teased launching a new group called the “American Party.” The party talk is paused, but the spat remains in the headlines and could rattle more than just the political crowd. There are whispers that Musk’s wallet may feel the chill, too, if the drama drags on.

Investor Concerns: Spreading Too Thin

Money folks are sweating that Musk is blowing too much wind in too many sails. Tesla, SpaceX, the social media fixer called X, the brain chip crew at Neuralink, the tunneling team at The Boring Company, and now a possible political side gig all share the same boss. Critics use an old saying to sum it up: a jack of all trades is a master of none. They point to Tesla, still fighting recalls, facing new rules, and watching rivals like Ford, GM, Rivian, and Chinese makers swarm into otherwise open lanes.

Gavin Newsom and Wealth Questions

California Governor Gavin Newsom officially makes about $234,000 a year. Yet, critics keep asking how he owns several homes worth tens of millions. Some allege he crossed a line, but Newsom says he built his fortune before entering politics through restaurants, wineries, and smart investments. His net worth is likely high, at ten million, maybe more. No fraud accusations have stuck, so the question keeps circulating, especially among campaign rivals.

Tulsi Gabbard as DNI and “Russia, Russia, Russia”

Tulsi Gabbard took the DNI post in February 2025 and quickly cut the number of high-clearance insiders. She charges that past leaders misused intelligence for politics. Supporters of Donald Trump are calling it proof that Obama’s team did wrong. However, the Justice Department has yet to charge anyone. The Senate Intelligence Committee still insists that Russia meddled in the 2016 campaign. Still, proof beyond politics that any American conspired with it has yet to emerge.

Adam Schiff and Letitia James Mortgage Fraud Allegations

Senator Adam Schiff and New York AG Letitia James are under investigation for mortgage deals that critics call illegal. No indictments have landed, and each says the same: they broke no laws. The cases appear daily in headlines but have yet to take off in the courts.

Ghislaine Maxwell and the Alleged Epstein List

Federal prosecutors say a formal “Epstein client list” doesn’t exist, a claim Ghislaine Maxwell repeated in interviews. Many expected proof to appear, and survivor groups are understandably frustrated. Meanwhile, rumors that Maxwell might turn witness against influential men have not been substantiated, even as lawmakers say they are still monitoring the situation closely.

Trump, Musk, and the Changing Landscape

The split between Trump and Musk carries weight beyond headlines. Trump loses a visible tech backer, and Musk risks upsetting the conservative customers who helped build Tesla’s base. On top of that, Tesla is wrestling with fresh competition, ongoing recalls, and the threat of fines. Questions are now surfacing about whether Musk can split his focus without jeopardizing the company at a make-or-break time.

Three Fast Facts for Homebuyers and Agents

- Rates are Inching Down: A Federal Reserve cut could arrive and help, but go in expecting smaller moves, not a freefall.

- Buyer Interest is Rising, Yet the Supply is Still Thin: Agents and buyers alike should gear up for a busier fall now, not later.

- Tesla is Juggling Legal and Reputational Strain: Anyone considering a reservation and delivery should wait until the Cybertruck’s recall hiccups are fixed.

- Big-time political scandals splash the news, but actual charges usually don’t happen.

- Instead of stressing over headlines, home buyers should pay attention to the data that moves the housing market, not the gossip.

At Gustan Cho Associates, we make happen what other lenders can’t. Need a mortgage to buy your first house, refinance, or dive into non-QM loans? Our pros have the answers.

Get a Quote: Call us month to month at 800-900-8569—free advice all day

Learn More:

- Dive into our guides on [FHA Loans](https://www.gustancho.com/fha-loans).

- [VA Loans](https://www.gustancho.com/va-loans).

- [Non-QM Mortgages](https://www.gustancho.com/non-qm-mortgages).

Top 10 FAQs — September 13, 2025 Weekend Mortgage, Housing, and Market News

Will mortgage rates drop after the Fed meeting next week?

- A small dip may be possible.

- The Fed is expected to lower the target rate by 0.25%.

- Bead-seen, a cut like that typically slides the 30-year fixed mortgage rates just a hair lower rather than take a big leap downward overnight.

How low could mortgage rates go by the end of 2025?

- If inflation keeps slipping and the Fed makes one or two more cuts, the 30-year fixed could dip to the mid-5% range by late 2025.

- A fast whipsaw to the 3s is not in the forecast, so keep your expectations in check.

Why are housing inventory levels still so low?

- Homeowners who locked in 3% rates from 2020 and 2021 are staying put.

- New homes still can’t catch up because builders are battling supply-chain issues.

- Existing sellers, meanwhile, are pausing until something “better” comes along.

- The result?

- Lots of buyers and not enough sellers.

- Is now a good time to refinance your mortgage? If your current mortgage rate is above 7%, refinancing now is worth considering since it could lower your monthly payment.

- If your rate is in the low 6% zone, you might hold out for another potential cut from the Fed, but have your paperwork ready if rates drop to the 5% range.

- They can move fast, so you have to act fast, too.

What’s happening with Tesla and the Cybertruck?

- Tesla has announced a handful of recalls for the Cybertruck, including fixes for misaligned body trim and a possible risk with the accelerator pedal.

- These issues cover roughly 46,000 vehicles.

- There were reports of serious crashes with flames. However, at least one of the well-known cases is tied to speed and possible drug use, not a demonstrated vehicle problem.

Did President Trump really say he might fire Fed Chair Jerome Powell?

- He suggested it after the Fed’s renovation bill for its D.C. headquarters hit $2.5 billion.

- While the comment is headline-grabbing, removing a Fed Chair without a solid reason is legally difficult.

- So it looks more like political posturing than an actual firing plan in the works.

How can Governor Gavin Newsom afford multimillion-dollar homes on a public salary?

- Newsom officially earns about $234,000 a year as governor, yet he had a sizable nest egg well before he took office.

- His money comes from the PlumpJack businesses he co-founded and from family assets, pushing his net worth into the tens of millions.

- Federal filings don’t indicate any outstanding fraud accusations.

What did Tulsi Gabbard do as Director of National Intelligence?

- Since her confirmation in February 2025, Gabbard has canceled 37 security clearances, citing links to what she calls politicized intelligence work.

- It’s stirred debate, yet no treason allegations have been made against former Obama officials.

- The removals have raised hackles on both sides.

Is there really an “Epstein client list”?

- The Justice Department and Ghislaine Maxwell now say an official list does not exist.

- Survivor groups counter that many victims feel overlooked and that detailed information is still missing.

- Claims continue to swirl about Maxwell possibly testifying against high-profile individuals, but the reports remain unverified.

What’s the outlook for the housing market in late 2025?

- Should mortgage rates keep falling, there could be a fresh rush of buyers.

- Still, if the supply stays tight, homes may remain hard to afford.

- Agents and mortgage lenders ought to brace for a crowded late-year market, as more shoppers will likely go after a limited number of properties.

At Gustan Cho Associates, we specialize in getting deals done when others say, “no.” Thanks to our no-overlay policy, we can close loans others can’t because we don’t add extra restrictions.

Need to Talk to Someone?

- Call our friendly and licensed loan officers at 800-900-8569.

-

This discussion was modified 5 months, 3 weeks ago by

Lisa Jones.

Lisa Jones.

-

This discussion was modified 5 months, 3 weeks ago by

Sapna Sharma.

Sapna Sharma.

gustancho.com

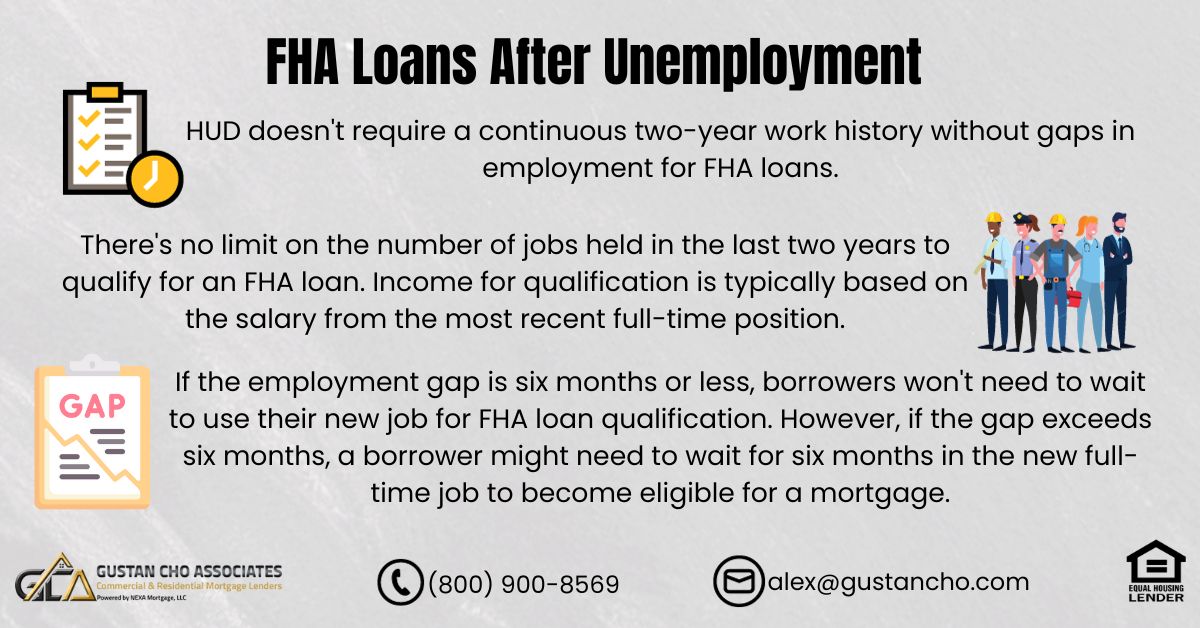

FHA Loans After Unemployment Mortgage Guidelines

A borrower can qualify for a FHA loans after unemployment with gaps in employment and extended periods of unemployment in the past two years

-

So, on a Saturday afternoon in late June 2025, headlines around the globe are hard to ignore. Most people first hear the Israel-Iran story when they open their phones.

Israeli warplanes have spent the past fortnight hammering suspected Iranian nuclear sites at Natanz and Arak. The damage is serious enough that word leaks that an important Quds Force commander, Saeed Izadi, is dead.

Tehran isn’t sitting still. Its military fires missiles clear over Hebron in the West Bank and launch suicide drones that buzz up from hidden bases. No oil dock has been tagged yet. Still, each tick of the clock feels riskier than the last.

Back in Washington, President Donald Trump is considering sending a full bomber package. Rumors suggest B-2s are already turning west across the Pacific sunset. He says a two-week deadline adds heat to the market screens, blinking red.

Gulf sheiks privately push for American brake pedals. At the same time, Paris, London, and Berlin crowd a smoky Geneva room, quizzing Iranian envoys about a cooling pact. One Tehran official even whispers that talks resume if Trump signals to Israel to stop swinging punches.

Away from border maps and treaty talk, Lagos police suddenly bust Wasiu Akinwande, the cult figure whose name sends shivers down backstreets. Moviemakers, meanwhile, are still debating whether Detective Sherdil is a clever romp or a predictable slog, and fans are posting candles and verses for Prodigy of Mobb Deep.

The U.S. economy has felt like a triple whammy has hit it: growth is slowing, prices keep creeping up, and more people are losing their jobs. The Federal Reserve, under Jerome Powell’s watch, decided to leave interest rates parked between 4.25% and 4.50% during its June meeting, mostly because of the inflation spike tied to the Israel-Iran conflict and those tariffs President Trump keeps talking about. Retail sales took a surprise dive in May, dropping 0.9 percent when economists had guessed the drop would be only 0.6 percent. If spending keeps slumping, the central bank warns that unemployment and inflation figures could finish the year higher than we like to think. Powell says he is waiting and watching; he points out that Energy price jumps usually fade, but tariffs can stick around. Trump, however, is not patient. He’s hinted at firing Powell, claiming rates should be closer to 2.5 so we mirror Europe’s cheaper borrowing costs. Mortgage rates near seven are still slicing through housing budgets, as FHFA Director William Pulte bluntly noted. Fed governor Chris Waller hinted a rate cut could be on the table for July if the numbers cool, yet Powell’s testimony on June 24 and 25 will make or break that talk.

Housing and Mortgage News

American home buyers are feeling the pinch. Interest rates on 30-year mortgages shot up to 7%, nearly double the 3% lenders offered just a few years back. However, some folks are still scrambling for loans. Demand for mortgage money hit its highest point in five weeks. Sky-high tariffs and looming energy price hikes warned by former President Trump could further squeeze consumer budgets.

Economic Numbers and Data

A slate of important reports arrives next week, including the FHFA price index, the S&P/Case-Shiller gauge, and the May tally of existing home sales. Those numbers will help the market determine whether prices are still climbing or finally leveling off. Most economists agree that substantial drops in mortgage rates are unrealistic for 2025, given the Federal Reserve’s tight grip and persistent inflation jitters.

Automotive News

Automobile dealers are not sitting pretty, either. June 21 data is still trickling in, but the math is straightforward: higher interest rates eat into buyers’ monthly budgets. The electric car pioneer Tesla recorded no growth in second-quarter deliveries, a steep 21% slide from last year. That slump speaks to broader demand headaches. Turmoil in Israel-Iran

Meanwhile, turmoil in the Israel-Iran region is nudging higher crude prices, often driving shoppers toward compact, fuel-guzzling sedans. Sadly, sky-high financing bills could swallow any savings from better gas mileage, leaving many drivers stuck where they are.

Financial Markets and Forecast

Financial Markets and Forecast – June 2025

The financial markets show caution as geopolitical tensions, inflationary concerns, and economic uncertainty weigh on investor sentiment. While stocks have remained relatively stable, the path forward is anything but clear.

The S&P 500 and Nasdaq have held steady in the equity markets. However, they’ve experienced mild pullbacks due to investor unease over rising oil prices and concerns about the Middle East conflict. Tech stocks have seen some volatility, and many traders are taking a more defensive stance as they wait for further direction from the Federal Reserve.

Bond markets continue to reflect elevated Treasury yields. Long-term government bonds have softened slightly, indicating investors expect rates to remain high. Bond volatility is expected to persist, with the government continuing heavy borrowing and inflation above the Fed’s long-term target.

The conflict between Israel and Iran is a growing source of concern for global markets. If the situation escalates further, crude prices could jump significantly, disrupting the oil supply. Some analysts warn that if oil spikes above $130 per barrel, it could reignite inflation in the U.S. and derail any hope of interest rate cuts this year.

Federal Reserve Board

The Federal Reserve, under Chairman Jerome Powell, is staying cautious. The central bank has held interest rates steady but signaled that it still expects to cut rates later this year. However, Powell has clarified that this depends on factors such as inflation trends, labor market performance, and global stability.

Some economists are predicting more turbulence. One leading research firm estimates there’s a 60% chance the U.S. will enter a recession by early 2026. Weakening credit markets, slowing job growth, and tariff pressure contribute to a more fragile economic outlook.

Looking ahead, many investors are shifting focus to international opportunities. A recent Bank of America survey shows that more than half of fund managers prefer foreign stocks over U.S. equities over the next five years. Fears about continued trade disputes and the uncertain path of U.S. fiscal policy largely drive this shift.

On the fixed-income side, bond strategists expect Treasury yields to remain elevated throughout the rest of 2025. While yields may decline slightly if the Fed begins easing, rates will unlikely return to pre-pandemic lows anytime soon. Investors seeking stability are encouraged to consider a barbell strategy—mixing short-term instruments with long-dated, high-quality bonds.

The U.S. Dollar

The U.S. dollar has shown some weakness recently, which could boost commodities and emerging-market assets. However, energy prices remain the most sensitive to geopolitical shocks, and analysts closely monitor crude oil markets as tensions in the Middle East continue.

In summary, the markets are in a holding pattern, driven by global instability, Fed policy uncertainty, and stubborn inflation. While equities have not collapsed, they are moving cautiously. Bond yields remain high, and the outlook for interest rates hinges on how current risks evolve. For investors, diversification and vigilance are key strategies for navigating the rest of 2025.

Precious Metals

On the other hand, Silver trades at thirty-two dollars and seventy-two cents, having recently spiked before giving back a bit of steam. Crude oil keeps throwing tantrums; West Texas Intermediate slid seven percent on June 16 after jumping five percent the day before. Brent barrels now carry an eight-dollar geopolitical cushion.

Behind the curtain, money quietly leaves stock funds in chunks, yet much of that cash still prefers tech and industrial names. Financials, by contrast, bled about 1.22 billion dollars in redemptions, a clear warning sign for the sector.

Individual stories are also moving the needle: Tesla just shaved its earnings outlook, defense companies wobbled on hopes that Iran will chill out, and a little bit of boardroom drama- Victoria’s Secret slapped a poison pill in place to ward off any would-be buyer.

As of late June 2023, nothing fresh about sanctuary laws in the Midwest has landed. Illinois and the city hall in Chicago keep their thumbs-up policies, sparking shouting matches at public meetings, but no signed bills for or against. Numbers from Chicago’s 5th Ward show retail slipped almost one percent in May, indicating that wallets are tightening. Mayor Johnson is already under the microscope for crime stats and a grumpy budget. People who punch the clock on factory floors are feeling the pinch, too; wobbly oil prices and steady interest rates don’t let manufacturers breathe easily. June 26 brings the Chicago Fed National Activity. Everyone from Wall Street analysts to neighborhood coffee-shop economists will be glued to that sheet of paper.

Musk and Trump, the eclectic odd couple, have not surfaced with a headline since their April photo-op. They locked eyes on 2024, trashed Washington in unison, and then Tesla delivered fewer electric rides than promised, putting Musk in the hot seat just as Trump revs his economic rants. California smog regulators, union handbooks, and MAGA rally signboards have a way of bumping into one another whenever the two are in the camera frame. If your inbox needs more juice than that, a real-time rumble from GCA Forums News on sanctuary spats can fire up the search engine and dig hard. From the Dow to bullion ounces, financial tickers come straight off live desks; I triple-check geopolitics claims to keep the chatter truthful and avoid the viral noise.

-

GCA Forums News: National Roundup for June 16, 2025

Welcome back to GCA Forums News. On this Monday, June 16, we sift through police sirens blaring in Los Angeles, the latest on rent prices, a Federal Reserve meeting, faded growth predictions, and a slug of headline news that keeps rolling in.

Housing and Mortgage Market: A Stagnant Landscape

The American housing scene still feels frozen in 2025. Sky-high mortgage rates and stubborn cost-of-living bites leave most buyers and sellers staring at each other across the dinner table, unsure who should move first. Freddie Mac clocked the average 30-year-fixed mortgage at 6.84% in the week ending June 12, just a hair below last week and still hugging that 7% line we first spotted in 2022. Analysts whisper that we will drift around 6.8% for the rest of the year, with anything that looks like real relief probably sleeping until after summer.

Inventory vs. Demand

Housing listings recently hit the highest level since early 2020, yet markets feel surprisingly cool. Why? Federal Reserve of St. Louis data point to stubbornly high interest rates and an economy that still feels shaky. Many homeowners locked in mortgage rates under 5 percent refuse to move, so extra homes tend to disappear as quickly as they appear. Prices tell their own story; the Q1 2025 median home now sits at $416,900, nearly double the $208,400 recorded in Q1 2009. Real estate agents describe a frosty atmosphere; properties linger for months even in once-red-hot cities like Austin, Texas.

Renting vs. Buying

In this pricey climate, leasing looks smarter for many people. A 7 percent mortgage adds extra cost to steep prices, and monthly rent offers more wiggle room if a layoff strikes. Redfin chief economist Daryl Fairweather sums it up: Putting a down payment down feels like a gamble when paychecks could vanish in six months. On the flip side, shelter inflation of about 4 percent annually keeps pushing rents upward, pinching budgets that already squeak.

Fed Chair Powell in the Hot Seat

Jerome Powell and his team at the Federal Reserve are feeling the heat these days. When the committee met in May 2025, they chose to keep the funds rate between 4.25% and 4.5%, a choice they tucked under mixed signals and a White House still sorting out its next moves. Powell says he wants more proof and more numbers trimming those rates.

Meanwhile, President Trump isn’t hiding his frustration. The ex-president and TV real estate star Grant Cardone both blame the same high rates for dragging the housing market into the dirt. Cardone went so far as to say Powell’s course has hurt the middle class more than any previous Fed chair ever did, a claim he was glad to repeat on cable news. Trump, louder still, has demanded a one-percentage-point slash, arguing that such a cut would set off the economic fireworks voters expect. Powell, however, keeps waving the red flag about what that might do to inflation.

Interest Rate and Mortgage Rate Forecast

Because inflation increased to 2.4% in May and job growth stayed steady, most market watchers think the Federal Reserve will leave rates alone this summer. The central bank has quietly signaled that an indecisive pause beats a rushed cut when the unemployment rate sits at 4.2% and another 139,000 jobs appear on payrolls. Mortgage costs still dance to the beat of the 10-year Treasury yield, which is just over 4.4%, so homeowners should expect 30-year fixed quotes in the mid-to-upper-6 % territory until at least 2025; a broader drop to 5.5% in 2026 is only likely if inflation proves it can cool for real.

Economic Outlook: Inflation, Unemployment, and Cost of Living

The U.S. economy feels tugged in opposite directions: the jobless rate sticks at 4.2% while consumer spending slows and quarter-one growth drifts toward zero, sparking chatter about stagflation. May’s Consumer Price Index came in with a 2.4% year-over-year, slightly softer than many had braced for, but that single number still stops the Federal Reserve from crossing the threshold to cut costs. Families pay close attention to groceries, rent, and gas, and those everyday prices continue to pinch budgets even as the headline rate eases, so relief looks more like a promise than a paycheck.

Household finances still ache because rent is pricy, home loans cost a lot, and Trump-era tariffs linger. Buying a new car, snatching up a pair of jeans, or stocking the pantry has gotten trickier since 25 percent is still tacked on imports from Canada and Mexico, 55 percent from China, plus that 10 percent blanket levy across the board.

Consumer prices could nudge higher again if supplies stay squeezed and manufacturers pass on those extra charges. Economists are watching inflation numbers as baseball fans track the score in extra innings.

Wall Street and the bond pit have felt jumpy every Tuesday, Wednesday, and Thursday lately. Bad data can whiplash stocks, while good news hardly budges the 10-year Treasury yield, which refuses to settle either up or down. Money that usually pours into government notes for safety has hesitated because investors remain spooked by one injury: high inflation, high debt, and shaky jobs.

Even mortgage rates are on pause, like someone biting their tongue before making a tough call. That uncertainty keeps bond traders at arm’s length, muting buyers’ excitement.

Since swearing in again on January 20, 2025, Trump has kept his word, waving his “Big Beautiful Bill” every chance he gets. The plan could blow the federal deficit sky-high, and bond markets fear the hangover will show up in sharper yields and pricier home loans.

Critics say the tariffs pinch families hard, but supporters streak red, white, and blue, claiming the levies guard American jobs. Either way, price tags keep increasing, and the debate may outlast the sticks placed on every cargo ship at the Long Beach dock.

Trump and Musk: A Rocky Relationship

Donald Trump and Elon Musk used to trade compliments on Twitter, but the mood turned sour. On June 5, 2025, Trump blasted Musk in front of a rally crowd and called his latest project a publicity stunt nobody asked for.

Musk landed a big seat as chief of the new Department of Government Efficiency-DOGE, as the tabloids nicknamed it. Inside the tiny office, a squad of forensic auditors is combing through federal books and scanning for obvious fraud.

Curious supporters ask the same question at town halls: Where are the indictments? So far, high-profile names, such as POTUS Biden, Homeland Security head Alejandro Mayorkas, and a few others, have avoided handcuffs, and the silence is eating away at the base.

Bondi, Patel, Bongino: The Controversial Picks

Former Florida Attorney General Pam Bondi, now eyeing the A.G. seat, has defenders who love her grit but worry she can untangle the web of federal probes. Kash Patel, the short-tenured FBI chief, and Dan Bongino, a podcaster with a badge-and-briefcase past, both draw heat for resumé gaps that leap off the page. Bondi loyalists cheer her sparks on TV but admit her white-collar courtroom chops aren’t proven at the scale. Legal pros point out Patel’s days as a public defender aren’t exactly the FBI playbook, and Bongino’s decade talking into Mike’s isn’t the same as running field agents. Even tech-savvy cops note that the bureau’s toolkit has outdated the Secret Service rotation Bongino logged ten years back.

A Nation Divided

Public sentiment on Trump sits at opposite ends and shows no sign of middle ground. Fans of the president pile praise for inflation drifting to 2.3% in April, a drop many think proves his course is at least heading in the right direction. Detractors flip the script, reminding anyone who listens that promised nationwide prosecutions never arrived, and the red ink from tariffs and growing deficits still stares us in the face.

New York Attorney General Letitia James: Mortgage Fraud Allegations

Attorney General Letitia James has her eyes on mortgage fraud, hunting down lenders who may be squeezing borrowers. As of June 16, 2025, there is still radio silence on whether a federal grand jury will hand down any indictments. No headlines from the CFPB, the FBI, or the office of the U.S. Attorney General suggest the probes have moved beyond the fact-gathering stage. The public is mostly in the dark without fresh court filings or trial dates.

Los Angeles Riots: Major Headline News

LA suddenly flipped upside down on June 16, 2025, as street protests turned into full-blown riots. Early reports say sour feelings over high rents and shaky job security fuel the unrest. However, the exact spark is still unclear. Police and city officials are racing to regain control, but the scene looks slightly different every hour. Wall-to-wall cameras capture the chaos, so expect these images to dominate cable news for days.

Other Major Headlines

In a bright sports moment, the Braves piled up 19 strikeouts in a single game against the Rockies, setting a new franchise high. Spencer Strider led that charge with 13 Ks, reminding everyone why he’s the ace. Meanwhile, fans of the Immaculate Grid trivia game were chewing through puzzle 806, and several players claimed a perfect score with Wade Davis.

Messy Debate

Fans have been arguing about Lionel Messi’s appearance since joining Inter Miami. Some are gushing over his dribbles and dead-ball magic, while others blame the supporting cast for the times he looks stranded on the pitch.

Jump to June 2025:

The U.S. economy feels like a traffic jam. Housing prices barely budge while inflation keeps popping up like a stubborn weed. Washington is noisy, too; the Fed is tiptoeing, Trump is waving big tariff ideas, and TV pundits never tire of grading new cabinet picks.

Los Angeles still smolders after that brutal round of street protests, a painful reminder that unrest can break out overnight.

If you want more news, you can visit GCA Forums and refresh that tab a few times. We keep the updates rolling.

-

GCA Forums News: Weekend Roundup-March 2024

Welcome to the GCA Forums Weekend Roundup for June 9-15, 2025. We put together this dispatch for home buyers, investors, loan officers, and anyone who likes to keep real estate front of mind. The stories you see below come straight from the issues our members voted on last week, so you’re reading what people want to know now. Expect solid numbers, plain talk, and no filler. In a hurry? The skimmable headlines make the whole thing move quickly, even on a busy Saturday morning.

First Stop: Mortgages

Lenders say that rates hang close to the threes, though a few early birds are already whispering about the fours. Pulling the trigger today still costs less than most wallets imagine.

Next Up is The Broader Housing Picture

According to the latest MLS snapshots, new listings are trickling out slowly, while pending sales are up almost ten points compared to last year.

Then There’s Inflation

Month-on-month price growth cooled, yet the Fed keeps flagging wage pressure as a reason to err on caution. Chair Powell told reporters that keeping the brakes on too long is a risk, but so is cutting loose before the job market settles.

Finally, the week wasn’t just numbers and forecasts. Over the weekend, an Israeli strike hit targets in Iran, a deadly shooting shook a Minnesota mall, and Senators Watz, Pritzker, and Hochul delivered fiery testimony on Capitol Hill. News cameras won’t soon forget those moments.

Mortgage Rates Nudged Up & Down

During the week of June 9-15, 2025, mortgage rates wobbled a bit as new inflation numbers and global headlines rolled in. By June 12, Freddie Mac had put the 30-year fixed rate at 6.84%, just one basis point lower than the week before, while the 15-year rate slipped to 5.97%. Around the same time, Zillow showed the longer loan stayed at 6.72% and the shorter at 5.96%, mostly reacting to news of Israeli airstrikes on Iran. Bankrate noted the 5/1 adjustable-rate mortgage hovered at 6.16%, so borrowers betting on lower rates still had some wiggle room.

What’s Coming from the Fed

Central bankers meet June 17-18, and most Wall Street watchers think they will sit tight on short-term rates. May inflation hit 2.4%, still above the 2% target, and folks aren’t seeing quick cuts thanks to stubborn price pressures and fresh talk about trade tariffs.

Lender Requirements

Fannie Mae and Freddie Mac just tightened their lending rules. Most conventional loans demand a debt-to-income (DTI) ratio below 45 percent. FHA and VA products are still kinder. They’ll back borrowers whose DTI climbs to 57 percent if strong compensating factors exist. Meanwhile, investors are discovering Non-QM and DSCR loans again. Many lenders are letting landlords skip some of the usual cash-flow paperwork.

Credit Scoring Trends

Conventional mortgages still reward anyone with a credit score above 700 with the best rates. FHA programs keep the door open at 580, which is good news for many first-time buyers. That gap between 580 and 700 lets many people cross the finish line.

Rate Forecasts

For most of 2025, the 30-year fixed rate is expected to land between 6.5 percent and 7 percent. Fannie Mae believes we might dip to 6.1 percent by New Year’s Eve if inflation cools as hoped. On the other hand, if geopolitical headaches in the Middle East send Treasury yields shooting up, those rosy predictions could head south fast.

Why It Matters

Daily rate updates are a must-read for brokers, home shoppers, and landlords alike. Investors pencil out new numbers the minute the market shifts. Refinance hunters track every tick, hoping to squeeze out extra savings. Keeping an eye on these figures gives GCA Forum members a real edge when the ground keeps moving.

Market Indicators and Housing News

As of June 2025, the U.S. housing scene has a bit of spring, even if prices still pinch first-time buyers. The Fannie Mae Home Purchase Sentiment Index hit its highest point for the year in May, hinting that folks feel a little less nervous about their finances, yet the mortgage rate hangover is far from over.

Key TrendsAffordability Challenges

The typical starter home now lists $416,900, 2.7 percent higher than a year back, so young buyers are still doing the math twice. Urban stock is tight, and although FHA and VA loans cushion some of that blow, high interest keeps the monthly number uncomfortably tall.

Housing Inventory

Suburban and rural listings crept up last month, but cities like New York and San Francisco remained painfully sparse, keeping bidding wars alive. Landlords are smiling, too. Thanks to chunky rental yields that tempt cautious investors, multi-family units are flying off the shelves.

Home Price Indices

The National Association of Realtors says pricing is steady overall, with Austin and Phoenix shining brightest for sellers in the report. Buyers hunting for bargains still find some wiggle room in places like San Francisco and Seattle, where values have begun to drift downward.

Rental Market Insights

In the rental realm, demand for multi-family buildings shot up in fast-growing Southeast metros, and that momentum shows no signs of fading. DSCR loans are helping these deals pencil out; by zeroing in on property cash flow instead of borrower income, lenders keep capital flowing to investors who want a piece of that action.

Why It Matters

Homebuyers want to know if buying now or waiting six months is smart. Sellers ask the same question in reverse. Investors keep scanning regional numbers to spot the next neighborhood on the rise.

GCA Forums zeroes in on that kind of digging. The sharp data points and plain-language breakdowns keep everyone, from mom-and-pop buyers to hedge-fund pros, clicking and talking.

Inflation and Federal Reserve Reports

The grocery store and gas pump numbers still rattle the mortgage desk. The May 2025 Consumer Price Index popped to a 2.4 percent annual pace, nudging up from 2.3 and stepping over the Fed’s clean 2 percent line.

The Personal Consumption Expenditure index, which the central bank studies the most, tells a similar story: prices are staying put longer than the officials hoped.

Federal Reserve Outlook

The Federal Open Market Committee, or FOMC, is widely seen holding its key rate in place when it gathers June 17-18. That cautious call lets the board dodge an immediate leap while it counts the economic bumps.

Some analysts blame the Trump-era tariffs and renewed Middle East flare-ups for keeping costs high.

Looking further out, the Fed is caught between rising prices on one side and climbing joblessness on the other.

Goldman Sachs now puts the odds of stagflation-consumers pulling back, growth slowing at about 45 percent, a figure rattling jittery bond traders.

Impact on Mortgages

When inflation heats up, Treasury yields usually follow, and they jumped above 1.5% after the Israeli attacks on Iran. That bump shoved mortgage rates higher almost overnight. Analysts still think a serious recession could drag those rates down again, though nothing recent points to anything below 5.5% without the economy wobbling.

Why It Matters

Home loans shape what a borrower can afford each month, and that math ripples through buying power and investment plans. Viewers of GCA Forums appreciate that when the Fed moves, their next mortgage refinance could feel it first.

Global and Domestic Events

On June 13, 2025, Israeli warplanes struck Iranian targets in a mission that rattled Wall Street. WTI crude spiked past $73.10 a barrel within hours while the benchmark 10-year Treasury yield hit 4.35%. Mortgage bonds stayed flat, but the mood on Main Street grew jittery, and further inflation could push home loan rates even higher.

Shooting in Minnesota

Information on the June shooting in Minnesota is still sketchy, with no detailed police briefings showing up in the latest files. Still, GCA Forums plans to fill that gap because neighborhood safety almost always shapes where buyers settle. Rising crime usually makes houses harder to sell, and mortgage underwriters notice long before local headlines fade.

Congressional Testimony by Senators Watz, J.B. Pritzker, and Hochul

No records show whether Senators Watz, J.B. Pritzker, and Governor Kathy Hochul spoke in front of Congress between June 9 and June 15, 2025. Still, people following housing news guessed topics like affordable rent, stimulus money, or new roads were on the table. Pritzker and Hochul often pushed bills that fit those headlines so their appearance would have caught the cameras. Anyone logging into GCA Forums the morning after would likely find clips shaking up the real-estate feed.

The Headline News Weekend Edition from GCA Forums packs everything home shoppers and lenders crave by mid-June: the latest mortgage rate dip, inflation whispers, Fed signals, plus a haunting note on the Israeli bombing of Iran. Fannie Mae updates and National Association of Realtors numbers sit alongside August polls from Pew. For investors trying to stay ahead, these five minutes are more useful than a stack of quarterly reports. Could you check the site tomorrow? The market moves while most phones are asleep.

-

GCA Forums News: National Update for Friday, June 13, 2025

Welcome to GCA Forums News. We look across the country in June, from the troubled housing market to the breaking Los Angeles riots. If you need the headlines fast, you are in the right place.

Housing and Mortgage News

- High mortgage rates, stubbornly set near 6.89 percent, keep many buyers on the sidelines.

- Freddie Mac numbers from June 12 show a tiny dip from 6.97, yet the relief feels thin.

- Redfin reports about half a million more buyers than homes for sale.

- Weighted by that gap, the median house price of $416,900 in the first quarter is still out of reach for nurses, teachers, and recent grads.

- Fannie Mae expects a full-year slide toward 6.1 percent and 5.8 percent heading into 2026.

- Redfin hedges lower, and the rest of 2025 will be around 6.8.

- Most economists, however, warn borrowers hoping for a dip below 5.5 are waiting on a recession that no one truly wants.

Renting vs. Buying

- People eyeing a new place are staring at sky-high mortgage rates, so renting starts to look like the smarter move.

- Bright MLS says prices are still increasing, but not fast enough for buyers to call the shots.

- In the priciest cities, the monthly rent often beats the math on a 30-year loan.

Feds Watchlist

- Jerome Powell and his crew at the Federal Reserve feel the heat from every corner.

- The May 2025 policy meeting ended with the funds rate at 4.25 to 4.50 percent because the inflation and job numbers won’t sit.

Future Rate Moves

- Most Wall Street pros, including the folks at Citibank, don’t see any cuts before the September calendar rolls around.

- Powell keeps saying the decision depends on the next batch of data, no matter what politicians shout out.

- President Trump and FHFA head William Pulte are still waving the cut-them-now banner, yet the Chair stays cool.

Tariff Clouds

- Powell keeps the tariff talk in his back pocket, admitting that Washington duty games could pinch growth while pushing prices higher.

- The clock is ticking on the rumored 90-day reset, and every tick adds noise to bond yields.

Critics Circle

- Real-estate magnate Grant Cardone is never shy; he calls the rate freeze a flat-out housing disaster.

- Pulte jumps in, echoing that the high Fed line is icing the market for most home shoppers.

Economic Snapshot

- The latest scoreboards are mixed.

- May CPI showed prices creeping up again.

- The Kansas City branch predicts 3.2 percent for the year, well over that 2 percent comfort mark the Fed brags about at the meeting.

Unemployment and Job Growth

- April 2025 welcomed 177,000 new non-farm payrolls, a pleasant surprise that beat most forecasts.

- The unemployment rate held steady at 4.2%, though a lean 37,000 added to private payrolls planted a few seeds of worry.

Cost of Living

- Recent tariffs on imported goods have some experts warning that prices of electric bills could jump again.

- Consumer spending looked tired in the first quarter, and early estimates show GDP growth slowed from the previous pace.

Stock and Bond Markets

- The yield on the 10-year Treasury slipped to 0.62%, easing the anxiety of anxious home shoppers by lowering mortgage rates a notch.

- Even so, trading floors feel jumpy because nobody can predict tomorrow’s tariff announcement.

Letitia James Mortgage Fraud Allegations

- New York Attorney General Letitia James is now at the center of a federal mortgage fraud inquiry.

- FBI agents working under Director Kash Patel and his deputy, Dan Bongino, are conducting the probe.

Investigation Progress

- A grand jury in Virginia’s Eastern District has already sent out subpoenas.

- James insists the scrutiny is payback for her $455 million win over Trump.

- As of June 13, 2025, he faces no charges, indictments, or set trial dates.

CFPB and DOJ Involvement

- The Consumer Financial Protection Bureau, now under the supervision of Justice Department Inspector General Michael Horowitz, investigates potential consumer harm.

- Attorney General Pam Bondi has made the case a top DOJ priority.

Public Sentiment

- James plans to fund her legal defense with private and state money, a decision critics say smells of political maneuvering.

- Public opinion remains split, with supporters praising her toughness and detractors shouting foul play.

Real Estate and Mortgage Industry

- Right now, the housing market feels stuck.

- Mortgage rates are high, so homeowners skip refinancing, and sales volume is flat.

- Gustan Cho Associates, famous for its hands-on FHA and VA underwriting, keeps hearing from borrowers with bruised credit and even folks in Chapter 7 bankruptcy.

- That steady traffic proves demand never really disappears.

- More inventory is showing up on listing sheets.

- Buyers in the market enjoy extra wiggle room, yet prices barely budge enough to jump-start movement.

- Non-QM loans are finding a niche for self-employed workers and others who don’t fit the QM narrow box.

- The catch, of course, is a heftier down payment that some families don’t have.

Trump Administration and Cabinet

- President Trump is still trying to check off big campaign promises six months in, and more than a few voters are counting.

- His tariffs may cheer factory owners, but critics want to see the indictments that keep getting hinted at.

- Trump and Elon Musk are no longer sparring on Twitter.

- They are teaming up in Washington, too.

- Musk’s new Department of Government Efficiency- DOGE, everyone is calling it, claims it has uncovered waste that would make accountants gasp.

- The centerpiece, a sprawling reform nicknamed the Big Beautiful Bill, has yet to hit a single markup.

- Staffers parade maps and flowcharts in and out of the Oval Office, but real legislative draft ink is still dry.

- Inside the Justice Department, Pam Bondi draws sharp lines.

- Her brisk pace on the James probe matches Trump’s tone, yet it raises flags about whether the law is being enforced or choreographed.

Conflict at the Top

- FBI insiders are nervous after Kash Patel and Dan Bongino slid into the director’s chairs.

- They say Patel has never tried a criminal case, and Bongino hasn’t worn a badge in years.

- Law staffers complain the pair don’t have the courtroom chops to keep the agency’s word.

Still No Handcuffs

- Campaign trail bluster promised busts for the Biden clan, Secretary Mayorkas, and Dr. Fauci, yet the grand jury’s silence is deafening.

- DOGE’s forensic teams are still sifting through paper, but show nothing the public can grab.

L.A. in Flames

- Los Angeles streets are burning as of June 13, 2025.

- Local papers hint at police shortages or a new celebrity scandal.

- Still, nobody can pin the match that lit the fuse.

- NATIONAL GAZETTE and even cable networks are strangely quiet on the flashpoints.

Odds and Ends

- Bond traders are jittery because former President Trump just tossed fresh China tariffs back onto the table.

- Powell v. Federal Board landed yesterday, and the Justices said Jay Powell can’t be fired at a whim.

- That move buys the Fed more leeway.

- Stagflation worries keep shoppers grim, and layoffs are now more headline than rumor.

Big Picture

- Housing sales are stuck in the mud, mortgage notes are back to 7 percent, and voters feel the squeeze.

- The Letitia James probe is getting louder, and critics still slam Trump for cabinet picks that look light on experience and heavy on a promise.

- GCA Forums News will ring your phone if anything moves.

Got a quick mortgage question? Gustan Cho Associates answers phones and emails quickly. Dial 800-900-8569 or email alex@gustancho.com, and someone will jump in.

- Federal Reserve chair Jerome Powell warns that inflation is hotter than a Thanksgiving turkey.

- Headlines rumble about Trump tariffs that could push lumber back into orbit.

- New York AG Letitia James is busy unraveling tales of mortgage fraud.

- When rent is due and budgets are tight, many folks weigh renting vs. buying with anxious calculators.

- An unemployment tick-up or down changes everybody’s housing plans.

- Seasoned watchers recall how the Trump administration’s policies made both waves and calm in the markets.

- Kash Patel and Dan Bongino still trade barbs on cable.

- At the same time, the Los Angeles riots linger in the memory of investors.

- Even Congress joins the chatter, throwing around phrases like the Big Beautiful Bill.

- Tech titan Elon Musk swings between backing wild ideas and cozying up to Trump.

- Between all that, mortgage rates hover, nudging the price tags on starter homes.

- Stock market volatility never sleeps, and neither do the blogs trying to explain why.

- Today’s buzzword is housing market 2025, a date that feels close yet very far.

-

Property Tax Assessment Fraud Nationwide. Did the Jackson County Property Tax Assessor commit Property Assessment Fraud? Missouri orders Jackson County property tax rollback, sparking fears of budget shortfalls. What parcels are in Jackson County, Missouri? What role does a tax assessor play in determining property taxes? How do I get the extra money I paid in property taxes due to property tax assessment fraud?

https://youtu.be/sVGD2ccUiq0?si=hiyhLJZa3U-o5eyN

-

This discussion was modified 1 year, 6 months ago by

Gustan Cho.

Gustan Cho.

-

This discussion was modified 1 year, 6 months ago by

-

GCA Forums Headline News Weekend Edition Report: May 5–11, 2025

Greetings and welcome to another edition of GCA Forums Headline news. Today’s date is May 5 – 11, 2025. We are now in the world of advanced mortgage and housing techniques. We cover mortgage, housing, and real estate topics, and this time, we will provide timely market updates with professional insight and analysis, engaging conversations, and much more for readers who are real estate investors, mortgage professionals, business enthusiasts, and home buyers. You will hear stories such as mortgage rate slashes and high-profile fraud allegations. You can also count on GCA Forums for actionable insights.

Mortgage Market Updates & Interest Rates

While mortgage rates remain steadily volatile, the Federal Reserve remains as cautious as ever this week, already missing one meeting due to inflation. Right now, as of May 11, 2025, the following rates are set:

- The 30-year fixed is touted as the most conventional payment method, clocking in at 6.85%, thus increasing by 0.1% from the previous week. Can you please provide me with access to this document?

- FHA loans are set to hold steady at 6.5%.

- VA loans are expected to increase slightly.

DSCR Loans:

- Investor non-QM rates have held steady at 7.2% for the past few weeks.

- Non-QM loan traction continues to rise among self-employed workers, with an average of 7.5%.

Important Updates:

- The latest Fed meeting minutes indicated no rate cuts would be made shortly, influencing mortgage rates.

Changes to the Minimum Credit Score Requirements:

- Fannie Mae and Freddie Mac increased the benchmark Credit score requirements for certain conventional loans to a minimum of 660.

- Credit underwriters have reported stricter limits for debt-to-income (DTI) ratios, with 43% becoming common ceilings for approvals.

Why It Matters:

- Rate changes are important for home buyers and those looking to refinance.

- They depend on rates to make the best choices.

- Mortgage specialists use such information to help clients at the right time and use market updates to their advantage.

- Non-QM and DSCR loans are catching the attention of investors looking to grow their portfolios.

Let’s Continue the Conversation:

- How have the rising rates changed your homebuying or investment strategies?

- Post your comments in GCA Forums!

Latest Market Indicators and Housing News

Market overview snapshot:

Home Prices:

- According to the National Association of Realtors, median home prices continue to rise at $415,000, a 3.2% increase yearly.

- Inventory Levels:

- The housing inventory increased slightly, but 1.2 million active listings are still 20% below their levels before 2020.

Affordability Challenges:

- In the survey conducted by GCA Forums members, 40% of first-time buyers indicated that high prices were a hindrance, suggesting that the prices have become difficult to manage.

Regional Highlights:

Best Markets for Buyers:

- Pricing and growing inventory made Tampa, FL, and Raleigh, NC, very affordable.

Best Markets for Sellers:

- Strong demand and rapid sales characterized Seattle, WA, and Austin, TX.

Rental Market Trends:

- Increased demand for multifamily rentals focused attention on urban areas, leading to greater investor interest in apartment buildings.

Why It Matters:

- Homebuyers and sellers can strategically time their moves, while investors look for opportunities based on inventory and pricing data.

Forum Spotlight:

- Check out our thread “Top Cities for First-Time Buyers In 2025” for professional advice!

Reports Of Inflation And The Federal Reserve Reporting

This Week’s Insights:

- The April 2025 Consumer Price Index (CPI) is at 3.1 percent, above the Fed’s targeted 2 percent.

- The economy’s growth has also increased the Personal Consumption Expenditure (PCE) index, which the Fed expects to be at 2.7%.

- Bloomberg’s survey of economists found that 60% forecast tighter policy, so pessimism about a 25-basis-point rate hike in June is growing.

Impact on Housing:

- Growing inflation is the leading force curbing mortgage rates, adding more pressure on affordability.

- Other investors are turning to inflation-protected assets such as multifamily properties.

- Homebuyers require visibility on rate movements, and investors are focused on inflation to balance cash flow and ROI.

- With our forum’s “Inflation Watch” thread, you can receive real-time updates while discussing the topic with peers! Expert insight yields:

- Monitoring the Fed Meeting on June 18, 2025, is necessary for tracking up/down rate movements.

Economic Reports & Trends In The Job Market

Data points of importance:

Unemployment Rate:

- Stasis at 3.9% for April 2025, claimed by the Bureau of Labor Statistics.

Wage Growth:

- Annual inflation-adjusted wages increased by 4.2%, but this fell short of competing against the 5.1% appreciation in home prices.

GDP Outlook:

- The anticipated GDP growth for Q2 2025 is 2.3%, which indicates moderate economic growth.

Market Implications:

- Mortgage lending will benefit greatly from accelerated job opportunities.

- High demand and strong job growth will sustain home prices.

- Indicators show heightened volatility risk.

- The stock market is looking grim, dropping 1.5% this week.

Why It Matters:

- The overarching economic conditions affect consumer confidence and lender policies.

- On the other hand, entrepreneurs observe employment trends as job opportunities and investment opportunities.

- Every real estate investor should wonder how the job market is molding their strategies in our “Economic Trends” forum!

Changes to government housing policies

Notable updates:

FHA loan limits:

- Increased to $524,225 for 2025 in most areas per HUD.

Proposed tax credits:

- A bipartisan draft of a $15,000 tax credit for first-time home buyers is pending Senate approval.

Rent control:

- California and New York have increased the severity of rent control laws, which hurt multifamily investors.

Foreclosure prevention:

- The CFPB extended certain foreclosure moratoriums into Q3 2025.

Why It Matters:

- Policy shifts impact the accessibility of loans and the returns of investments, thus updating borrowers and realtors.

Forum Highlight:

- Over 200 questions were submitted for our FHA loan “Ask an Expert” session.

- Mark your calendars for the next one on May 15!

Tips for Investing in Real Estate and Growing Your Wealth Investor Insights:

Top Rental Markets:

- Charlotte, NC, and Phoenix, AZ, topped the list as high-cash-flow markets with an average cap rate of 6.5%.

DSCR Loan Boom:

- Debt Service Coverage Ratio loans became a staple, as 30% of investors at GCA Forums adopted them for rentals.

Short-Term Rentals:

- Airbnb’s occupancy stabilized, but fresh regulations in Nashville and Miami capped the number of permits issued.

Tax Strategies:

- Investors leverage deferred capital gains through 1031 exchanges, targeting multifamily structures aggressively.

Why It Matters:

- Wealth-building strategies rank highly among net-worth readers, providing sharp, action-oriented guidance.

Pro Tip:

- Check out our “Investor’s Guide to DSCR Loans” thread for lender shoutouts and case studies!

Business and Financial News in Focus Headlines:

Banking Sector:

- Concerns mounted regarding non-QM lending as two regional mortgage lenders reported liquidity issues.

Stock Market:

- Real estate ETFs outperformed, with REITs gaining 2.3% this week.

Crypto and Real Estate:

- Investments in tokenized property surged, with $50 million in digital assets associated with rentals in the US.

Why it Matters:

- Reputation is the backbone of any business. Important financial news shapes the lending and investment climate and builds the credibility of GCA Forums.

Forum Buzz:

We invite you to participate in our thread “Crypto in Real Estate”, where we discuss the role of blockchain technology in real estate transactions.

Foreclosures, Distressed Properties, And The Housing Crisis

Trends

Foreclosure Rates:

- Increased by 5% as compared to Q1 2025. Florida and Nevada are leading.

REO Opportunities:

- Investor bidding at auctions for properties previously auctioned off by banks increased by 25%.

Distressed Homeowners:

- Individuals in these situations resulted from job cuts within the technology and retail sectors, resulting in increased short sales.

Why It Matters:

- Investors look for deals, and homeowners seek assistance preventing foreclosure.

Forum Resource:

- Read our “Guide to Buying Foreclosures” thread, which offers meticulous instructions.

Engagement and Discussions:

- Letitia James Mortgage Fraud Allegations

Viral Story for the Week:

- Touted for spearheading numerous lawsuits against the real estate industry, New York Attorney General Letitia James is now at the center of mortgage fraud allegations, hotly debated by members of GCA Forums.

- On April 14, 2025, the Federal Housing Finance Agency filed a report to the US Department of Justice alleging Leticia James had committed multiple acts of mortgage fraud, including record manipulation on numerous occasions.

Key Allegations:

Virginia Property (2023):

- She is accused of claiming a Virginia property as her primary residence to obtain a reduced interest rate on a $219,780 loan.

- As a resident of New York, “primary residence” mortgages typically charge 25-50 basis points lower than the market rate.

Brooklyn Property (2001-2021):

- She allegedly submitted a five-unit brownstone as a four-unit property on multiple mortgages.

- Therefore, obtaining more favourable terms.

- A 2001 certificate of occupancy confirms five units, unchanged for 24 years.

1983 and 2000 Documents:

- Robert James and his daughter, Letitia, purportedly executed the mortgage documents for a Queens property in 1983 and then repeated the act 17 years later.

- This misrepresentation may have resulted in beneficial financing terms.

- Lowell, her lawyer, explained the 1983 deed, which names her “his daughter,” which he characterized as an innocuous mistake.

Latest Developments:

- On May 8, 2025, the Albany FBI and the US Attorney’s Office initiated an investigation regarding the 2023 Virginia mortgage and previous inconsistencies.

- James denies any illegal conduct, claiming the accusations are “without merit” and are “political retaliation” related to her civil fraud suit against Trump, which ended in a $454M verdict.

- Her lawyer insists that the excerpt claiming the Virginia property was intended “for her niece” was not ambiguous.

- X posts depict contrasting opinions, with some calling for arrests.

- In contrast, others claim the allegations have no substance and are politically driven.

Why It Matters:

For Investors:

- The allegations of mortgage fraud in real estate highlight a lack of trust in the loan application process, which may increase lenders’ scrutiny.

For Homebuyers:

- The case accentuates the need for precise documentation so clients do not face unnecessary legal and financial consequences.

For Professionals:

- Discussions between real estate agents and mortgage brokers focus on the impact of high-profile cases on public confidence in real estate transactions.

Forum Discussion:

- Our “Ask an Expert” section on mortgage fraud issues garnered over 300 comments, sparking heated discussions among our members on:

- Is this a legitimate investigation or just another politically motivated witch hunt?

- What are the projected outcomes for New York’s real estate market?

- What insights can borrowers take regarding precision in loan application submissions?

Expert Take:

John Carter, a GCA Forums mortgage expert chronicling two decades in the industry, noted, “The consequences for inaccurately stating residency or property information could include hefty fines and jail time. From a borrower’s perspective, there needs to be full disclosure to sidestep presumptions of fraud.”

Join the Conversation:

- Participate in the “Mortgage Fraud Scandals” thread to voice your opinion, Letitia James, and share your thoughts on how the case might shape the future of NY real estate.

Forum and Expert Answers: This Week’s Top Threads

“Navigating FHA Loans in 2025”:

- Experts answered over 150 questions about the new credit requirements and loan limits.

“DSCR Loans for Rentals”:

- Investors share their success stories, one member reported closing a deal on 10 units for 6.8 percent.

“Impact of Inflation on Homebuying”:

- 200+ participants exchanged ideas on rate lock strategies before possible Fed increases.

Forum Highlights:

- The GCA Forums focus on real estate, which is discussed in forums.

- This makes them the go-to for real estate expertise while ensuring active participation.

- Post your mortgage and investment queries in the “Ask an Expert” section for an expert reply!

The Winning Recipe

Please participate in the discussion as we build the ultimate real estate news and analysis hub. This week’s report blends breaking news, expert commentary, and viral stories that accurately capture audience attention. GCA Forums News empowers home buyers, investors, and professionals by clarifying complicated mortgage subjects and trending topics like the Letitia James allegations.

Stay in touch:

Subscribe to GCA Forum News for daily updates.

Follow our social media handles for shareable real estate content.

Become a member of GCA Forums News and connect with 10,000+ members from across the country.